The global flood insurance industry reached $13.4 billion in 2022. With extreme weather events becoming more frequent, demand for flood coverage is increasing among homeowners and businesses located in flood zones.

The National Flood Insurance Program only covers about 5 million policyholders out of over 120 million households nationwide. This leaves a huge gap in the market that new flood insurance companies can fill. By offering customized coverage and harnessing innovative technologies like flood mapping and modeling, entrepreneurial startups have a chance to succeed.

This guide will explain how to start a flood insurance company of your own. Topics include market research, accounting processes, registering an EIN, forming a legal business entity, customer focus, branding, and more.

1. Conduct Flood Insurance Company Market Research

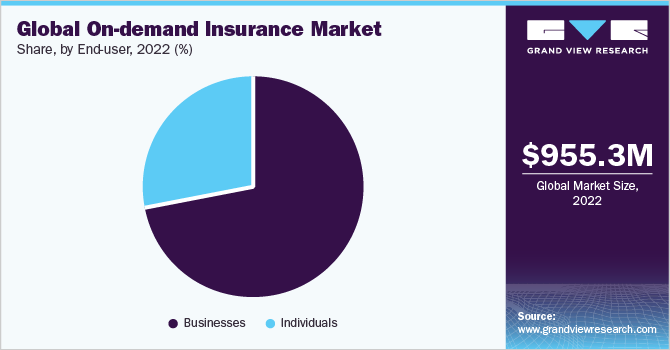

The first step to seizing the opportunities in the flood insurance industry is thoroughly analyzing the market. This means understanding both broad market trends as well as specifics around competitors, those looking to purchase flood insurance, and regulations.

The US flood insurance market is expected to grow steadily due to climate change leading to more extreme weather. When it comes to the competitive landscape, the dominant player is the National Flood Insurance Program (NFIP) which is managed by FEMA.

As for customers, the main targets are homeowners, renters, and business owners in 100-year and500-year floodplains designated as high-risk by FEMA flood maps, Additional demand comes from areas impacted by hurricanes and flash floods. Customers want affordable premiums along with seamless onboarding and claims processing.

When launching a flood insurance company, strict regulations around solvency, underwriting, claims handling, and more must be followed. Key agencies include state insurance departments, FEMA, and the National Association of Insurance Commissioners (NAIC). Understanding legal obligations is essential.

2. Analyze the Competition

Successfully launching a new flood insurance provider means going up against established brands. Apart from the National Flood Insurance Program, other insurers are looking to help consumers with a flood insurance claim. Carefully evaluating the competition is key to identifying strategic advantages.

For private insurers, focus on major carriers like Liberty Mutual and The Hartford as well as Insurtech competitors. Evaluate coverage options, pricing models, underwriting guidelines, and integration of risk assessment tools.

Online, review sites like Clearsurance to see customer satisfaction scores and complaints. Check rating sites for financial strength grades. Gather quotes through Policygenius or Insurance.com to compare costs.

Analyzing established flood carriers this way highlights gaps between what they provide against customer needs and pinpoints ways an insurer can disrupt the sector. The key is translating those insights into defensible competitive advantages.

3. Costs to Start a Flood Insurance Company Business

Getting new flood insurance companies off the ground requires significant upfront investment and managing ongoing expenses. Based on historical data from the insurance industry, here are realistic cost estimations.

Start-up Costs

In terms of start-up costs, initial capital requirements to meet state solvency and reserve rules could run between $5-10 million. Applying for a license also means fees of up to $1,500 just to file, according to the National Association of Insurance Commissioners.

Developing underwriting guidelines and policies requires actuarial work. Hiring consulting actuaries can cost over $300 per hour. A basic proprietary flood model also starts around $100,000. Ongoing data and risk analysis tools add tens of thousands more.

On the personnel side, plan on a compliance officer ($70k salary), managers ($80-90k), insurance agents ($40k base with commissions), and administrative staff ($35k). This already tallies over $400k per year.

Ongoing Costs

In terms of office space, small commercial spaces can run $20 per sq ft upfront and then $10-15 per sq ft monthly. For a 1,500 sq ft space, that’s $30k upfront and $15k after. Equipment like furniture and computers could total $15k initially.

Working with independent agents requires building an agent network management platform which starts around $40,000. Customizing consumer websites and portals would also likely require hiring developers, adding more costs.

Other expenses like business insurance, legal fees, taxes, and advertising should also be accounted for and might cost $50,000+ per year depending on location and scope.

In an ideal scenario reaching profitability in 3-5 years, projected ongoing costs are high. The above personnel, office, tools, and other fees can quickly amount to over $500,000 per year.

Average loss and loss adjustment ratios in the flood insurance sector often exceed 75%. After factoring those payouts on policies, net income relies on bringing in significant premium revenue through customer acquisition and retention campaigns in a crowded market.

4. Form a Legal Business Entity

When starting a flood insurance provider, the legal structure impacts everything from liability to taxes. Weighing the pros and cons of each for this regulated industry points to forming a limited liability company (LLC).

Sole Proprietorship

Sole proprietorships offer simplicity with no formal creation process beyond typical business licenses. Owners use personal assets for capital requirements and directly receive company profits and losses on personal tax returns. Lacking corporate veil protections, owners carry unlimited liability. Given coastal flooding can cause millions in damage, that personal risk exposure makes sole proprietorships ill-suited for flood carriers.

Partnership

Partnerships like LP’s, LLP’s, and general partnerships allow pooling of assets and skills from co-owners. However, similar to sole proprietorships, general partners remain personally liable for business debts and court judgments. Even innocent partners can lose assets in a lawsuit. Thus partnerships also fail to sufficiently protect flood insurance entrepreneurs’ interests.

Limited Liability Company (LLC)

LLCs limit owner liability to personal assets invested directly into the company. While still taxed as pass-through entities like sole proprietorships, forming an LLC shields personal assets like houses from court rulings related to coverage disputes. This advantage makes LLCs a common choice within the insurance industry. Owners benefit from flexibility around management structure, voting, and profit distribution as well.

Corporation

Corporations also provide liability protections but face double taxation on company earnings and shareholder dividends. The C-corp structure better suits pursuing outside investors rather than bootstrapped entrepreneurs. Moreover, regulations around ownership changes can inhibit pivoting a flood insurance corporation as the business scales.

5. Register Your Business For Taxes

Before collecting premium payments or writing coverage, new flood insurance providers must obtain an Employer Identification Number (EIN).

An EIN serves as a business’s tax ID number for federal tax purposes. It functions similarly to an individual’s social security number allowing a company to pay taxes, open business bank accounts, apply for licenses and permits, and complete other critical administrative tasks.

Obtaining an EIN is simple and free through the IRS website. The streamlined online application only takes minutes to complete. You will need basic information like business name, address, accounting details, and ownership structure. As the applicant, your personal information is also required including name, SSN, date of birth, and contact info.

Follow these steps to get your EIN instantly:

- Go to IRS EIN Assistant

- Check if you are the only member liable for taxes or employing anyone

- Select flood insurance carrier as business type

- Provide your LLC or corporation info

- Submit supporting details listed above

- Get your EIN immediately

After registering your federal EIN, contact your state taxation office about sales tax permits, business license fees ($50-$100) and insurance carrier registration procedures specific to your location.

6. Setup Your Accounting

Properly managing finances and taxes right from the start is critical for flood insurance companies. Implementing accounting software and working with professionals lays a strong financial foundation.

Accounting Software

After securing your EIN, linking business bank accounts, and acquiring a business credit card, using services like QuickBooks to organize everything is strongly advised. The software connects to accounts to automatically track income, expenses, account reconciliations, and more. This eliminates relying on burdensome spreadsheets and makes producing financial statements and tax documents much easier.

Hire an Accountant

While extremely helpful, software alone cannot replace professional accounting expertise. Flood insurance finances and policies contain complexity making ongoing support invaluable.

During the first year, securing a bookkeeping service to reconcile transactions, produce monthly reports, and ensure accuracy before tax time could cost $2,000-$4,000. This prevents issues with documenting losses and business uses deductions that may trigger audits down the road.

Open a Business Bank Account

Keeping business and personal finances completely separate is also vital. Commingling funds or paying owners without proper documentation makes accurately reporting revenue and expenses to the IRS difficult. Using a dedicated business checking account and credit card only for company transactions simplifies this division.

Apply for a Business Credit Card

Apply for company credit cards requiring your EIN and business details. Issuers determine limits based on business revenue and assets, not your credit score. This further segments business from personal financials.

7. Obtain Licenses and Permits

Before promoting private flood insurance policies or collecting a single premium, new flood insurance companies must seek proper licensure and approvals. Find federal government license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

Navigating insurance regulations begins with your home state’s Department of Insurance. Each has unique licensing procedures, capital requirements, and compliance rules. Applications include extensive details about your founders, planned coverage area, reinsurance partners, and anti-fraud controls. Once submitted, the formal review process takes 3-6 months.

For example, Texas has a 14-page application demanding descriptions of all products planned in the first 5 years along with a $1,500 filing fee. California charges up to $10,000 and requires covered policy limits 50% higher than Texas. Understanding state prerequisites helps plan properly.

A key license comes from the National Association of Insurance Commissioners (NAIC). Flood carriers must complete rigorous NAIC training covering everything from rate filings to claims practices. A final certification exam costing $150 takes 8 hours. Renewing every 5 years ensures staying updated on law changes.

Additionally, the Federal Emergency Management Agency (FEMA) issues special WYO flood insurance licenses allowing private insurers to sell policies under government programs. Obtaining WYO status means meeting strict standards but allows tapping into millions of potential customers mapped by FEMA flood plains.

Finally, flood carriers must integrate with insurance-scoring leaders like ISO and AAIS. Accessing existing data on risk ratings and historical claims helps accurately price policies from day one.

While long and complex, properly licensing new flood carriers protects policyholders. States levy hefty fines and suspend operations for non-compliant insurers. Following best practices avoids such outcomes allowing entrepreneurs to thrive in this high-demand market.

8. Get Business Insurance

Even flood insurance providers need to protect themselves against liability and risk. From obtaining your own flood insurance coverage to general liability insurance, commercial auto insurance, and beyond, you should invest in policies to safeguard your assets.

Policies like general liability insurance defend against expenses tied to bodily injuries or property damage caused by employees. Especially for a startup still establishing protocols, accidents happen. If an agent improperly denies a claim and the uninsured client sues, the founders’ assets are at stake without liability coverage.

Securing cyber insurance also hedges against data breaches or ransomware attacks compromising policyholder information or company systems. The nature of underwriting risks storing sensitive data. Lacking cybersecurity tools or IT expertise internally, the expense of responding to an attack could sink fledgling firms.

Additionally, errors & omissions (E&O) insurance protects against claims tied to negligent conduct, inaccurate advice, or mistakes made by the business. In flood insurance, subpar risk models or coverage decisions could spark litigation from those impacted by unpaid claims. E&O defends the company.

The process of getting insured simply requires calling agents and providing details on operations and ownership structure to receive quotes. Expect to spend $500-$1,500 annually depending on limits and deductibles. Following these tips streamlines the process:

- Gather relevant documents like licenses, financials, and policies

- Shop quotes through sites like CoverWallet and NextInsurance

- Review options with an agent familiar with insurance regulations

- Select a preferred mix of coverages balancing premiums and risk

Having core business coverages gives flood insurance entrepreneurs defense and resourcing to manage unplanned problems. The sector’s inherent unpredictability makes insurance that much more vital from day one.

9. Create an Office Space

Finding the right workspace helps you as an insurance agent build credibility with prospective policyholders and agents early on. On the bright side, if you rent through external property owners, you can make a pitch for them to buy flood insurance or property and casualty insurance from you.

Coworking Office

Coworking spaces like WeWork supply infrastructure allowing teams to assemble. Many offer private offices renting for $500-$800 monthly plus reasonable member fees. Flood risk analysts collaborating with sales staff benefit from the shared community supporting different specialties interacting. Yet customizing spaces to convey stability as an insurer often proves difficult.

Commercial Office

Securing standalone commercial retail suites conveys permanence and space for customer meetings. Rates hover around $30 per square foot in suburbs or smaller cities. However, the three-year leases and build-out costs reaching $30,000 deter bootstrappers from lacking significant capital. Achieving profitability first and then expanding into retail settings protects early investment.

10. Source Your Equipment

Launching a carrier entails more than just software and phones. Properly setting up physical infrastructure requires finding affordable office furniture and supplies. Strategic sourcing saves thousands while conveying professionalism.

Buy New

Purchasing new equipment from retailers works for larger budget firms. Sites like Office Depot and Staples offer desks, chairs, printers, shredders, and basic tech discounted when bundled. Higher-end inventories allow customizing interiors to impress visiting prospects. However, costs quickly escalated from $15,000 for just 5-6 employees initially.

Buy Used

Seeking used furnishings curbs overspending without sacrificing function. Local liquidators acquire office goods from companies going remote or bankrupt for pennies on the dollar. Expect to pay up to 70% less than big box listings. For example, a $300 ergonomic task chair sells to liquidators for $30-40. Be ready to move fast on listings or lose out.

Rent

Renting equipment also helps contain expenses long term versus buying outright. Providers like CORT Events supply modular desk systems, chairs, and even technology available short or long-term. Basic packages serving 10 employees rent for approximately $800 monthly. However, limited option customization hinders branding spaces.

Lease

For most flood carriers, mixing P2P scores on core inventory and then renting overflow furniture optimizes startup budgets. Used desks and chairs from liquidators gain prominence on video calls over new items. Splurging on ergonomic models boosts productivity and conveys employee investment when fundraising later on.

11. Establish Your Brand Assets

Getting consumers to buy a standard flood insurance policy through you vs. other casualty insurance companies requires some trust. Brand recognition helps improve consumer trust in your flood insurance protection. Investing in core brand assets professionalizes new entrants against well-known national carriers.

Get a Business Phone Number

Securing a unique business phone line using platforms like RingCentral elevates credibility over personal cell numbers. Toll-free options provide nationwide access fitting companies with broad reach. Call routing and recording also help customize engagement. Expect basic plans to run under $30 monthly.

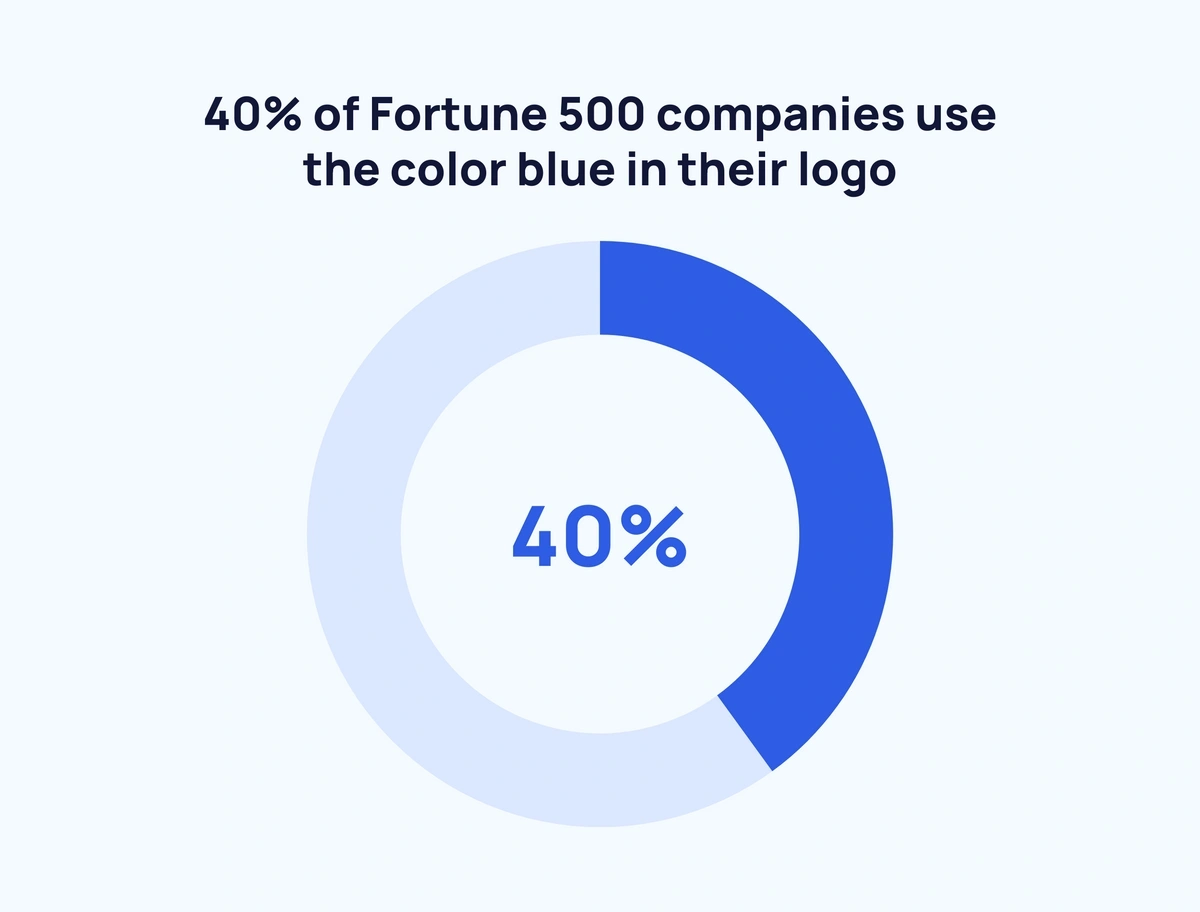

Design a Logo

Similarly, creating a distinctive logo and visual identity makes recalled brands 23% more memorable. Services like Looka offer affordable packages to design marks and complementary brand imagery assets that reinforce sophistication. This allows customizing sites, documents, signage, and everything needing consistency.

Print Business Cards

Printing professional business cards also conveys legitimacy when meeting daily. Providers like Vistaprint deliver 500 cards affordably to have on hand touring potential office spaces or wooing talented job candidates. For customer meetings, agents should represent new insurers impressively.

Get a Domain Name

Staking a claim online requires securing aligned domain names from registrars like Namecheap for stability and branding. Finding available .com domains with target keyword signals acting fast to control the brand. Even if launching with shoppable sites down the road, locking affordable domains builds early traction.

Design a Website

Constructing basic websites also helps establish market positioning digitally. Using website builders like Wix facilitates getting pages live quickly even before customizing further. For more complex platforms, hiring skilled web developers on freelance sites like Fiverr prevents the stretching of internal resources. Expect to invest $500-$5,000 depending on complexity.

12. Join Associations and Groups

Even in a digital era, building personal connections remains vital for fledgling insurance professionals. Tapping into established associations, events, and online groups helps you navigate the supplemental flood insurance industry.

Local Associations

Identifying relevant local associations offers structured networking with industry veterans. Organizations like the National Flood Association and the National Association of Insurance Commissioners are great places to start. Expect reasonable annual dues of around $250. Meetings facilitate valuable face time with fellow underwriters or risk experts that remote startups lack initially.

Local Meetups

Attending wider conferences and tradeshows also connects entrepreneurs with industry innovators advancing new models. Sites like Meetup index countless niche gatherings nationally related to InsurTech trends worth exploring. Registration fees vary based on scale, but conversational events harbor the most fertile brainstorming. Chat about the flood insurance program NFIP, and learn how competitors sell flood insurance.

Facebook Groups

Vetting online communities supplements in-person networking shaping business plans pre-launch. For instance, Facebook groups like FLOOD – Insurance Tips/Advice and Insurance Agent Opportunities enable crowd-sourcing guidance from thousands of global professionals daily. Read posts about preferred flood insurance in your area and post to ask questions.

13. How to Market a Flood Insurance Company Business

Generating interest and trust with prospective policyholders proves vital for fledgling flood carriers competing against household brand insurers. Strategically promoting services accelerates acquiring customers and building credibility.

Personal Networking

Tapping into existing professional networks offers the most fertile lead sources early on. Warm referrals from colleagues, friends, and family who have dealt with flood damage in the past make ideal first clients. Offering discounts or referral rewards once satisfied helps incentivize referrals. For example, providing a $100 credit for every confirmed customer sent spreads awareness exponentially.

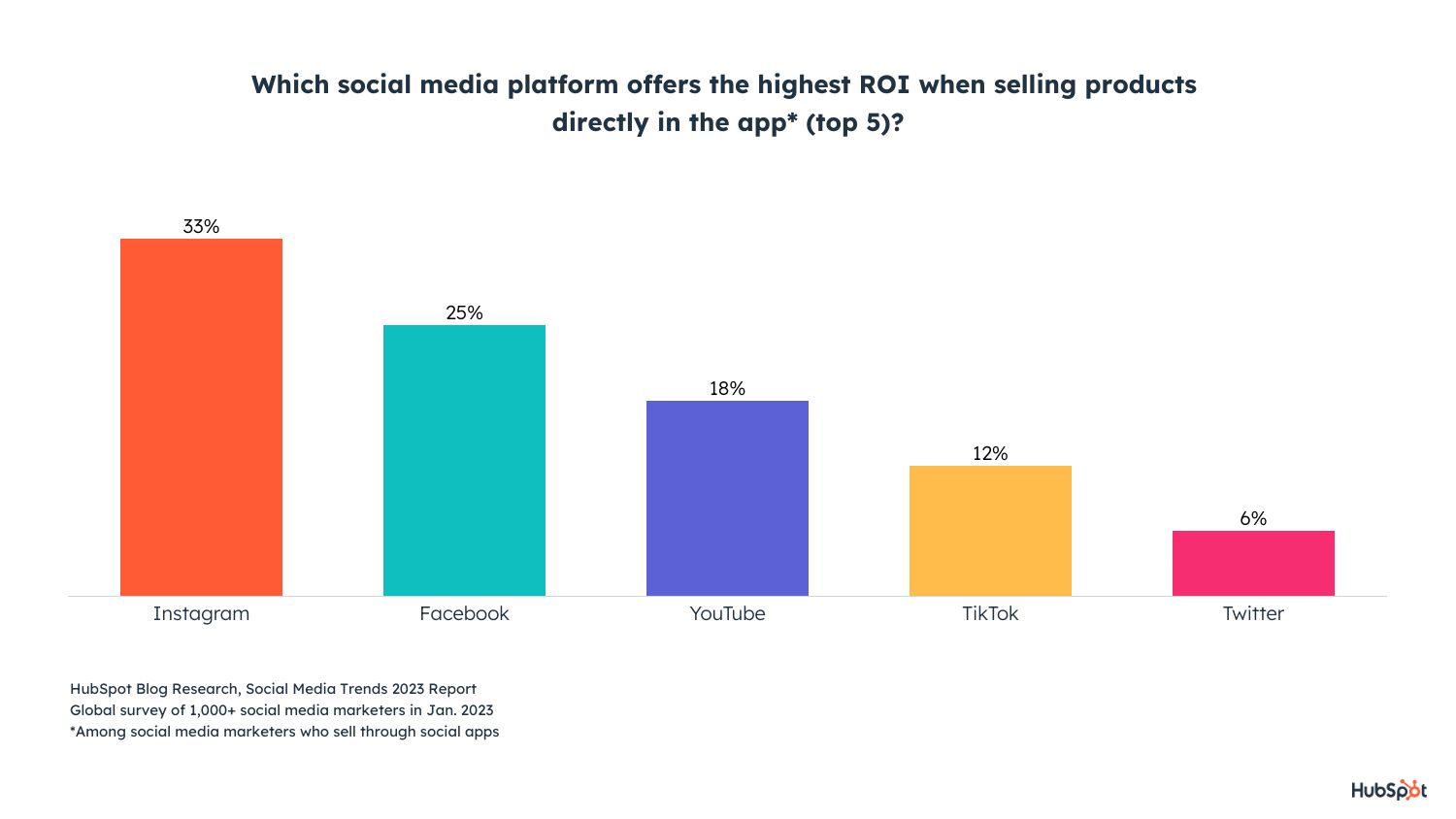

Digital Marketing

Digital channels present affordable promotion opportunities to target wider prospect pools ripe for new coverage options. Useful tactics include:

- Google Ads campaigns geo-targeting flood zone residents by keywords like “flood insurance” bids on desirable search traffic to agency sites

- Facebook ads help segment homeowner demographics like 30-45 yr olds with $500k+ houses near coasts bringing tailored offerings

- Publishing educational blogs around protecting properties better attracts readers looking to learn more about how providers can support

- YouTube explainer videos build visibility around services for visual learners less responsive to text-based marketing

- Retargeting clicks with customized messaging keeps products top of mind for visitors leaving sites without converting initially

Traditional Marketing

Traditional options better suit policyholders less active online but seeking local providers in their community. Considerations like:

- Direct mail flyers in utility bills spotlight new neighborhood partners for worried homeowners

- Local newspaper ads in weekly circulars or newsletters distributed in flood-prone zip codes make locals aware of offerings

- Radio spots on AM stations frequented by older listeners gain traction with underserved demographics

- Chamber of Commerce networking spotlights unique capabilities helping fledgling firms introduce services

- Sponsoring flood readiness workshops or preparedness events positions brands as trusted community stewards

Balancing digital targeting and tangible visibility compels multiple demographics to consider new flood carriers suitable for protecting local homes or businesses. Activating advocates as brand ambassadors sustains word-of-mouth interest driving conversions too.

14. Focus on the Customer

Providing exceptional service distinguishes successful flood carriers creating lifelong client relationships. Prioritizing policyholder needs first fuels referrals driving growth.

Unlike transactional insurers, flood ventures protect customers’ most precious assets – their homes and properties. The nature of coverage requires intimate underwriting consulting homeowners on minimizing exposure. Agents must demonstrate authentic empathy guiding applicants in protecting cherished investments.

Excelling on the small touches like emailing weather alerts for upcoming storms or scheduling annual check-in calls shows proactive care lacking with national insurers. Consider sending handwritten notes after claims are completed thanking properties for their trust.

Upholding principles of transparency and fairness treating policyholders like family or friends to be supported, not transactions to optimize, earns goodwill. This custodial approach sparks referrals as happy customers advocate for the business that stood by them when it counted most.