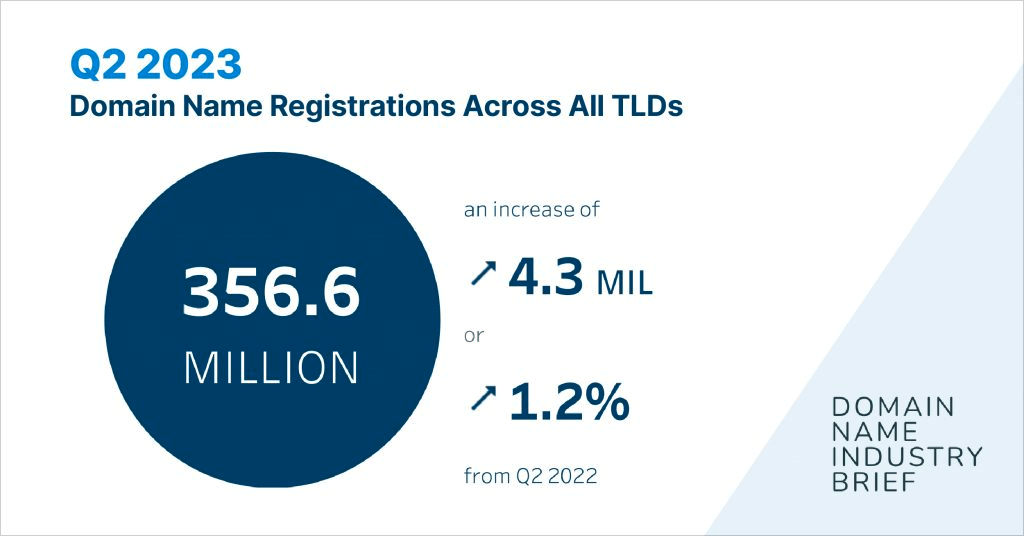

The global planner book market grew to $1.02 billion in 2022. With a projected compound annual growth rate (CAGR) of 4.1%, the market could reach a whopping $1.3 billion by 2028. This makes it a great time to get started working with traditional paper planners.

There are many avenues within the business planners industry to explore. Business planners help keep track of professional meetings while party planning documents are easy to follow in a party planner book. It’s what’s inside the planner that counts. Strategic planning makes it easy for aspiring business owners to carve out a profitable niche.

This introductory guide will cover how to start a planner book business. Topics include opening a business bank account, market research, competitive analysis, and more. Here’s everything to know as you start a planner business.

1. Conduct Planner Book Market Research

Market research offers valuable insight into the planner book industry. It tells you popular modes of social media, how much it costs to start up, your target market, local market saturation, and other details you’ll need to start an online planner business store.

Several factors are driving growth:

- Busy modern lifestyles and the need to organize across work, family, and personal responsibilities make planners and organizers essential tools.

- Digital connectivity also increases the need for planning and task management.

- Many consumers see planners as keepsakes or self-care tools for reflection, memory keeping, and goal setting.

- Boutique and specialty planner businesses can differentiate through creative designs, unique formats, or targeting specific niches.

- High-end, handcrafted planners also appeal to those seeking a personalized product.

- The two biggest challenges for new Planner Book businesses are the large established brands like Erin Condren, Day Deand Signer, and competition from digital tools.

- Digital planners with things like a monthly subscription, or calendar planner feature are becoming popular.

Overall, the market outlook for new Planner Book businesses is strong. Doing thorough research, identifying a profitable niche, developing a quality product, executing savvy marketing, and providing excellent service can lead to success. While risks exist, the opportunities outweigh the challenges.

2. Analyze the Competition

Understanding the competitive landscape is crucial when launching a new Planner Book business. There are several key steps entrepreneurs should take:

- Identify direct and indirect competitors. Look at both larger established brands and smaller competitors. Search online marketplaces and planner review sites to find competitors. Also, look locally for stores selling planners.

- Evaluate competitors’ products and branding. Order samples if possible. Compare quality, designs, formats, features, and pricing. See who offers personalized or niche planners. Assess brand personalities – are they quirky, sophisticated, fun? This can inspire differentiation.

- Research competitors’ online presence and marketing. Study their websites, social media, SEO, and ads. See what engages their audience. Assess strengths and pain points.

- For local stores, visit in person. See store experience, products, displays, and prices. Talk to the owner to learn about their business. Observe customers and what sells.

- Use tools like Google Trends, SEMrush, and Alexa to analyze search volume, top keywords, traffic sources, and site analytics for key competitors.

- Gain market insights from reviews, customer comments on social media, and planner forums. Learn what shoppers like and don’t like.

Ongoing competitive analysis lets planner entrepreneurs refine their strategy. They can identify service gaps, opportunities for specialization, and areas where they can beat larger players on quality, personalization, or community.

3. Costs to Start a Planner Book Business

Starting a Planner Book business requires significant upfront investment, as well as budgeting for ongoing expenses. Ask yourself, “How much does it cost to open a planner journal business?” Here’s everything you need to break down for a cost analysis.

Start-up Costs

- Business registration fees typically range from $50-$150 depending on location and business structure. Any licenses or permits needed could cost $100-$500.

- Developing a business website and setting up e-commerce functionality usually costs $1,000-$5,000. This includes site design, development, hosting, security, payment integration, and more.

- Basic office equipment like a computer, printer, phone, furniture, and supplies will likely run $2,000-$5,000 or more.

- Initial product design and development is a major investment. Creating unique planner layouts and artwork, sourcing quality materials, and producing physical samples can easily exceed $10,000.

- Early inventory production is expensive due to minimum order quantities. Expect to spend at least $5,000-$10,000 on the first inventory order.

- Brick-and-mortar retail spaces average $20-$30 per square foot monthly. A small 300 sq ft shop would cost $6,000-$9,000 per month. Buildout and remodeling expenses are also required.

- Initial marketing and advertising budgets typically start around $5,000. Funds are needed for brand development, online ads, trade shows, and PR.

- The first few months of insurance premiums, utilities, and payroll for any staff will add several thousand in startup costs.

In total, launching a planning business likely requires $30,000-$75,000 in startup capital.

Ongoing Costs

- Inventory replenishment is a regular expense, likely $5,000 per production cycle. New designs also require investment.

- Operational costs like rent, payroll, utilities, and insurance amount to thousands per month. Office administration and sales expenses add up too.

- Marketing and advertising require an ongoing budget, around $500-$2,000 per month is typical. Trade shows, Google Ads, and social advertising all cost money.

- Transaction fees from credit card payments and selling through online marketplaces can range from 3-5% of revenue. These fees quickly add up.

- Website hosting, maintenance, licenses, software subscriptions, and customer service tools cost $100-$500 per month generally.

- Contracting designers, photographers, writers, and other talent for new planner developments will cost thousands annually.

- Taxes, accounting fees, legal fees, and other professional services amount to thousands per year as well.

In summary, planner entrepreneurs must budget for at least $5,000-$15,000 in monthly operating expenses, as well as larger annual investments as the business grows. Careful financial planning and cost control is imperative. Make sure you leave room for extra costs you might encounter.

4. Form a Legal Business Entity

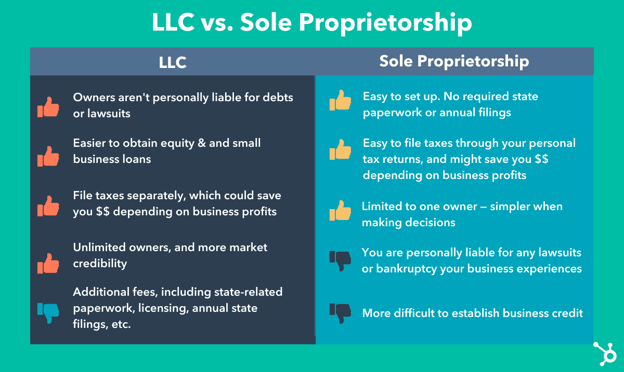

When starting your own journal business, selecting the right legal entity is an important decision. The four main options each have pros and cons to weigh. Here’s what you need to know about business entity options.

Sole Proprietorship

A sole proprietorship is the simplest structure. You can register the business name and start operations, without forming a separate legal entity. This offers ease of setup, but the owner has unlimited personal liability. Any business debts or legal issues can impact their assets. This risk makes a sole proprietorship inadvisable for a Planner Book company.

Partnership

A general partnership involves two or more co-owners sharing management and liability. Like a sole proprietorship, partners are personally responsible for all business debts and legal disputes. Partnerships can be registered by filing a “doing business as” certificate. But they offer little liability protection, so are not the best choice.

Limited Liability Company (LLC)

Many Planner Book businesses will opt to set up a limited liability company (LLC). This combines pass-through taxation with liability protection. Owners have limited personal exposure if the business is sued. LLCs allow greater credibility, access to business credit, and legitimacy versus informal structures.

Corporation

A corporation offers the strongest liability shielding but requires the most complex setup and maintenance. Corporations are separate legal entities from their owners. They require filing articles of incorporation, establishing directors and officers, issuing stock, and holding shareholder meetings.

5. Register Your Business For Taxes

One key legal task when starting a high-quality planner book business is obtaining an Employer Identification Number (EIN) from the IRS. This unique identifier is similar to a social security number but for a business entity.

An EIN is required for important steps like opening a business bank account, applying for business licenses, hiring employees, and paying taxes. Essentially any time the business needs to interact with state or federal agencies, an EIN is mandatory.

Sole proprietors can use their SSNs instead of EINs. However, the best practice for any serious business venture is registering for an EIN, even if you don’t plan to hire employees. This keeps your personal and business finances separate for liability protection.

Applying for an EIN is free and can be done online via the IRS website here: Apply for an Employer Identification Number.

The online application process only takes about 10-15 minutes. You will need basic information about your business structure and ownership details. The IRS will then provide your EIN immediately upon approval.

In addition to the federal EIN, Planner Book businesses need to check their state’s requirements for sales tax registration, reseller permits, and business operating licenses. These can often be applied for on your state government’s website.

6. Setup Your Accounting

Proper accounting is critical for Planner Book companies to maximize deductions, manage cash flow, and remain IRS compliant. Investing in tools and support provides significant value.

Accounting Software

Using small business accounting software like QuickBooks helps automate the tracking of income, expenses, inventory, taxes, invoices, bank transactions, and more in one centralized system. Cloud-based options with mobile apps allow access anytime.

Integrations with payment processors, banks, and e-commerce platforms sync data seamlessly. DIY software costs $5-$50 per month. This saves tons of time on manual bookkeeping.

Hire an Accountant

Working with an accountant is still recommended. A qualified professional provides reporting, reconciliation, tax planning, and advisory services. They can set up your accounting system optimally and ensure accurate books.

Expect fees of $200-$500 per month for basic bookkeeping services, and $1000-$3000 to prepare annual tax filings. Audit support also runs $5000+ if ever needed. This expert guidance protects against costly errors.

Open a Business Bank Account and Credit Card

Keeping business and personal finances wholly separate is essential. Register for an Employer ID Number (EIN) and establish a dedicated business bank account. Never come funds or pay personal expenses from the business.

Open a business credit card too. Business cards use credit limits based on the company, not your creditworthiness. Apply with the EIN, your address, and projected revenue.

7. Obtain Licenses and Permits

Launching any new business venture legally requires researching and obtaining needed licenses, permits, and regulatory approvals. Check with the U.S. Small Business Administration for information on federal license requirements. The SBA local search tool offers insight into state and city requirements.

- Business license – Most cities and counties require all businesses operating in their jurisdiction to register for a municipal business license. This verifies the business as legitimate and authorized to operate locally. Fees are generally $50-$100 annually.

- Zoning permit – For any type of retail storefront, specific zoning permits related to the property’s designated use may be necessary. There are often special applications, hearings, and fees for changing zoning. Home-based businesses may also need zoning approval.

- Sales tax license – Any business selling products in a state must collect and remit sales tax. A sales tax permit or seller’s license is needed to legally collect and report tax. States have different requirements and associated fees.

- Fictitious name registration – If operating under a “doing business as” name different than the owner’s legal name, most states require registering the fictitious name. This is commonly called a DBA. Fees start around $50.

- Food service permit – Planner shops planning to sell drinks and snacks alongside merchandise may need permits related to food service and prep. State restaurant or food handling licenses cost $100-$500 typically.

- Building permits – Constructing a new retail space for the business requires all the proper building permits – plumbing, electrical, fire system, construction, occupancy, and more. Architectural plans and inspections are part of the process.

- Sign permit – To install visible building signs or window displays, sign permits are often required depending on local ordinances related to size, placement, lighting, etc. Applying for signage approval is important.

Consulting local governments to identify expected licenses, permits, and business regulations is an essential early step. The requirements and associated fees vary based on location and business activities. However, obtaining all mandatory approvals legally allows for opening doors and avoiding problems.

8. Get Business Insurance

Having proper insurance is crucial for any Planner Book business to mitigate risk. Policies protect against losses that could otherwise devastate the company.

For example, without coverage, a fire could destroy your retail store or warehouse inventory. Or a customer could sue for injury on your premises. Employee theft could also occur. These catastrophic scenarios could lead to bankruptcy without insurance to cover damages, legal liabilities, and lost income.

To get insured, first, determine your risks and needed coverage types. Common small business policies include:

- General liability – covers bodily injury, property damage, and personal injury claims.

- Product liability – protects against damages from your products.

- Business property – insures possessions like equipment, merchandise, and furnishings.

- Business interruption – replaces income lost due to disaster.

- Worker’s compensation – mandatory for employees, covers job-related injuries.

Next, research providers, get quotes, pick a company, and complete the application process. Having detailed info on your business operations and financials speeds approval.

Finally, pay premiums on time to keep policies active. Review coverage annually and adjust as the business grows. Insurance provides essential risk transfer for Planner Book ventures.

9. Create an Office Space

Having a dedicated office space can provide legitimacy and efficiency for a new Planner Book startup. An office allows meeting with clients and collaborators, provides room for inventory storage, and separates work and home life. There are several options to consider:

Home Office

A home office in a spare bedroom or basement is convenient and affordable starting. With some basic furnishings, WiFi, and organization, entrepreneurs can handle the core business from home during launch for little to no cost. However, home offices lack a professional appearance for meetings and make separating work/life challenging.

Coworking Office

Coworking spaces like WeWork offer an upscale office environment with business amenities and community. For $300-$800 per month, you can secure a private office in a shared workspace. Coworking spaces provide flexibility to scale up or down and interact with other entrepreneurs. But noise and lack of privacy can hinder productivity.

Retail Office

Retail office space connected to a storefront allows meeting with customers conveniently. However, retail rental rates often start around $3,000 per month in a prime location. The space also takes away from profitable retail merchandising square footage.

Commercial Office

A small commercial office rental provides the most professional setting for meetings and room for inventory. Class B office space leases for $18 per square foot annually in many markets. A 500-square-foot unit would cost $750/month. While more expensive than a home office, the legitimacy and separation benefit the business.

10. Source Your Equipment

Launching a planner company requires acquiring supplies like paper, printing equipment, binding machines, planner mockups, and more. Here are some options for sourcing these startup materials:

Buying New

Specialty websites like PrintNinja, BookBaby, and NoIssue sell printing and binding machines alongside paper, book mockups, and planner templates. Budget at least $300-$2000+ for basic equipment. These sites also handle print-on-demand services. Office supply stores sell printers, software, and some binding machines for similar prices.

Buy Used

Used printing presses, binding machines, industrial printers, and other equipment can be found at auctions, liquidation sites, and classifieds like Craigslist and Facebook Marketplace. Prices are 30-70% off retail but may require maintenance. Used office printers and supplies are widely available too.

Rent

Renting printing equipment companies allow short-term rental of presses and machinery. This saves the capital expense of purchasing equipment while testing different options. Rates range from $200-$500 weekly for basic equipment.

Lease

Leasing production machinery allows the use of equipment without a large upfront payment. Leasing contracts spread costs over 12-36 months. Approval is based on business financials. Leasing expensive equipment also enables upgrading more easily.

11. Establish Your Brand Assets

Developing a strong brand identity is crucial for Planner Book companies to stand out and connect with customers.

Some key assets to create include:

Getting a Business Phone Number

Having a professional business phone system promotes credibility with customers. Services like RingCentral provide toll-free and local numbers, call routing, voicemail, and analytics starting at $30/month. A dedicated business line makes a far better impression than using a personal cell.

Creating a Logo and Brand Assets

A logo encapsulates a brand visually. Options like Looka provide affordable logo design services starting at $20. A clean, memorable mark that reflects your planner brand personality is ideal. Complete the brand identity with letterheads, packaging, social profile images, and marketing materials featuring the logo. Keeping branding cohesive builds recognition.

Business Cards and Signage

Business cards serve as portable advertisements that are exchanged at networking events, trade shows, and client meetings. Signage and displays visually identify storefronts. Vistaprint offers 500 basic cards for $20 and large vinyl banners for under $100. These small investments make first impressions.

Buy a Domain Name

Name Choosing a domain name for your business website requires brainstorming short, memorable options that align with your brand name and offer a .com availability. Services like Namecheap provide domain registration starting at around $15 annually. Secure your domain as soon as you have a business name.

Build a Website

Websites establish an online presence and house key information about your brand. Entrepreneurs can use DIY website builders like Wix to create sites themselves or hire web developers on platforms like Fiverr starting at $500. Having a professional site designed specifically for your brand is ideal.

12. Join Associations and Groups

Joining local associations and networks provides valuable connections and insights when starting a Planner Book company.

Local Associations

Local Associations Research small business alliances, arts councils, stationery guilds, or craft groups in your city. These organizations offer networking, education, and promotion for members.

Local Meetups

Local Meetups Platforms like Meetup list upcoming craft fairs, trade shows, and mixers near you. Attending in person helps build relationships with fellow stationery enthusiasts and makers.

Facebook Groups

Facebook Groups Facebook communities let you connect and get advice online. Examples include the Start Your Digital Planner Business and Planners Gonna Plan. You can also search for local groups.

Collaborating with other entrepreneurs provides chances to exchange ideas, find mentors, discover suppliers, and more. Make connections through associations, events, and social platforms tailored to your niche and region. This support system boosts success.

13. How to Market a Planner Book Business

Your marketing efforts are essential for a successful planner book business. With the right strategies, entrepreneurs can build their brands and sales.

Personal Networking

Leveraging one’s personal and professional network is the most valuable starting point. Satisfied customers who organically rave about your product to friends and social media followers provide powerful referrals. Offering promotions like 10% off for referrals motivates sharing.

Digital Marketing

- Run Google Ads campaigns with keywords related to custom planners, journals, and stationery. Targeted search ads build visibility.

- Use Facebook and Instagram ads to reach relevant demographics interested in planning, creativity, and gifts. Retarget past customers.

- Start a YouTube channel creating tutorials on planner organization techniques and desk tours showcasing products.

- Launch a blog sharing planner tips, small business advice, and behind-the-scenes glimpses to engage visitors.

- Optimize SEO with keyword-focused content and backlinks to improve search visibility and website traffic.

- Email marketing campaigns that provide value and promote new product releases. Collect emails to build a list.

Traditional Marketing

- Create eye-catching flyers and mailers to distribute at local small businesses, colleges, community centers, and networking events.

- Take out print ads in arts and culture magazines/newspapers. Some niche publications cater to your target demographic.

- Sponsor booths at craft fairs, and plan events, and local festivals to engage the community in person.

- Radio spots on stations popular with your audience could provide reach but tend to have limited direct response.

- Billboards can offer broad awareness, but are geographically limited and offer low conversion rates.

With dedicated and strategic marketing across channels, Planner Book brands can expand their audience, drive online and in-store traffic, and boost revenues.

14. Focus on the Customer

Providing exceptional customer service needs to be a top priority. How you treat customers directly impacts your brand reputation and revenue growth. Some ways to improve customer focus in your own planner business include:

- Taking time to get to know your clients, offer recommendations tailored to their needs, and resolve any issues promptly shows you genuinely care.

- Surprising a returning customer with their favorite planner layout and a handwritten thank you note deepens loyalty.

- Personally handling warranty issues rather than outsourcing immediately diffuses frustration.

- Knowledgeable and friendly service also helps convert first-time shoppers who may need guidance selecting the perfect planner. Patience and thoughtfulness go a long way.

- The benefit is that excellent service earns 5-star reviews, referrals, and repeat business. A customer who raves to all her friends after a great experience is powerful marketing you can’t buy.

- Alternatively, poor service experiences quickly spread and do damage. Dissatisfied customers won’t recommend you and may look elsewhere next time.

For Planner Book companies where products are personalized and emotional, customer service must be prioritized as much as product quality and marketing. The customer experience you cultivate determines your brand reputation and ability to acquire and retain buyers. Going above and beyond pays off.