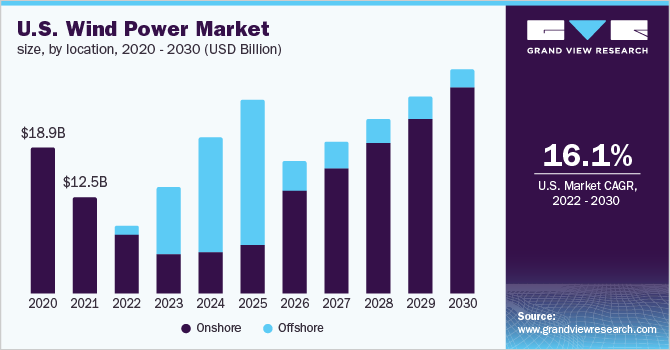

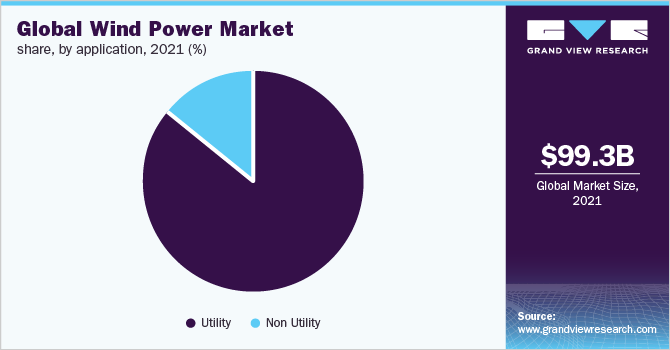

The global wind energy market is projected to reach $278.43 billion by 2030, growing at a CAGR of 13.67% from 2023 to 2030. With increasing demand for renewable energy sources and favorable government policies, there are significant opportunities for new entrants in the wind energy industry.

Those with sufficient resources and knowledge can profit in this growing industry. Work as both independent power producers selling to the grid and operators contracted under power purchase agreements.

This guide will walk you through how to start a wind farm company. Topics include market research, competitive analysis, customer focus, registering an EIN, obtaining business insurance, and more.

1. Conduct Wind Farm Market Research

Market research is essential to starting a wind turbine business. It offers insight into the best sites for offshore wind farms, where to source equipment for your wind farm project, average wind speed for wind turbines, and more.

Some details you’ll learn through market research in the renewable energy industry include:

- In the next decade, new installations are forecast in developing economies like China and India.

- Land-based, fixed-foundation wind turbines comprise 90% of installations.

- Project returns are dependent on factors like project scale, wind resource quality, access to transmission infrastructure, power market dynamics, and policy frameworks.

- Returns are also determined by capital structure, projects able to secure low-cost tax equity, debt, and grants can achieve better returns.

- Developers should target sites with good wind speeds (Class 3 or higher), near existing infrastructure.

- Obtaining permitting and approvals can take 2-5 years.

- The typical 250 MW project costs $400 million+.

- Installed projects can generate $100 million+ profit over turbine life.

- Projects qualify for federal ITC tax credits and accelerated depreciation.

- Operations are low cost – with minimal labor beyond technicians.

- Revenue can be predictably forecast based on historical wind data.

- The top site yields an average of 45% capacity factors.

- Combining complementary sites helps manage intermittency. Demand is evergreen, unlike solar which fluctuates seasonally.

With the right combination of assets, expertise, and access to cost-efficient capital, wind energy offers reliable yields. New entrants should be prepared to invest substantial resources in developing a long-runways pipeline until sufficient scale is reached. Patient project portfolio builders can succeed.

2. Analyze the Competition

Understanding the competitive landscape is crucial when assessing the market opportunity. With high barriers to entry, there are limited direct wind farm developers to track. Key players like NextEra operate large utility-scale portfolios across states and globally.

Monitor public info on competitor project locations, power generation, and customers to deduce insights on strategy, risk appetite, and partnerships. Given long development timelines, track pipelines to gauge future competitive supply dynamics.

Assess strengths, larger players benefit from robust balance sheets, development experience, and lower cost of capital. However small players can target niche segments and geographies. For example, position projects for emerging corporate demand through bilateral deals vs competing in wholesale markets.

Social platforms like LinkedIn provide visibility, especially on personnel moves suggesting changes in strategic direction. Leverage platforms like ZoomInfo to gather intelligence on company developments, and leadership contact information to build relationships.

Conferences and industry events provide opportunities to directly engage with channels and competitors. These help procure specific component providers and service contractors used by competitors to benchmark peer performance.

3. Costs to Start a Wind Farm Business

Starting a wind farm requires substantial upfront capital with the biggest cost being development expenditures and turbine procurement. Additional project infrastructure like roads, cabling and the balance of the plant can equal or exceed turbine expense.

Starting your own wind farm would entail the following costs:

Start-Up Costs

- Development rights and leases: Securing site control and wind rights via lease and easement agreements with landowners involves legal fees of $50,000.

- Permitting and pre-construction studies: Legal and permitting fees for zoning variances, construction, and permits can add another $500,000.

- Turbines: Procuring 125 x 2MW turbines would be around $175 million. Full payment is not upfront – milestone-based payments allow using project financing for this major capital cost.

- Balance of plant: The remaining infrastructure like access roads, underground cabling, and substations allowing grid connectivity can total $140 million.

- Consulting: Highly specialized technical (engineering), legal, tax, and regulatory consultants are imperative in the development phase incurring at least $500,000 fees.

- In-house team: A core team well-versed in initial development would require at least $400,000 in annual salaries.

Ongoing Costs

On achieving commercial operation by commissioning the wind farm, expenses transition more to fixed operating costs:

- Operations staff: To operate the facility you’ll require a permanent team working under an O&M services contract worth $7 million per year fixed for at least 5 years.

- Turbine maintenance: A 5-year service agreement would likely cost $15 million annually.

- Balance of plant: Substations, transformers, and cables require ongoing maintenance with annual material and contractor costs of $5 million.

- Insurance: Operating such an infrastructure facility mandates insurance like property damage, liability, and workers’ compensation costing over $750,000 annually depending on risk appetite.

- Land leases: With 250 MW capacity across 1000 acres, annual lease payments enabling the use of the land for turbines could exceed $500,000.

- Administration: In-house administrative staff managing activities like accounting, compliance, and servicing debt would cost upwards of $300,000 annually.

- Financing: Project finance interest and principal repayment are major outflows for developers without full upfront equity funding of the $400 million investment.

The levelized cost of wind power ranges from $26-50/MWh. Revenues from power sales and tax incentives must exceed operating costs and debt payments for investor returns.

4. Form a Legal Business Entity

Before starting any wind farm projects, you’ll need to form a legal business entity to operate in the United States. Small startups in the wind resources industry are best suited to the Limited Liability Company formation. Here, we’ll break down the most common entities to choose from.

Sole Proprietorship

A sole proprietorship is owned and operated by one person. This is the simplest structure with minimal legal requirements to set up. However, the owner assumes unlimited personal liability for debts and legal claims. Losses flow through directly to the individual. This poses significant risks given the high asset values and liabilities involved in wind farms.

General Partnership

A GP avoids double taxation as profits pass through to partners. But like sole proprietors, partners have unlimited personal liability which is concerning for hazardous activities inherent in turbine operation and maintenance. Disagreements between partners can also dissolve the business. Overall, general partnerships remain unsuitable.

Limited Liability Company (LLC)

LLCs limit owner liability to their investment stake while providing pass-through tax treatment avoiding double taxation on gains. The flexible structure allows adapting to complex deals with tax-equity investors and lenders critical in renewable financing. LLCs can elect to be taxed as partnerships.

C Corporation

C corporations offer complete limited liability for shareholders. But taxation occurs at both corporate and shareholder levels upon distribution of dividends leading to lower investor returns. Still, the rigor required in documentation, governance, and compliance builds institutional credibility helpful in engaging large utilities and regulators.

5. Register Your Business For Taxes

An Employer Identification Number (EIN) serves as a unique tax ID number for a business entity, similar to a Social Security Number for an individual. Wind farm developers need to obtain an EIN from the IRS even as a sole proprietor or new LLC before hiring employees or opening business bank accounts.

The EIN allows reporting employee payroll taxes, opening commercial utility accounts essential to operating high voltage infrastructure, and claiming tax benefits like the Investment Tax Credit critical for project economics.

Fortunately obtaining an EIN is fairly simple and free through the IRS website. The key steps are:

First, gather information like the LLC agreement if entities have been formally established, and details on the ‘responsible party’ – either an officer in a corporation or owning partner in a partnership/LLC.

Next begin the EIN Application identifying either the Social Security Number or existing EIN, name, and address along with the start date/state of formation of the business entity seeking an EIN.

Selecting the appropriate legal structure like LLC or corporation and answering whether payments to owners/officers have been made clarifies the tax treatment.

The application then requests the principal economic activity matching the NAICS industry classification code which for wind farm developers and operators would be 221115 – Wind Electric Power Generation.

Business information like expected hiring dates, use of employee payroll services, and estimated tax liability is collected before an EIN is issued upon submitting the form.

With the EIN secured, bank accounts can then be opened to facilitate invoicing, cut checks and transact seamlessly as an established business. It formalizes wind farm entrepreneurs as serious market players able to navigate legal requirements.

6. Setup Your Accounting

Operating wind farms involves complex financing structures and significant asset values warranting structured accounting right from the development stages. Poor record-keeping related to costs like turbines, logistics, and construction makes it hard to track project budgets.

Accounting Software

Using software like QuickBooks integrates bank data to automate tracking for real-time financial status. Cloud access aids remote monitoring across far-flung turbines. QuickBooks also eases filings and is widely used enabling smoother adoption by investors/lenders.

Hire an Accountant

Software is no substitute for accountants given the intricacies of wind project accounting. Construction accounting recognizes complex contractor invoices and change orders to determine completion % and tax depreciation eligibility. Valuations of project sub-entities, and require allocation across equity investors and lenders require specialized know-how.

Open a Business Bank Account

Separate personal and business accounts entirely. Commingling invites IRS trouble if ever audited. Have a dedicated business checking account to transparently track cash flows. Route all project-related transactions from construction drawdowns to turbine invoices through this account.

Apply for a Business Credit Card

Open a business credit card solely for company expenses like corporate filings, travel, and legal retainers. This evidence helps prove business rationale if questioned by the IRS.

7. Obtain Licenses and Permits

Wind farms involve substantial infrastructure buildout on leased lands which triggers various regulatory requirements before starting construction or operations. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

- Federal Aviation Administration (FAA): As wind turbines can reach 500 feet tall, the FAA requires Form 7460 clearance. This may require adjusting turbine quantity or layout. The FAA may mandate lighting upgrades for night-time visibility adding costs.

- Local zoning permits: Counties have strict land use laws governing the height, noise, or lighting regulations for structures. Zoning changes may be needed if current frameworks prohibit commercial-scale electricity generation. Public hearings often deliberate such requests.

- Environmental Impact Assessments (EIA): Pre-construction reviews analyzing acoustic, ecological, and visual impacts on wetlands, and wildlife are mandated. Mitigation like minimizing land clearing may be stipulated, although habitat restoration is common.

- Stormwater management: Grading land for access roads and turbine pads increases runoff during rains. Projects exceeding 5 acres require Stormwater Pollution Prevention Plans stipulating drainage mechanisms to prevent downstream flooding. Monitoring may continue post-construction.

- Right-of-way permits: Constructing underground transmission cables, and overhead lines to connect the wind facility to the grid needs county permits for public right-of-way access for digging trenches. Traffic management is mandated during cable laying to avoid public impact.

- Operational licenses like FERC market participant authorizations squarely apply for merchant wind selling power competitively. Load-serving entities buying wind power handle compliance with signed power purchase agreements.

State policies like Renewable Portfolio Standards are also shaping permitting timelines and process efficiency as more regions invest in renewable infrastructure. Understanding the various stakeholders concerned by land use changes aids engagement for successful licensing so projects can legally proceed.

8. Get Business Insurance

Operating wind turbines posing massive potential liabilities requires adequate insurance to sustain operations. Unlike office spaces, complex machinery breakdowns, fires, and natural disasters pose higher risks. Being underinsured even briefly can permanently impair projects.

For example, a lightning strike could destroy control systems and generators costing millions to replace. Storm damage may disrupt operations for months until specialized parts can be re-procured elongating revenue impact. Blade detachment during overspeed conditions could even injure technicians.

Such scenarios can lead to crippling lawsuits from injured staff, suppliers, and utilities and force bankruptcy without insurance cushions. Premiums seem costly upfront but quantified risk transfer is indispensable. It also signals business professionalism to contractors.

Common coverages like:

- General liability protects against third-party bodily injury, and property damage claims onsite.

- Workers’ compensation is mandatory for employee medical/wage loss.

- Asset insurance finances the cost of rebuilding infrastructure damaged by natural causes.

- Business interruption policies pay losses from suspended operations.

- Umbrella policies offer excess liability above other policy limits.

The typical application process begins with submitting details on business activities, location, revenue, and employee count. Insurers use such information to understand exposures and offer quotes on tailored coverage.

Developers should compare premiums-to-deductibles tradeoffs across insurers like The Hartford, and Travelers Insurance before binding coverage. Independent agents can aid selection of cost-optimal bundles meeting risk appetite. State filings may apply depending on the business structure.

Maintaining consistent insurance through the multi-year development cycle until decommissioning is advised given wind plants’ long operating lives. Periodically reviewing policies against emerging risk scenarios helps manage gaps.

9. Create an Office Space

Having a professional central office space lends credibility when engaging landowners, utilities, regulators, and investors critical for multi-year development cycles. Site visits and construction phases warrant proximate spaces for strategic coordination while minimizing travel costs.

Coworking Office

Coworking spaces like WeWork offer flexible terms if deal flows remain uncertain early on. With monthly rents of $300+ and the ability to upsize/downsize on-demand, the pay-as-you-go models align with the scalability needs of startups. Coworking perks like meeting rooms, admin support, and mixing with other entrepreneurs foster innovation.

Commercial Office

As the first power generation facilities get commissioned, scaling into commercial office buildings in the 15,000+ sq. ft range near project sites streamlines oversight. Lease terms average 5 years enabling stable regional operations growth. While rents approach $40 per square foot in major metros, secondary cities average $25 per square foot.

10. Source Your Equipment

The core equipment for wind farms is the turbines themselves powering generation. But hundreds of balance of plant components like transformers, cables, breakers, towers enabling collection and transmission are also integral. Sourcing quality equipment cost-efficiently is key.

Buying New

Procuring the latest utility-scale turbines like GE‘s 4.8 MW model or Siemens Gamesa‘s 5. X platform directly from OEMs ensures warranties, and maintenance support and maximizes energy output. Units exceed $3 million each but scale discounts apply for orders above 100 MW.

Buying Used

More available inventory enables faster deployment but lacks manufacturer relationships for service, parts risk, and downtime losses. Still, a 30-40% discount on new systems makes globally used suppliers like Wind-Turbine.com attractive.

Renting

Rather than outright buying the cranes, trenchers, and road graders costing $ 100,000, short-term rental from United Rentals for the duration of deployment optimizes capital. With 500+ locations availability is ensured for temporary needs.

Leased

Joining queues for new transmission infrastructure can take 5+ years. Instead, developers can lease capacity in existing networks to accelerate project buildouts. While WACC premiums apply, this unblocks Route identification, permitting done upfront, and fast-tracking operations.

11. Establish Your Brand Assets

Cultivating a distinctive brand builds awareness and trust with landowners, utilities, and investors amidst a fragmented competitive landscape. A polished identity also fosters pride and cohesion internally between remote field technicians and deal origination teams.

Getting a Business Phone Number

Get a number from providers like RingCentral to exude professionalism when contacting county zoning boards, and permitting agencies. Auto-attendants and vanity numbers with business names aid recall and mobile apps enable seamless usage by distributed staff.

Creating a Logo and Brand Assets

Designing a logo centrally projects wind farm capabilities. Clean circular logos evoking turbine blades and gradients connoting clean energy can define visual identity. Services like Looka aid rapid yet refined designs.

Business Cards and Signage

Printed business cards enable in-person relationship building with site neighbors, suppliers, and partners critical for the highly networked renewable sector. Cards with sustainably sourced cardstock from Vistaprint and QR codes to digital assets can further eco-conscious positioning. On-site signage also helps manage safe access.

Purchasing a Domain Name

Obtaining a domain name that’s easy to remember without hyphens, numbers or prefixes establishes discoverability including for non-technical landowners. Containing “Wind” and geography connotes regional specialization. Domain registrars like Namecheap enable branding within emails as well.

Design a Website

Modern businesses require a professional website to promote authority in their fields. Leveraging website builders like Wix facilitates quick DIY sites while developers from Fiverr can create sophisticated platforms showcasing dynamic data like real-time energy output.

12. Join Associations and Groups

Joining regional wind associations offers visibility into policy changes, contract opportunities, build, and best practices to navigate complex development hurdles.

Local Associations

Associations like the American Clean Power Association supply groups on grid interconnections, and wildlife impacts central to project viability. Conferences feature innovator showcases that can spark partnership ideas while networking facilitates contractor referrals.

Local Meetups

Attending industry events hosted by Meetup groups like Wind Workforce aids continuing education across fast-evolving technical domains from turbine optimizations to battery storage co-location. Developer-focused forums enable benchmarking project timelines and financing trends.

Facebook Communities

Joining groups like Wind Farm Construction facilitate advice-sharing as developers navigate county permitting. Others focus on careers allowing recruitment even amid nationwide talent shortages as portfolios scale.

13. How to Market a Wind Farm Business

Strategic marketing is imperative for developers to drive discovery by utilities, landowners, and local permitting boards influencing project destiny. As pioneers in a region, awareness building secures vital relationships underpinning expansion.

Personal Networking

Leveraging networks via introductions from existing partners like turbine OEMs or engineering firms can endorse credibility. Offering project equity to well-networked industry veterans in exchange for sponsor connections also pays dividends.

Digital Marketing

Digital campaigns effectively scale outreach to specific personas:

- Google/Facebook ads target landowners near high wind areas to gauge lease interest

- Retargeting nurtures utility bid teams across websites to influence RFP decisions

- Paying legal/permitting influencers builds reputation across regulators

- Optimized content and SEO improve discoverability for niche investor terms

Building a subscriber email newsletter shares milestone updates, policy impacts, and regional insights to stay top-of-mind.

Traditional Marketing

Traditional formats include:

- Large project billboards along highways inform local communities bolstering political support

- Sponsoring energy trade podcasts and panels elevates exposure to vendors

- Direct mail campaigns to eligible land plots offer options analysis

- Print advertorials in zoning board magazines aid in permitting

- Radio segments highlight project jobs’ impact to reinforce media narratives

Starting targeted and expanding multi-channel outreach sustains visibility amidst long development timelines. Prioritizing formats aligned to stakeholder consumption habits improves conversion.

14. Focus on the Customer

Delivering robust customer service and assertively seeking referrals is pivotal in the reputation-driven wind energy sector spanning landowners, utilities, and inspectors over decades-long asset lifetimes.

Being responsive to initial inquiries from farmers about turbine leasing builds goodwill even if projects don’t materialize immediately. Maintaining dialogue facilitates faster deal completion when scouting adjacent plots later. Impressed landowners also endorse developers within their networks, unlocking new partnerships.

During project construction, being prudent by mitigating disruptions for nearby residential areas like minimizing night work or dust buildup earns community support. This facilitates quicker approvals for expansions. Locals can also influence politicians in deciding on permits.

Proactively monitoring turbine performance metrics provides visibility to issues before receiving complaints. Technicians must rapidly address concerns raised by neighboring homeowners facing any nuisance like shadow flickers or obstructed views to prevent spiraling resentment.

In an industry with multi-year cycles, nurturing strong customer relationships mitigates risks from political shifts or individual transitions. It also unlocks invaluable growth opportunities through referrals. Thus customizing support for the diverse needs across wind farms’ lifespan is an invaluable investment.