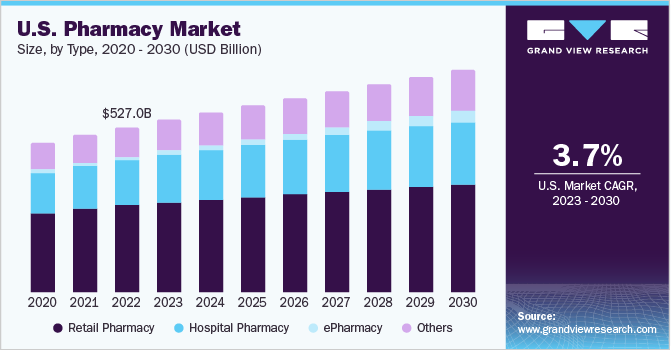

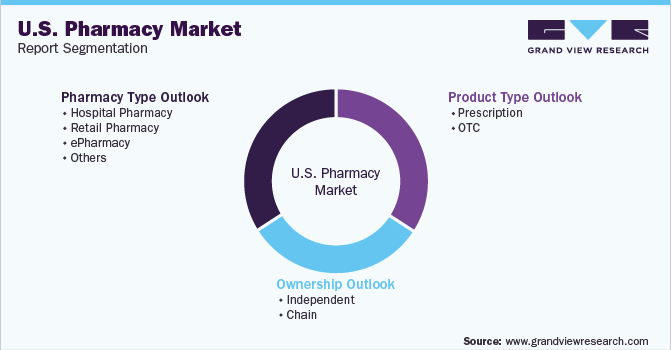

Pharmacy businesses are on the rise with a potential compound annual growth rate (CAGR) of 4.6% from 2022 to 2032. This means the market could reach $1,740 billion by 2032. For a new pharmacy owner or pharmacy consultant, this makes it a great time to get involved.

Offering personalized care and niche services can help community pharmacies compete against the big chain drugstores. If you have a passion for helping customers with their pharmaceutical needs, now may be the ideal time to open your pharmacy.

This guide will walk you through how to open a pharmacy. Topics include market research, opening a business bank account, obtaining business insurance, applying for licensure through the Drug Enforcement Administration, and other details important to running a successful pharmacy.

1. Conduct Pharmacy Market Research

Market research is integral to getting to know your target market and developing a solid pharmacy business plan. Details you learn through market research teach you about trends in the industry, how to develop a study pharmacy brand, the best type of pharmacy software, and more.

Several key factors driving this sector include:

- With older individuals utilizing more prescription medications, this demographic shift will spur more demand.

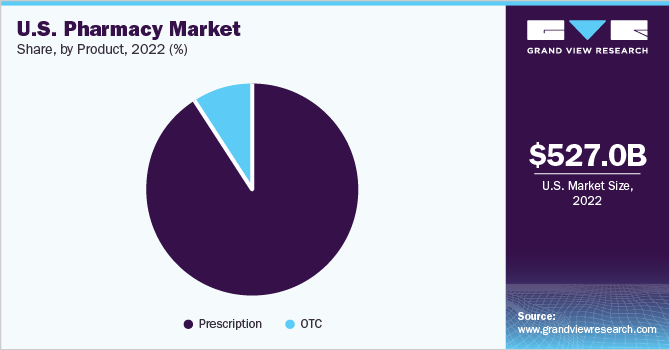

- Specialty drug use is rising quickly, with specialty medications projected to represent over 50% of drug spending by 2023.

- Independent community pharmacies can capitalize on this growing industry by offering personalized care and niche services versus big chain pharmacies.

- Specializing in compounding, immunizations, medication synchronization programs, and health screenings can attract loyal local customers.

- Partnering with senior living facilities also provides a consistent patient base.

- Partnering with other medical facilities is a great idea to increase sales, especially with an urgent care or dental facility.

- The initial pharmacy start-up costs for licensing, inventory, staff, real estate, and more require substantial capital. Applicants must also demonstrate proof of assets for licensing.

For entrepreneurs with pharmacy experience and adequate financing, owning an independent drugstore can prove a profitable endeavor given the vast and expanding US medication market.

2. Analyze the Competition

Understanding the competitive landscape is crucial when starting any small business, especially in the vast pharmacy industry. When scouting locations for a brick-and-mortar pharmacy, assess pharmacies within a several-mile radius to analyze proximity, services offered, and apparent customer volume.

Some ways to get to know competitors in your own pharmacy business include:

- Utilize data from the National Council for Prescription Drug Programs to research state and county prescription statistics.

- Use the National Association of Boards of Pharmacy directory to look up pharmacy licenses in your area to gauge competitors.

- Research nearby pharmacies online too, evaluating their websites and digital presence.

- Run competitors through review platforms like Google, Facebook, and Yelp to assess customer sentiment and reported volume.

- Google any pharmacist employees listed to determine the breadth of experience.

- Search industry terms related to your planned specialty services on Google to analyze the top-ranking results and online ads.

- Leverage free online tools like Google Analytics and SEMrush to quantify website visitors and search traffic for competitor sites.

- Follow and monitor social media for neighboring pharmacies, looking for several followers and customer engagement.

- Download the apps for larger chains to assess features and convenience. Signing up for emails and loyalty programs can provide additional competitor insights.

While the landscape analysis requires effort upfront before opening, keeping abreast of competitor offerings and digital marketing once launched is equally important. This competitive intelligence allows new pharmacies to stand apart in patient care and specialized services to capture market share within a geographic area or online.

3. Costs to Start a Pharmacy Business

Starting an independent community pharmacy requires substantial upfront investment before opening the doors and serving the first customer. From licenses and legal paperwork to inventory, staff, and real estate, the initial costs add up quickly.

Start-up Costs

- Pharmacy License and Permits – $5,000-$10,000 The specific pharmacy license application requirements and fees vary by state.

- Build Out and Real Estate – $100,000-$500,000 Whether leasing existing pharmacy space or developing a new standalone building, costs for necessary reconfigurations and structural elements like raised counters, private consultation rooms, and security systems.

- Inventory and Supplies – $50,000-$150,000 From pills on the shelves to pharmacy management software, the initial inventory and supply outlay averages $50,000 to $150,000 before opening.

- Staff – $60,000 While independent pharmacies average 2-8 employees, between pharmacy techs and pharmacists, annual staff payroll often exceeds $60,000. Benefits offerings make hiring more costly. Many pharmacy owners take on initial technician roles themselves to control labor expenses.

- Insurance – $3,000+ Annually General business liability insurance runs over $1,200 per year. Pharmacists can also incur thousands in specialized professional liability coverage to hedge against dispensing errors. Policies ensuring inventory and protecting customer data also prove essential.

In total, starting an independent pharmacy requires around $200,000-$700,000 in upfront investment covering the many licensing, inventory, staffing, facility expenses, and more.

Ongoing Costs

- Ongoing Operating Costs Rent/Mortgage Payments – $20,000+ Annually. Property lease or purchase financing costs pharmacy owners $20,000+ per year depending on location and size.

- Staff Payroll – $150,000+ Annually With 2-8 employees from techs to pharmacists, yearly payroll tops $150,000 and keeps rising as independent pharmacies expand staff.

- Prescription Inventory – $100,000+ Annually Keeping prescription medications consistently stocked to serve customers costs independent pharmacies $100,000 or more each year. Inventory management is crucial for profitability.

- Software Costs – $3,000-$10,000 Annually From pharmacy management systems to electronic medical records programs and digital marketing services, independent pharmacies rely on various software platforms to operate efficiently, costing several thousand dollars yearly.

- Insurance Premiums – $5,000+ Annual business, liability, and malpractice insurance premiums exceed $5,000 for coverage levels meeting industry standards.

Between staffing, real estate, maintaining the drug inventory, and financing critical systems, the ongoing operating expenses also tally over $200,000 annually for many independent pharmacies before marketing dollars or profit distributions.

4. Form a Legal Business Entity

When starting a pharmacy, choosing the right legal business structure impacts everything from personal liability to taxes and potential growth. The four main entity options each have pros and cons for a pharmacy owner to weigh.

Sole Proprietorship

Operating as a sole proprietorship allows pharmacists to get up and running quickly with no formal business registration. However, the owner faces unlimited personal liability for debts and claims tied to the pharmacy, putting personal assets at risk. Sole proprietors also pay self-employment taxes on all income. This model works best for temporary arrangements or mobile pharmacy services.

Partnership

Creating a partnership around a pharmacy with a signed partnership agreement spreads liability and combines the strengths of two owners. However, partners can still be personally responsible for pharmacy errors or debts. Disagreements between partners can also trigger dissolution. This structure facilitates co-ownership but has risks.

Limited Liability Company (LLC)

For most pharmacies, forming an LLC offers the best of all worlds. As the name indicates, it limits owner liability and better protects personal assets if sued. Single-member LLCs allow for pass-through income tax treatment while multi-member LLCs provide partnership flexibility. LLC pharmacy owners can also more easily secure business financing.

Corporation

Establishing a pharmacy as a S-corp or C-corp creates a separate legal entity that shields owners from liability. And corporations can more easily bring on investors and eventually sell or go public one day. However, the significant legal and accounting costs make a corporation overkill for a small pharmacy just starting. Corporations also face double taxation on profits unless structured as an S-corp.

5. Register Your Business For Taxes

An Employer Identification Number (EIN) serves as a pharmacy’s equivalent to a social security number, identifying the business entity for key tax and banking purposes. All pharmacy businesses must obtain an EIN – it is not optional.

Specifically, an EIN allows new pharmacies to open business bank accounts, apply for essential financing, hire employees, report income taxes appropriately, and more. Even pharmacies planning to operate as sole proprietors need to secure an EIN rather than only using a Social Security Number.

The Internal Revenue Service (IRS) oversees EIN administration, with the online application only taking minutes to complete. To apply:

- Step 1) Gather Key Information Have your pharmacy’s legal business name, address, accounting details, ownership structure, and taxpayer ID handy before logging into the IRS EIN Assistant tool.

- Step 2) Answer Application Questions

Respond to a short series of questions regarding your entity type, reason for applying, and contact information. Helpful tooltips guide you. - Step 3) Get Your EIN After submitting your answers, an EIN will be assigned and provided immediately. Print and save this for your records.

The EIN application is free directly through the IRS. You’ll only owe state taxes if you form a legal entity like an LLC or corporation. With an EIN established, new pharmacies must still register with state boards to collect and remit sales tax on items sold. Failing to charge sales tax leads to penalties.

6. Setup Your Accounting

Correct accounting is crucial when starting and running an independent pharmacy. With substantial prescription inventory expenses, payroll, insurance costs, and more, carefully tracking finances prevents headaches at tax time and facilitates smart business decisions.

Accounting Software

Early on, pharmacy owners should invest in small business accounting software like QuickBooks. The estimated $200 yearly subscription integrates directly with bank and credit card accounts to automatically categorize income and expenses. Features like automated invoicing, inventory management, and reporting dashboards save hours over manual methods.

Hire an Accountant

Most pharmacies should also enlist an accountant, particularly when just getting started. A qualified accountant provides bookkeeping and reconciliation services starting around $100 per month. This keeps daily transactions classified accurately, ensuring clean records if the pharmacy gets audited. Accountants also prepare official fiscal year-end taxes for roughly $1,000.

Open a Business Bank Account

New pharmacy owners must also take care to separate personal and business finances. This means establishing a dedicated business checking account and credit card solely for pharmacy expenditures. Never comingle spending.

Apply for a Business Credit Card

Besides cloud accounting software, using a separate business credit card simplifies tracking pharmacy expenses. Compared to personal credit cards, business card approvals focus more on company financials versus just a person’s credit score. Expect lower limits initially but the opportunity to increase over time. Have your EIN and revenue projections handy when applying for pharmacy business cards.

7. Obtain Licenses and Permits

Before an independent pharmacy dispenses its first pill, the business must obtain several essential licenses and permits from state and federal agencies. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

All pharmacies must hold a state-level pharmacy business license demonstrating approval to stock controlled substances and prescription medications. Requirements like naming a professional pharmacist-in-charge, carrying adequate business insurance levels, and facility safety standards aim to protect public health.

Pharmacies must also specifically register with the U.S. Drug Enforcement Agency (DEA), which grants legal access to order and sell federally controlled drugs. DEA registration costs about $888 annually, subject to state fees. The stringent application scrutinizes storage procedures, inventory systems, and security measures.

Most municipalities require all businesses including pharmacies to obtain local commercial operating permits along with health and fire inspections before opening. Zoning regulations must also permit pharmaceutical services at your pharmacy’s physical address.

Medicaid Provider Registration To fill prescriptions covered under government-funded Medicaid programs, independent pharmacies must formally enroll as Medicaid-approved providers in their state. This allows for billing and reimbursement for low-income patients.

In some states, pharmacies may need additional permits tied to selling medical devices, providing home medical equipment services, or compounding specialty medications on-site. Research all state and local pharmacy operation requirements thoroughly before investing in a new location.

8. Get Business Insurance

Given the high costs of inventory loss and liability risks around dispensing errors or customer privacy breaches, independent pharmacies require tailored insurance coverage right from launch. Otherwise, minor incidents turn into major financial blows for uninsured businesses.

Specifically, specialty pharmacy insurance packages protect against:

- Property damage from fires or floods destroying shelves of valuable medications

- Employee theft leading to missing prescription drug stock

- Lawsuits from customers harmed by incorrectly filled prescriptions

Without adequate pharmacy insurance, these common issues could shut down operations. Just replacing lost inventory often proves cost-prohibitive without insurance claims to rely on.

To avoid disaster by launching without protection, pharmacy owners should research plans and obtain quotes from major pharmacy insurers like Pharmacists Mutual and RPS Insurance.

The step-by-step process involves:

- Researching pharmacy insurance providers like RPS Insurance

- Requesting quotes online or contacting insurer agents directly

- Comparing coverage terms like prescription drug, equipment, and business interruption components

- Purchasing the optimal pharmacy policy aligning with local requirements

- Providing insurer discounts to staff to demonstrate your commitment to risk and safety

Confirm all active insurance policies at least annually, adjusting limits higher as your independent pharmacy grows over time. A single lawsuit or burglary sinks unprotected pharmacies.

9. Create an Office Space

While the public retail floorspace takes center stage, having a dedicated back office area in an independent pharmacy allows for essential inventory management, privacy reviewing of patient histories, and financial reconciliation beyond public sightlines.

Coworking Space

For under $300 monthly, shared workspaces like WeWork provide amenities like WiFi, printing, conference rooms, and community networking. However, privacy restrictions around protected health information make coworking impractical for pharmacies. You also cannot store prescription medications onsite.

Retail Pharmacy Office

Ideally, dedicated pharmacy retail builds include private back-office areas for prescription processing and inventory monitoring along with customer-facing sales floors. Most states mandate minimum space requirements per pharmacy license too. While embedded offices cost more upfront within new building construction, they facilitate efficient pharmacy workflow and storage.

Commercial Office Space

Leasing generic office suites near $20 per square foot offers more flexibility than retail spaces to customize layouts. However, strict regulations around handling certain drug products make converting random offices burdensome. And such spaces still fail to provide the visibility and accessibility of a standalone pharmacy.

10. Source Your Equipment

Launching an independent pharmacy demands significant upfront equipment investments from counters to prescription processing technology before opening for business. New pharmacy owners have four primary options to obtain the necessary gear based on budget and timeline considerations:

Buy New

Ordering shiny new pharmacy fixtures directly from manufacturers like ScriptPro and Telepharm facilitates custom layouts but costs significantly more. Still, new equipment qualifies for tax deductions. Be prepared to spend $75,000 outfitting a pharmacy with the latest tech and storage from scratch.

Buy Used

Purchasing gently used pharmacy shelves, point-of-sale systems, and medication dispensers from previous Independent pharmacies saves substantially over new options. Shop industry liquidators that inventory used equipment. Buying second-hand reduces budget by 40-50% for first-time owners.

Rent

Some pharmacy equipment companies offer short-term rental programs for tablet counters, IV machines, and software if buying proves cost-prohibitive initially. This helps launch on a budget with newer tech. However, accumulated monthly fees add up over multi-year terms.

Lease

Leasing pharmacy tools through equipment finance companies spread costs over years through fixed monthly payments while deploying the latest tech. But leasing agreements run 3-5 years locking businesses in. Compare terms like balloon payments at the end carefully.

11. Establish Your Brand Assets

Crafting a consistent brand identity helps independent pharmacies attract loyal local customers versus large chains. Patients connect more with pharmacy owners they know personally through branding elements like logos and custom signage.

Getting a Business Phone Line

Rather than relying solely on personal cell phones, using a professional business phone system like RingCentral starting at $30 monthly reinforces legitimacy. This allows listing a permanent phone number on websites, signs, and business cards customers can call with questions or refill needs.

Creating a Logo and Visual Brand

An emblem that evokes professionalism, care, and trust makes lasting impressions on prescription bags, pharmacy windows, and uniforms. Services like Looka provide fast logo design including revisions from $20. Simple, recognizable symbols best represent independent brands versus elaborate graphics.

Printing Business Cards and Signage

Business cards establish credibility when meeting with drug reps, insurers, and local doctors who may refer patients. 500 basic cards from Vistaprint cost under $20. Window signage and custom interior displays also showcase independence from chains through signage.

Buying a Domain Name

The right .com domain captures search traffic and directly communicates your pharmacy’s name and location. Keep names short, local, and easy to spell. Use hyphens for multiple words. Check availability across registrars like Namecheap listing for under $20 annually.

Building a Website

An information-rich website enables 24/7 access for prescription requests, refills, and questions. Users can create one through Wix and WordPress website builders or hire web developers on Fiverr and Upwork. Budget $500 minimum for professional pharmacy site development.

12. Join Associations and Groups

While independent pharmacies aim to uniquely serve their local communities, connecting to broader industry resources and fellow pharmacy professionals proves invaluable for insider techniques and moral support.

Local Associations

Joining regional pharmacy trade associations like state-level branches of the National Community Pharmacists Association (NCPA) provides access to regional peers, insurance contract negotiating power, and ongoing training seminars. Expect $100-$300 in annual NCPA chapter dues enabling local collaboration.

Industry Events

Attending national trade shows allows networking with thousands of fellow independent pharmacy owners while discovering the latest innovations and service offerings. Those unable to travel can find regional pharmacy meetings via sites like Meetup.

Facebook Groups

For daily idea exchanges and troubleshooting peers encounter, more than 18,000 pharmacy professionals interact within niche Facebook Groups like Pharmacist to USA, Canada, and Australia forum and Pharmacy Tech Talk. The online community provides morale and mental health boosts amidst pharmacy hardship.

13. How to Market a Pharmacy Business

While exceptional patient care builds an independent pharmacy’s reputation over time, proactive marketing proves essential to initially attracting local customers and driving revenue growth month-to-month.

Personal Networking

An owner’s personal and professional network serves as the most valuable asset early on. Offering discounts or loyalty rewards incentivizes happy customers to endorse your pharmacy to friends, colleagues, and social media followers. Start with people you know and nurture referrals.

Digital Marketing

- Run Google and Facebook ads geo-targeting neighborhood demographics, highlighting unique pharmacy services, and promoting first-fill discounts

- Create a YouTube channel publishing weekly videos on medication tips, specialty offerings explained, and health awareness campaigns

- Launch an email newsletter providing drug safety notices, wellness advice, and pharmacy features to build an audience

- Blog regularly about chronic condition management and prevention to establish SEO authority

Traditional Marketing

- Print full-color flyers and mailers to advertise expanded prescription delivery options and medication pickup convenience

- Sponsor little league teams and events at the nearby senior living facilities to raise local visibility

- Periodically distribute pamphlets detailing pharmacy specialties like custom compounding medications and immunization services

- Leverage billboard and radio ads along commute routes to target drivers in the area

While digital platforms provide advantages around metrics-driven testing and targeting, traditional outlets still reach certain older demographics. Try both channels when introducing your pharmacy to the neighborhood.

14. Focus on the Customer

For small pharmacies aiming to compete against massive chains, providing personalized care and compassion sets your business apart. Patients will switch pharmacies and drive many miles further for exemplary service they cannot find elsewhere.

Specifically, independent pharmacies must prioritize:

- Greeting every patient by name and listening attentively to medical concerns beyond just filling scripts

- Keeping patients updated on medication availability and insurance questions as they arise

- Offering home delivery options for mobility-impaired seniors or busy parents

- Proactively alerting customers to dangerous drug interactions before dispensing

- Spending time explaining specialty medication regimens to avoid confusion and increase compliance

This degree of individualized attention simply does not exist at high-volume corporate pharmacies. Demonstrating genuine empathy and care for your customers pays dividends.

Satisfied patients share positive pharmacy experiences with extended families, neighbors, and doctors – providing free word-of-mouth promotion. They also continue transferring all prescriptions to the pharmacy providing not just accuracy but meaningful advice and support.