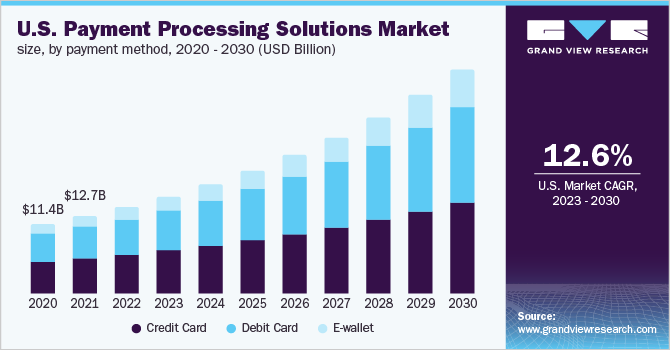

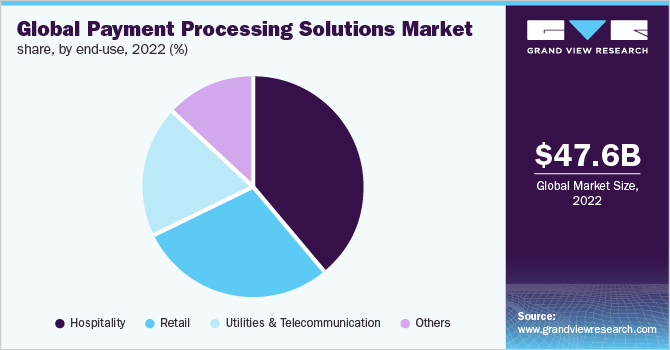

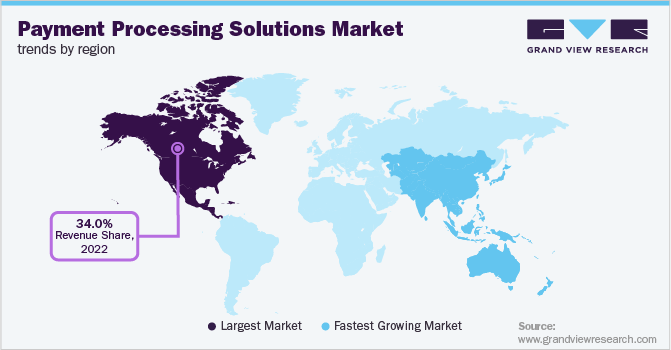

The payment processing industry is massive and rapidly growing. According to one report, the global payment processing solutions market size was valued at $1.5 trillion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 11.4% from 2022 to 2030.

Companies need technical capabilities to handle secure transactions and compliance with complex regulations around consumer data and fraud prevention. A deep understanding of the competitive landscape is also critical.

This guide will walk you through how to start a payment processing company. Topics include market research to develop a business plan, accounting details like opening a business bank account, how to register an EIN, obtaining business insurance, and more.

1. Conduct Payment Processing Market Research

Market research is essential for any new credit card processing company. It offers insight into trends in payment processing services, your target market, local market saturation, and more.

Driving this growth is rising smartphone and internet penetration plus more merchants offering ecommerce channels. With this fast evolution, legacy systems struggle to keep pace. New customer-centric tools emerging, include:

- Omnichannel capabilities and unified commerce solutions

- Frictionless payments with embedded finance and one-click options

- International expansion and cross-border commerce streamlining

- Subscription management and recurring billing automation

Real-time data is another area bringing competitive advantage. Merchants want insights to accept more transactions, reduce fraud, and improve customer experiences. Despite fierce competition, the market remains fragmented globally.

Small businesses are an often underserved segment, lacking the resources of large chains to integrate complex systems. Startups focusing on specific merchant niches and geographic regions can thrive by understanding those specialized local needs.

With low barriers to launching payment apps and platforms, the number of players keeps expanding. But relationships and trust still drive the industry—important for startups to emphasize security, compliance, and transparency in their offerings upfront. As consumer awareness of data privacy grows, processors must demonstrate stewardship of transactional data.

2. Analyze the Competition

Competitor analysis is crucial for any new entrant in the payments space. As an ever-evolving industry with both established brands and disruptive startups, understanding other payment processing companies informs your own positioning and go-to-market strategy.

For online presence, look beyond just feature/function comparisons. Dive deeper into elements like Similar Web, customer review sentiment analysis across sites like TrustPilot, as well as social media follower growth and engagement metrics. These provide an indication of brand awareness and loyalty which are key in a trust-driven business.

Evaluate not only direct payment processor rivals but also adjacent players. For example, SaaS platforms like Shopify that offer integrated payment capabilities can be competitors for your intended SMB merchant segment. Business management apps with accounting, payroll, etc.

For customer profiling, leverage available data to classify merchants by criteria like order value, revenue tiers, chargeback rates, and processing volume patterns. Then assess which competitors focus on specific subsets you want to target. This highlights whitespace opportunities for underserved niches.

Offline proximity and sales relationships still matter, so local field analysis is also vital, especially when positioning services to brick-and-mortar SMBs. Profile merchant clusters around factors like density, transactions, industry categories, and average ticket size for different neighborhoods.

Note terminal providers in such areas along with retail bank footprints. Such geospatial intelligence gathering informs everything from partnerships and channel distribution to pricing and sales staff deployment.

3. Costs to Start a Payment Processing Business

When starting a payment processing company, the upfront investments cover all the legal, technical, and operational foundations. From obtaining office space to credit card processing fees and setting up your payment gateway, there are many expenses involved.

Top expenses include:

Start-up Costs

- Legal Fees – Expect $5,000-$10,000 for forming business entities, drafting terms, and acquiring licensing and permits based on states/regions targeted.

- Incorporation – $2,000 average for C-Corp or S-Corp formation, drafting articles of incorporation, company bylaws, etc.

- Account setup – At least $3,000 per banking relationship (approval process can take 3+ months). As a processor, you’ll need a sponsor bank account to handle settlements.

- Software and Hardware – For omnichannel processing supporting in-store, mobile, e-commerce, etc. the latest terminal hardware, security layers, and custom platform development can cost over $150,000 initially. Upwards of $250,000+ for advanced systems.

- Team Hiring – Key roles like product developers, security/fraud experts, and merchant support reps. $60,000+ average salaries plus equity packages for top fintech talent. Let’s budget $300,000 for core leadership.

- Office – Small commercial space averages $22/sq.ft per year, so $15,000 annually for a 1,000 sq. ft setup. Plus one-time $10,000 furniture, supplies, and build-out costs.

In the first year, $500,000 provides a foundation for an MVP processing platform to start merchant onboarding and live transactions.

Ongoing Costs

- Transaction Fees – Interchange, assessment, and network charges apply for payment volume processing. Around 2% of processing totals go to these fees.

- Gateways – For plugin payments, subscriptions, etc. Gateway costs are $5,000-20,000+ annually

- Chargebacks – As the merchant portfolio grows, chargeback costs scale over 0.5-1% of volume depending on risk management.

- Staff – Add $100,000+ for building out customer service, underwriting, and compliance/risk personnel. Talent remains a key ongoing cost.

- Technology – Yearly upgrades to security, hardware, and software capabilities to support changing regulations, new payment methods, etc. Budget $50,000+

- Marketing – To keep growing the merchant book, channel partnerships, and lead generation through SEM/SEO, events, etc. needs a $100,000+ investment.

By maintaining strong gross margins north of 5%, payment processors balance ongoing costs with profitability over multi-year horizons. Raising additional capital from investors to fund growth will help fund these costs.

4. Form a Legal Business Entity

When starting a payment processor business, choosing the right legal structure impacts everything from liability protections to potential growth limitations down the road. There are four main choices of business entity formations for payment service providers.

Sole Proprietorship

A sole proprietorship is the simplest route administered. You operate as an individual, so no formal registration is needed beyond taxes and licensing. However, you assume unlimited personal liability for company actions and debts. Any legal action directly impacts your assets. Difficult to raise external funding without a formal entity.

Partnership

Forming a general partnership spreads ownership between two or more founders. But there’s still unlimited liability unless registering as a Limited Partnership or LLP. Partnerships don’t have perpetual existence either–they dissolve if a partner leaves. These uncertainties make raising capital a challenge.

Limited Liability Company (LLC)

Given the data security risks and potential claims against payment processors, limiting personal liability is crucial. This makes an LLC structure the most appealing. LLCs separate your assets from company financial/legal obligations. They limit liability to your capital contributions. The operating agreement defining ownership stakes also provides flexibility as more partners/investors come on board.

Corporation

Registering as a C-corp or S-corp does have some advantages for payment processors eyeing an IPO or eventual acquisition exit. Corporations can raise capital by issuing stock rather than membership unit transfers used by LLCs which can complicate later valuation. Legal continuity and potential perpetuity of corporations also appeal to outside investors.

5. Register Your Business For Taxes

An Employer Identification Number (EIN) serves as a unique taxpayer ID tied to your business structure. The IRS requires obtaining an EIN if you hire employees, create a legal entity like an LLC, or file employment tax returns as a business.

Applying online at IRS.gov takes just minutes. Simply answer questions about your business’s legal structure, ownership details, and reason for the EIN. On successful submission, you get an EIN assignment immediately. This ID number then goes on your tax returns and any documents establishing payroll services or business bank accounts.

Along with federal requirements, individual state registrations are also crucial for payment processors to legally collect, report, and remit sales taxes. The setup process and rules vary by location. For example, California mandates seller permits while those with a Texas nexus must request a sales tax permit.

Thankfully most states don’t charge fees for registering and obtaining standard sales tax permits/IDs. However, staying compliant with monthly, quarterly, or annual tax reporting does take diligent bookkeeping. Consider fees for incorporation services or accounting tools/advisors to maintain proper documentation.

By proactively getting an EIN and lining up required sales permits, payment processors steer clear of tax violations. These IDs also legitimize your business structure for securing financing and demonstrating compliance to customers. Take the time upfront to formally register with state and federal agencies to avoid missteps down the road.

6. Setup Your Accounting

As a payment processor, meticulous accounting and financial recordkeeping are mandatory for legal compliance and transparent operations. Here’s an overview of best practices to consider and common requirements:

Accounting Software

With complex transactional data flows, automation brings major efficiency gains. Cloud accounting platforms like QuickBooks seamlessly connect to bank/credit card accounts to import and categorize all spending activity. Plan $200+/month for robust QuickBooks capabilities suited to fintech transaction volumes.

Hire an Accountant

Supplementing with an accountant adds professional oversight to validate financial accuracy. From monthly close assistance to sales tax calculations, small business accountants charge around $150-200 per month for ad-hoc services. Come tax season, expect returns preparation fees from $700+.

Open a Business Bank Account

As a best practice, keep business finances completely separate from personal banking and spending. Apply for a business checking account in your company name using your freshly minted EIN. This segregates cash flows for easier tracking and reporting.

Apply for a Business Credit Card

A business credit card also makes reconciliation smoother, with all company expenditures in one place. Business cards shift liability from personal assets to the corporate entity. Approval is based on your EIN, corporate income docs, and personal credit score. Typical limits reach $10,000+ to start.

7. Obtain Licenses and Permits

Launching a payments company involves extensive licensing and compliance to handle sensitive financial data. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

At the federal level, registering as a Money Services Business (MSB) is required for any company transferring funds on behalf of merchants. This includes payment gateways, wallet providers, payment facilitators, and more.

The Financial Crimes Enforcement Network (FinCEN) oversees MSB licensing. The forms clarify business activities, ownership structure, anti-fraud controls, and more to ensure legitimacy before approving operations.

Specialized MSB licenses may involve bonds and background checks. Expect legal fees of up to $5,000 to complete everything properly. Non-compliance risks stiff penalties plus blacklisting from banks hesitant to provide accounts.

Applicable state banking departments also demand licensing to transmit payments or handle currency transactions in their jurisdiction. For example, the New York Department of Financial Services has a strict “BitLicense” for crypto companies.

Recognize that regulations frequently update to address emerging payment types like stored value cards or modern options like Apple Pay. Keep compliant via legal counsel monitoring for new licensing mandates.

Consumer data protection also requires vigilance as payment platforms must safeguard personally identifiable information (PII) like names, addresses, and card numbers. Contract technical security audits to get PCI-DSS certified alongside general data rules like GDPR or CCPA.

8. Get Business Insurance

Unlike personal policies, commercial business insurance directly covers company assets and earnings potential. It prepares for scenarios that could otherwise bankrupt operations.

For example, imagine a data breach where hackers access your merchant transaction records and steal funds. Without a tailored cyber liability plan, you must cover legal damages, card network fines, forensic investigations, and credit monitoring services for impacted merchants. Easily millions in expenses that bankrupt unprepared processors.

Alternatively, natural disasters could cause extended outages, preventing transaction processing for clients. The resulting income loss plus infrastructure repairs again create six-figure hits many small businesses cannot weather.

Another exposure is an employee lawsuit over discrimination or harassment allegations. Legal defense fees mount rapidly without employer liability buffers. Damage awards drain cash reserves quickly.

The good news is custom policies address all the above cases. Brokers like CoverWallet offer bundled coverage protecting assets, income streams, and unique risks payment processors face, including:

- Cyber and data security to fund data breach response

- Business interruption to replace income lost from outages

- Errors and omissions to cover failed transactions

- Employee dishonesty where internal fraud occurs

- Directors and officers for executive lawsuit defense

With fast online applications, coverage activates quickly once approved. Expect total premiums of around $2,000 annually for robust protection given the liability exposures.

9. Create an Office Space

As a startup payment processor, office space establishes legitimacy, supports staff collaboration, and provides room to meet merchants/partners. While remote work is popular, an office remains vital for core business functions. Here are the primary options to weigh:

Coworking Office

Coworking spaces like WeWork provide stylish, flexible offices for small teams. With month-to-month commitments instead of multi-year leases, you shift variable real estate from fixed cost to align with revenue fluctuations. Expect all-inclusive rates from $300 per desk monthly.

Commercial Office

Over the long term, dedicated commercial offices best support the expanding teams and infrastructure demands of payment providers. Expect $20-$30 per square foot annually for conventional office setups. While necessitating upfront capital investment, the permanence and customization better represent long-term commitments to merchant clients.

10. Source Your Equipment

Launching a payment processing platform requires significant upfront investments in secure infrastructure and services. From hardware to software, here are the main sourcing options entrepreneurs have:

Buy New

New terminal devices remain the backbone for omni-channel processing. Major providers like PAX and Ingenico supply the latest EMV and contactless-enabled systems. Though premium models run $300+, emerging IoT features like loyalty program scanners justify costs. Buy directly or via distributors like Card Payment Solutions.

Go Digitial

Certified payment gateways like Stripe or PayPal also furnish merchant transaction APIs for custom development. Volume tiering applies but expect minimums of around $200 monthly for starter accounts to test implementations before scaling.

Buy Used

Used equipment does carry risks despite discounted pricing. Inspect third-party POS units closely for flaws while confirming acceptable firmware levels and encryption specs. Purchase any extended warranty/support options still available through authorized resellers only.

Rent

Renting terminals offers flexibility to upgrade hardware alongside seasonal demands or staffing changes. However, subscription fees still tally over $50 monthly per device with vendors like Helcim. Only helpful temporarily before buying/leasing better long-term options.

11. Establish Your Brand Assets

Establishing a strong brand builds awareness and trust vital for customer acquisition in the payments space. From visual identity to online properties, systematically develop foundational assets for growth:

Get a Business Phone Number

Secure a toll-free business number via providers like RingCentral to project professionalism when merchants call. Expect around $30 monthly for a dedicated local vanity line with call routing features.

Design a Logo

Brand marks like logos increase recognizability. Services like Looka furnish packs with icons, fonts, and color palettes ready for use across sites, apps, and marketing materials. Spend $150+ for commercial license access allowing unlimited revisions. Fintech brands lean on abstract marks and bright accent colors that Feel futuristic yet trustworthy.

Print Business Cards

With brand assets in hand, order starter batches of business cards, letterhead, and store signage from Vistaprint. These establish legitimacy when meeting suppliers, investors, or pitching merchant partners in person. Cards also help sales reps stand out at industry events and trade shows.

Get a Domain Name

Before broader marketing pushes, prioritize locking a . COM domain reflecting your brand name for the payment processor site. Check availability with registrars like Namecheap while also considering .PAY alternatives if preferred names are taken. Expect $15 per year per domain.

Design a Website

Building out the website as an informational hub and merchant portal is then possible by leveraging DIY platforms like Wix for drag-and-drop simplicity. Expect $20+ monthly for e-commerce capabilities suited to SaaS models. For advanced customization, specialists on Fiverr provide WordPress sites for $500 based on specifications.

12. Join Associations and Groups

Joining industry associations and peer communities accelerates growth for new payment processors through shared knowledge and partnerships:

Local Associations

Regional industry groups like the Northeast Acquirers Association offer networking with other processors and adjacent players like ISOs, banks, and merchants. Expect $500 annually for access to conferences, compliance resources, and supply-chain contacts.

Local Meetups

More broadly, sites like Meetup list fintech/payments gatherings nationwide for informal peer learning and career growth. Look for local chapters of groups as entry points before joining niche communities once established.

Facebook Groups

For online advice across all facets of the payments ecosystem connect with leading groups like:

- Payment Processing & Business Consulting

- Payment Processing Solutions for eCommerce (Stripe, Paypal…)

- Merchant Services Payments Professionals

Expect support on everything from vetting technology partners to positioning value propositions for vertical niches.

13. How to Market a Payment Processing Business

Marketing drives sustainable growth for payment processors by consistently attracting new merchants. With so many digital channels now, focus efforts on targeted outreach and customer referrals:

Referral Marketing

Referrals from satisfied merchants remain the most valuable customer acquisition channel. Small gestures like sending thank you notes after onboarding wins influence positive word-of-mouth. Consider referral bonuses like enqueue devices for members who recommend friends.

Digital Marketing

On social channels, educate followers with security tips, product update previews, and industry news to establish expertise. Payments marketing relies more on helpfulness than hard sales.

Other digital tactics worth testing:

- Google Ads geofenced around merchant-dense zones like malls, tailoring messaging by keywords and intent signals

- Retargeting ads keep your brand top of mind during lengthy sales cycles

- Paying influencers in commercial districts to demo payment solutions on live shop-along streams

- Launching a “Payments in Practice” educational YouTube channel

Traditional Marketing

Traditional approaches like direct mail require more budget without digital precision. For example, sending custom brochures to chambers of commerce for them to distribute could uncover member leads. Advertisements in industry magazines create a brand impression.

The foundation of referral momentum plus targeted digital outreach gives payment processors formulaic growth. Audit marketing results quarterly, doubling down on what moves the revenue needle.

14. Focus on the Customer

Providing exceptional customer service is vital for a credit card processing business to drive referrals and mitigate churn in a crowded marketplace. Especially as a startup lacking brand recognition, positive merchant experiences separate you from transactional rivals.

Make onboarding frictionless through dedicated account managers who proactively guide clients through tax ID setup, equipment configuration, and reporting dashboard training. This high-touch onboarding reduces anxiety during a nerve-racking transition from old systems.

Emphasize approachability in support channels like chat, email, and phone. Instead of offshored call centers with high turnover, cultivate an in-house team educated on the nuances of your platform and merchant pain points. Empower them to waive fees, expedite payouts, and essentially delight customers.

Consider account health reviews to advise clients on optimizing processing volumes, avoiding chargebacks, and keeping software integrations current. Merchants will appreciate the consultative guidance.

Extending exceptional assistance at every touchpoint earns gratitude. Request feedback to uncover areas for improvement. Then prominently feature cheerful testimonials on your website and other assets to build authority.

With positive word-of-mouth, customers become your best marketing asset. The ROI on delivering phenomenal support is immense.