The U.S. mortgage market is set to expand at a compound annual growth rate (CAGR) of 18% from 2023 to 2029. With interest rates still near historic lows, there is huge demand for mortgages as millennials enter prime home-buying age and baby boomers look to downsize. Whether you want to be a loan officer or mortgage broker, now is an opportune time to break into this massive industry.

You’ll need to get licensed, build a client base, and establish relationships with banks and other lending institutions. The payoff of owning a profitable mortgage business is financial freedom and the ability to help people achieve the American dream of homeownership.

This guide will walk you through the step-by-step process of how to start a mortgage company. From writing a business plan with market research to navigating industry regulations with licensing and permits to registering an EIN. Here’s everything to know about getting started in the mortgage industry.

1. Conduct Mortgage Market Research

Market research is important to starting your own mortgage company. It offers insight into your target market, market trends, and saturation within your local market. Use primary and secondary research to learn how to start mortgage company business planning.

Some details you’ll learn through market research include:

- There is ample opportunity throughout the value chain.

- Mortgage bankers and brokers originate nearly 70% of all mortgages.

- Lenders can thrive via retail and wholesale channels by capitalizing on purchase/refi demand.

- Title companies ensure clean title transfers; security firms handle credit reporting and flood certifications.

- Roughly 5-6 million existing home sales occur annually.

- First-time buyers and repeat buyers at different life stages underpin volume stability.

- Favorable demographics (i.e. peak millennial entry) bode well for sustaining long-range demand.

- With home values up 40% amid inventory scarcity, refi opportunities exist too as owners tap equity.

- Even if rising rates limit some activity, the mass market nature ensures ongoing business.

- Specialty areas like jumbo, self-employed, and investor loans provide earnings growth potential as well.

While the purchase and refinance components fluctuate annually, the core market opportunity remains immense. Given the necessity of housing and embedded financing needs, mortgage sector revenues demonstrate resilience through cycles. With tailored strategies and prudent risk management, profitable niches can thrive across rate environments.

2. Analyze the Competition

To scope out competitor mortgage brokers, begin by identifying established mortgage brokerage business owners in your geographic target market. Check state license listings to pinpoint local mortgage bankers, brokers, and retail lenders.

Review their websites and social media for services offered, areas of lending focus, and clientele served. This establishes the competitive landscape.

Evaluate online reviews for customer satisfaction insights and possible service gaps. Monitor complaint logs via the CFPB database as well. Negative commentary can reveal opportunities.

Search public records to gauge financial performance. Business profitability filings like Schedule C tax forms contain revenue data to benchmark against. Assess the technology platforms competitors use also, as seamless processes attract customers.

Local housing market statistics can determine if adequate demand exists to support new entrants. Estimate market share potential based on population demographics like age and income. Evaluate penetration among key buyer groups as well, including first-timers, move-up buyers, and self-employed borrowers.

Analyzing such qualitative and quantitative details will inform strategic decisions. You can pinpoint unmet consumer needs to tailor services around. Understanding the technology, efficiency, and pricing of incumbents lets you craft targeted competitive advantages too.

Routinely monitoring market competitor intelligence safeguards your enterprise as evolving conditions shift dynamics within the local mortgage sector.

3. Costs to Start a Mortgage Business

When launching a mortgage enterprise, properly budgeting for initial and recurring expenses is crucial. Undercapitalization is a common pitfall for newcomers. Conducting due diligence on required outlays across key operational areas will set realistic cost expectations.

Start-up Costs

- Obtaining necessary mortgage broker/lender approvals runs $300-$5,000 depending on your state. Brokers average around $750 while bank sponsors incur licensing costs too.

- Leasing modest office space for 2-3 loan originators will likely entail $2,000-$3,500 monthly. This covers rent, utilities, parking, and workspace buildout.

- Budget $3,000-5,000 upfront if a sec-deposit equal to one month is required. A small branch footprint can help control overhead initially.

- Employing 1-2 commissioned loan officers at typical 40-60% splits necessitates seed money for their 3-6 month ramp-up. With base salaries of say $60,000, factor $30,000+ to onboard quality talent and ease their cash shortfall through initial loan closings.

- Legal, accounting, and insurance needs add up too. Plan for $3,000+ in legal retainers to establish the corporate entity and HR scaffolding, alongside $2,000+ for an accountant to handle licensing/operational compliance like trust accounts.

- Also earmark around $2,000 annually for general business insurance covering E&O, D&O, cyber, and umbrella policy premiums.

Ongoing Costs

- Volume incentives, training, and marketing events add variable outlays tied to scaling production. Staffing represents the largest recurring spending area.

- Occupancy fees for leased offices and any associated equipment/supplies impose continuous costs scaling with business needs.

- Marketing and advertising are imperative for sustainability too, encompassing digital channels like websites, social media, and lead aggregators. Budget several thousand dollars monthly for contextually targeted promotions.

- Ongoing licensing, bond, and E&O requirements to legally operate tally another few thousand dollars annually as well. And robust software capabilities for consumer direct interfaces plus loan processing/underwriting systems carry subscription expenses, although marginal per deal.

Astutely managing both start-up cash needs and ongoing operating costs is mandatory. Avoiding premature scaling and efficiently growing into infrastructure builds enterprise value. Setting practical budgets then positions an emerging mortgage business for prosperity.

4. Form a Legal Business Entity

When structuring a mortgage business, using a limited liability company (LLC) provides the best blend of owner protections and tax flexibility. As an attorney assisting thousands of small business launches, LLCs effectively shield personal assets while enabling pass-through income benefits.

Sole Proprietorship

Sole proprietorships offer simplicity but no liability separation. Owners face unlimited personal exposure for company debts and legal claims. Income flows directly to personal returns lacking corporate formalities. While convenient initially, risks expand with company growth.

Partnership

Partnerships facilitate equity sharing among co-founders. However, they still expose personal assets much like sole proprietorships. Income passes through to partner tax returns proportionately. Unless carefully crafted, partnerships can heighten disputes and require buyouts if a founder departs.

Limited Liability Company (LLC)

LLCs provide independent t corporate structures with pass-through taxation. The LLC shields owner assets – only what’s invested is at risk. Personal homes and bank accounts enjoy protection from business legal and debt liabilities. Startup is fast and flexible for any ownership split. As a separate entity, continuity persists despite individual transitions.

Corporation

C-corporations trigger double taxation, once at the entity level and again for dividends. However, they facilitate raising funds from investors seeking share-based equity, unlike LLCs. Required corporate formalities also impose administrative burdens relative to LLC simplicity.

5. Register Your Business For Taxes

Forming an official business entity necessitates obtaining an Employer Identification Number (EIN) from the IRS. This unique tax ID number identifies your company and facilitates opening business bank accounts, applying for licenses, and hiring employees.

Sole proprietors can use Social Security numbers instead. However, establishing a distinct EIN better tracks mortgage enterprise financials separately while limiting personal tax liability. The EIN application process is free and available online.

First, determine your responsible party and entity structure to secure your EIN online. Gather personal details of the principal owning/managing the company. Next, classify your formation type as LLC or corporation. With these basics confirmed, you simply:

- Visit the EIN online application

- Input your entity information as prompted

- Specify ‘View Additional Types’ and select ‘Finance/Insurance’ as your industry

- Provide owner/responsible party info

- Review all entries for accuracy

- Submit the application

Once submitted, your EIN should be supplied immediately. This then enables opening business bank accounts and completing state/local licensing registration. Also, establish sales tax collection infrastructure to fulfill requirements in the states you operate in. Failing to adhere leaves the business and owners individually liable.

6. Setup Your Accounting

Proper accounting is imperative for mortgage enterprises to track complex transaction flows and safeguard compliance. Unlike personal finances, navigating industry regulations, trust accounts and lending settlements warrants infrastructure mapping receipts to exact revenue categories.

Accounting Software

Deploying small business accounting software centralizes tracking to automate reconciliations and reporting. Platforms like QuickBooks seamlessly integrate with bank/credit card accounts to log all cash inflows/outflows. This alleviates manual entry bottlenecks while enhancing accuracy.

Hire an Accountant

Supplementing with an accountant adds specialized oversight to optimize financial health. Core assistance like bookkeeping and payroll processing is estimated to run $200-$500 monthly. This lightens the administrative workload so owners can focus on revenue-driving activities.

Open a Business Bank Account

Maintaining completely separate finances from personal banking and credit is essential. Beyond solely relying on an Employer Identification Number (EIN) for accounts, housekeeping disciplines like distinct credit cards bearing one’s legal business name manifest legitimate operations.

Apply for a Business Credit Card

Applying for a business credit card requires submitting details like your EIN, mortgage license documentation, and projected financials. Issuers determine approvable borrowing limits based on both personal and business credit histories. This equips flexibility in managing larger expense outlays.

7. Obtain Licenses and Permits

Before conducting transactions, mortgage enterprises must adhere to federal and state licensing laws to legally operate while safeguarding consumers. This includes obtaining a mortgage broker license. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

At the national level, loan originators and brokers must secure licenses via the Nationwide Multistate Licensing System (NMLS). This centralized infrastructure oversees licensing and publicly displays registered companies and originators across state lines. Specific documents, exams, and fees apply based on your location and lending activities.

Additionally, the Safe Act outlines standards for state-level laws ensuring ethical conduct and minimum competency criteria. Compliance helps build consumer trust through transparency. Renewals are required annually.

Certain states mandate licenses for loan processing and underwriting roles too. Evaluate if correspondents you work with have the necessary approvals, as lacking credentials jeopardizes loan eligibility. Ignorance of unique statutes is no defense when facing penalties.

Registering your business entity and verifying municipal approval for office locations requires permits and zoning allowances as well. Local commercial licenses often entail fees based on the number of onsite employees. Building codes may necessitate office modifications too.

Skirting license rules or ignoring compliance steps can prompt severe fines upwards of $25,000 alongside license revocation. Beyond jeopardizing livelihoods, violations erode critical consumer trust. It pays to meticulously track renewal deadlines across your entire staff’s credential spectrum.

8. Get Business Insurance

Beyond protecting physical assets, business insurance defends a mortgage broker business against unforeseen liability events. It’s inadequate to solely rely upon County recorder bonds or E&O coverage mandated through state licensing. Comprehensive policies provide a safety net for any established mortgage company.

Scenario examples exposing vulnerability without adequate coverage span technology failures, natural disasters, and employee dishonesty. A hacked server leaks client data prompting massive statutory damages. Floods destroy paper records before scans are complete, disrupting deals. An unscrupulous loan officer falsifies borrower details contributing to loan defaults.

Such threats highlight coverage gaps fixed through Business Owners Policies (BOPs) blending property, liability, and loss of income staples.

The application process examines your operations model and exposures to craft tailored recommendations:

- Specify Mortgages/Financial Services as your sector

- Provide employee count, office square footage, payroll totals

- List out current licenses, compliance controls, and risk management

- Submit for customized quoting based on unique indicators

Common enhancements like Cyber and Employment Practices Liability sharpen protection further. Premium costs vary based on location, industry, and revenue size. Expect $1,500-$4,000 annually depending on scale.

9. Create an Office Space

Establishing office operations elevates a mortgage business’s perceived professional legitimacy versus solely remote work. While home offices minimize costs, client meetings benefit from commercial settings reflected in pricing tiers. Weigh options based on growth plans, team size, and desired brand positioning.

Coworking Office

Coworking spaces like WeWork supply flexible shared work areas on membership plans as low as $300 monthly. This is a great option for your own business if you don’t want a long-term contract involved. A coworking space provides meeting rooms, printing, wifi, and messaging without extensive build-outs. Great for independent loan officers, but tight for larger staff.

Retail Office

Short-term retail spaces enable temporary setups serving local home-buying events or weekend office hours supplementary to regular operations. Costs tally $500 or less depending on duration and market rates. Provides community visibility at key high-traffic times when consumer lending interest peaks seasonally.

Commercial Office

Multi-year commercial office leases facilitate enduring corporate identities with room for personnel growth. Typical starter spaces from 1,500-3,000 square feet list around $4,000-$10,000 monthly inclusive of operating expenses in suburban areas. Signage and customized interiors project market success.

10. Source Your Equipment

As mortgage operations rely more on software capabilities than extensive hardware infrastructures, sourcing needs boil down to office furnishings, computer/tech gear, and multifunction printers. While buying new ensures the latest features, significant cost savings stem from alternate acquisition models without sacrificing functionality.

Buy New

Purchasing new computers and devices guarantees optimized speed, storage, and warranty protections typically lasting 1-3 years on hardware. All-in-one desktops or laptop/tablet sets for loan originators run $500-$1,500 from retailers like BestBuy. Top printers/scanners tally another $300. Prioritize performance needs over style frills.

Buy Used

Second-hand marketplaces like Craigslist and Facebook Marketplace continuously list law office surplus items in quality condition at 50% discounts. Search locally for sellers liquidating desks, file storage, chairs, computers, and printers from similar professional settings. Expect some wear from a few years of use, but thousands saved over new.

Rent

Rentals also moderate initial cash outlays while securing essential productivity tools. National chains like Rent-A-Center offer flexible leasing terms on electronics and furniture without credit checks or down payments. This facilitates getting established at lower risk before business growth substantiates large investments.

Lease

Leasing copiers and printers on managed service contracts give access to the latest models with ink/toner included for a competitive monthly rate. Average $100-$300 covering equipment costs, repairs and maintenance. Useful for minimizing administrative hassles on a predictable basis.

11. Establish Your Brand Assets

Cultivating a distinct brand identity enables mortgage companies to connect more memorably with potential customers. Investing in professional collateral conveys business legitimacy critical amid trust-based financial transactions. From logos to websites, thoughtful branding attracts and retains clients.

Get a Business Phone Number

Centralizing communications under a dedicated business phone line projects accessibility. Services like RingCentral deliver call routing, voicemail transcriptions, and online fax abilities for $30 monthly. Vanity numbers with custom greetings align with branding as well.

Design a Logo

Hiring designers to craft custom logos crystallizes corporate vision into recognizable graphic marks. Looka‘s AI artists instantly generate thoughtful logo options representing your ethos for under $50. File formats supplied facilitate broader brand imagery and style guide cohesion.

Buy a Domain Name

With the boom in internet searches for lenders, establishing an owned media presence is vital. The domain name registrar Namecheap offers intuitive website extensions. Get a .com address to show your clients you are an authority in your field.

Design a Website

Once secured, builders like Wix quickly launch sites with built-in SEO and analytics. Alternatively, marketplaces like Fiverr connect affordable freelance developers to construct more complex responsive sites. Expect a few hundred dollars for unique designs and a custom content population. Ongoing marketing content production is simplified within their Content Creation services too.

Print Business Cards

Vistaprint‘s budget-friendly cards and office signage help cement branding in the physical world. 500 basic business cards tally under $20. Yard signs, banners, and apparel extend exposure at open houses, community events, and office settings.

12. Join Associations and Groups

Beyond digital visibility, actively networking with other local mortgage and real estate businesses cultivates referral partnerships and specialized knowledge sharing. Trade organizations, community events, and online forums build connections to expand deal flow.

Local Associations

Industry associations like the National Association of Mortgage Brokers (NAMB), National Association of Realtors (NAR), and state mortgage banker chapters provide structured networking. Expect yearly memberships running a few hundred dollars to access training programs, conferences, and directory listings to heighten regional exposure.

Local Meetups

Sponsoring or attending real estate investment Meetup facilitates meeting engaged prospects face-to-face []. These regular gatherings centered around property, lending, and policy news assemble key influencers within local real estate ecosystems primed for personalized relationship building.

Facebook Groups

Specialized national Facebook communities enable crowd-sourcing guidance from tens of thousands of industry peers at scale. For example, the Mortgage & Financing Solutions and Realtors, Mortgage Professionals, and Real Estate Investors Network share job opportunities, technology insights, and sales best practices central to productivity.

13. How to Market a Mortgage Business

Implementing ongoing marketing is imperative for mortgage businesses to continually attract and convert new clients. While an owner’s sphere of influence establishes early customers, expanded outreach quickly taps growth potential. Blending digital and traditional channels sustains visibility.

Referral Marketing

Referrals from satisfied first-time homebuyers represent the most valuable customer acquisition source. Ensure flawless service, then follow up post-closing to ask for online reviews and social media testimonials. Consider $100 closing gift cards for any new referrals.

Digital Marketing

Amplifying visibility requires engaging modern platforms where borrowers spend time. Digital channels allow targeted, measurable promotion:

- Google Ads geo-fences neighborhoods with personalized loan offers to site visitors

- Retarget past website visitors with pre-approval incentives via Facebook Ads

- Create educational YouTube videos optimized for local search rankings

- Guest blog for regional real estate sites to highlight specialty programs

- Collect email leads via giveaway contests offering home-buying guides

- Automate email nurturing funnels delivering value to subscribers

Digital Marketing

While digital marketing should headline efforts for scale, localized traditional options assist too:

- Print flyers distributed at community centers and apartments

- Place testimonial newspaper ads in Sunday real estate sections

- Host first-time buyer seminars at the public library branches

- Sponsor a hole at local charity golf tournaments

- Mail refi offers to expired listings in your farm area

- Advertise on streaming radio during drive time blocks

The most effective customer acquisition strategies will likely shift across campaigns. Closely monitor performance by traffic channel and audience segment to double down on what works best. Budgeting 15-25% of revenue for marketing represents a reasonable starting point to fuel above-average growth.

14. Focus on the Customer

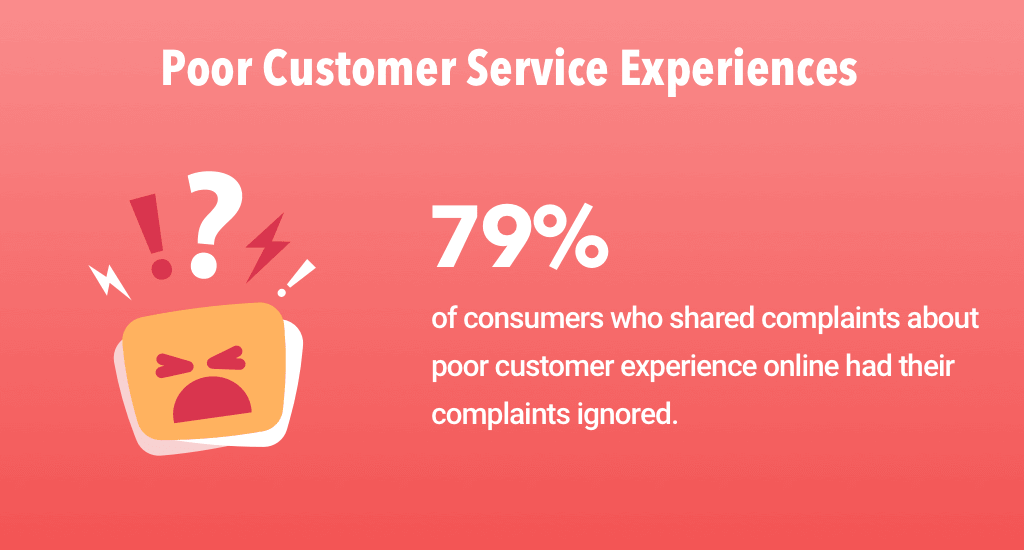

Providing an incredible client experience cements loyalty with mortgage customers amid a traditionally impersonal, stressful process. Beyond fostering referrals, attentive service disciplines also mitigate reputation risks from vocally dissatisfied borrowers. Investing in the human touch creates evangelists.

Given the long-term financial consequences of loans, customers long for advisors who educate on options, simplify complex paperwork, and respond promptly to questions. These reassuring interactions build trust and liking critical for referrals. 75% of consumers do more business with brands delivering excellent service.

Mortgage originators should target “raving fan” levels of support. For example, sending regular email updates during underwriting keeps buyers stress-free during radio silence periods. Another tactic is providing digital tools letting clients easily calculate payments based on rates and down payments 24/7.

Supplementing digital convenience with human connections sparks meaningful word of mouth. Realtors and past customers happily endorse advisors who simplify mortgage hurdles. Yet they will quickly broadcast shortcomings online to thousands of social media connections.