The private lending industry has exploded in recent years, with an estimated market size of $152.98 billion in 2022. With the housing market booming and interest rates still near historic lows, there is no shortage of borrowers looking for quick financing or real estate investors seeking funding for fix-and-flip projects or new property purchases.

With the right information and guidance on private money lending, you can set up a lean company that provides attractive returns on investment while still serving client needs. This guide will walk you through how to start a private lending company. Topics include market research, competitive analysis, registering an EIN, obtaining business insurance, and more.

1. Conduct Private Lending Company Market Research

Thorough market research is an essential first step when considering any new business venture, and private lending is no exception. Market research helps you better understand your target market as a private money lender, along with trends in the money lending business landscape.

Some information you’ll learn through market research for your private lending business includes:

- Geographically, the western and southeastern states led by California, Florida, and Georgia make up over 50% of the current private lending market.

- Most experts predict the fastest growth will occur in states like Idaho, South Carolina, and Alabama where housing markets are heating up but traditional lending remains constrained.

- With fix-and-flip projects and new property purchases requiring fast, customizable lending beyond conservative bank terms, investors will continue to dominate demand.

- The private lending space has over 350 active companies reports Sageworks, ranging from small operations with a few staff to large firms with hundreds of employees.

- Most players cluster in the middle market, doing between $5 million and $30 million in annual lending volume.

- With lower regulatory barriers than traditional finance verticals, the market remains relatively fragmented meaning newcomers can still carve out a niche.

- New entrants face a moderately high risk of failure in the first years predominantly due to cashflow issues from loan defaults.

- Conducting rigorous due diligence on borrowers is crucial to mitigating default exposure.

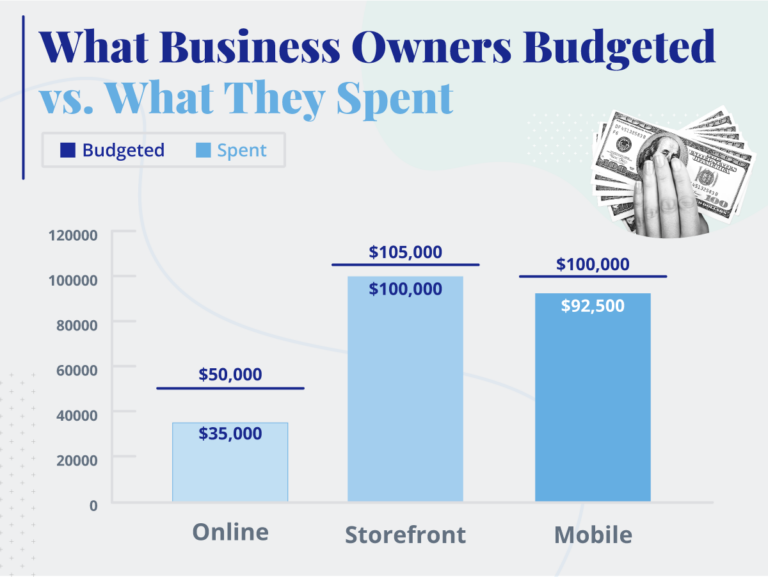

- Onboarding costs are also estimated at $50k-$100k for licensing, legal, talent, software, etc. presenting another startup hurdle.

Current growth trends and demographic shifts make private lending an attractive market full of unmet borrowing needs. With thorough underwriting and risk management procedures combined with a targeted regional/customer strategy, the typical barriers to entry are surmountable.

2. Analyze the Competition

Given the fragmented nature of the private lending industry, new market entrants will likely face competition from multiple private money lenders. Carefully analyzing these competitors is key to finding an underserved niche and building sustainable advantages in your chosen segment.

The first step is identifying direct rivals that operate in your target locality and customer vertical using licensing databases and industry association member listings. For example, those looking to specialize in the real estate business loan market would search groups like the American Association of Private Lenders for key regional actors.

Once identified, evaluating hard money loan websites and marketing materials gives insight into their positioning, rates/terms offered, underwriting procedures, and borrower types. Equally important is assessing online reputation via customer review analysis on platforms like Trustpilot and Google. This research will reveal potential weaknesses to leverage.

Competing private lenders must display license credentials on their websites by law. Verifying credentials ensures they operate legally while expired licenses may present an opportunity to service neglected customers.

The final analysis angle is examining the digital footprint of identified competitors using metrics tools like SEMRush. Tracking their search traffic, AdWords spend and referral patterns sheds light on marketing traction and focus areas, while on-page optimization checks reveal SEO capabilities.

Taken together, this three-pronged competitive analysis will uncover the playing field dynamics in your locale, expose major player vulnerabilities, and outline a positioning strategy to best serve borrowers, that other lenders, ignore. Ongoing tracking of the competitor landscape is also crucial once operational to stay abreast of new threats.

3. Costs to Start a Private Lending Company Business

Getting a private lending operation off the ground requires navigating some key upfront licensing, legal, and talent expenses before factoring in the working capital needed to fund loans. Meanwhile, keeping things running necessitates managing various operational overheads.

Start-Up Costs

- Licensing & Legal: As a financial services provider, private lenders must register for relevant state licenses which can cost between $2,000 to $5,000 including application fees and legal assistance.

- Staffing: At a minimum, administrative and underwriting roles will need to be filled at launch. Industry average salaries for these positions land between $50k and $80k.

- Software & Infrastructure: A centralized lending platform for originating and tracking loans can cost around $1,000 per month.

- Working Capital: The amount needed depends on lending strategy and volume expectations but $500k is reasonable for most operators initially.

In total, launching a private lending firm requires around $600k to $700k on average with working capital needs making up the bulk and licensing/staffing the other key items.

Ongoing Costs

- Interest Costs: For working capital needs, most firms use credit facilities or private investment at 7-12% interest rates.

- Labor: As lending volume ramps, additional underwriting and servicing capacity will be needed. Budget $60k to $90k per new hire depending on the experience required.

- Software & Infrastructure: $5k to $10k annually covers analytics tools, digital channels, and data infrastructure.

- Marketing: Dedicated digital marketing activity also becomes essential for growth relying less on brokers/referrals. Typical ad spend ranges from $3k to $7k monthly including platforms like Google Ads.

In essence, the core operational expenses for a private lender circle back to interest costs, payroll, and targeted reinvestment in systems/marketing to drive volume. Keeping these in check while scaling fast is fundamental long term.

4. Form a Legal Business Entity

Selecting the right legal structure is an important first step when establishing any business. For private lenders, limiting personal liability exposure from loan defaults while allowing for operational flexibility to access external funding makes forming an LLC the best choice.

Sole Proprietorship

Simple and inexpensive to set up, proprietorships place full responsibility and by extension legal liability for the business on the individual owner. Any loan defaults could thus put personal assets at risk beyond invested lending capital. This model also poorly accommodates taking on equity partners for expansion.

Partnership

Similar to sole proprietors, general partners in a partnership face unlimited personal liability for entity debts and lawsuits. Limited partners enjoy liability only up to their invested capital. Yet conflicting partner interests can hamper decision-making in this structure. And partner exits usually necessitate dissolving the current entity.

Corporation

Separating ownership from management, corporations limit owner liability and facilitate raising funds through share issuance. However, the high setup/compliance costs and inflexible ownership structure under this model offer unnecessary capacity for early-stage lending firms unlikely to pursue VC funding.

Limited Liability Company (LLC)

Providing the liability protection of a corporation without ownership restraints or administrative burdens, multi-member LLCs are ideal for fledgling private lenders. LLC status shields personal assets from loan default judgments and other business lawsuits. With the ability to freely add/remove co-owners, LLCs gracefully support small businesses with multiple owners.

5. Register Your Business For Taxes

With the legal entity formed, obtaining an Employer Identification Number (EIN) from the IRS represents the next critical tax registration step for your lending business. Much like an individual social security number, the EIN serves as a unique identifier in all tax-related proceedings.

Unlike sole proprietors who can use their SSNs, LLCs and other entities must acquire an EIN for federal tax purposes. The EIN also enables opening business bank accounts, applying for licenses/permits, and hiring employees down the line.

Thankfully securing an EIN is free and straightforward via the dedicated IRS portal. Simply navigate to Irs.gov and provide key details like entity name, address, and ownership structure when prompted.

The online application takes just 10-15 minutes to complete. Once submitted, the EIN is provided immediately eliminating the previous need to wait days for postal correspondence. Be sure to keep this number on file.

On the state and local level, registering for any applicable sales tax licenses is also essential. Most private lenders are service providers meaning sales tax may not apply initially. However, some states do require lending institutions to pay annual property taxes on the value of loaned capital. Connect with your Secretary of State office to understand requirements.

With both federal EIN and local sales tax registrations secured, you can officially commence lending operations knowing all tax reporting is covered as transaction volume grows. Just be sure to monitor license renewal dates and whether added certificates are ever necessary. Staying compliant from the outset reduces audit and penalty risks.

6. Setup Your Accounting

With multiple moving parts tracking transactions, incoming payments, tax liabilities, and cash flow, a private lending operation’s accounting can quickly become complex. Getting systems in place early and leveraging financial software streamlines keeping financials organized as deal volume grows.

Open a Business Bank Account

After forming your LLC, one of the first steps should be establishing a dedicated business bank account and credit card. Keeping company finances separated from personal transactions simplifies reporting and shields personal assets should the business ever face legal action.

Accounting Software

For lending operations, QuickBooks is the ideal small business accounting platform. The software connects directly to the company bank and credit card accounts automatically importing all inflows/outflows. Users can then categorize transactions for easy income statement and balance sheet reporting. At $30/month, QuickBooks delivers serious financial organization with minimal manual work.

hire an Accountant

As lending activity picks up, consider retaining an accountant or bookkeeping firm to handle reconciliations, collections, quarterly/annual financial statements, and tax paperwork. Expect to invest around $200 per month for basic supports like bank reconciliation and sales tax calculations and up to $2,000 monthly for full-scope recording and reporting.

Apply for a Business Credit Card

Applying for a dedicated business credit card also eases accounting by further separating expenditures. Business cards weigh factors like company revenue, age, and credit score less heavily than personal cards when determining limits.

7. Obtain Licenses and Permits

Before originating any loans or conducting business, all private lending outfits must register for the necessary licenses at both state and federal levels. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

The most critical credential, state lender licenses establish compliant operating authority, permit interest rate charges, and set guidelines on fees/terms. Requirements and costs vary significantly across states with California requiring over $2,000 in bonds while Texas charges $500 for example. Some locales also expect licensed personnel.

Fortunately, the Nationwide Multistate Licensing System and Registry provide a streamlined application portal handling documentation, payments, and tracking for most states. You can also apply for multiple state licenses in the same submission depending on expansion plans.

While this system eases administrative burdens, understanding license sub-types is still key. Principal licenses allow brokering and servicing loans handled by an outside funder while lending licenses confer direct lending powers funding deals on a proprietary basis. New operators should acquire lending authority from the start.

Mortgage Servicer License – Required in some states when loan repayment management is handled internally, these regulate escrow accounts, payment processing, and customer service. States like Tennessee have exemptions for private lenders managing five or fewer loans hence due diligence on servicing statutes based on location and portfolio is essential.

Debt Collector License – In certain states, entities collecting late loan payments on a third-party basis need this additional certification that includes bonding requirements, audits, and added fees. Most private lenders service their deals, but those planning third-party collections at any point (or acquiring distressed notes) should be aware.

8. Get Business Insurance

Insuring your private lending operation serves as a crucial shield against financial ruin should the worst occur. Policies cover expensive legal costs, property damage, or employee incidents that could otherwise sink the business.

Without coverage, just a few scenarios pose massive risks:

- Cybercrime/Data Breaches – With access to sensitive borrower information, lending platforms are prime hacker targets. The average data breach now costs over $4 million suggests IBM, mostly from legal damages and lost business. Cyber insurance offsets these costs.

- Borrower Lawsuits – While rare, frivolous lawsuits over perceived reporting errors, collections issues or even advertising claims could arise. Without insurance, legal fees start at $10,000 a case.

- Office Disasters – Incidents like fires, storms, or pipe leaks causing office destruction lead to major repair bills, wiped computers/files, and lending delays during premises renovation. Business property coverage handles this.

To secure protection, contacting an independent insurance broker that serves financial institutions simplifies accessing niche lending policies. Expect brokers to request key details like entity type, location, employee count, lending volume, and, procedures.

Top coverage areas for private lenders include Professional Liability Insurance covering errors, omissions, and negligent acts at around $4,000 annually. Cyber protection for data and identity theft events can cost over $5,000 depending on IT infrastructure. Business Property Insurance averages $1,000 but varies based on office size.

Securing the right blend prevents disastrous incidents from permanently derailing operations. Brokers can also source specialty protection like tax audit insurance given higher audit odds for lenders.

In total, expect to invest $10,000 to $15,000 in yearly premiums for adequate coverage across critical lending risks. View this expenditure as ensuring business continuity rather than just a sunk operational cost. The fallout of just one uncovered claim could jeopardize everything.

9. Create an Office Space

While many lending functions can remain remote, securing an office space provides a professional home base for critical in-person borrower meetings while enabling future growth. Let’s examine potential real estate paths:

Coworking Space

As deal volume increases, shared workspaces like WeWork bridge professional space needs while remaining flexible via short-term leases. Expect to pay $300-500 monthly for an office with seating for client reviews accommodating 20+ loans monthly. Coworking spaces also furnish ready meeting rooms useful when underwriting deals. The collaborative community can also spark referral partnerships.

Retail Office

Some states require physical offices for customers to submit applications and make payments. Leasing a main street storefront at around $2,000 monthly provides walk-in accessibility and local branding that resonates with certain demographics. But longer commitment retail leases reduce flexibility if relocating while lacking coworking’s built-in networking.

Commercial Office

Finally, for multi-employee operations, signing a long-term commercial lease secures the necessary room for expansion while allowing custom architecture to better express brand identity. However, costs ranging from $3,000 for basic units to over $10,000 monthly for Class A spaces with ample parking are only justifiable at a significant scale.

10. Source Your Equipment

As a predominant online enterprise, private lenders’ core infrastructure consists of technology hardware and software rather than specialized machinery. Necessary items boil down to computers/devices, internet connectivity, security tools, and lending platforms. Strategic sourcing balances affordability and performance.

Buying New

The latest laptops, printers, and devices provide speed and reliability but top-spec configs get expensive fast. Expect $2,000+ for a high-end finance workstation suggests DigitalTrends. NewEgg and BestBuy offer competitive pricing on new equipment with steep holiday discounts. Consider mid-range or previous-generation devices for cost savings.

Buying Used

More affordable than new, used electronics carry a heightened risk of equipment failure. Test thoroughly before purchasing. Craigslist and Facebook Marketplace post used laptops under $500 routinely while specialty refurbishing businesses like Newegg Business offer warranties starting at around d $800 per machine.

Renting

Equipment rental allows scaling hardware access as needed while testing tools before major purchases. National chains like Rent-A-Center offer flexible terms from week-to-week commitments to 12-month leases for items like laptops, printers, and POS terminals. However, longer-term costs get expensive fast.

Leasing

The most strategic option, leasing locks in usage rights through monthly payments while keeping ownership with the lessor. Terms for essentials like computers span 36-60 months enabling upgrades once paid off. Direct leasing companies offer custom bundles packaged with service/warranty perks from as low as $100 monthly per user.

11. Establish Your Brand Assets

Crafting a distinctive brand identity enables private lending outfits to build awareness, trust, and receptivity crucial for client acquisition and company growth. Let’s examine key assets to prioritize:

Getting a Business Phone Number

Acquiring a unique local phone number via Voice over IP services like RingCentral lends legitimacy to over-reliance solely on personal mobiles. Expect just $30 monthly for a dedicated line with call routing, voicemail, and unlimited national calling. This facilitates branding on documents and ads while providing clients with reliable channels for inquiries.

Creating a Logo and Brand Assets

A polished logo synthesizes visual identity to reinforce memorability and professionalism. When choosing designs, private lenders should lean into motifs like circles or squares suggesting security and trust. Popular online logo maker Looka starts at just $20 per custom concept.

Creating Business Cards and Signage

Business card design aligned with the emerging brand identity keeps memorable information ready to exchange at events or client meetings. 500 high-quality cards from Vistaprint cost under $50. Consider spotlighting license credentials that inspire confidence.

Purchasing a Domain Name

Finding an available .com domain name matching the brand name via registrars like Namecheap enables building a dedicated lending website. Expect just $15 yearly. Keep names short and intuitive while summarizing value.

Building a Website

Every lender needs an online locus presenting services, educating applicants, and driving document submissions/payment. Turnkey website builders like Wix require no coding knowledge and cost only $20 monthly. Those wanting added functionality can hire experienced freelancers on platforms such as Fiverr for custom design affordably.

12. Join Associations and Groups

Joining key professional groups and associations accelerates vital networking for advisory relationships, origination partners, and even prospective joint ventures in the local lending scene.

Local Associations

Area chapters of national trade groups like the American Financial Services Association offer member forums to engage peers while accessing compliance insights from national advocacy efforts. Expect around $500 yearly for access.

Local Meetups

Regularly participating in general small business meetups via sites like Meetup forges local connections and referral pathways over time while keeping a pulse on community issues influencing borrowing appetite. With enough networking, partnerships with compatible providers like accountants, designers, or even marketers may emerge.

Facebook Groups

As the largest online community, Facebook hosts countless niche groups uniting remote specialists where advice-sharing and strategy debates generate insights. For example, the Hard Money Lenders & Private Lenders List and Private Money Lenders USA have thousands of financing pros to exchange loan opportunity leads and marketing techniques.

13. How to Market a Private Lending Company Business

Implementing an expansive marketing strategy leveraging both digital and traditional channels kickstarts vital brand building while generating a pipeline of prospective borrowers.

Personal Networking

Early on, mining connections among existing networks, past clients and internal contacts aid vital word-of-mouth exposure. Offering finder’s fees or discounts for referrals helps incentivize organic referrals.

Digital Marketing

- Google Ads targets local investors by bid terms like “private real estate lenders County” and “rehab loan County” in covered zip codes. Expect to invest $500-$1,000 in testing niche terms with hyperlocal landing pages.

- Facebook Ads displays loan offers the custom homeowner and real estate investment interest groups within key cities primed for fix-and-flips or new projects. Plan $300 monthly testing creative and unique offers.

- YouTube Videos showcase lending advantages over banks through a branded channel targeting “loans” searches. Promote via Ads for $100 monthly to demonstrate expertise via free education.

- Industry Forum Sponsorships associate your brand with specialist peer groups. A featured lender profile on biggerpockets.com runs $300 monthly but provides direct access to over 1 million members.

- Email Newsletters send property profiles, market insights, and loan resources to subscribers building thought leadership. Expect less than 10% open rates initially but improved borrower dialogue.

Traditional Marketing

- Direct Mail Flyers with current loan terms mailed to inherited lead lists or property records for “distressed” homeowners prompt responses from as low as 1%. Tests start at 500 recipients for under $1,000.

- Radio Ad Campaigns on local AM stations detailing unique loan programs build local awareness at around $500 per aired creative. Longer flight times improve recall.

- Chamber of Commerce sponsorships establish community bonding and localized networking channels. Featured member packages start around $5,000 annually with higher tiers including event speaking.

- Cross promotions with settlement agents offering discount closings for your borrowers earn reciprocal lending referrals from embedded partners over time.

- Print investment magazine ads in niche publications like Rehab Valuator Magazine enable targeting engaged rehabbers. Expect around $3,000 per placement.

With constant testing through integrated digital and traditional channels, creative approaches will find cost-efficient customer acquisition recipes signaling where to double down. The key is allocating enough budget to optimize effective platforms.

14. Focus on the Customer

In a heavily relationship-driven sector where borrowers have sensitive financial needs, providing excellent customer service accelerates referral rates and retention essential to scalable lending books. Prioritizing user experience distinguishes operations.

Customers valuing seamlessness and partnership from their hard money lenders become top referrals. To be successful in hard money lending, you must earn consumer trust.

Customer advocacy sparks crucial word-of-mouth referrals. For example, an investor receiving flexible bridge financing tailored to their flipping timeline ahead of schedule is more inclined to discuss your solution-focused approach within investor circles. In a niche sector, peer viewpoints greatly influence vendor selection.

Simplifying document submission, eSignatures, and fast underwriting turnarounds establish your lending process as more user-friendly than competitors still reliant on slow manual workflows. Refining user journeys pays dividends securing customer loyalty that powers growth for years.

Top lenders also integrate frequent nurturing touchpoints like market insight newsletters, repayment performance reporting, and ongoing networking invitations demonstrating commitment beyond just origination.