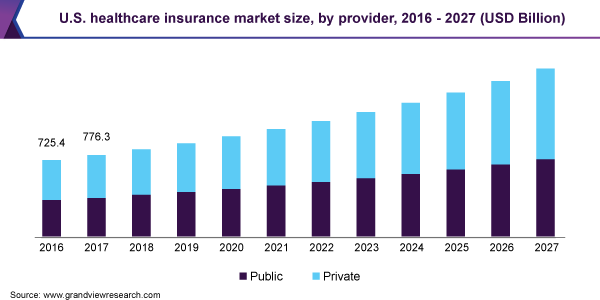

The health insurance industry is expected to grow at a compound annual growth rate (CAGR) of 6.7% from 2020 to 2027. With rising healthcare costs and an aging population, the demand for private health insurance is expanding. The market presents an opportunity for aspiring entrepreneurs to launch their own health insurance companies and disrupt the status quo.

Starting a health insurance company allows you to fill gaps in coverage, provide specialized plans, and improve customer experience through technology and services. You can target specific demographics and geographies instead of competing nationwide.

This guide will walk you through how to start a health insurance company. Topics include market research, competitive analysis, registering an EIN, obtaining business insurance, customer focus, and more.

1. Conduct Health Insurance Company Market Research

Market research is integral to starting an insurance agency. It offers insight into your target market, local market saturation, and trends in insurance products and services.

Some details you’ll learn through market research for your own insurance company include:

- Certain states like California, Texas, and Florida with large uninsured populations are untapped markets for affordable individual and family health plans targeted at middle and low-income segments.

- Specific niches like supplemental insurance, overseas expatriate health plans, and vision and dental plans, also remain fragmented across the country.

- Niche markets allow new health insurance companies to gain a foothold without directly competing against large national payers.

- Ample growth opportunities exist despite the health insurance industry being extremely capital and resource-intensive.

- Strict regulatory compliance, complex data, and pricing requirements, nationwide provider network development, fierce talent competition, technological barriers, and more pose notable challenges.

With sufficient starting capital, a durable value proposition, a lean operating structure, a defined target market, and a patient growth strategy, new health insurance carriers can prosper long-term. Conducting in-depth opportunity analysis, actuarial evaluations, competitive benchmarking, customer research, and seeking expert legal and regulatory counsel is vital before pursuing this ambitious endeavor.

2. Analyze the Competition

Entrepreneurs should thoroughly analyze competitors when starting a health insurance business. Conduct competitive benchmarking across key metrics and business attributes before launch. This information helps you form price plans and marketing strategies for your own health insurance company.

For the in-state competition, utilize the state’s Department of Insurance listings to identify and investigate incumbent health insurers. Review their financial statements, plan offerings, pricing practices, customer complaints data, key regions covered, and more.

For potential national competition from major carriers, study their SEC filings for subscriber numbers, membership growth trends, medical loss ratios, premium revenue, sales and marketing budgets, and overall strategy. This will indicate if an emerging niche you aim to capture is their focus as well.

Monitor the tech capabilities of bigger players to avoid significant gaps that raise barriers to entry. Smaller players should strive for infrastructure that enables operational agility despite constraints on physical footprint.

Online, search “health insurance companies near me” or target geographic variations and note which carriers rank prominently on local SERP and third-party review platforms. Run technical SEO audits on their websites by comparing backlink profiles, keyword rankings, and visibility in local SEO listings like Google My Business.

Supplement this with founder interviews, reading trade publications covering the health insurance space, attending industry conferences, creating buyer personas through customer surveys, and more.

The depth of competition analysis should align with positioning plans – national payers warrant more rigorous benchmarking than hyperlocal startups. Target identifying 3 to 5 direct regional or niche competitors at minimum to deeply analyze.

3. Costs to Start a Health Insurance Company Business

Starting a successful insurance company requires substantial upfront capital and ongoing investments to cover complex operating expenses. Below is a breakdown of typical costs entrepreneurs must budget for:

Startup Costs

- Licensure fees – State application fees range from $5,000 to $100,000+ depending on location. Some require deposits up to $1 million held in reserve.

- Incorporation expenses – Legal and professional costs to establish the corporate entity, filing fees, ownership agreements, etc. can total over $150,000.

- Actuarial services – Developing pricing models, financial projections, utilization rates, etc. needs skilled actuarial analysis costing roughly $200,000 initially.

- Infrastructure / Technology – Core administration systems, claims platforms, call center setup, and analytics software can involve over $5 million in systems integration if built from scratch. Leveraging licensed SaaS platforms can lower this to under $2 million.

- Personnel – Hiring leadership, even a compact founding team, requires competitive salaries totaling $700,000/annually including CEO pay. Plus recruiting fees.

- Workspace – Bespoke headquarters or modest commercial rental space ranges from $60 to $125/sq. ft in most regions annually. Space planning and office build-outs add ~$100,000 in one-time costs.

- Insurances – E&O, D&O, Cyber and Business Insurance policies are essential for risk mitigation, costing upwards of $150,000 to obtain high enough coverage limits.

Other overheads like legal retainers, travel budgets, office equipment, etc. can add over $200,000 in upfront capex.

Ongoing Costs

- Provider contracting – Network access fees paid to hospital systems and medical groups cost in the tens of millions for decent coverage. Reimbursement rates directly impact revenue.

- Staff salaries – As the company grows and adds employees, personnel costs surge. Successful carriers see benefit expenses alone reach over 15% of all operating expenses over time.

- Advertising – Member acquisition and brand building require major advertising outlays rivaling even technology companies, easily crossing $100 million for new market entrants fighting for share.

- Other major categories include commissions, sales, IT infrastructure, administration, taxes, corporate overheads, and more. Working capital needs remain extremely high due to lag in premium inflows while having to fund claims payouts continually.

In total, expect first-year costs to cross at least $15 million with multi-year runway capital above $150 million before becoming net positive if attempting to cover a broad market. Niche startups can get by on much lower capital injections to efficiently target narrower buyer pools.

4. Form a Legal Business Entity

When establishing a health insurance carrier, the legal structure carrying the most appropriate liability protections is a limited liability company (LLC).

Sole Proprietorship

Sole proprietorships offer no personal asset protection. The business owner is personally liable for all debts and legal actions against the company. This poses tremendous risk given the complex regulatory and litigation exposure health insurers face.

Partnership

Partnerships allow raising startup capital from co-owners but still expose the personal assets of all partners to business liabilities. Inter-partner disputes can also sink operations. Not ideal for this capital-intensive sector.

Limited Liability Company (LLC)

LLCs limit owner liability to their capital contributions alone. Personal assets remain shielded from business-related risks, lawsuits, debts, etc. LLCs also have fewer recordkeeping and reporting requirements than corporations. Ownership is flexible – equity stakes can be distributed across founding partners and sold to investors without much paperwork.

Corporation

Corporations also limit liability to business assets much like LLCs. However, they have stricter governance and ownership regulations imposed by state agencies. Formal processes manage share issuance and transfers, director elections, shareholder voting, etc. making leadership transitions complex.

5. Register Your Business For Taxes

Health insurance companies must obtain an Employer Identification Number (EIN) from the IRS to handle federal tax obligations properly. This unique nine-digit number identifies your business to the IRS much like a Social Security number identifies individuals.

Some key reasons necessitating an EIN specifically for insurance carriers include:

- Opening business bank accounts

- Applying for niche SBA loan programs

- Processing employee payroll

- Filing business tax returns

- Claiming allowable tax deductions

Applying for an EIN is free and can be completed online via the IRS website in minutes. Simply provide basic information about your company structure and ownership details to generate the EIN in real time.

The online EIN Assistant tool guides applicants through a series of brief questions before creating your unique entity identifier for prompt use. It eliminates mailing delays making it the preferred approach.

Additionally, health insurers must complete state-level tax registration to comply with jurisdictional obligations around corporate income taxes, sales tax collection from policyholders if applicable locally, payroll taxes, and more.

Costs are generally administrative fees below $100 for processing the business license application. This facilitates tax remittances while operating legally statewide.

Multi-state expansion triggers additional registrations with each Department of Revenue to fulfill localized compliance mandates before transacting across borders. Consider third-party tax compliance help if scaling operations across the U.S.

6. Setup Your Accounting

Robust accounting practices are vital for health insurance carriers given the strict regulatory financial reporting and capital reserve requirements imposed on the industry. Investing in the right software, personnel, and banking infrastructure lays a strong financial foundation.

Open a Business Bank Account

Start by establishing a separate business checking account to maintain order between personal and company finances right from inception. Apply through banks convenient for your operations providing the necessary registration details like EIN paperwork.

Accounting Software

Acquire feature-rich accounting software that supports the intricacies of running insurance providers. QuickBooks offers tailored editions for healthcare entities with tools aiding premium tracking and claims reserving against rigorous accounting rules like statutory reporting.

Hire an Accountant

Supplement DIY software capabilities by partnering with an accounting firm specializing in health insurance verticals from the start. The costs range from $2,000 to $7,500 monthly for comprehensive bookkeeping, reconciliation, financial reporting, tax filing assistance, and advisory on optimizing profitability.

Apply for Business Credit Cards

Apply for credit cards to simplify tracking certain operating expenses like corporate travel or marketing charges separately from claim liabilities and administrative overheads hitting the business checking accounts.

7. Obtain Licenses and Permits

Health insurance carriers must secure licensure. The State Insurance Commissioner’s Office and the U.S. Small Business Administration are a good place to start. The SBA also offers a local search tool for state and city requirements.

The Department of Insurance Certificate of Authority represents formal clearance to transact insurance business as an admitted carrier within a state. Going through the mandated application process establishes legitimacy in consumers’ minds and approves policy plan designs.

NAIC uniform applications detail minimum capital, organization structure, oversight personnel, and operational procedures needed for licensure. Timelines average over 6 months from submission to securing certificates. Some applications even scrutinize strategic plans for growth and risk management.

Third-party administration (TPA) registration enables claims processing, network development, and plan administration to be outsourced to specialized partners as needed while awaiting formal authority. This facilitates launching operations faster as licensing gauntlets continue in parallel.

Additionally, surety bonds must be filed with DOIs guaranteeing financial ability to pay out member claims in cases of insolvency. Otherwise, claim costs default to state guaranty funds – scenarios bonds help prevent. Minimum requirements range from $50,000 to even 10% of written premiums in some states.

At the federal level, registering as a Risk-Purchasing Group under the ERISA exemption facilitates self-insuring plans for company workforces before enrolling external members. This lets employer groups pilot plan designs, pricing models, and utilization management techniques.

8. Get Business Insurance

Business insurance is crucial for health insurance carriers to ensure continuity of operations when unpredictable scenarios arise. It transfers the financial risks of running the company to specialized underwriters.

Not carrying adequate coverage can cripple startups in this capital-intensive sector upon the occurrence of unfortunate events like natural disasters, lawsuits, employee errors, or cyber crimes.

For example, a network security breach exposing thousands of customer medical records risks multi-million dollar class action damages without solid cyber liability coverage.

Additionally, technology failings interrupting claims payments processing for days warrants business interruption insurance to offset revenue losses from reputational damage.

And elaborate telehealth mobile apps could require substantial rebuild costs if source code gets corrupted without proper data or software coverage beyond basic backups.

The typical process involves identifying the largest business risks and then requesting quotes online from various commercial insurers like The Hartford, Travelers Insurance, or Next Insurance.

Common policies needed include General Liability Insurance, Commercial Property Insurance, Professional Liability Insurance, and Commercial Auto Insurance. Other potential insurance products include:

- Cyber Insurance aids data breach response costs with premiums ranging from $100 per month for $1 million coverage.

- Directors’ & Officers’ policies shielding management decisions run $150 monthly while Errors & Omissions insurance to guard advice given to customers can cost over $300 monthly.

- Umbrella Insurance supplements thresholds across other policies for enhanced protection.

Evaluate all quotes diligently regarding coverage scope, exclusions, and insurer financial strength ratings before binding multiple policies. Streamline at renewal by bundling through a single trusted brokerage firm.

9. Create an Office Space

Establishing a professional office is vital for health insurance companies to conduct sensitive customer meetings, host healthcare partners for network contract negotiations, and attract talented staff through an uplifting work environment.

Coworking Spaces

WeWork provides handy turnkey spaces nationwide with versatile month-to-month commitments scaling from private offices to entire floors as needs evolve. Expect to budget $300-500 monthly per dedicated desk. While flexibility and creative community perks aid productivity, heavy foot traffic risks confidential dealings common in this industry.

Commercial Office

Long-term leases spanning 3-5 years for modest commercial spaces still average $25-40/sq ft in most metros today – translating to $5,000+ monthly for only 150 sq ft per person. Building out spaces with IT infrastructure and customized branding can double upfront costs. But the stability, security, and credibility make it worth investing at scale.

10. Source Your Equipment

Launching a health insurance carrier primarily requires investing in technology infrastructure both for customer-facing policy/claims portals and internal data analytics/admin platforms.

Buying New

Top-tier servers, network gear, firewalls, etc. can be purchased directly from vendors like Dell, Cisco, or Lenovo running $15,000 for adequate redundancy. SaaS alternatives like AWS enable tapping cloud infrastructure without huge hardware capex.

Buying Used

Often outdated equipment gets liquidated by enterprises on sites like eBay for 90% discounts but reliability concerns demand thorough testing. Still, buying refurbished servers and PCs can provide short-term savings potential.

Renting

AV equipment rentals allow securing devices like printers, phones, laptops, etc. without large upfront costs. For rapidly evolving tech like tablets and video gear, renting enables staying updated with minimal risk.

Leasing

Mission-critical infrastructure like servers and network hardware warrant long-term leases spanning 3-5 years. While monthly costs exceed buying over time, leases enable upgrading equipment more frequently to avoid obsolescence issues.

11. Establish Your Brand Assets

Cultivating a strong brand builds awareness and trust vital for customer acquisition in the health insurance sector. Investing in core assets professionalizes market positioning for growth.

Get a Business Phone Number

Start by securing a unique toll-free business phone line with advanced call routing/handling features. Services like RingCentral provide vanity numbers with custom greetings, IVR menus, hold music, and voicemail set-up for professionalism. Expect costs around $30 monthly.

Design a Logo

Create a modern logo through online services like Looka that utilize AI to generate dozens of polished icons and wordmarks for under $50. Opt for simple, recognizable representations congruent with positioning.

Print Business Cards

Business cards display legitimacy during network negotiations, conferences, and client meetings. Order 500 to 1000 cards for under $40 total from print shops like Vistaprint to share contact info conveniently during outreach.

Get a Domain Name

A domain name matching the brand name rockets SEO visibility and consumer recall. Use registrars like Namecheap for $9 domains bundled with hosting and email. Ideally, incorporate .com or .biz for ubiquity.

Design a Website

An informational company website builds confidence while capturing visitor data to nurture leads. Employ user-friendly website builders like Wix for $20 monthly. Outsource skilled web developers on freelance networks like Fiverr if pursuing complex portals.

12. Join Associations and Groups

Joining select industry groups builds strategic relationships while gleaning insights into regulations, technologies, value-adds, and partnerships transforming health insurance.

Local Associations

State health insurance trade groups like the Health Insurers Association provide lobbying around better regulations and consumer protections. They run carrier education events on compliance changes. Annual dues for smaller carriers average $5,000.

Local Meetups

Utilize aggregators like Meetup to find regional health tech events discussing trends like telehealth adoption, payment innovators, health data exchanges, etc. These enable meeting distribution partners.

Actuarial society meetings offer recruiting opportunities to find credentialed talent since niche pricing and utilization forecasting skills are imperative but in short supply. Expect registration fees of around $800 per full conference.

Facebook Groups

Larger online groups like Life and Health Insurance Agents and Independent Health and Life Insurance Agents provide advice channels spanning operational hurdles, recommended solutions vendors, and patient experience tips from peers nationwide.

13. How to Market a Health Insurance Company Business

Creating visibility and consumer trust is vital for emerging health insurance companies to attract their first wave of policyholders in new markets. Strategic marketing fuels growth while word-of-mouth referrals and strong customer satisfaction maximize retention long-term.

Personal Networking

Start within your networks by sharing the company’s unique value proposition across social channels. Soft launches through friends and family enable testing communication material and core messaging. Their early feedback and support are invaluable.

Incent happy initial customers to endorse your offerings online or directly refer peers also needing policies. Discounts on future premiums, gift cards, and personal thank-you notes encourage organic advocacy.

Digital Marketing

- Run Google/Bing PPC ads focused on solving common consumer pain points with hyper-targeted landing pages for lead generation through compelling content.

- Sponsor relevant health and wellness influencers on Instagram to tap into their engaged audiences and report on campaign conversions.

- Utilize LinkedIn’s robust professional demographics to deploy sponsored content for B2B client acquisition targeted by traits like industry, job title, and company size.

- Launch a small geo-fenced run of streaming audio ads to validate mass media traction and optimize broader radio/podcast investments for the future.

Traditional Marketing

- Coordinating mail and email acquisition campaigns through digital print vendors provide traceable response tracking unavailable with direct mail only. Start modestly.

- Schedule in-person visits with large regional employers, benefits consultants, and unions to educate on new plan options that can get your foot in the door with sizable member groups.

- Print brochures and flyers for distribution at local networking events, waiting rooms of strategic partner clinics/hospitals, etc.

- Donate services or sponsor community health initiatives to gain goodwill and brand exposure including subtle signage without appearing predatory.

Capitalize on flexibility and hunger as a startup to test creative grassroots initiatives while laying brand foundations before scaling budgets. Stay nimble and go niche!

14. Focus on the Customer

Delivering exceptional customer service distinguishes newer health insurance carriers aiming to capture market share from large national payers. Policyholders have greater expectations today amid premiums rising faster than wages and inflation.

Simple digital tools like interactive coverage checkers and provider lookup portals add convenience in securing renewals. Integrating telehealth and nurse advice lines into plans provides valued care navigation assistance.

But technology cannot replace human touchpoints. Empower member support teams to resolve complaints swiftly and audit recordings to continually improve responsiveness. Small gestures like following up by name after issues help.

Consumer surveys reveal health insurance ranks lowest in customer satisfaction across all industries as processes remain stubbornly antiquated and opaque.

Innovate around transparency – share plan comparisons, denial logic, and pricing methodology. Guide users through translating codes or complex EOB statements.

Building trust and brand affinity increases member longevity and referrals. Each health journey is highly personal so individualizing service earns a reputation despite market dominance by faceless corporations.