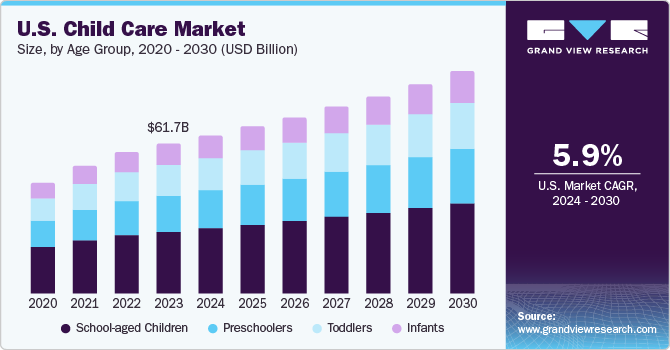

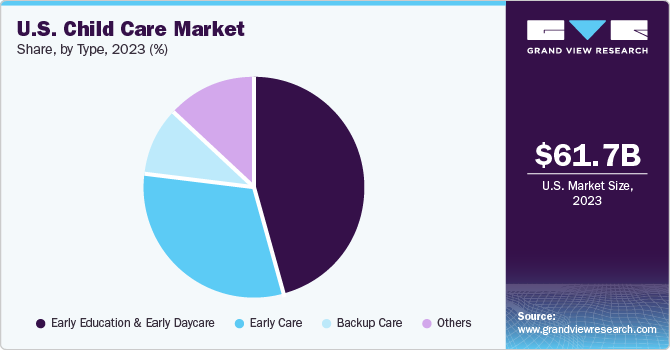

Over 6.5 million people in the U.S. have a developmental or intellectual disability, driving demand for inclusive environments. Along with this number of families in need, the daycare business market is expected to expand at a CAGR of 4.18% from 2023 to 2030. Now is a good time to get involved.

Rising awareness and improved testing mean more students nationwide require supportive resources. Opening a special needs daycare allows you to fill a critical gap in your local community while pursuing your passion for child development.

This guide will walk you through how to start a special needs day care. Topics include market research, competitive analysis, registering an EIN, obtaining business insurance, forming a legal business entity, and more.

1. Conduct Special Needs Day Care Market Research

Thorough market research is the foundation of any successful business plan. When exploring the special needs daycare sector, focus your analysis on identifying target demographics in your area. Market research will provide valuable insight for your own special needs daycare business plan.

Start by determining the potential reach of your services. Compile relevant statistics from reputable sources like the CDC and local government agencies. These numbers will help estimate the total addressable market.

Next, research population projections for the coming years. Ask yourself – is the number of special needs children expected to increase or decrease in your area? Determine if similar growth patterns apply locally.

Pinpoint age ranges, specific needs, parental preferences, income levels, and other attributes of your target market. Parents may desire ABA therapy, speech assistance, social skills groups, or life skills development alongside traditional child care.

Examine existing special needs care options near you, and ask yourself:

- How much competition exists?

- Are competitors actively advertising and appealing to your ideal customers?

- Is there room in the market for another provider?

Record strengths, weaknesses, and gaps you could fill with a differentiated approach.

Thorough research allows you to back up financial projections, establish a competitive edge, and confidently move forward with your specialized daycare concept. Revisit assumptions yearly as community dynamics evolve.

2. Analyze the Competition

Sizing up the competition is imperative when launching any small business, especially in the special needs care sector. Given the personalized nature of these services, local childcare facilities directly compete for the same customers.

Start by identifying childcare providers in your area offering occupational therapy through online listings and referrals. Look up details like location, capacity, operating hours, amenities, and areas of specialty for each one. Then schedule in-person tours to evaluate further.

Pay attention to the facility, safety protocols, cleanliness, staff experience and turnover, teacher-to-student ratios, and inclusion practices. Note any specific resources offered from sensory rooms to technology stations for nonverbal students. Don’t be afraid to ask questions to center leadership as well.

Document strengths and weaknesses compared to what you aim to provide. Look for potential partnerships rather than viewing everyone as the enemy – for example, centers with different specialties could refer parents to each other.

Research the online presence of competitors too. Google search results, informative websites, active social media pages, and positive online reviews all influence family decision-making today. Make sure you plan and budget for a robust online marketing strategy.

3. Costs to Start a Special Needs Day Care Business

Embarking on opening any small business comes with substantial financial investment. For specialized daycare centers catering to children with disabilities or delays, expenses span facility needs, equipment, payroll, supplies, insurance, licensing, and more.

When budgeting, break costs into separate start-up and ongoing categories.

Startup Costs

- Daycare facility Down Payment – If you don’t plan on having a daycare at home arrangement, you’ll have to factor in a security deposit for leasing physical space at roughly $3,500 plus the first 2 months’ rent ($5,000 estimate).

- Furnishings & Equipment – Outfitting classrooms include everything from child-sized tables and art supplies to sensory play stations at about $3,000 per room depending on size.

- The kitchen setup adds roughly $1,000.

- Specialized gear like sound-proof spaces or lift systems for mobility support can also add between $2,000-$5,000 in equipment per room.

- Program Materials – Curriculum materials, communication boards, social stories, fine motor tools, and academic manipulatives specially designed for disabilities run around $500 per child.

- Outdoor Play Area – Fencing, surfaced areas, play structures, and padding essential for safety average $15/square foot. For a small playground, allot $5,000-10,000.

- Supplies – Arts supplies, sensory materials, cleaning products & office basics average ~$1,000 to start.

- Licensing & Permits – Completing state certification for daycare facilities costs $25-$250 depending on location. Some cities add zoning permits at ~$500 as well.

- Website & Branding – Contract web development and branding design from $2000-$5000 to convey your programs, register families, and begin digital marketing.

Grand total startup for your own business = Approximately $25,000-$50,000 and up.

Ongoing Costs

- Rent & Utilities – Typical commercial lease agreements run $15-$25 per square foot monthly. Center electricity, water, and Wi-Fi budget about $1000 monthly.

- Payroll – Teacher salaries start around $35,000 with health insurance, retirement, and payroll tax costs per classroom. Director wages at $55,000. Part-time assistants and subs add PT wages.

- Classroom Supplies – Arts materials, sensory items, and cleaning supplies at $250 per month per class. Kitchen goods and food costs extra.

- Insurance – General liability plus professional coverage for teachers should cost $150-$300 monthly. Workers’ compensation is also required.

- Marketing – Social media ads, printed materials, and website hosting average $500 monthly initially.

Overall, project higher budgets for specialized development centers given small class sizes and trained staff. Connect with state disability agencies for potential reimbursements and offset costs through fundraising. Revisit budgets quarterly and adjust based on actual enrollment.

4. Form a Legal Business Entity

When establishing any child care center, one of the first legal steps is formally structuring your business. The entity type you choose impacts taxes, liability, operations, and more. Weigh the options below to determine the best fit.

Sole Proprietorship

Simplest simple to set up, naming yourself an official owner requires no formal actions beyond typical small business licensing. You remain personally responsible for all financial and legal liabilities without corporate protection. Income passes directly to personal returns allowing fewer tax options.

Partnership

Formalizing joint ownership between two or more individuals makes separating financial risk and managerial duties easier than informal agreements. Partners divvy profits and losses. However, each partner’s assets stay vulnerable to joint debts or lawsuits unless more advanced structures like LP or LLP are instituted.

Limited Liability Company (LLC)

LLCs limit owner liability while avoiding double taxation by passing income directly to personal returns. Unlike sole proprietors, your personal and company assets stay separated legally in an LLC unless co-mingled illegally. LLC registration protects owners from debts and legal issues.

Corporation

Establishing a formal corporation offers the highest level of liability of separation between business and personal assets due to that definitive corporate veil. Owners, directors, and shareholders own shares of the company itself, not its assets directly. Corporate taxes apply for corporations.

5. Register Your Business For Taxes

With a legal business entity formed, the next compliance step involves proper tax registration on both federal and state levels. This requires procuring an Employer Identification Number (EIN) from the IRS and often securing a sales tax permit locally.

An EIN serves as the Social Security Number for your business – it identifies your company as a unique tax-paying entity. While sole proprietors can use SSNs, all other structures including partnerships and LLCs require an application for an EIN.

Register instantly online at no cost via the IRS website in just a few minutes: Apply for an EIN. Simply verify your entity type, share basic information, assign a responsible party, and receive your EIN electronically upon completing the process.

With EIN documentation, open a dedicated business bank account, apply for financing, register for state licenses, hire employees via proper payroll processes, and file annual tax returns for your entity.

Nearly all states also require sales tax collection and remittance for goods and services provided to local customers. Secure certificates by visiting your Secretary of State or State Tax Board sites. Common permits include a Seller’s Permit, Sales & Use Tax Permit, or Resale Certificate.

Fees range from $10-$100 annually depending on location. Be sure to display certificates publicly and integrate sales tax rates correctly into your pricing and POS systems. Dedicate a separate business account or debit card for simplified documentation and remittance when filing regular sales tax payments.

6. Setup Your Accounting

With a registered business entity formed, establishing organized fiscal processes ensures compliance and security for your specialized child care center. From bookkeeping software to accountant services, proper accounting prevents headaches at tax time and safeguards finances in case of an audit.

Accounting Software

Implement small business accounting software like QuickBooks to automatically track income, expenses, payroll, invoices, bank transactions, and taxes in one integrated platform. Cloud-based options sync seamlessly across devices for remote access allowing directors and staff to enter program budgets.

Hire an Accountant

Consider hiring an accountant even if leveraging software. Their expertise proves invaluable for periodic tasks like financial statement generation, expense categorization, and cash flow analysis. Expect to invest a minimum of $200 monthly for standard bookkeeping with additional fees between $750 to $2,000.

Open a Business Bank Account

Remember to separate all personal and business accounts from the get-go. Keep funds wholly distinct across bank accounts, credit cards, billing systems, and taxes. Commingling finances risks personal assets in any lawsuits brought solely against the company while also complicating reporting.

Apply for a Business Credit Card

Business credit cards also simplify tracking program expenses, build a credit history, and improve approval chances for loans and financing down the road – which commonly fund growth initiatives like adding classes or therapy services. Qualify based on your LLC’s financial reports.

7. Obtain Licenses and Permits

Before welcoming your first student, secure all legal and regulatory compliance for a special needs daycare business. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

Start by connecting with your state’s main child care licensing department, often a branch of the Health and Human Services agency focused on youth welfare and education. For example, Texas utilizes the Department of Family and Protective Services for oversight.

States determine capacity allowances, teacher-student ratios per classroom, square footage requirements, and more. You may have separate max ceilings for infants vs. Pre-K ages for example. Having appropriate general liability insurance levels also proves mandatory.

Many states issue ranked certifications based on levels of support provided by a center for functional delays, medical complexity, or developmental differences. Understand criteria determining designations ranging from basic to intensive intervention specialists. Display granted permissions.

Municipalities also incorporate say business permit applications before they advertise services or hire teachers. Again these help confirm adherence to codes impacting commercial properties. Jurisdictions levy fines for ignoring protocols.

Work closely with your state representatives guiding facilities licensing to maximize credibility and fast-track processes well in advance of projected opening timelines. Figure eight to twelve months for completion handling build-outs and paperwork navigating both bureaucratic and facilities requirements across jurisdictions.

8. Get Business Insurance

Business insurance protects your company’s financial health in the event of unforeseen circumstances from minor mishaps to catastrophic claims. For childcare centers serving vulnerable populations, the coverage provides an indispensable safety net should legal situations arise.

Imagine the fallout if a nonverbal child got lost on an outing and parents sued for negligence. Or a center vehicle got into an accident causing injuries without proper liability limits. What if a fire disrupts operations for months or a supplier falls through without order insurance?

Providers lacking policies risk personal bankruptcy from legal judgments exceeding business savings or forced shutdown unable to rebuild after disasters. Simply put: safeguard your livelihood against worst-case scenarios.

Start by educating yourself on common small business policies below:

- General Liability – Protects from 3rd party bodily injury, property damage, personal injury, and advertising injury claims. Attorney costs and settlement payouts are covered.

- Professional Liability – Shields from claims directly related to educational services provided.

- Vehicle/Driver Coverage – Applies to any center buses, vans, or carpools.

- Workers Compensation – Legally required for staffers and shields from on-the-job accidents/illness.

- Umbrella Insurance – Additional liability limits protecting assets if underlying coverage is exhausted.

Next, obtain quotes through insurers familiar with child care and disability-focused providers. Coverage needs vary given size, vehicles, therapies offered, and claims histories. Expect monthly premiums between $150 to $600+ budgeting higher limits for peace of mind.

Visit The Hartford and Travelers to receive tailored recommendations from knowledgeable agents who explain policy fine print and exclusions in depth before binding agreements. Rest easier knowing your center and personal assets remain shielded.

While no one anticipates disasters, every entrepreneur must safeguard their business appropriately through insurance buffers. Risk transfers allow childcare owners to focus on serving students not worrying over hypothetical threats to livelihoods.

9. Create an Office Space

Directors need administrative areas for handling enrollment, payroll, parent meetings, and therapist consultations. Having an office away from classroom duties is essential for a special needs day care.

On-Site Office

For a fully functional professional daycare, an on-site office is beneficial. This allows you to maintain constant supervision over your business while managing administrative duties in a quiet space separate from the children’s environments.

Home Offices

Converting basements or spare bedrooms into desk areas offers convenience and Familiarity can calm anxious children visiting your residence. Unfortunately, guests complicate mortgage deductions and privacy proves challenging with family members sharing walls.

Coworking Spaces

Nearby shared offices like WeWork allow user-friendly month-to-month commitments without lengthy leases. Move-in ready workstations, front desk staff, and coffee lounges facilitate productivity. Public visibility risks unauthorized access to records. Sensitive conversations carry in open spaces despite conference room rentals.

10. Source Your Equipment

Outfitting classrooms, therapy rooms, and outdoor play areas with appropriate gear keeps students engaged while advancing development. Whether buying new or secondhand, sourcing specialty items on a budget takes savvy shopping.

Buying New

National chains like Lakeshore Learning supply games, educational manipulatives, art supplies, furniture, and therapy items approved specifically for early intervention and special education programs. Expect premium quality with price tags to match. Budget $5,000 and up to fill a classroom.

Buying Used

Scour Facebook Marketplace, Craigslist, and eBay for steeply discounted wares in playable condition from closing centers or retiring therapists and teachers. Snag tables, puzzles, play kitchens, and more for a fraction of retail prices.

Renting

Children’s therapy equipment companies like Ability Tools in California rent specialty items as needed month to month for trial periods before committing to expensive purchases. This helps determine the effectiveness of varying diagnoses. Shop multiple regional providers for the best selection and rates.

Leasing

If desired items exceed budgets, equipment leases through third-party financing companies deliver flexible monthly payment options at competitive interest rates over 3 or 4-year terms tailored to future reimbursement projections. Credit approvals determine amounts qualified for finance.

11. Establish Your Brand Assets

Branding sets the tone for your specialized child care center before even opening doors. From logos to websites, crafting a distinctive, professional identity attracts enrollments and conveys your commitment to students.

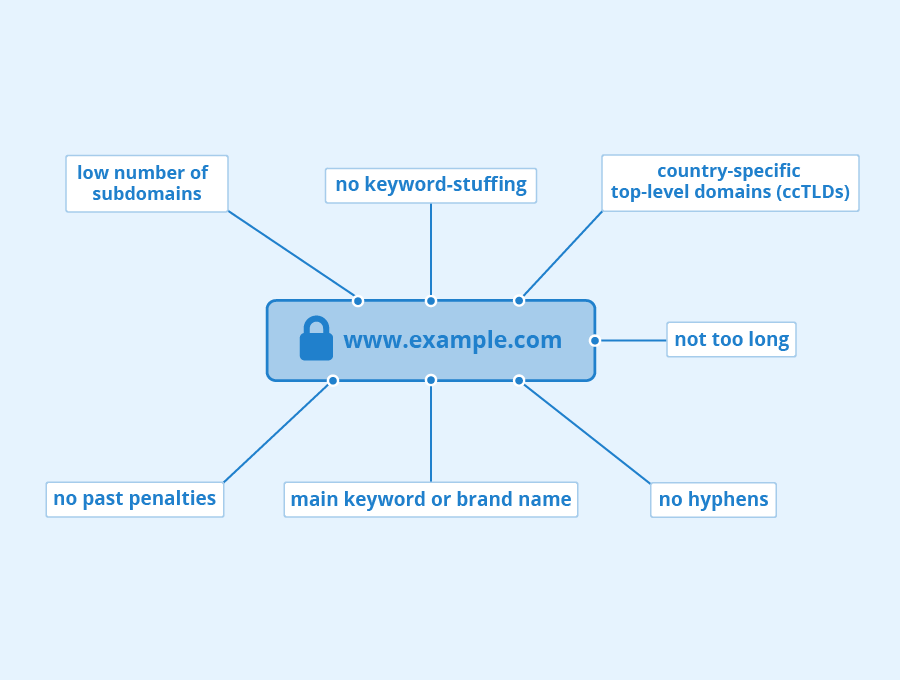

Purchasing a Domain Name

Select domains should convey organizational focus while being short enough for easy retention and social media integration. Verify availability across .com and .org domains. Namecheap domains run under $15 annually. Enable auto-renewal and private registration avoiding spam.

Getting a Business Phone Number

Centralize communications under a dedicated business line via providers like RingCentral. Call forwarding, voicemail transcriptions, toll-free options, text messaging, and mobile integration keep directors connected to parents, vendors, and staff remotely or onsite seamlessly.

Creating a Logo and Brand Assets

Hire designers on platforms such as Looka to craft logos encapsulating your program’s mission and values for less than $50. Scalable vector files keep the mark crisp on print materials, signage, websites, and merchandise.

Business Cards and Signage

Business card exchanges build credibility during school enrollment fairs, pediatrician referrals, and therapist consultations. Cards also enable directors to share or record key contact information while navigating hectic days easily. Order sturdy cardstock finishes from Vistaprint for under $20.

Building a Website

Consider convenient DIY site builders like Wix boasting modern templates from $10 monthly. But for advanced personalization, hire web developers on Fiverr starting around $500. Budget additional fees integrating custom forms, galleries, calendars, and registrations facilitating enrollment 24/7.

12. Join Associations and Groups

Expand your center’s network through area nonprofits, digital communities, and professional associations. Look for support groups and government agencies working with children with special needs. You may even find some financial support for services like speech therapy and other customizations.

Local Associations

Connect locally with The Arc chapters working to bolster inclusion or United Cerebral Palsy arms focused on advancing accessibility. Their conferences and memberships build community ties while offering CE credits for staff development.

Local Meetups

Attending early childhood and special education conventions keeps directors tuned into trending interventions, curriculum updates, and safety best practices as research progresses. Scan sites like Meetup for area events.

Facebook Groups

Participate in niche social media groups facilitating open idea exchanges around challenges. Groups like Daycare Owners and Special Needs/IEP Homeschool Support – ADHD, Dyslexia, Autism spectrum, etc offer advice directly from fellow members.

13. How to Market a Special Needs Day Care Business

Gaining visibility within the special needs community drives essential word-of-mouth referrals and enrollment for niche care providers. An omnichannel marketing strategy spanning digital platforms and grassroots outreach offers the greatest chance of resonating with parents actively seeking supportive resources.

Personal Networking

Kickstart efforts by activating personal networks. Inform all contacts about your center’s specialized offerings and grand opening plans. Request introductions to families who could benefit. Parents who finally secure the perfect fit will eagerly refer friends facing similar struggles. Satisfaction earns loyal advocates.

Digital Marketing

- Launch Google and Facebook ads geo-targeting local searchers of applicable terms like “special needs child care [city]” and “autism day program [county]”. Monitor clicks and leads by source.

- Start an email newsletter with enrollment tips, research spotlights, and center updates to nurture prospective families. Popups on your website capture addresses.

- Post daily on social media highlighting classroom activities. Tag partner therapists and teachers to expand reach. Images and videos perform best.

- Claim free Google Business and Yelp pages. Earn reviews through email requests. Update services, photos, and offerings consistently.

- Guest blog for regional publications and relevant sites like FriendshipCircle.org introducing your center’s viewpoints on inclusion or ADHD accommodations.

Traditional Marketing

- Introduce your center via Sponsorships and booths at local special needs fundraising walks and awareness events. Distribute merch and coupons.

- Display brochures in pediatric therapy offices, clinics, community centers, and places of worship frequented by target demographics.

- Run local radio ads on stations aligned with your service population. Provide special codes offering free assessments or tour bookings.

- Print full-page ads in regional Special Needs event guides, resource directories, and agency newsletters.

- Partner with school district special education coordinators and adjacent special needs schools to facilitate transitions or joint programs.

Track interest metrics across initiatives to double down on what moves the needle most. Consistency and longevity allow niche providers to build meaningful community connections over time through a blended outreach approach.

14. Focus on the Customer

While credentials and programming rightfully earn attention when launching special needs services, customer care builds the lifelong loyalty that fuels growth for niche providers.

Recognize that inherently private, emotionally-charged conversations happen daily with vulnerability around children’s complex diagnoses and uncertainty navigating myriad options for assistance. You do not merely watch kids, but support entire families through uncertainties.

Go above and beyond curating customized accommodations for every student’s unique needs from sensory issues to mobility limitations. But also carefully listen to overwhelmed parents openly communicating fears and frustrations few relate to. Validate concerns.

This degree of thoughtful care earns glowing word-of-mouth referrals as parents facing daunting developmental challenges and anxiety find someone who finally ‘gets it’ beyond sympathetic lip service. Your center grows its niche exponentially. A positive work environment has a mirror effect on customers.

Stellar customer care centered wholly on understanding people, not just special needs, creates evangelists for your services changing lives for the better. The personal touch proves unmatched by any digital ad or brochure for referral marketing success.