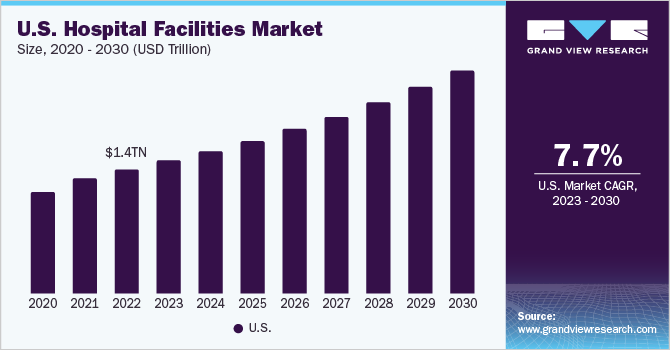

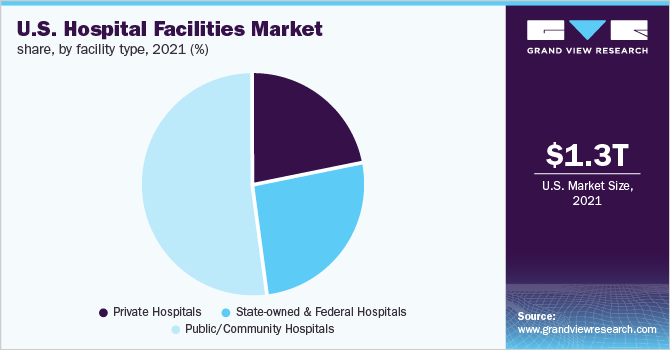

The healthcare industry is booming in the United States. According to Statistica, the hospital industry is projected to grow at a compound annual rate of nearly 3.42% from 2024-2028. With rising healthcare costs and an aging population with complex medical needs, starting a hospital can be a lucrative business opportunity.

This guide will walk you through how to start a hospital. Topics include market research, accounting processes, competitive analysis, customer focus, registering an EIN, obtaining business insurance, and more.

1. Conduct Hospital Market Research

Thorough market research is essential when considering opening a new hospital. It provides insight into your target market, successful hospital services, and trends in medical services. Research helps you develop a realistic hospital business plan for your own hospital.

Some details you’ll learn through hospital facility market research include:

- The most fundamental data points to assess are population size, density, demographics, and growth trends within your intended service area.

- With higher healthcare utilization rates, markets with large or increasing senior populations present significant opportunities.

- Evaluate the prevalence of chronic conditions and average household income levels as higher incomes equate to better insurance coverage and utilization.

- Once you’ve identified fast-growing markets with favorable demographic indicators, dive deeper into existing hospitals in the area.

- Medicare’s Hospital Compare tool contains comprehensive data on existing facilities’ service lines, quality of care, patient experience, pricing, and more useful competitive insights.

- In many states, new hospitals must obtain a Certificate of Need (CON) to open which requires conducting a community health needs assessment and demonstrating necessity.

- Model outpatient volume and payer mix projections based on population data, gaps in competition’s service capabilities, and reimbursement rates.

- While higher margins come from privately insured patients, limiting service to solely high-paying customer segments risks community backlash and barriers to growth.

- Maintaining positive consumer perception and serving patient needs across the socioeconomic spectrum is key.

With sound market research methodologies and data from reputable healthcare industry sources, entrepreneurs can effectively assess community healthcare needs, target favorable service areas, and right-size facilities, and develop sustainable business models for their hospitals.

2. Analyze the Competition

Understanding the competitive landscape is crucial when assessing the viability of a new hospital. Conduct site visits to competitors’ locations to evaluate their strengths and weaknesses across key domains, facility appeal, service breadth, technology adoption, staff friendliness, patient wait times, and more.

Speak with health plans to ascertain competitors’ reputation, clinical quality, and patient satisfaction scores. Review public data from Hospital Compare and third-party rating sites analyzing timely care metrics, infection rates, readmissions, mortality measures, patient reviews, and reputational scores.

Analyze competitors’ payer mix between Medicare, Medicaid, and private insurance using American Hospital Directory data. High privately insured volume signals strong community preference through present equity challenges. Medicaid dependence stresses margins so modeling optimal volume balance is key.

Assess the level of specialty service line duplication in cardiology, orthopedics, oncology, etc, to inform decisions around differentiating by expanding niche services. Equipment and staffing costs for comprehensive cancer or transplant centers, for example, require sufficient patient volumes to sustain.

For an accurate competitive analysis, evaluate both direct substitute options for acute inpatient or emergency care as well as indirect competition from ambulatory surgery centers, urgent care clinics, and telehealth platforms luring patient volume.

Monitoring competitors’ growth plans, new service launches, and other strategic investments also guards against duplication of high-cost clinical investments in a finite geographic market.

Ongoing competitive analysis should encompass benchmarking clinical quality, patient experience and loyalty, actual vs. projected service line utilization, new attraction and retention tactics, and fluctuations in payer mix and reimbursement levels to fine-tune strategy to maintain optimal positioning in an evolving marketplace.

3. Costs to Start a Hospital Business

Launching a hospital requires extensive upfront investment totaling upwards of $100 million for construction, equipment, supplies, staffing, and, working capital. Continued operating costs also run high due to round-the-clock operations, specialized staff, stringent regulatory overhead, and complex billing procedures.

Startup Costs

- Budget $15-20 million for a 15-acre parcel allowing future expansion.

- Construction costs average $500K to $1 million per licensed bed for materials, contractors, and design fees.

- A 200-bed hospital would thus require roughly $130 million for a high-end build.

- Medical devices like MRI machines can run $2-3 million each while EHR systems cost upwards of $50 million.

- Telemetry monitors, ventilators, and other moveable equipment add several million more. For a technology-advanced 200-bed facility, allot $75 million.

- Outfitting hospital communications systems, wifi networks, workstations, and, interfaces represents around 15% of equipment costs or $11 million for this 200-bed example.

- Sign-on bonuses to recruit specialty physicians and nurses in competitive markets reach $100K per person.

- Advance hiring is also needed for revenue cycle coders, administrators, and support personnel, with a budget of $5 million.

- Certificate of Need application costs, state/federal licensing, attorney fees, and facility insurance tally around $8 million.

- Working Capital Fund covers 3 months of operating expenses until revenue stabilizes with a $15 million buffer.

- Cost overruns or unforeseen expenses require a 10-20% contingency reserve which would be $20 million.

Total Startup Costs tally $200 million.

Ongoing Costs

- Nurses represent over 50% of hospital payrolls, followed by specialized physicians.

- Average annual nursing wages of $75K per FTE plus benefits total $6 million monthly for a 200-bed facility.

- Implants, devices, and disposables average $2000 per admission. 200 beds at 50% occupancy and a 5-day length of stay generates $1 million in monthly supplies expenses.

- Equipment Leases and IT 24/7 maintenance, biomed equipment repairs, and IT infrastructure incur $3 million in fixed monthly costs

- Collections teams and clearinghouses take around 5% of net revenue, averaging $500K monthly for a mid-sized hospital

- Utilities, insurance, interest payments on outstanding debt financing, etc. add $1 million in costs each month.

With breakeven daily revenue requiring $1.25 million to cover high fixed expenses from around-the-clock operations, astute patient volume modeling and payer mix forecasting are imperative to keep hospitals financially viable over the long term.

4. Form a Legal Business Entity

Before you buy medical supplies or start formulating a solid business plan for healthcare services, you need to form a legal business entity. There are four main entities to choose from for a private medical practice, including:

Limited Liability Company (LLC)

When starting a hospital, the legal structure carrying the most protection against personal liability for the owners is an LLC, a limited liability company. Unlike sole proprietors who bear unchecked risk, LLC members enjoy liability safeguards similar to those of corporate shareholders. LLCs also allow pass-through taxation like partnerships bypassing corporate double-taxation.

Sole Proprietorship

Sole proprietorships function well for smaller practices but hospital investors need liability buffers from massive operating budgets. Personal assets would be forfeited under extreme legal or financial duress absent insurance which can still have coverage gaps.

Partnership

General partnerships don’t prevent any one partner’s malpractice or debts from damaging the other’s finances. A partnership is a good formation choice for a family-owned business. Ownership is split between partners.

Corporation

Forming a C-corporation first aids venture capital and private equity fundraising before the hospital opens. The corporation can then establish a wholly-owned subsidiary LLC hospital company following investment to retain pass-through partnership benefits.

5. Register Your Business For Taxes

Before hiring employees or accepting payments, every hospital must obtain an Employer Identification Number (EIN) from the IRS to facilitate federal tax reporting for your business income, payroll, and other returns. This unique 9-digit number functions like a personal Social Security Number to identify your business to the IRS.

Applying online at IRS.gov for an EIN takes under 15 minutes and speeds processing over mail applications. Simply navigate to the EIN Assistant and select “View Additional Types” including healthcare and social assistance providers to correctly categorize your hospital’s industry focus.

You’ll need to provide basic information like the hospital’s legal name, address, responsible party, and ownership details to verify legitimacy to the IRS. The online tool guides question-by-question before instantly providing your EIN at completion.

This EIN now registers your hospital with federal and most state tax agencies for seamless reporting integration. However, certain states including Arizona, California, and New Jersey also require formal state-level business entity registration and sales tax licensing – typically under Secretary of State or Taxation Departments.

Online filing through your state portal outlines specific processes for licensing, sales/use tax permits, and disability/employment insurance compliance needed to legally operate. Costs range from $100-$500 depending on state regulatory complexity.

IRS Form SS-4 also allows registering for an EIN by fax or mail if preferred over online but adds weeks of delays compared to instant registration through the EIN Assistant’s streamlined slides and menus.

6. Setup Your Accounting

With multi-million dollar budgets from high fixed costs and thousands of transactions daily from patient services billing alone, dialed-in accounting infrastructure and controls prevent profit erosion or costly audits down the road.

Accounting Software

Implementing medical billing software with practice management and EHR integrations automates the capture and coding of provider services for claims processing and revenue cycle management. Platforms like Quickbooks seamlessly reconcile patient ledger and insurance payment data with tax-ready financial reporting.

Hire an Accountant

Outsourcing certified accountants specialized in healthcare finances offers invaluable expertise so doctors can focus on patients rather than fiscal planning. Full-service accountants handle everything from monthly close, bank reconciliation, and consolidated financial statements to year-end filings, tax planning advice, and representing your interests under IRS audit if challenged.

Open a Business Bank Account

Strict separation between personal and hospital business finances simplifies reporting – from credit cards to bank accounts. Under IRS accountability standards, all expenses paid supporting business activities need clear justification as such. Clean accounting trials prevent “hiding” personal costs within company accounts tempting but risky without transparency.

Apply for a Business Credit Card

Establishing business credit cards also builds legitimacy with rating agencies and improves approval odds for larger credit limits as your hospital’s financial track record lengthens. Terms for new businesses average around $5000 for credit lines but investment backing substantially increases that ceiling.

7. Obtain Licenses and Permits

Before welcoming your first patient, properly licensing a hospital at both federal and state levels ensures full compliance with rigorous healthcare facility and patient privacy standards. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

At the federal level, registering with the Centers for Medicare and Medicaid (CMS) allows for treating government-insured patients which comprise over half of hospital revenue. Gaining a National Provider Identifier (NPI) number lets CMS track services while fast-tracking Medicaid and Medicare reimbursement processes from the start.

CMS also dictates conditions of participation from quality of care to patient rights policies. Their surveyors conduct site visits assessing hundreds of standards tied to payment so staying audit-ready is key.

HIPAA compliance around patient data security and privacy represents another federal mandate with heavy fines for breaches. Appointing a dedicated HIPAA Privacy Officer accountable for information policies and staff training is advised.

However, state licensure drives the most stringent and consistent oversight through both Departments of Health and broader Health Planning Agencies. Certificate of Need (CON) laws require extensive proof of public necessity for new hospitals along with impact studies on existing providers. The complexity demands legal guidance from application through regulation beyond initial permitting.

Maintenance inspections occur at least annually at the state level while CMS revisits every 9-15 months. Deficiencies prompt tense follow-up visits so staying self-audit ready is key.

Facility permits must align with services provided from general medical, surgical, pediatric, and critical care beds to imaging scanner equipment operation. Radiology equipment faces their accreditation while pharmacies require certified pharmacist oversight and separate licensing.

Failure to maintain licenses risks payment revocation from Medicaid and Medicare, devastating major revenue streams. Penalties for unauthorized services or fraudulent billing among the hundreds of coding nuances lead to seven-figure settlements.

8. Get Business Insurance

Adequate insurance protects against financial ruin when inevitable issues arise in complex hospital operations. While no amount erases tragic loss of life from clinical errors, proactive risk management and insurance buffers viability.

“Going bare” without General Liability coverage opens unlimited personal assets exposure from vast liabilities like patient injury, employee discrimination, or, privacy suits. Umbrella policies adding extra liability limits beyond base GLs make sense given litigious patient cultures and seven-figure malpractice settlements.

Even with strong protocols, imagine air conditioning failures cause temperature-sensitive pharmaceuticals to spoil. Lacking separate Property coverage securing replacement drugs and lost revenue amid repairs leads to six-figure holes.

If ransomware locks access to systems before data backups hit, uninsured Business Interruption losses tally $150K daily in lost collections and care capacity.

Partnering with an independent broker with specialized healthcare resources simplifies securing comprehensive policies. Have them shop facilities, malpractice/errors, directors and officers liability plus any state-required workers’ compensation. Brokers present optimum carriers/terms absent insurer conflicts of interest.

When gathering multi-year loss run histories from prior facilities that owners/partners worked at plus current entity financials, the broker submits tailored applications to underwriters for pricing options. Coverage terms average 12 months as hospital risks, exposures, and operations fluidly evolve over shorter cycles.

Expect detailed questionnaires assessing security controls, clinical governance, risk reporting, and other safety procedures. Underwriters deny more applications than accept so working closely with brokers to align responses with desired risk-management messaging optimizes approvals.

Also, know that claims against policies raise concerns while too large a gap without coverage prompts new underwriting. So maintaining coverage through any transitions between policies prevents coverage gaps while showing stability.

9. Create an Office Space

While hospitals utilize extensive specialized grounds for facilities and equipment, maintaining corporate back offices helps consolidate administrative management and strategic planning. As major campus construction is completed over several years, flexible interim spaces allow refining operations.

Coworking Spaces

Turnkey flexibility allowing partners to plug into common conference rooms with printing/scanning equipment and blazing internet speeds proves useful for planning sessions. Options like WeWork provide professional addresses associated with the space for legal registrations before central headquarters have physical locations. Costs average $300 monthly per dedicated desk.

Commercial Office

Former medical office spaces often have built-out IT cabling, privacy compliance, and other specialized infrastructure in place that facilitates hospital management teams establishing longer-term hubs. Expect leases around 5 years as breakeven costs to tenant improvements like customized AV systems, security controls, and soundproofing run $100 per square foot.

10. Source Your Equipment

Outfitting a hospital requires millions of dollars of advanced medical systems, machines, and technologies. Sourcing specialized equipment from leading manufacturers and reputable suppliers ensures patient safety and optimal outcomes when lives are on the line.

Buying New

Contracts with major device producers like McKesson run sizable bulk purchase discounts for standard imaging, monitoring, and surgical devices. Multi-year warranties and maintenance packages promote budgeting predictability while supporting training, installation, and post-sales troubleshooting for new technologies.

Buying Used

Certain medical equipment categories retain solid lifespan and performance beyond initial deployments like patient beds or specialty room build-outs. Evaluate hours logged, preventative maintenance records, and software upgradability if considering pre-owned capital purchases. Try Bimedis for high-quality used hospital equipment.

Renting

Many specialty treatment technologies rapidly advance and renting proves more practical than buying outright. Shorter-term rental periods allow swapping newer modalities as innovation warrants while offloading risks that new devices don’t deliver expected clinical utility. Rental fees hit operating budgets rather than large capital cash layouts also aiding flexibility.

Leasing

Long-term equipment leases ease large capital investments by building in maintenance, upgrades, and options to buy out leases for core systems with decades of relevance like imaging CT and MRI scanners. Under bundled managed services models, third parties own then license usage which simplifies budgeting predictability against mercurial reimbursement environments.

11. Establish Your Brand Assets

Cultivating consistent brand recognition, trust, and affinity within your community drives customer acquisition and loyalty for hospitals as with any competitive business.

Getting a Business Phone Number

Toll-free numbers using Voice over Internet Protocol systems like RingCentral exude professionalism and technological competence. Built-in call routing, voicemail transcriptions, and unlimited calling plans accommodate staff growth over time. Number portability also aids seamless transitions between back-office vendors.

Creating a Logo and Brand Assets

A well-designed logo encapsulates your hospital’s mission and values identity. Sleek icons printing clearly on building signage and insurance cards also boost memorability. Logo maker platforms like Looka create multiple style options for testing with focus groups when designing new hospital brands.

Business Cards and Signage

Business cards offer indispensable physical “leave-behinds” for physicians networking at conferences or health fairs while high-visibility exterior hospital signs direct patients to your emergency room or lab draws. Digital printers like Vistaprint ship professional-grade cards affordably with fast turnarounds.

Purchasing a Domain Name

Secure the .com matching your hospital name for branding continuity across online and offline channels. Healthcare domains run $500 giving competitive value so services like Namecheap facilitate bidding purchases, custom emails, and reliable hosting.

Building a Website

Well-designed sites inspire confidence in patients seeking care options by communicating hospital capabilities, insurer acceptance, satisfied customer stories, and physician credentials. Build via user-friendly Wix templates or hire specialized healthcare web developers on freelancer marketplaces like Fiverr for custom designs.

12. Join Associations and Groups

Tapping into shared wisdom from professional communities accelerates success for fledgling hospitals through camaraderie, benchmarking, trendspotting, and troubleshooting beyond journeys traveled alone.

Local Hospital Associations

State hospital associations like the Florida Hospital Association provide political lobbying on legislative issues impacting healthcare operations and financing. They also offer treasured networking amongst an impressive swath of executive peers at annual conferences. Top state associations publish data-rich newsletters to guide strategy.

Meetup for Local Healthcare Meetings

Meetup proves an invaluable platform for finding regional healthcare leadership meetups facilitating connections within local hospital ecosystems. Brainstorm, and share job openings or event co-marketing opportunities. Discussion groups also exist surrounding medical coding, revenue cycle management, and clinical specialization interests for broadening the subject matter grasp.

Facebook Hospital Management Groups

With thousands of members, Healthcare Hospital & Clinic Jobs USA and USA Hospital Workers are premier Facebook forums for candid conversations including administrator job transitions, rev cycle winding paths, and accounts receivable dilemmas. Leaders lend first-hand guidance on standing up profitable service lines and balancing quality metrics amid rapid change.

13. How to Market a Hospital Business

Implementing an integrated marketing strategy connects your hospital’s capabilities and caregivers to those needing services in the community. Tactical campaigns raise visibility and trust while data-driven consumer insights propel strategy and refinement.

Referral Marketing

Word-of-mouth referrals remain the lifeblood for growth as satisfied patients share experiences within their circles carrying more weight than ads. Structured referral programs incentivizing existing patients with small gifts for successfully sharing your hospital’s strengths encourage organic amplification.

Digital Marketing

- Google/Facebook paid ads geo-target nearby households using healthcare interest data for highly qualified traffic to tailored landing pages detailing service lines

- Create physician spotlight content on the hospital website and promote videos through YouTube boosting trust and approachability

- Launch email nurture campaigns that educate expecting moms on prenatal class options and pediatrician selection

- Provide health risk assessments on heart disease, skin cancer, etc, and offer related screening exam discounts

- Partner county public health outreach campaigns on drug take-back days and COPD education aligned to community needs

- Blog regularly sharing stories demonstrating care outcomes, awards, and milestones reinforcing capabilities

Traditional Marketing

- Local magazine health columns and radio segments position physicians as experts in areas like stroke intervention

- Direct mailers to households in target zip codes conveying hospital advantages relative to competitors

- Print brochures distributed through pharmacies, libraries, and health fairs describing insurance acceptance

- Physician speakers presenting continuing education at local conferences raise the credibility

- Community event sponsorships like health screening tents at festivals and races

- Highway billboards with memorable designs announcing new specialty treatment additions

Continually test messaging, offers, and outreach channels while analyzing response and conversion rates across campaigns.

14. Focus on the Customer

Providing an exceptional patient experience distinguishes hospital brands fueling community trust, loyalty, and organic referrals. Competent clinical care expectedly represents the core hospital offering. However, compassionate support through stressful health events proves equally vital.

Little touches like recognizing a nervous child’s favorite stuffed animal during intake interactions or accommodating preferred meals for elderly patients accustomed to home routines promote comfort when vulnerable. These gestures get remembered and shared, embedding positive impressions that overcome consumers defaulting to the nearest or cheapest facilities.

Seeking post-discharge patient feedback, both qualitative insights and statistical satisfaction scores, highlights areas for customer service training from improving call wait times to more carefully explaining aftercare instructions. Track feedback over time correlated to admission volumes to quantify experience metrics on acquisition.

While physicians directly guide treatment courses, nurses and support staff manage emotional connections and logistics friction points from admissions to billing. Hiring inherently warm, empathetic individuals for patient-facing roles better ensures interactions exceed expectations rather than merely checking tasks off perfunctory chore lists.

Customer service platforms like Zendesk also let patients seek assistance digitally at their convenience through online portals and mobile apps as needs arise over their care journeys.