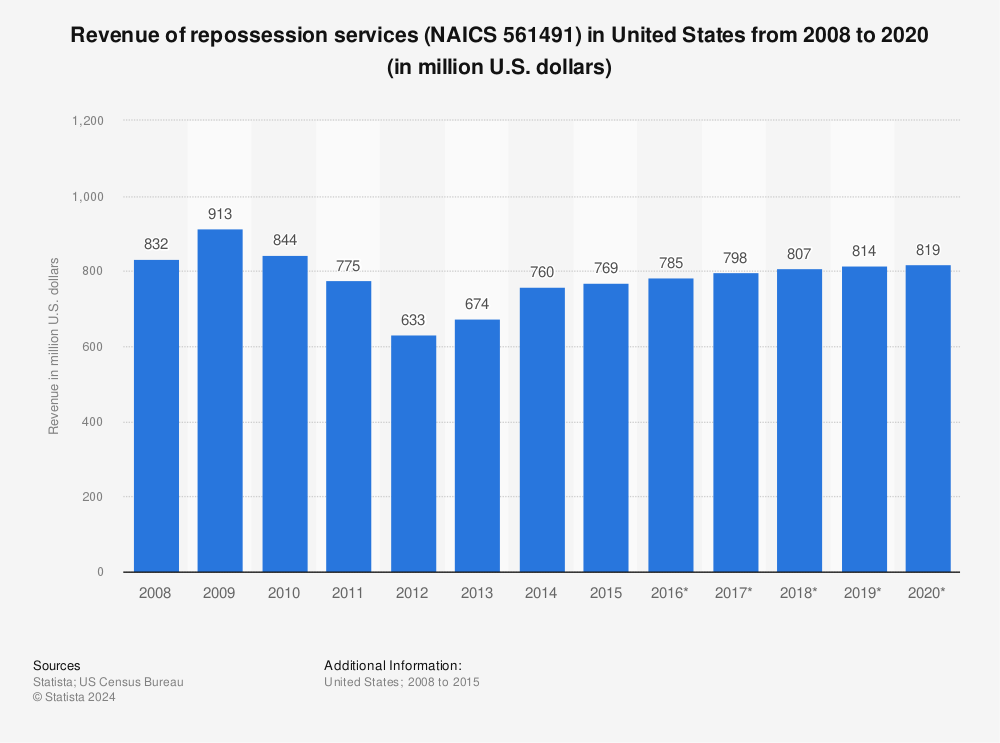

The U.S. Repossession industry is a $1.1 billion market and continues to grow. Over the next five years, the market is set to expand, making this a great time for newcomers to get involved in the repo industry. While anyone can start a repo business, it takes research, dedication, and funding to get started and be successful as a repossession agent.

With more people struggling financially, many are unable to keep up with car payments, leading to a rise in repossessions. This creates ample opportunity for those looking to get into the repo business.

This guide will help you learn how to start repo business building. Topics include market research, competitive analysis, registering an EIN, getting the right licensure like a commercial driver’s license, sourcing equipment from car dealerships, and more.

1. Conduct Repo Market Research

Market research is essential to building a thorough business plan for any new business. In a repo business, it offers insight into local competitors, where to apply for your repossession license, trends in services and products, pricing guides, and more.

Some details you’ll learn through market research for your own repo business include:

- Most repo companies operate locally and regionally, though some national ones have upwards of 7 million vehicles under management.

- A growing auto financing market means ample business for repo companies and agents.

- The breakeven point for a local operation is roughly 30 repossessions per month, as experienced agents can complete 2-3 nightly.

- At an average $350 per vehicle fee, this equals around $10,500 monthly revenue.

- Deducting operating costs and agent payroll, a single-agent business could generate $5,000+ monthly profits.

- Urban areas see more volume, though competition can be intense.

- Individual contractors keep 100% of fees but sacrifice benefits, while larger agencies offer stability but take a cut.

- Newbies should expect only $25,000-$50,000 until building a clientele.

A lean solo repo operation can generate a comfortable living, while more scaled agencies present a stronger profit upside. Through strong execution and sales, six figures are realistic. Just be ready to work odd hours while carefully managing costs.

2. Analyze the Competition

When launching a repo company, sizing up local competitors is crucial to strategizing your positioning and go-to-market plan. This analysis should evaluate both existing brick-and-mortar agencies as well as their digital footprint.

Some ways to get to know your repossession business competitors include:

- Identify major players through online directories and resources.

- Search listings by proximity to compile a competitor list, then visit websites and social channels to gather intel.

- Evaluate services, features, assets (trucks, equipment), and areas of specialty like luxury repos.

- Estimate market share based on fleet sizes. This quantifies what share is still up for grabs.

- Digital presence shows how findable and appealing brands are.

- Google competitors and geo-variations to see search visibility, plus keywords they rank for.

- Check online reviews on sites like Facebook as a proxy for reputation.

- Sign up for email lists to analyze messaging.

- Higher web visibility and positive community sentiment signal stronger positioning. New entrants should identify gaps where competitors fall short digitally.

Local filings like business registrations may surface added details like founding year, corporate structure, leadership, and locations. Newer startups signal an opening for other fresh entrants.

Use these insights to position competitively. If incumbents falter on client-friendly tech, highlight digital conveniences. Spotty coverage means expansion opportunities. Shoddy reputations allow for delivering a higher-caliber experience. Base your strategy on objective competitor findings.

3. Costs to Start a Repo Business

Getting a repo company up and running entails both substantial one-time startup costs as well as ongoing operational expenses. Expect an initial $50,000 to $100,000 investment depending on scale, along with roughly $15,000 to $25,000 in monthly recurring costs.

Start-up Costs

Before completing your first repo job, laying the proper operational foundations requires sinking cash into assets, licensing, professional services, and working capital. Key startup costs include:

- Incorporation Fees: Forming an LLC for liability purposes rings up around $800 when including state registration, drafting operating agreements, and publishing notices.

- Office Lease: A small retail space or commercial warehouse suits most local repossession agencies’ needs for storing impounded vehicles. Allow $2,500 per month for a basic space in many markets.

- Furnishings & Supplies: Outfitting your office with desks, filing cabinets, computers, and repo management software will likely require around $15,000 upfront.

- Towing Trucks & Equipment: Expect to spend $50,000+ per heavy-duty tow truck with lift gates, not including customizations like dual wheels for added stability and payload capacity. Assume 1 truck per agent.

- Licensing & Insurance: States require specific licenses like California’s $1,500 Vehicle Repossession Agency License. Liability policies providing necessary protection start at around $2,500 annually.

- Cash Reserves: Having robust operating capital prevents struggling with overhead costs before revenue stabilizes. Set aside at least 3 months’ worth of operating expenses – so around $45,000+ for our 1-truck operation example.

Solo agents can start more leanly with just their tow rig and administrative tools, while mid-size agencies should budget $75,000+ for proper facilities, multiple trucks, and ample working capital.

Ongoing Costs

Once opened for business, delivering smooth repo operations and maintaining profitability means managing key monthly expenses:

- Facilities Overhead: Assuming that the $2,500 office lease is above, plan another $700 monthly for utilities, repairs, maintenance, and other landlord pass-thru costs.

- Tow Truck Costs: From fuel to maintenance to custom hideaway lights, operating industrial-grade trucks capable of lifting 2+ ton vehicles costs approx. [$1,500 per rig] spend about $1,500 per month per tow truck on gas, maintenance, repairs, and insurance payments.).

- Software & Admin Tools: Specialized repossession management systems optimize dispatching and inventory tracking but add another $1000 to monthly spending.

- Insurance: Expect to fork over $600 monthly to properly insure the business including liability, commercial auto, and worker’s compensation for employees.

- Payroll: Experienced repo agents command at least $40,000+ annually, equating to around $3,500 per employee monthly – our example above staffed 1 agent.

4. Form a Legal Business Entity

Entrepreneurs launching a new repossession agency face an important early decision – formally structuring the legal business entity. The optimal choice balances personal liability protection, tax implications, and ease of management as the company grows.

Sole Proprietorship

Sole proprietorships represent the simplest and most common initial structure – you directly own the business as an individual. However major liability risk exists as no legal separation shields personal assets like your home if the company faces lawsuits or bankruptcy. Taxes are straightforward with pass-through treatment but may hit higher personal income tax rates.

Partnership

General or limited partnerships allow sharing ownership with multiple partners, easing capital raising. However, they still expose personal assets to substantial risk as partners retain direct liability for debts and legal actions against the partnership. The lack of liability protections compared to LLCs makes partnerships poorly matched for hazardous repo work as well.

Corporation

Forming a C corporation or S corporation creates a distinct legal entity insulating owners from liability claims. However, the significant legal paperwork and mandatory formalities like shareholder meetings add overhead costs and administrative hassles better suited to large enterprises. State regulations also poorly accommodate the nomadic nature of repo work across regions.

Limited Liability Company (LLC)

For starting repo agents, limiting legal liability while retaining operational simplicity points clearly to forming an LLC. As separate legal entities under state statute, repo LLCs shield members’ assets like houses, cars, or bank accounts from court judgments related to the business.

Taxes use simpler pass-through treatment like partnerships avoiding double taxation, unlike corporations. Different classes of ownership interest better accommodate bringing on investors or employee-partners, facilitating growth. And meeting formalities are minimal versus s-corps.

5. Register Your Business For Taxes

Once your repo company is legally formed, crucial next steps include registering for federal and state tax purposes. This establishes your ability to operate legally, bill clients, and hire employees. Let’s walk through what’s required.

First, head to IRS.gov to obtain your federal Employer Identification Number (EIN). This unique 9-digit identifier acts like your business’s social security number establishing tax and banking abilities.

The EIN application process only takes a few minutes online:

- Navigate to the EIN Assistant and select “View Additional Types” including LLCs.

- Choose reason code 11 for “Started a New Business” under “Other” on the dropdown menu.

- Work through the short application with basic information like name, address, and responsible party. Double-check for accuracy.

- After submitting, your EIN will display immediately. Print this page for your records.

Completing this free and simple registration legitimizes your repo agency as a registered business in the eyes of the IRS, partners, and clients.

You must also formally register for a state seller’s permit for collecting and remitting sales tax in locations where you operate. Expect under $100 in initial state filing fees. Any physical repossession services are taxable.

6. Setup Your Accounting

Handling repossessions brings enough operational headaches without inviting IRS trouble. That’s why properly structuring your agency’s finances and accounting proves so important from day one. Follow key best practices like implementing integrated software, working with an accountant, and rigorously separating expenses.

Accounting Software

As an industry dealing in significant tangible assets like vehicles, careful bookkeeping and tracking ensure you capture available tax deductions on tow trucks, fuel, equipment maintenance, and other operating costs. However, manually logging expenses risks missing write-offs. That’s where software like QuickBooks generates major value.

Hire an Accountant

Retaining a provider exclusively handling small business clients proves pivotal for optimal tax preparation. Expect fees between $200-500 annually for basic filing, though more complex partnerships may spend $5,000+. Value emerges from identifying every possible deduction and credit to legally minimize tax obligations.

Open a Business Bank Account

Avoid common pitfalls like mingling personal and business finances. Keeping dedicated checking/credit accounts simplifies separating expenses come filing time. Understand card limits derive from your agency’s financials, not your credit score.

7. Obtain Licenses and Permits

Beyond basic corporate formation, repo agencies must obtain specific state and federal clearances allowing legal operation. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

Local repossession business laws may require a specific business license or repo license for your new company. For example, California issues Vehicle Repossession Agency Licenses starting at $400 with renewals over $230 biennially.

Typical requirements include passing background checks, meeting bond/insurance minimums, and paying accompanying fees. State police also run fingerprints verifying applicants don’t have recent criminal records that might raise integrity concerns around collateral recovery.

Check regulations to determine if individual agents must also carry approved credentials when operating in the field away from home office oversight. Renew license documentation on time to continue practicing uninterrupted.

Since repossessing vehicles involves towing across public roads, the federal Department of Transportation also imposes clearance requirements under the Motor Carrier Act.

You’ll need USDOT Numbers displayed on all commercial vehicles plus CDL-licensed drivers. Some states waive CDLs for certain lighter GVWR vehicles – understand exactly which trucks fall under DOT rules to stay compliant.

8. Get Business Insurance

Operating in the high-risk repossession industry leaves business owners navigating a potential minefield of hazards from tragic accidents to disgruntled vehicle owners. Without adequate insurance backing, a single incident could spell financial and legal ruin for your uninsured agency.

Some common business insurance products include:

- General Liability Insurance: This foundational policy insulates against third-party losses like medical bills from customer injuries on your premises or damage to their property while towing. It also covers associated legal claim expenses. Limits often reach $1 million total and cost around $1,200 annually for a single location.

- Commercial Auto Insurance: Given high collision and turnover risks for repossession trucking demanding late-night highway transport and loading/unloading of vehicles, secure robust commercial policies on all company rigs. Bare minimum premiums still run $1,800 annually but provide the necessary protection.

- Workers Compensation: Required in nearly every state, this covers lost wages, medical bills, and rehabilitation costs if a driver or support staffer gets injured executing their duties whether it’s a tow scene assault or severe strain from a vehicle recovery. Plus it preempts them suing your business directly. Expect $40+ monthly premiums per unique employee factoring in role risk exposure.

- Umbrella Liability: For additional buffer given the hazard potential in repo work, supplemental umbrella policies add millions more coverage protecting your personal and business assets if a court judgment exceeds primary liability limits. These cost-effective policies start around $500 annually per $1 million in added protection but drive major peace of mind against financial risk.

9. Create an Office Space

While much of a repo company’s critical work stays on the road recovering vehicles, maintaining some formal office space provides key benefits. Use it to securely store paperwork, conduct sales calls, manage staff, and temporarily hold repossessed asset inventory. Weigh several real estate alternatives based on cost and functionality factors:

Home Office

Converting an extra bedroom or basement area offers convenience for solo entrepreneurs. Expect minimal explicit costs beyond dedicated desk and storage solutions running a few thousand dollars. However home resale values may take a minor hit. It still offers substantial autonomy given no lease commitments. Provides limited customer/asset hosting capacity, however.

Coworking Space

For collaborative camaraderie and networking with fellow entrepreneurs, coworking spaces like WeWork offer short-term desk rentals for around $300 monthly. Add small private office rentals from $650 for sales calls/meetings. Great for flexibility but secure inventory storage needs likely require upgrading to conventional office rental.

Commercial Office

For mid-size repo outfits housing multiple agents spread across units like document processing teams and sales staff supporting recovery crews, multistory commercial spaces offer abundant capacities for under $10 per square foot. Locate facilities near secured impound lots rather than heavy retail density. Gives control to build-out amenities like evidence rooms or customer service areas facilitating operations.

10. Source Your Equipment

Launching a properly equipped repo operation means investing in specialized rigs and gear for safely transporting repossessed vehicles. Evaluate options for acquiring these assets new or used, along with more capital-friendly rental alternatives.

Buying New

The gold standard remains all-new purpose-built repo trucks and attachments allowing flawless legal compliance and reliable performance even under extreme workloads. Brands like NRC offer customizable cab chassis starting around $50,000 supporting add-ons like:

- Wheel Lifts ($15,000+) – Secure vehicle frames during transport

- Slides ($4,000+) – Load inoperable vehicles

- Tow Dollies ($10,000+) – Flat tow 4 wheels down cars

While expensive, buying new provides warranty support plus modern feature sets like GPS tracking assisting in asset recovery. Finance newer models to conserve capital for those with strong credit.

Buying Used

Scour classifieds like Craigslist and industry forums for quality secondhand trucks costing 40% less than new without the customization advantages. Perform thorough mechanical inspections before purchasing to confirm roadworthiness, suspension, transmission, and electrical components see punishing use requiring ongoing maintenance in repo applications.

Renting

For flexible access to properly equipped rigs without six-figure capital costs, rental options exist but command premium pricing between $700-$1,500 weekly. Compare costs of longer-term commitments against buying. Key caveat – operators must already possess insurance and proper operating licensing to meet agreements. Short-term but not budget-friendly.

Leasing

Custom leasing programs through dealers like Trimor offer competitive rates to purchase rigs over longer 3-5-year terms. Requires strong business credit history. Down payments are still demanded upfront. Offers path towards ownership without large lump sum payments that direct purchase options require.

11. Establish Your Brand Assets

Distinguishing your repossession company amidst a crowded industry starts with nurturing instant name recognition. Implement essential branding elements conveying quality and reliability when engaging with lenders, debtors, and other consumer groups.

Getting a Business Phone Number

Ditch personal cell numbers prone to ignoring unknown calls. Services like RingCentral provide customizable toll-free and local pro numbers from $30 monthly. Forward calls automatically to any staffer’s devices untethering agents from desks.

Creating Logos and Branding

Build distinctive visual identity cueing security and reliability through cohesive logos, truck wraps employing a limited color palette, and complementary letterhead/uniform aesthetics. Services like Looka provide custom design options starting at $20 harnessing AI for quick professional iterations.

Business Cards and Signage

Back your trucks up with professionally printed materials like 10¢ standard cards from Vistaprint establishing legitimacy for sales discussions and onsite interactions. Window cling signage and ID lanyards enhance authority in managing tense vehicle seizures.

Purchasing Domain Names

Anchor online visibility to your distinctive brand name via a matching .com domain from registrars like Namecheap for $9 annually. Convey professionalism and aid discovery by lenders searching locally online.

Building Websites

Either utilize website builders like Wix with customizable templates and hosting for $10 monthly or hire niche repo site developers on Fiverr for $200 delivering custom-coded functionality. Promote capabilities and client testimonials building trust while lead capturing.

12. Join Associations and Groups

Navigating the highly competitive collateral recovery trade requires building mutually beneficial relationships with lienholders and other key industry players. Seek out these invaluable networking opportunities:

Local Associations

Major state groups like the Repo Alliance organize regular local meetings, seminars, and conferences connecting repossession agents regionally for idea exchange and peer support. Annual dues run a few hundred dollars but open doors to contractor jobs plus mentorship opportunities accelerating practical learning.

Local Meetups

Sales-driven repo events hosted throughout the year in most states offer hands-on training across topical areas like compliance plus access to role models and innovators pushing the industry forward. Find nearby offerings through aggregators like Meetup and checkout equipment vendors displaying the latest tow truck and gadget breakthroughs.

Facebook Communities

For 24/7 idea exchange from the masses, industry-specific Facebook groups like Small Business Supporters (USA-based) enable crowd-sourced guidance on everything from recommended gear and documentation tips to workshop promotions and job openings. Lean on thousands of fellow reclamation veterans in these digital sanctuaries to accelerate success.

13. How to Market a Repo Business

Gaining a share in the competitive collateral recovery market relies heavily on vigorous promotion to connect with new lender partners. Balance digital approaches with selected offline tactics maximizing awareness of your reliable services and rapid response across regions.

Leverage Existing Networks

Seed success through current spheres of influence like professional connections made locally plus friends and family open to spreading positive experiences using your services and securing their assets.

Request 5-star online reviews on platforms like Facebook and Google highlighting reliability. Referral rewards like branded shop swag or reduced 10% friend fees keep the unity flowing. Nothing fuels conversion like word-of-mouth from those who already trust you.

Digital Marketing

- Launch Google Ads campaigns with geo-targeted keywords like “repo company [city]” driving searches to your website capture forms.

- Publish helpful repo process explainers on sites like Medium drawing organic traffic.

- Run retargeted Facebook and Instagram video ads demonstrating recovery capabilities following customized pre-sale audiences.

- Contact vehicle finance publications about contributing repo guest articles putting your name before industry influencers.

- Start an email newsletter providing security tips for nurturing lender relationships and referral pipelines.

Traditional Marketing

- Print glossy brochures with brand summaries and client wins for in-person sales meetings.

- Advertise late-night AM radio ads blanketing recovering regions when repossession agents drive routes.

- List with B2B directories like Yelp building visibility among finance company searchers.

- Host free regional seminars on asset protection securing speaking slots touting expertise.

- Sponsor relevant trade groups aligning with peer verticals in automotive and finance.

The most effective marketing mixers synergize online and offline channels with networking efficiently will multiply your agency’s visibility and trust signals. Let me know if you need any other repo promotion pointers!

14. Focus on the Customer

In the reputation-dependent collateral recovery industry, how you treat both lenders and debtors proves pivotal in determining referral rates and retention. Make providing an excellent customer experience a top strategic priority right from the start.

Some ways to improve customer focus within your repossession business include:

- Respond quickly to new service inquiries with custom quotes within 24 hours, vastly outpacing the multi-day lags of slower competitors.

- During actual repo operations, instruct agents to carefully explain legal protocols if challenged by emotional vehicle owners, defusing tensions by emphasizing options around retrieving essential medications or documents.

- Follow up within 48 hours of assignments to ensure both creditors and debtors that repossessions occurred properly.

- Address any outstanding pickup coordination issues if vehicles require alternate transportation.

- Foster relationships with every point of contact when working with asset finance partners, whether front desk staff or executives.

- Thoughtful gestures like periodic coffee meetings demonstrate commitment beyond per-job transactions.

- Encourage happy clients and consumers to post online reviews or provide website testimonials, and consider small incentives like $100 credits on future projects.

Delivering such personalized, compassionate support compounds into loyalty, retention, and critically important referrals. Outcare the competition across each customer interaction to shape a reputation for superior service enabling sustainable repo business growth.