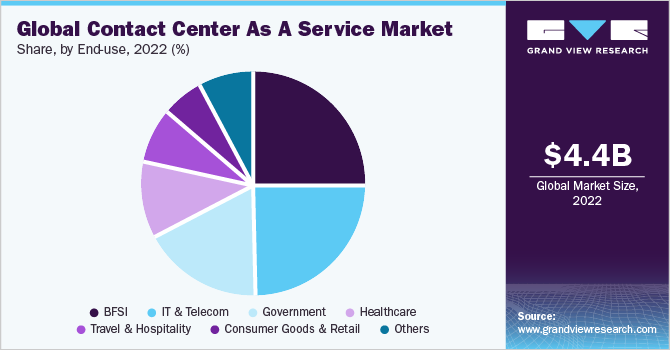

The call center industry is growing at a compound annual growth rate (CAGR) of 22.7% from 2022 to 2032. This means the market could reach $14.6 billion by 2032. As more businesses utilize call centers for sales, customer service, and technical support functions, the demand for these services continues to rapidly expand.

Opening your call center can be an extremely lucrative entrepreneurial endeavor if done correctly. You’ll need to make key decisions on services offered, location, technology platforms, staffing models, and more. Successfully launching a call center requires thorough planning, substantial capital investment, and excellent management skills to handle daily operations as well as ongoing growth.

This guide will walk you through how to start a call center. Topics include registering an EIN, obtaining business insurance, organizing your LLC, performing market research, and more. Here’s everything to know about creating an in-person or virtual call center.

1. Conduct Call Center Market Research

Market research is essential to opening your own call center. It offers insight into trends in the call center market, details on your target market, saturation within the virtual call center landscape, and more.

Some details you’ll learn through market research include:

- Ongoing shifts to e-commerce, mobile apps, and digital self-service continue to expand demand for call center sales and customer service support for these digital channels.

- Many businesses still utilize onshore call centers located in their own country rather than overseas, due to factors like data privacy laws.

- The onshoring trend is especially prevalent among companies in highly regulated industries like healthcare, financial services, and technology that handle large volumes of confidential personal and financial data.

- Automated self-service customer support options like AI-powered chatbots also have inherent capability limits at present.

- Specialized expertise amongst call center agents is increasingly valued over general capabilities.

- Customers want to speak with representatives who have deep knowledge of that specific company’s unique products, services, internal systems, policies, and procedures.

- Excellent niche opportunities exist in numerous specialty areas such as healthcare appointment setting, insurance policy or claims assistance, and high-level “tier 2 and beyond” technical troubleshooting.

By comprehensively analyzing target markets, and identifying specialized needs not adequately met by dominant current providers, new call center ventures can thrive. Ultimately the market handsomely rewards those entrepreneurs who best understand prospective customers.

2. Analyze the Competition

Successfully launching a new call center requires thoroughly analyzing potential competitors, both large established players as well as smaller regional and niche operators.

When assessing the competitive landscape, focus both on other companies’ current market share and capabilities as well as their likely future strategies. Some ways to better get to know inbound call centers in your area include:

- Monitor relevant news updates for additional intelligence on mergers, acquisitions, service portfolio changes, and more.

- It’s also crucial to evaluate the competitive relevance of non-traditional players.

- Mystery shopping your call center services provides invaluable competitive intelligence.

- Recording sample calls to analyze interaction quality, issue handling procedures, agent expertise levels, call routing systems and after-call surveys establish objective competitive benchmarks for your team to meet or exceed across key performance indicators.

- Online review sites also yield a wealth of data from actual customer commentary.

- Aggregator sites like Trustpilot as well as reviews on a competitor’s Google Business Profile or industry-specific forums reveal pain points, service gaps, pricing reactions, and more to help shape your positioning.

By holistically evaluating larger dominant players, smaller specialty operators, technology solution vendors, and raw feedback from a competitor’s actual customers – new call center entrants can strategically craft offerings that stand apart in the market to capture new business.

3. Costs to Start a Call Center Business

Getting an inbound call center up and running requires significant upfront capital investment in technology, infrastructure, hiring, and training to handle initial call capacity needs.

Start-up Costs

- A cloud-based call center software platform removes overhead for owning on-premise systems yet still carries subscription fees, typically ranging from $45-$150 per agent per month.

- Headsets, desktop computers, and other hardware average around $700 per agent initially.

- Average industrial rental rates run $6-$10 per sq ft monthly in many US metro regions, translating to $7500-$15,000 in rent per agent yearly.

- Experienced call center agents draw salaries averaging $30,000-$45,000 depending on capabilities and industry specialty.

- After accounting for employer payroll taxes, medical benefits, and other fixed employment costs, budget $60,000 per fully-loaded headcount.

- Training costs often exceed $5,000-$10,000 per person.

- Incorporating business costs between $200-$800

- Payroll software runs in the range of $360-$1,440 per year

- HR platforms can cost upwards of $100-$500 per employee per year

- Business insurance will cost approximately $2,000-$5,000 annually

- Licensing is highly variable by location and call center specialty

With other potential costs like office furnishings, branding/marketing, legal and professional services – total start-up costs for a new call center with 50 agents can easily surpass $3 million.

Ongoing Costs

While the start-up investment is significant, ongoing operational costs also add up to running an effective call center business:

- Rent & Utilities: $7500+ per agent annually

- Technology Platform Subscriptions: $5000+ per agent annually

- Agent Wages & Benefits: $60,000+ per employee yearly

- Management/Supervisor Salaries: $70,000-$100,000 per leader

- Quality Assurance & Training: 10-15% of payroll ($300,000+ for 50 agents)

- Marketing: 5-10% of revenue, potentially 6-7 figures for a growing company

- General & Administrative Expenses: 5-7% of revenue

- Finance & Accounting: 3-5% of revenue

Taken together, the recurring fixed and variable costs involved illustrate why call center profit margins are often just 10-15%, requiring high efficiency and strong cash flow management. However, the essential services and tremendous scalability call centers offer still make it a highly attractive industry for savvy entrepreneurs.

4. Form a Legal Business Entity

When establishing a legal structure for a new call center business, choosing the right entity type is a key early decision with long-term implications on liability protection, taxation, record-keeping, and the ability to access investment capital down the road. The four primary options each have pros and cons to weigh:

Sole Proprietorship

Sole proprietorship simply involves operating under your identity with no formal business registration, allowing quick launch yet offering zero corporate veils from legal and financial liabilities related to the company.

Partnership

Partnerships enable multiple owners to combine expertise and investment but still expose personal assets. This is ideal for family-run businesses. Like a sole proprietorship, a partnership doesn’t protect your assets if your business comes under financial fire professionally.

Corporation

Corporations yield complete limited liability but have greater complexity in formation, ownership tracking, and tax-compliant operation. This is the most expensive and complicated entity to establish. It is best suited to large businesses.

Limited Liability Company (LLC)

Limited Liability Companies (LLCs) offer the best of all worlds, simpler registration procedures than corporations with pass-through taxation benefits, yet strong liability protections limiting legal exposure if ever sued while conducting company business. This is the best option for a small or new business looking to establish space in the customer relationship management market.

5. Register Your Business For Taxes

Before legally operating any business in the United States, owners must obtain an Employer Identification Number (EIN) from the IRS to facilitate all tax-related reporting and remittance obligations.

Applying online for an EIN is free and easy via the IRS website, taking just minutes to complete. Simply navigate to irs.gov and provide basic information about your call center company including name, address, and ownership details.

The EIN essentially functions as a Social Security Number (SSN) for your business entity. While SSNs identify individual taxpayers, EINs enable opening business bank accounts, registering for state/local licenses, and allowing employees to associate tax withholdings from paychecks with your company.

Most importantly, an EIN enables legally employing workers per labor regulations. It also allows submitting quarterly payroll tax paperwork and annual income tax filings for your call center corporation. Therefore obtaining an EIN is a mandatory step before hiring any call center staff.

Beyond federal requirements, register your EIN for state and local tax compliance purposes too. For example, if selling call center services in California or Colorado which levy sales tax, you must respectively submit BOE-410-EIN and DR-0172 applications to legally collect and remit state sales tax from customers.

With some diligence upfront, managing tax obligations for a call center business is very achievable. But skipping foundational steps like procuring an EIN and sales tax permits does risk steep fines or frozen bank accounts down the road – undermining even thriving operations.

6. Setup Your Accounting

Properly structuring the accounting function is a crucial back-office pillar for any call center venture right from launch. The high transaction volumes from recurring monthly service contracts, variable usage charges, payroll runs, and daily supplier payments mean that properly tracking financials with adequate controls is mission-critical.

Open a Business Bank Account

Start by establishing a dedicated business bank account to maintain the separation of company finances from personal. Commingling funds invite IRS scrutiny and tax headaches. Leading small business banking platforms also offer unlimited transactions, integrated accounting software connectivity, and even cash flow insights to simplify financial oversight specific to call centers.

Accounting Software

Cloud accounting systems like QuickBooks seamlessly centralize accounting. QuickBooks sync bank/credit card accounts to automatically log transactions, reconciliation, invoicing, and other workflows to run a call center “books” without tedious manual entry. The rounded picture of cash flow timing, AR aging, and profitability by clients provided in QuickBooks generates financial visibility key for growth decisions.

Hire an Accountant

While the software does the heavy lifting on transactions, independent accountants remain invaluable for ensuring actual compliance. The IRS holds business owners fully accountable for accurate filings, risking penalties or audits for mistakes. Beyond tax prep assistance, accountants also provide controller services like reconciling bank/credit card accounts monthly and helping benchmark financial KPIs to optimize growth.

7. Obtain Licenses and Permits

Beyond formal business registration, call centers must secure several regulatory approvals before handling live customer interactions. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

Exact permits vary by location and industry specialty, but common examples include:

- Municipal Occupancy Licenses – Local city or county zoning boards require formal occupancy permitting upon moving into a new facility. Approvals often take 30-60 days with fees ranging from $500-$1500+.

- Specialized Industry Certifications – Call centers serving verticals like healthcare, public utilities, and financial sectors with stringent oversight often mandate specialty licenses.

- PCI Compliance – Any call center taking payments from customers must conform to Payment Card Industry (PCI) standards for safely handling transactions. Requirements include data encryption, access controls, and physical security considerations around card terminals.

- State/Municipal Business Licenses – Nearly all jurisdictions require standard business operating permits with costs ranging from $50-$500+ annually.

Contemporaneously navigating approvals during buildout streamlines opening. The trust that compliance fosters among risk-conscious healthcare providers, banks, and utilities makes securing specialty credentials strategic for accessing lucrative markets. Consult experienced local counsel to identify and steadily tick required licenses off the list pre-launch.

8. Get Business Insurance

Business insurance is crucial protection for call centers to mitigate financial risks that could otherwise cripple operations. Policies cover liabilities related to customers, employees, events beyond your control, and mistakes that could otherwise bankrupt the company.

For example, basic General Liability coverage insulates against customer injury lawsuits if a fire or earthquake damages your call center and they get hurt on the premises. Separate E&O (Errors & Omissions) policies guard against clients suing for mistakes like telemarketers sharing private data that triggers personal damages for consumers.

Additionally, Worker’s Compensation insurance is legally required in nearly all states to cover employee injuries, medical bills, and partial income replacement for staff that cannot work after workplace accidents. Going without policies opens entrepreneurial owners to unbounded legal and associated settlement costs.

Obtaining coverage begins by taking inventory of property, customers, staff, and operations to self-assess risk scenarios. Next, comparing quotes through independent insurance marketplace sites, while consulting specialists, yields affordable packages catered to call centers. Expect $1500+ in annual premiums for robust protection including:

- General Liability: $500,000 – $3 million policy limits

- Professional Liability: $250,000 – $2 million limits

- Cyber Liability: $500,000 – $5 million limits

- Workers Compensation: Statutory state minimums

- Business Property: Equipment value coverage

- Business Interruption: 6-12 months expense coverage

Finally, follow carrier application instructions for submitting relevant corporate documents, financial statements, and other evidence to activate policies after paying the first premium. Then review annually with agents to adjust limits reflecting growth.

9. Create an Office Space

Securing a properly outfitted call center office space is challenging given acoustic needs, network infrastructure demands, and sizable personnel requirements, but essential for professional operations. When evaluating facilities, consider functionality alongside cost.

Coworking Office

Affordable coworking providers like WeWork offer attractive turnkey options to launch call center MVPs. With monthly memberships starting around $300, flexible terms to expand (or cancel anytime), and inclusive amenities from lighting to internet.

WeWork spaces are perfect for call centers with remote workers working from home. Administrative and management professionals can use coworking office spaces to connect with the team while maintaining a higher level of professionalism than a home office allows.

On-Site Office

Certain specialized call center functions like political campaign organizing may strategically benefit from high foot traffic and visibility/walk-ins if compliant with municipal zoning. Understand limitations in privacy, parking, equipment storage, and monitoring before retail center leasing. Costs range from $20-$40 per square foot.

Commercial Office

For most serious call centers projecting 20+ seat capacity within 12-18 months, securing standalone office space for customized buildout is the best option despite higher fixed costs. Expect $10-$25 per square foot monthly rent plus utility costs and multi-year leases. While demanding higher upfront investment, commercial spaces pay dividends by enabling controlled, compliant, and more easily expanded operations vital for enterprise clients.

10. Source Your Equipment

Launching a call center requires significant upfront investment in desks, phones, headsets, computers, and enterprise-grade network infrastructure to support a smooth customer experience. New entrepreneurs have options between buying new, buying used, leasing, or renting equipment:

Buying New

Top providers like Cisco, Avaya, and Mitel offer bundled call center hardware and software solutions including servers, routers, switches, phones, cabling, and dashboards. While investing in flagship systems from enterprise telecom leaders costs over $1000 per agent upfront, their performance, capacity, and reliability enable strong service levels.

Buying Used

Purchasing refurbished servers, headsets, and other hardware through resellers on sites like Facebook Marketplace cuts expenditure substantially without compromising quality. Focus searches on professionally refurbished, Grade A inventory with accompanying battery/performance testing data and at least 90-day warranties to reduce risk. Expect 40-60% savings buying used versus new call center tech.

Renting

Rent-to-own companies offer flexible financial options too. Acquiring equipment through Rentacomputer or similar rental marketplaces stretches payments over 12-24 months. Usage rights begin immediately with options to renew leases or purchase outright. Rental also enables accessing the latest phone and headset models more affordably. Downsides include no equity stake or included maintenance.

Leasing

Long-term capital leases through specialty fintech lenders like EverBank provide fixed monthly payments over 3-5 years enabling usage without immediate cash layout. Drawbacks over renting include credit checks, early termination fees, and non-warranted equipment. Leasing works best for established operators with consistent revenues.

11. Establish Your Brand Assets

Crafting a distinctive brand identity helps call centers stand out in a crowded marketplace while conveying expertise that retains clients long-term. Strategically moving beyond generic names to creatively capture your mission via logos, taglines, and visual systems promotes trust and recall.

Getting a Business Phone Number

Acquire a unique business phone and fax number from advanced voice-over-IP providers like RingCentral to present a professional image to customer prospects and partners. Call routing, voicemail transcriptions, and built-in analytics offer helpful marketing insights as well.

Creating a Logo and Brand Assets

Logos visually encapsulate brands by blending meaningful imagery with elemental geometry and colors symbolizing your values. Looka’s AI logo maker combines icons and fonts suited to call centers for only $20. Iteratively develop variations focused on attributes like responsive support, clear communication, and transparent operations.

Creating Business Cards and Signage

Business cards enable exchanging contact info during industry events, sales meetings, and networking encounters. 250 basic cards from Vistaprint are only about $20. Highlight core capabilities, ideal client profile, years in business, specialist credentials, and other conversation starters.

Purchasing a Domain Name

Secure an ownable .com domain from registrars like Namecheap for about $12 annually. Short, descriptive names containing your company like AcmeCallPartners improve findability and typing convenience.

Building a Website

Either utilize DIY platforms like Wix for drag-and-drop website creation or hire specialized designers on freelance marketplaces like Fiverr for just $150. Well-crafted sites promote capabilities 24/7 and build SEO authority around service offerings. Integrate client testimonials and case studies to convey trust.

12. Join Associations and Groups

Beyond daily operations, networking with industry peers often sparks growth ideas while building beneficial referral partnerships. Connecting with other call center professionals locally and virtually through multiple channels widens perspectives.

Local Associations

In major metro regions, chapters like the International Customer Management Institute (ICMI) and Contact Center Association of America (CCAA) convene periodic meetups, conferences, and charity events to exchange insights. Attending quarterly meetings seeds relationships with fellow call center owners around mutual growth opportunities and hiring pipelines.

Local Meetups

General small business networking events via Meetup draw varied specialized service providers ideal for cross-referring leads from lead generation. A bookkeeper spotting call center needs among their client base offers win-win introductions. Venue sponsors may also provide helpful operational resources.

Facebook Groups

Industry-specific Facebook Groups like Call Center Universe ETC other Business is OK to share job posting templates, and case studies on new technologies. Groups like Work From Home – Customer Service Jobs-INBOUND CALL CENTER help you connect with other call center workers to increase customer satisfaction.

13. How to Market a Call Center Business

Implementing multifaceted marketing across digital and traditional channels is essential for scaling call center revenues by continually filling sales pipelines. While word-of-mouth referrals from satisfied early customers provide the most valuable validations, proactively promoting capabilities expands reach.

Personal Networking

Never underestimate the power of word-of-mouth marketing, even for a call center agent business. As a call center manager, your friends, family, and past coworkers can do a lot by sharing your business card, passing out flyers, email forwarding, and sharing social media posts about your new business.

Digital Marketing

- Launch Google Ads campaigns focused on relevant keywords like “patient appointment reminders” and “medical office call center” to appear for searchers actively seeking related solutions.

- Run Sponsored Updates showcasing specialty credentials to health system executives within 25 miles.

- Develop optimized sales outreach email sequences promoting available capabilities to the chief operations officers of local hospitals.

- Consider guest blog posts for sites like HealthcareTechOutlook.com to raise SEO visibility as subject matter experts.

- Post educational call center operations content onto YouTube for subscribers and organic discovery.

Traditional Marketing

- Although digital promotion typically provides better returns, physical mailers with unique value propositions catch noticeable attention from recipients already familiar with services.

- Occasional radio spots on local NPR stations similarly boost general brand familiarity in metro area markets.

- Print signage near high-traffic medical office parks increases visibility to ancillary decision-makers like doctors who provide referrals.

- Booth exhibits at relevant trade shows offer helpful exposure, though very costly at thousands per event in fees and travel.

While reinvesting early profits into continual omnichannel promotion seems counterintuitive to cash-strapped founders, consistently showcasing specialized differentiation pays exponential dividends over time by filling the pipeline with ideal new accounts.

14. Focus on the Customer

Providing exceptional customer service is the key competitive differentiator for call centers to retain accounts, unlock referrals, and enable repeat sales. How agents engage voice and digital interactions directly shape brand perceptions and spending decisions.

Each call offers the opportunity to enrich the relationship. When assisting a distressed policyholder requiring claims support, educate them on lesser-utilized plan provisions useful in their situation for stronger coverage.

These memorable interactions spark organic referrals. A home services provider benefiting from expanded insurance payouts after an agent’s careful consult might subsequently mention the call center to peer contractors needing reliable customer support capacity.

Further, post-call surveys specifically asking satisfied customers if they would recommend your services to associates provide identifiable referrals to directly contact. Track these referral usage rates and outcomes as distinct lead sources with separate customer lifetime value (LTV) designations rather than generic “word of mouth” to continually refine referral stimulation initiatives and agent reward programs.

With platforms like Promoter streamlining Net Promoter Score (NPS) surveying and reviews management, ensuring every call strengthens sentiment pays compounding dividends as operational excellence attracts new business faster than any advertisement ever could.