The estate sale industry is booming. As Baby Boomers continue to age and downsize their living situations, the demand for companies to help liquidate their belongings is skyrocketing. According to IBISWorld, the estate sale services industry reached $236.1 million in 2023. This makes now an opportune time to launch an estate sale business.

You don’t need prior experience to get started. Armed with an understanding of the liquidation process, marketing tactics, legal requirements, and client relations, entrepreneurs from all backgrounds can capitalize on this industry’s potential.

This guide will walk you through how to start an estate sale business from the ground up. From registering an EIN to obtaining the appropriate business insurance, and marketing your brand, we’ll explore the practical steps to turn your passion for antiques and secondhand goods into a thriving business.

1. Conduct Estate Sale Market Research

Market research is important when starting a business in local estate sales. It offers details on your target market, local market saturation, and trends in products and services.

Some details you’ll learn through estate sale companies’ market research include:

- While demand looks strong, competition is still relatively high in this industry.

- Low barriers to entry mean many solo entrepreneurs and small teams compete for local market share.

- Some estate sale liquidator businesses partner with real estate agents to access products left behind in homes being sold by the deceased’s family.

- Standing out requires thoughtful branding, ethical operations, and superior inventory.

- Those new to the estate sale industry should specialize in a niche to establish authority and regular clientele early on.

- Popular niches include antiques and collectibles, downsizing/decluttering, luxury estate sales, and art and artifacts.

- No matter what inventory you specialize in liquidating, providing white-glove service and understanding client psychology around parting with belongings is paramount.

- Honing soft skills in this domain gives an edge over transaction-focused competitors.

Industry analysis confirms estate sales offer a compelling business opportunity today. Leveraging specialization and service differentiation allows new entrepreneurs to compete and secure market share within the estate liquidation industry.

2. Analyze the Competition

Successfully launching an estate sale company requires understanding your competitors. Conduct estate sales competition analysis in your geographic target area.

Search Google Maps for estate liquidators near you. Note their locations, branding, areas of specialty, and online presence. Drive by retail locations (if applicable) and observe foot traffic, display aesthetics, and inventory offerings.

Evaluating competitors’ digital footprint is also important, as much of estate sale marketing happens online nowadays. Search their business names to uncover websites, social media pages, and reviews.

Consider areas for differentiation like:

- Brand personality – Is their branding sleeker or more homemade than yours? What values do they communicate visually and verbally?

- Service specialties – Do they focus broadly or on particular niches like antiques, art, and downsizing help?

- Business longevity – The number of years in business can signify reputation and connections for sourcing referral partners and estates to liquidate.

- Pricing structure – Transparently published commission fees? Hourly consulting rates? Competitor pricing influences how you can position yourself.

- Online following – Social media followers and email list size indicate audience reach potential. Can yours be grown faster through paid advertising?

- Reviews and ratings – Positive customer testimonials lend credibility while evaluating complaints helps avoid their mistakes.

By analyzing competitors across key metrics from location and branding to reviews and specialization, strategic opportunities appear for positioning your differentiated services.

3. Costs to Start an Estate Sale Business

Getting an estate sale company off the ground requires initial investments before you can begin operations and start generating revenue. Some of the business expenses you’ll encounter before and after your first estate sale include:

Start-up Costs

- Business Registration Fees – Registering your LLC or corporation will cost $100-$800 depending on your state.

- Estate Seller Licensing – Acquiring a secondhand dealer license runs $25-$100 annually depending on location. Some states may require additional licensing.

- Inventory Software – Cloud-based software for tracking inventory, customer contacts, and financials start around $30/month. Popular options include EstateSales.org and Monza.

- Renting Storage Space – A 50-100 square foot storage locker to hold estate sale staging inventory costs approximately $100-$250 monthly.

- Office Supplies – Dedicated business phone, computer, printer, filing cabinets, and misc office supplies will run you around $1000-2000 upfront.

- Marketing Assets – Professional branding, a website, graphics, and signs/banners for advertising estate sales cost roughly $2000-$4000 depending on complexity.

- Fuel/Transport – A cargo van for hauling equipment and estates’ furnishings run $25,000+ to purchase. Expect to budget for gas, maintenance, and insurance expenses.

- Security System – Cameras, alarms, and theft protection for your storage space average $2000.

- Staff Uniforms – Polo shirts or jackets embroidered with your logo for staff identification cost approximately $25 each.

These upfront investments mean launching an estate sale company requires around $30,000 to 60,000 in start-up capital.

Ongoing Costs

- Rent + Utilities – Retail shop or warehouse space typically runs $1500 monthly depending on location and size. Expect another few hundred per month for electricity, gas, water, etc.

- Storage Locker – Budget $100-$250 monthly for your offsite staging locker.

- Fuel + Maintenance – With frequent trips to estates and sale sites, fuel and vehicle upkeep averages $300+ monthly.

- Software Subscriptions – Inventory and record-keeping programs cost around $30+ per user monthly.

- Advertising – Paid search, social, website, print, and radio ads average $2000 per month altogether.

- Hired Staff – Employees to assist with organizing, home staging, and working sales amount to $2000 in monthly payroll expenses.

- Insurance – General liability insurance plus bonding insurance averages $150 monthly.

- Transaction Fees – Credit card payment processor and cash advance fees add up to around 3-5% of sales.

- Accounting help – Professional bookkeeping services cost $300+ per month typically.

In total, plan for ongoing operating costs of approx. $6500 per month as you work to drive sales through executed estate liquidations. Keep costs lean in the first year as you reinvest earnings back into growth.

4. Form a Legal Business Entity

When starting an estate sale business, you must choose a legal entity to register it under. Each entity type has implications on taxes, liability protection, and ease of formation that new entrepreneurs must consider.

Sole Proprietorship

A sole proprietorship represents the simplest and most common default option. You own all assets and debts with no legal separation between personal and business finances. While easy to set up, sole proprietors receive unlimited liability, meaning your assets can be seized to settle business debts and lawsuits.

Partnership

Forming a general partnership splits ownership between two or more partners. However, each partner assumes unlimited personal liability for debts and legal issues incurred by the business. Disputes can also more easily dissolve partnerships.

Limited Liability Company (LLC)

Given the frequency of high-value goods changing hands in estate sales, protection from liability makes formations like limited liability companies (LLCs) smart choices. LLCs limit owner liability and keep personal assets shielded from company debts and legal judgments. LLCs also impose fewer operating requirements than corporations.

Corporation

Converting to a corporation in the future remains simpler with an LLC too. In general, corporations are better suited to large companies. They require more complex registration and are expensive to form.

5. Register Your Business For Taxes

Even sole proprietor estate sale businesses need to obtain an Employer Identification Number (EIN) from the IRS for tax purposes. An EIN functions like a social security number for your company.

Acquiring your unique EIN is free and easy through the IRS website. The online application takes less than 15 minutes to complete. You’ll need your personal identification documents, business address, and details about ownership structure ready.

The process involves:

- Navigating to the EIN Assistant page on IRS.gov

- Selecting View Additional Types, then continue to the assistant for Sole Proprietor application

- Providing your personal info and business details as prompted

- Reviewing your business information summary before submitting

Once submitted, your EIN gets issued immediately. The IRS emails a confirmation notice containing your new number for tax documentation.

You’ll also need to register with your state to collect and remit sales tax from estate sale transactions. Every state has slightly different procedures but generally involve submitting a simple form and paying a nominal fee. For example, the California seller’s permit application costs $20 and takes a few minutes to complete.

Check your state’s business tax resources to apply for required sales licensing, understand tax obligations, and smoothly handle payments. Keeping compliant means your growing estate sale company avoids potentially costly penalties down the road.

6. Setup Your Accounting

Keeping accurate financial records is imperative in an estate sale business where high-value inventory constantly changes hands and commission percentages determine profits. Without diligent accounting, you risk facing IRS penalties, overpaying at tax time, or lacking the clarity required for optimal strategy decisions.

Open a Business Bank Account

Start by separating personal and business bank accounts. Never pay personal expenses from your business checking account. Opening a dedicated account provides clean documentation of all business income and expenses flowing through it.

Accounting Software

Acquire bookkeeping software like QuickBooks to automatically centralize your finances. Connecting bank/credit card accounts to QuickBooks enables easy categorization of every transaction, invoice tracking, and seamless tax documentation. This eliminates manual data entry and reconciliation busywork.

Hire an Accountant

While software handles daily logging, work with an accountant quarterly on oversight. Expect costs between $200-500 per month for routine bookkeeping and financial statement preparation. Come tax season, your accountant can also handle sales tax calculations, tax payments, payroll filings, and compiling your annual returns for roughly $1000-2000.

Apply for a Business Credit Card

Getting a business credit card also simplifies record keeping with clear documentation of company purchases. Business cards function similarly to consumer cards but usage won’t impact your credit score. Limits match your projected monthly expenditures rather than individual income like personal cards.

7. Obtain Licenses and Permits

Operating a lawful estate liquidation business means demonstrating compliance through required licenses and permits. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

For example, at the federal level, an estate sale business must acquire secondhand goods dealer licensing per IRS Publication 526. Report inventory acquisition details within 30 days for all goods purchased excluding vehicles. This proves legal sourcing and ownership should audits arise later.

Several other federal permits may also apply depending on operational areas like aviation, agriculture, alcohol, firearms, or hazardous materials disposal. Assess current and future services to ensure full compliance.

State-level licensing forms the next compliance checkpoint. Common required permits include a professional seller’s license, sales tax registration tied to your EIN and special use licenses if transporting oversized vehicles.

For instance, those hauling large furniture or commercial vehicles for asset removal may need commercial driver’s licenses (CDL) and transport permits that list maximum load weights.

Check with your Secretary of State office using their small business licensing wizard to identify required documentation. Renew licenses annually according to state guidelines as well.

At the county level, zoning permits likely apply to any leased brick-and-mortar retail space or fixed-site warehouse usage. Different counties enforce specific rules regarding operating hours, customer volume, signage, or building access for those with disabilities.

Reconfirm compliance when signing any property lease or making retail site modifications. The same often applies to finalizing contracts to host periodic estate sales at private event venues too.

8. Get Business Insurance

Insuring your estate sale business safeguards its financial viability against unforeseen losses. The frequency of high-value goods changing hands makes particular coverages vital from day one.

For example, general liability insurance protects when third-party property damage or bodily injuries occur because of your operations. It covers legal judgments should a customer get injured at a sale.

Another essential policy, employee theft insurance shields against inventory shrinking when staff steal. Crime bonds also cover financial losses from robberies, computer fraud, counterfeiting, and other criminal activities.

Operating sans insurance leaves grave vulnerability. Consider if a contracted moving company drops and destroys a full antique bedroom set. Or an overnight burglary results in $20,000 of jewelry disappearing from your secure storage. Both easily spell business dissolution without proper coverage.

Compared to those figures, yearly premiums cost reasonable pence on the dollar. They eliminate having to personally cover five- and six-figure risk possibilities that accompany estate sales.

Gaining quotes involves simply submitting details like your business type, location, number of employees, and revenue online through insurer websites like The Hartford and Next Insurance.

This yields cost estimates tailored to your situation for desired policies like:

- General liability – $500,000 limits

- Professional liability – $1 million limits

- Commercial crime insurance – $100,000 limits

- Cyber insurance – $100,000 limits

Evaluate if current cash reserves could sustain your business through the example incidents mentioned. If uncertainty exists, get insured immediately.

9. Create an Office Space

Operating an estate liquidation business entails frequent offsite meetings with clients plus remote work weeks spent coordinating sales. A formal office remains helpful for conducting consultations, securely storing sensitive documents, and separating professional/personal lives. Weigh options like:

Home Office

Converting a spare bedroom into a basic home office costs a little upfront. It provides privacy for client meetings and flexible 24/7 access for late-night work sessions. However, storing valuables onsite and distractions from family members often undermine productivity and security. Expect around $100-200 to set up with a basic desk and supplies.

Coworking Space

Nearby WeWork locations offer convenient on-demand meeting rooms from $40/hour. Store commonly-used equipment in 24/7 member-access cubbies. Tiered monthly memberships like WeWork’s Virtual Office also provide a business address to list professionally on websites/business cards starting at $60/month.

Retail Office

For estate sale operators planning retail components too, storefronts double as offices. Store merchandise displays and backrooms house desks for behind-the-scenes administrative tasks between assisting shoppers. Average 700 square foot units in shopping complexes lease for $1500+ monthly.

10. Source Your Equipment

Successfully liquidating estates requires reliable transportation, staging, and merchandising equipment. Source cost-effective equipment for your own estate sale company through:

Buying New

While pricier, dealerships provide warranty protections on new vans, shelves, and electronics. Cargo vans with rear storage specs adequate for hauling start around $25,000 before custom shelving. Durable collapsible display racks and customizable tag systems run $2000. Invest in rugged mobile devices like tablets and label printers too.

Buying Used

Major savings arise when purchasing quality secondhand goods if comfortable with wear and shorter shelf life. Facebook Marketplace and Craigslist offer nearby deals on used cargo vans under $10,000. Expect to pay half compared to new retail for solid furniture pieces or electronics as well.

Renting

When only requiring larger vans temporarily for single estate cleanouts, renting proves most economical. U-Haul rents out cargo vans for $20-$30 daily including insurance. For seasonal storage overflow, movable container rentals start around $100 monthly. Rent cafe and reception furnishings as needed for hosting live sales as well.

Leasing

Benefit from consistent usage with less upfront cash required by leasing primary vehicles and equipment over 36-60 months. This also bundles asset insurance coverage and scheduled maintenance services for reliable mobility. Expect equivalent monthly rental costs but with longer access terms and restricted mileage caps.

11. Establish Your Brand Assets

Crafting a distinctive brand presence allows estate sale entrepreneurs to cut through the noisy local competition and earn trust quicker with target shoppers.

Begin by securing branded fundamentals like:

Getting a Business Phone Number

Replace personal cell numbers with a professional business line using providers like RingCentral. Expect starter digital plans with call routing features and toll-free availability from $30/month. Prominently showcase your dedicated company numbers across all marketing to streamline communications.

Creating a Logo and Brand Assets

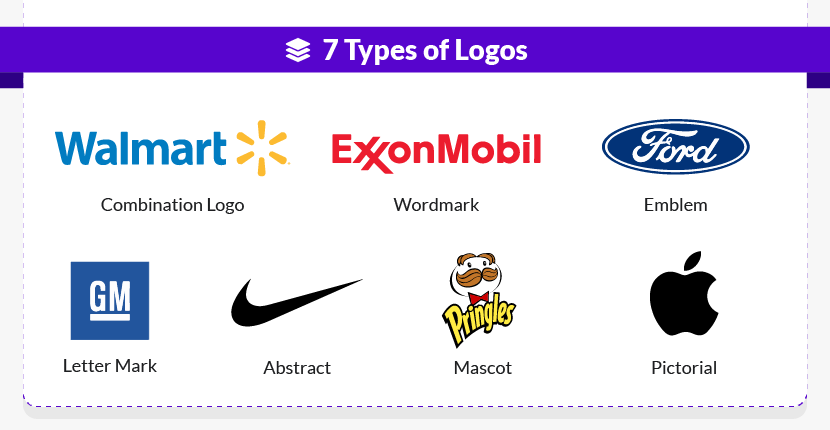

A thoughtfully designed logo becomes the cornerstone of your visual identity. Consider cleanly typographic wordmarks or emotive brand mascot logos. Looka’s AI tools help create on-brand colors, fonts, and graphic elements like badges and monogram seals for under $20.

Print Business Cards and Signage

Business cards displaying your logo, tagline, website, and contact info should be carried by all staff as roving 3D advertisements. Signage postings at storage facilities, live sales, and outreach events further heighten exposure. Order 500 to 1500 professionally printed cards and 10 lawn signs for around $50 total through convenient online printers like Vistaprint.

Purchasing a Domain Name

Secure matching.COM domain names reflecting your location and expertise using registrars like Namecheap for under $20 yearly. A domain transforms into a valuable marketing asset to list across all materials and helps customers conveniently find your website.

Building a Website

Constructing even simple sites quickly conveys legitimacy online. Those with website creation confidence can use Wix’s drag-and-drop editor from $14 monthly. Alternatively, delegate design entirely by hiring specialized freelancers found on marketplaces like Fiverr to finish quality sites from $500 and up.

12. Join Associations and Groups

Plugging into localized estate sale owner communities accelerates practical knowledge and referral partnerships. Fellow consigners happily share industry best practices and recommend proven partners that took years to uncover themselves.

Local Associations

In most metro areas, regional estate liquidators associations exist bringing multiple competing business owners together regularly. The American Society of Estate Liquidators is a great group to start with. Expect reasonable annual dues under $100.

Local Meetups

Keep a pulse on emerging trends and talent by attending area Meetup groups. Discussion panels feature unique operational approaches outside your current perspective. In-person networking kindles relationships with fellow sellers, storage companies, truck rental providers, and liquidators.

Facebook Groups

Thousands of fellow entrepreneurs nationwide face similar estate hurdles daily making social forums infinitely valuable. The ESTATE SALE LIQUIDATOR PROS and Liquidators USA groups share firsthand stories, planning templates, employee management tactics, and niche specialization ideas to bolster any business model. Post questions yourself to receive tailored guidance from those already excelling across the country.

13. How to Market an Estate Sale Business

Implementing ongoing marketing proves imperative for consistently driving new estate sale client acquisition and maximizing turnout at hosted liquidations.

Begin converting contacts using:

Personal Networking

Tap friends, family, past clients, and local Facebook connections to lay initial referral foundations as you establish operations. Offer 10% referral bonuses or complimentary consultations for anyone providing verified consignment leads who sign contracts.

For example, pleased sellers who recommend additional contacts could receive an estate commission donation to their named non-profit. This incentivizes viral word of mouth as you deliver excellent liquidation support.

Digital Marketing

- Google Ads – Target local searchers seeking related services through paid search campaigns. Expect to invest $300-$500 monthly to attract visitors by researching terms like “downsizing assistance near me”.

- Facebook Ads – Create lookalike audiences mirroring the demographics of current clients. Then showcase photo galleries of your estate sale services through Facebook/Instagram advertisements.

- Start a YouTube Channel – Publish weekly vlogs documenting behind-the-scenes liquidation projects or spotlights on unique pieces you come across. Build a loyal audience of commerce enthusiasts and elder shoppers through consistent value-focused entertainment.

- Guest blog for retirement and senior living publications to present your empathetic service perspective in front of relevant audiences already searching for your offerings.

Traditional Marketing

- Door-to-door outreach introducing your specialized offerings to retirement communities and independent/assisted living facilities. Follow up with brochure mailers to key local decision-maker contacts.

- Place eye-catching print advertisements in regional antique publications and newspapers. Especially highlight upcoming multi-estate tent sale events promising vast collections and elevated inventory.

- Negotiate organic social media endorsements from vintage boutiques benefiting from your funnel of estate goods. Complementary product trades or discounted buying rates could entice ongoing partnerships.

Apply targeted digital and traditional techniques consistently to cement awareness and seller relationships within communities needing compassionate estate solutions.

14. Focus on the Customer

Delivering empathetic and reliable estate sale guidance cements positive word-of-mouth referrals in this intimate service business. Remember you’re assisting customers in navigating profoundly emotional moments while sorting through heirlooms and possessions.

Expert listening allows proper tailoring of your organizational approach to match seller priorities whether that’s maximizing profits or respectfully finding new homes for items with dignified histories. Read body language during initial walkthroughs to uncover true sensitivities and inform recommendations.

Follow up post-sale as well to check on customer sentiments regarding the liquidation process and outcomes. Ask kindly for public or private testimonials if the experience positively impacted their transition.

Testimonials on social media and your website compel local readers on similar journeys to confidently secure your services. Overdeliver on empathy early on, especially amidst harried estate scenarios.