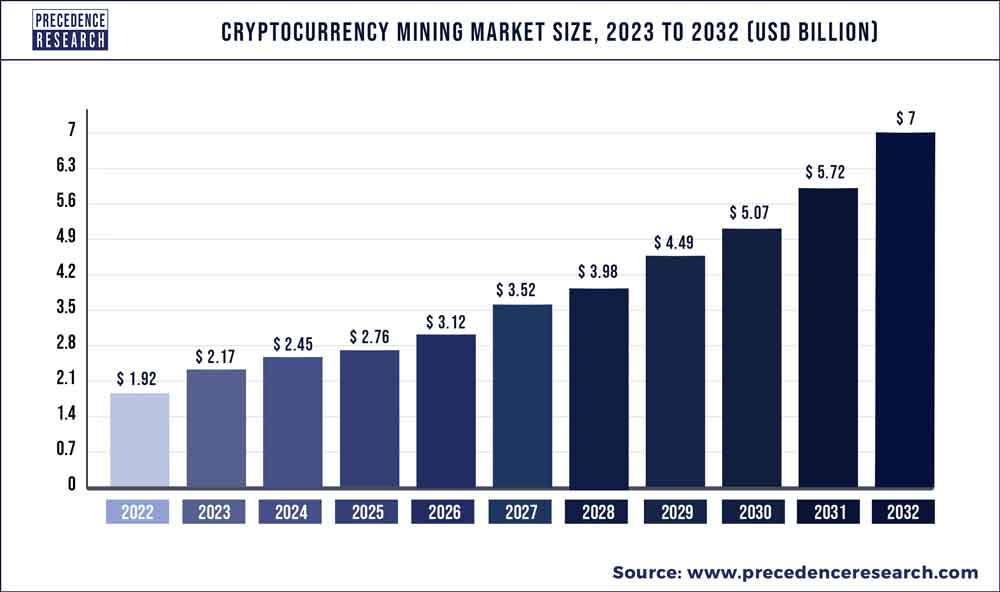

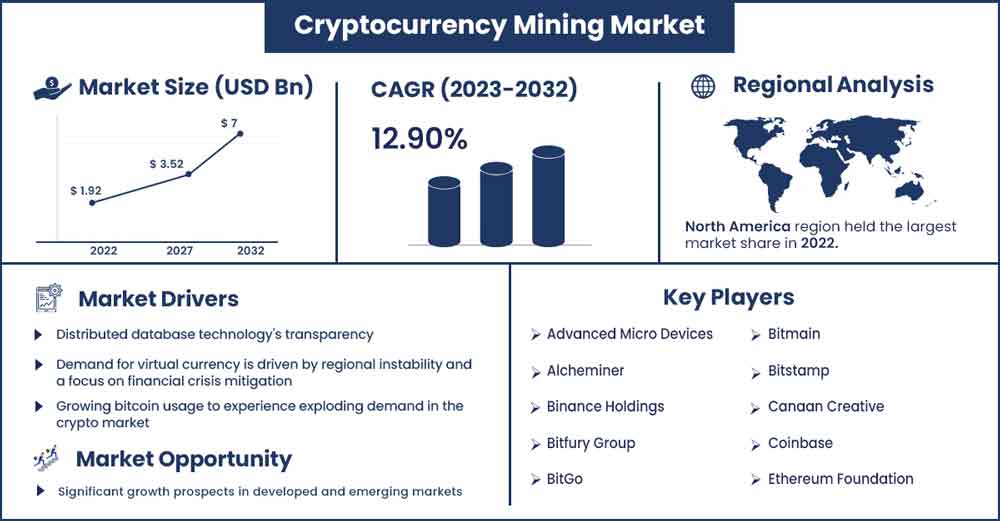

The global cryptocurrency mining market was valued at $1.49 billion in 2020 and is projected to reach $4.94 billion by 2030. With the rising popularity and adoption of cryptocurrencies like Bitcoin and Ethereum, there is a growing need for crypto mining operations to verify transactions and release new tokens.

As crypto prices have skyrocketed in recent years, crypto mining has become increasingly profitable, allowing even small mining operations to earn substantial returns if set up properly. However, launching a successful crypto-mining venture requires strategic planning, significant technical know-how, and smart investments in equipment and infrastructure.

This guide will walk you through how to start a crypto-mining business. Topics include market research, competitive analysis, forming an LLC, obtaining business insurance, and other important aspects of developing a bitcoin mining business.

1. Conduct Crypto Mining Market Research

Market research is essential to mining Bitcoin as a business. It offers insight into market trends, top mining software, and local market saturation.

There are multiple underlying factors contributing to this rapid growth:

- The prices of major cryptocurrencies like Bitcoin and Ethereum surged drastically between 2020-2021 before stabilizing at substantially higher levels than prior years.

- Technological improvements are making crypto mining hardware significantly more efficient.

- New ASIC mining chips can deliver 100x higher performance per unit of energy than predecessors 5 years ago.

- The shift towards cryptocurrency adoption amongst mainstream financial institutions signals long-term faith in the lasting relevance of crypto coins.

- There are also risks involved in entering the crypto-mining sector: governments could impose restrictive regulations that severely limit participation.

- Crypto mining represents the chance to capture outsized rewards before mass adoption kicks in.

- The expertise barrier is coming down quickly with automated mining management solutions, while financial barriers could be overcome through business model creativity.

- The market is also highly fragmented.

- As the industry matures over this decade, there is ample room for innovative players to carve out leading positions through strategic moves before consolidation accelerates.

The macroeconomic forces propelling crypto adoption forward make this a golden era for mining entrepreneurs to tap into explosive growth and secure a lucrative stake. Tempered with business model adaptiveness to contend with inherent volatility, the market opportunity is incredibly promising.

2. Analyze the Competition

To assess the competitive landscape, first, use a crypto mining pool ranking site to identify the largest pools by hash rate distribution. The biggest pools like AntPool, F2Pool, and ViaBTC account for over 50% of global Bitcoin mining power currently.

Some other ways to get to know mining operation competitors include:

- Research the major hardware manufacturers serving the market. Compare their mining rig specifications and pricing as benchmarks.

- Cross-check whether any of these leading crypto-mining firms have announced plans for new facilities in desirable geographic regions that have low electricity costs, favorable regulations, and climate advantages.

- Monitor local business registrations to see if competitors may be establishing local footholds.

- Search forums like BitcoinTalk to gather chatter on which players crypto miners are closely tracking, issues/complaints raised against major brands, etc.

- Industry blogs like CoinDesk often provide coverage of notable ventures as well.

- For online presence, check the SEO visibility of key companies in search engines and their website traffic statistics on Alexa.

- Study their web content strategy and ad placements across social media platforms. This fuels creative ideas on content and community building.

- While crypto mining is not location-dependent, target regions with cheaper energy, cooler climates, or preferable policies.

- Seek grants/incentives from municipal governments wanting to attract crypto mining businesses.

Join forums and online mining communities to directly interact with practicing miners. Learn their perspectives on key success factors, major hassles they face, and where profitability challenges lie. Use their collective wisdom to refine your mining operations strategy.

3. Costs to Start a Crypto Mining Business

When starting a crypto mining venture, the single biggest expense is the advanced ASIC miners and graphics cards. A good rule of thumb is budgeting $10k per machine for starters. Let’s more closely examine the costs you’ll encounter to make your bitcoin mining profitable.

Start-up Costs

- Robust PSU power supplies ($300-500 each) to handle heavy-duty usage

- Durable metal racks ($200+) for installing the rigs

- High-end routers ($150+) to manage traffic

- Proper cooling (around $500-800 per air cooling unit or $2,000 per liquid cooling)

- Leasing warehouse space conducive for constructing high-density data centers can easily cost $3-8 per sq ft monthly, with the minimum floor area needed for just 5-10 miners being at least 500 sq ft up to a few thousand square feet for larger 50-100 rig operations.

- Some crypto entrepreneurs buy land plots in low-cost regions expressly for deploying portable mining containers ($5,000-10,000 per 20-foot container)

- Electricity connection and underground wiring for sites not on existing utility grids could cost tens of thousands depending on remoteness.

- Compliance filings and licenses generally involve $500-1,500 in assorted registration paperwork fees

- Accounting software for managing crypto inventories (asset tracking) and tax prep runs $100-300 monthly.

- Hiring 1-2 technical staff ($4,000-7,000 monthly salary) can free you to focus on business development

- Broadband connectivity ($100-500 monthly)

- Insurance premiums (up to 5% of overall equipment value annually)

All considered, starting a modest crypto mining business with just 5-10 mining rigs, and basic racks/cooling infrastructure within leased storage premises can be initiated at around $70,000-100,000 in start-up gear and facility costs.

Ongoing Costs

While start-up outlays are considerable for aspiring mining entrepreneurs, the profit upside makes it a compelling business case as Bitcoin and Ethereum values grow. Breakeven is typically achievable within 12-18 months after launching smartly.

Ongoing costs also become more manageable at larger scales with hundreds of miners through economizing on infra/admin overheads.

4. Form a Legal Business Entity

To start a business as a Bitcoin miner, you must first form a legal entity in the United States. There are four entity types to form, including sole proprietorship, partnership, LLC, and corporation. Let’s take a closer look at these and how they might impact Bitcoin mining business profitability and liability.

Sole Proprietorship

The simplest structure is a sole proprietorship with a single owner directly managing the crypto mining business. All income and losses flow directly to the individual miners’ tax returns. This offers easy startup and autonomy over decisions.

Partnership

Forming a general partnership enables multiple owners to jointly operate the mining venture while splitting managerial duties, skills, and financial resources. Gains, losses, and legal liabilities are distributed across partners. But inter-partner disputes can trigger instability, while still exposing assets beyond the business.

Corporation

A defining aspect of a corporation is the distinct legal identity it establishes separate from its ownership. Crypto mining corporations can attract VC investors through share offerings but face double taxation on company income and shareholder dividends. Formal board oversight also imposes management structure. Significant start-up compliance duties make incorporation expensive over simpler alternatives.

Limited Liability Company (LLC)

For most mining entrepreneurs, a Limited Liability Company (LLC) strikes the best balance. It limits owner liability to their capital contributions, while allowing flexible participation in directing operations based on defined stakes, akin to a partnership. Taxation is only at the member level without double layers like in corporations.

5. Register Your Business For Taxes

An EIN, also known as a federal tax ID number, acts as a unique identifier in dealings with the IRS for business entities, similar to how Social Security Numbers are used for individuals. Even if not hiring employees currently, all LLCs must acquire an EIN for tax filing and banking purposes.

Applying for an EIN from the IRS is conveniently free and fast through their dedicated online application. The only documentation required is having the LLC Certificate of Organization from your state registration handy. The self-service portal allows obtaining the EIN instantly without paperwork delays.

The step-by-step EIN application process only takes 10-15 minutes:

- Select view ‘Additional Types’ under ‘Choose the type of entity’ to specify the LLC

- Enter the number of LLC members and managing member details

- Specify if LLC is single-member or multi-member owned

- Select applicable tax classification (most cryptocurrency mining LLCs can choose ‘Disregarded Entity’)

- Provide basic business information like name and address

- Submit the online application and instantly receive an EIN confirmation

Alongside the federal EIN, registering for necessary state taxes is also essential for compliance. Most states levy sales tax on goods purchases, requiring collection and filing under assigned sales permit numbers. Sign up directly through your state’s Department of Revenue portal.

Establishing both federal and state tax identifiers squarely positions mining LLCs to cleanly handle their tax liabilities. This facilitates accounting, payments, and staying compliant as scale increases. It also builds legitimacy for the venture when engaging with equipment vendors, service providers, hosting partners, and exchanges.

6. Setup Your Accounting

As an intensive computing operation, crypto mining involves tracking myriad deductible technology expenses like high-powered ASIC rigs, GPUs, electrical infrastructure (e.g. using mini solar farms), and cooling systems. Miners receive crypto tokens as income, which must be recorded at fair market value in USD at the time of mining and held as taxable digital inventory.

Accounting Software

Using dedicated small business software like QuickBooks can automate transaction categorization, reconcile balances across integrated bank/credit card accounts, deliver financial reports, and simplify tax prep. Their dashboard neatly consolidates financial snapshots and activity trends across linked revenue sources.

Hire an Accountant

It is still advisable to engage an accountant specializing in crypto tax accounting to ensure full compliance. They can handle meticulous tracking of mining output, reconciling crypto receipts and disbursals across wallets/exchanges, cost-basis calculations, and converting proceeds to fiat currency. Expect fees of $100-150 monthly for full bookkeeping services, with $500-1,000 for yearly tax filing assistance.

Open a Business Bank Account

Maintaining completely separate financial flows from personal finances is vital. All mining-related transactions should pass through dedicated business bank accounts and credit cards only. This enables transparent expense/revenue reporting.

Apply for a Business Credit Card

Business credit cards also offer higher limits based on business income, not personal credit scores. Providing the company’s EIN and past financial reports can secure approval for $10,000+ initial limits.

7. Obtain Licenses and Permits

As an energy-intensive computing operation, crypto miners can benefit greatly from registering with utilities as commercial customers to access lower electricity rates. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

Depending on annual energy consumption thresholds crossed, some jurisdictions may also require obtaining specific high-density load commercial utility licenses or permits to continue legally drawing the required electricity.

For example, the state of Washington mandates registration as an individual electric utility once usage exceeds certain limits across a rolling 4-month period. The application involves submitting projected power budgets. crypto miners may also qualify under the utility’s high-demand customer classification if electricity appetite consistently exceeds established marks.

Seeking federal, state, or municipal tax incentives, subsidies or grants established specifically for crypto mining facilities can provide cost advantages. Such specialized incentives require separate pre-qualification permits with proof of assets deployment plans over 12-24 month horizons to unlock the significantly discounted usage rates.

Local building codes may also stipulate added approvals if setting up mining data center-grade electrical infrastructure across server farms with high-density racks housing dozens of high-powered ASIC rigs running 24/7. Fire suppression systems and heat ventilation permits are common dependencies for such specialized implementations.

Lastly, federal communications equipment authorizations and state public utility certificates may be required for dedicated radio/microwave data transmission networks linking remote crypto mining sites. These formal consents ensure electromagnetic spectrum usage rights to provision very low latency connectivity critical for real-time blockchain protocols to avoid propagation lags.

8. Get Business Insurance

Given substantial investments in specialized mining hardware and the risk of electronic component failure over time, insuring equipment against breakdowns and manufacturing defects is prudent.

Without protection, severe scenarios can cripple operations:

- A lightning storm fries circuits across the ASIC server farm, charring rigs costing $300k

- An overlooked design flaw causes GPU cooling fans to fail prematurely

- A botched firmware upgrade bricks an entire batch of new Antminer S19 units

Business interruption policies cover income loss if unable to mine coins for prolonged periods. Premiums depend on average monthly revenues.

Cyber insurance is also vital given crypto’s digital DNA. Hacker infiltration of wallets or diversion of processing power for illicit mining could have massive fallouts.

The typical application process would be:

- Research specialized crypto mining insurance providers like Coincover

- Furnish key details on mining hardware, facilities, revenues, and payroll

- Evaluate premium, cover, and deductibles across alternative packages

- Select optimal coverage aligning with risk management priorities

- Complete application submission and furnish additional documents if needed

- Finish premium payment requirement once approved

Staying sufficiently insured allows crypto mining enterprises to sustain and bounce back from events outside of their control. Reviewing protections yearly and adjusting policies as the business scale expands is key.

9. Create an Office Space

While crypto mining does not require office-based staff or equipment, having an administrative hub can be useful for select functions:

- Storing sensitive physical records like contracts, and equipment invoices securely outside private residences

- Providing mailing address for official communications from regulatory agencies, business partners etc

- Hosting meetings with investors, new talent interviews, and onboarding orientations privately

- Getting reliable internet/power infrastructure resilient to residential service outages

Potential office types for bitcoin miners include:

Home Office

A basic home office conversion for the mining founder or sole early employee to handle backend workflows costs under $5,000 including basic office furniture, computer equipment, and broadband upgrades tailored for commercial-grade stability. However, hosting external visitors regularly is inconvenient.

Coworking Office

For crypto miners fully working remotely but needing to arrange periodic in-person sessions, flexible coworking spaces like WeWork offer convenient logistical support from $300 monthly across dedicated desks or meeting rooms usable as required. However, these public environments risk exposing confidential information.

Commercial Office

Established miners can consider acquiring small standalone office condos combining stable utilities, parking, and visitor reception with better data security than open workspaces. All-inclusive ownership costs run around $2,000-3,000 monthly at $300 plus per sq ft.

10. Source Your Mining Equipment

The core mining hardware like ASIC rigs, GPUs, and PSU power supplies can be acquired through four approaches:

Buy New

Purchasing brand new models from leading original manufacturers like BITMAIN, MicroBT, and Canaan ensures tapping the latest hash rate efficiencies. Costs per TH/s are highest here, with flagship Antminer and Avalon units easily costing $8,000-15,000 each. Orders are placed directly through company sites or large crypto-mining distributors like Compass Mining.

Buy Used

Second-hand rigs can be sourced more affordably on used markets, accepting risks of shorter useful lifespans due to accumulated wear and tear. Top sites to find bargains include:

Established miners periodically liquidate older-gen hardware in bulk once upgrading to newer, more efficient models. Marketplace communication allows negotiating batch deals.

Rent

Renting hashing power for specified durations through cloud mining contracts or joinable mining pools lets small players start without major capex. Sites like NiceHash and MiningRigRentals offer a wide selection of hourly/daily rig rates. However, profits are split unfavorably.

Lease

Leasing rigs through franchising partnerships with larger miners amortize costs over longer terms with profit sharing. Specialists provide managed infrastructure alongside maintenance.

11. Establish Your Brand Assets

Crafting a distinctive brand identity helps mining ventures stand out to prospective investors and talent versus competing firms. It also builds legitimacy and trust when engaging with vendors, exchanges, and mining pool partners.

Get a Business Phone Number

Acquiring a unique business phone line via a provider like RingCentral enables seamlessly conducting calls and messages across devices with custom greetings and online fax services using the company’s name.

Design a Logo

An iconically designed logo and visual assets like fonts, colors, and graphic styles that form the core brand identity are key. Services like Looka provide access to pools of professional graphic designers to create tailored mining logos encapsulating attributes like innovation, security, and technology.

Print Business Cards

Having well-designed business cards via Vistaprint available for founders, sales reps and technical talent aids networking at industry events, introductions to prospective partners, etc. Distinct company signage also builds awareness.

Buy a Domain Name

Securing a .com domain name identical to the official business name via registrars like NameCheap enables setting up dedicated web assets that fortify credibility. Some best practices for domains include:

- Prefer shorter memorable word combinations for wide recall

- Use hyphens (-) to connect multiple words readably

- Check global availability to allow for international growth

Design a Website

A tailored company website designed through DIY sites Wix or hiring specialized crypto developers on Fiverr provides the digital portal for investors and miners to learn about operational prowess. Well-articulated visions, leadership profiles, security frameworks, and infrastructure details are common inclusions.

12. Join Associations and Groups

Tapping into collectives like local mining clubs, technology trade groups and blockchain entrepreneur networks allows miners to regularly exchange insights with practitioners facing similar opportunities and pitfalls. These connections offer conduits for trusted guidance.

Local Associations

Joining statewide umbrella bodies like the Bitcoin Mining Council with 300+ entities involved in crypto operations for networking and policy advocacy is advantageous. Area-specific groups like Blockchain and the Crypto Mining Association also organize recurring peer discussions. Annual memberships span $50-500 depending on benefits like advertising visibility.

Local Meetups

Attending physical blockchain conferences and meetups using discovery platforms like Meetup builds relationships with miners, investors, and developers. Location-based search filters meetings, hackathons, and demo days to join.

Facebook Groups

Participating in online mining forums via Facebook’s Communities feature connects with rig troubleshooting threads, second-hand gear deals, and guidance across operational facets like electricity sourcing, maintenance, security, and tax management.

Some groups like Mining Crypto and Rigs, Free Crypto Mining, and Cryptocurrency Mining Group have thousands of international members.

13. How to Market a Crypto Mining Business

Implementing multifaceted marketing is pivotal for customer acquisition and revenue acceleration once mining operations stabilize. Communicating specialized value propositions spotlights niche advantages versus competitors.

Personal Networking

Tap into personal networks at launch, then incentivize referrals. For example, offering crypto coins for each new customer referral activates word-of-mouth promotion.

Digital Marketing

Digital channels enable targeted, measurable campaigns:

- Run Google Ads campaigns focused on related keywords like “crypto mining company”, “ASIC rig hosting” etc based on services

- Publish educational blogs on topics like optimizing hash rates, new protocol changes, etc to attract organic traffic

- Post videos on YouTube demonstrating mining setups and operations to humanize branding

- Participate in Reddit subgroups like r/BitcoinMining to share insights from experience

- Enable Twitter presence with updates on company milestones and retweeting industry news

Traditional Marketing

More traditional alternatives suit some business models:

- Insert brochures in relevant local tech magazines and newsletters

- Sponsor or exhibit at physical crypto/blockchain conferences and networks

- Distribute custom swag items like t-shirts, and device stickers at events to expand visibility

- Run radio ads on local financial talk shows aligned to target investor demographics

- Rent outdoor billboards or posters near regional crypto hotspots to spark curiosity

A blended approach allows miners to meet potential customers wherever they are researching and discussing relevant topics across both digital ecosystems and physical venues.

14. Focus on the Customer

Delivering exceptional service is pivotal for mining ventures to stand out and nurture loyal advocates who actively refer others, accelerating growth.

As a tech-driven industry without much direct support historically, miners feel frustrated when control panels are confusing or server downtime drags on. Competent 24/7 help resources and onboarding guidance to smoothly manage rigs thus becoming a vital customer retention and referral engine.

Consider a new client who purchased hosting capacity for Antminer S19 units worth $15,000. Assuring prompt activation and remote diagnostics if the hash rate drops prevents dissatisfaction. Checking in proactively daily during the first week to optimize configurations and offer firmware upgrades shows commitment beyond transactions.

If pleased with the thorough service, the delighted customer may readily share their positive experience with peers considering mining investments, directly connecting high-intent prospects. Rewarding referrals also incentivizes enthusiasm. Over several years, just 10-15 strong advocates could facilitate 100 new relationships worth over $1.5 million in equipment sales or hosting revenue.

The lifetime value of a single impressed customer is thus multiplied by the word-of-mouth goodwill generated through circles of trust. Investing in thoughtful onboarding, transparent infrastructure visibility and prompt issue resolution pays off with an army of brand promoters. This community shield further cements competitive positioning.