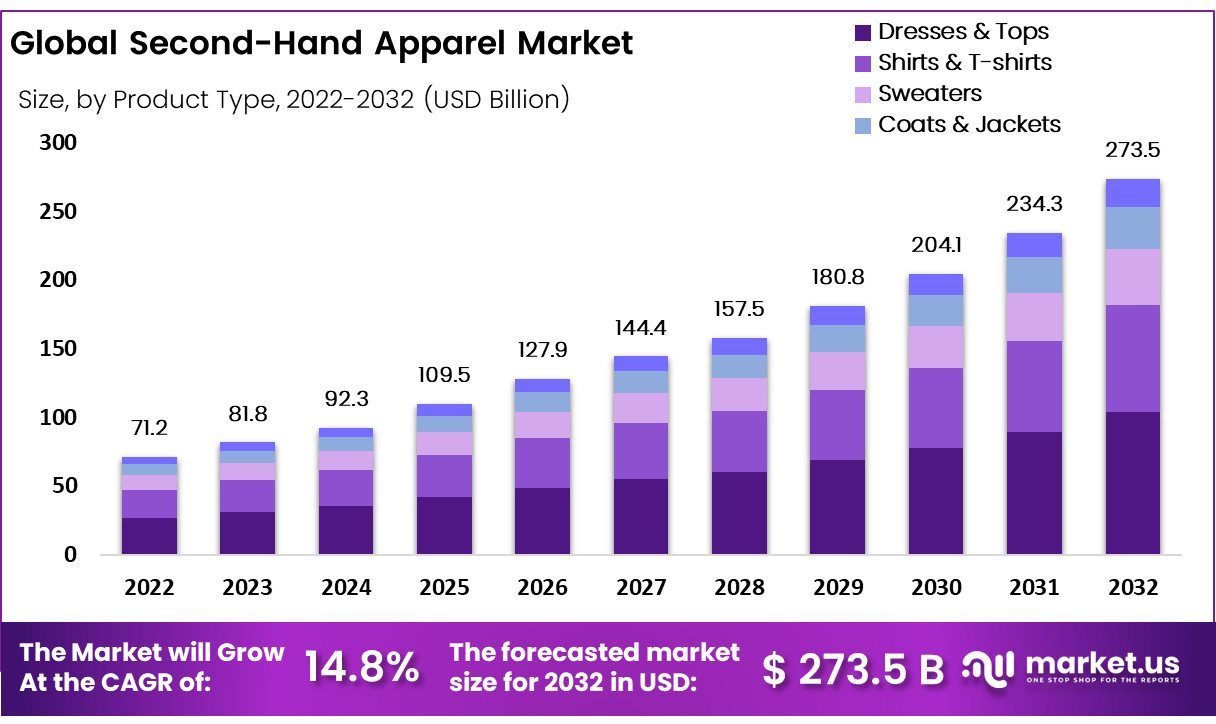

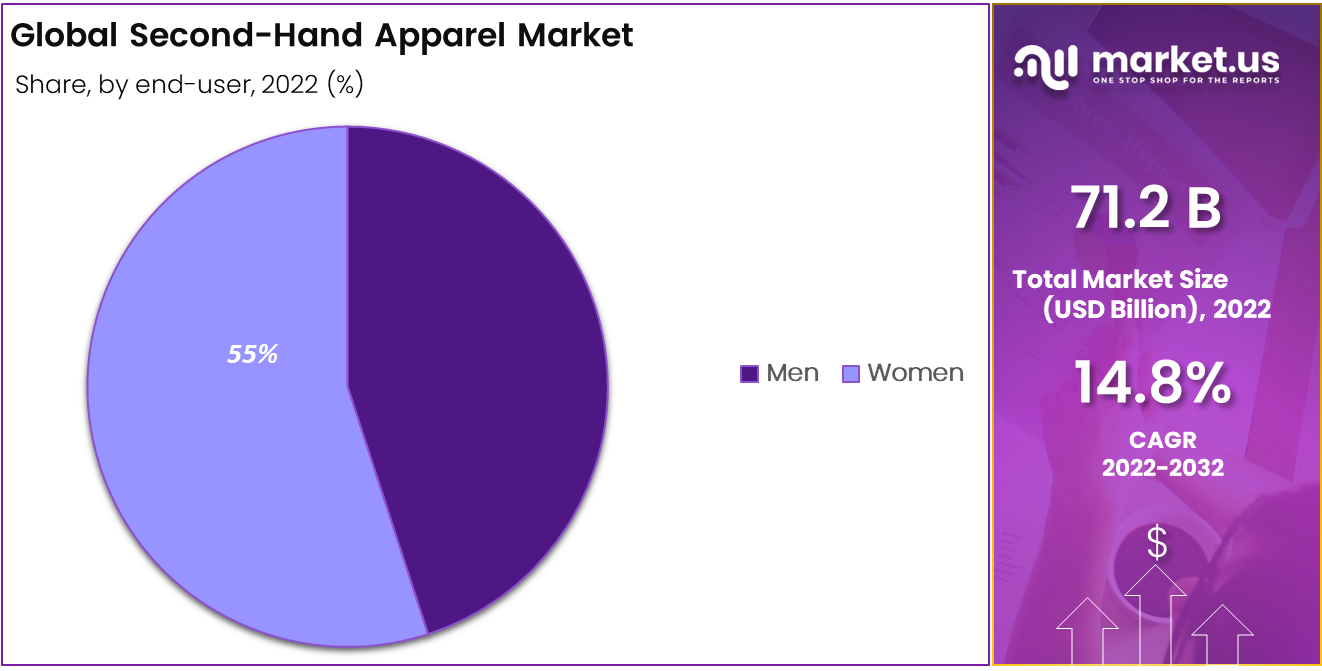

The secondhand clothing market reached over $71 billion globally in 2022, with a compound annual growth rate of 14.8% from 2022 to 2032 according to this report. With growth significantly outpacing traditional retail and increasing consumer interest sustainably, now is an ideal time to launch a thrift store.

This guide will walk you through how to start a thrift store. Topics include market research, sourcing materials, marketing, implementing payment and accounting systems, and developing a customer service strategy. Following this framework can set up any aspiring entrepreneur for success in the popular and rapidly expanding reuse market.

1. Conduct Thrift Market Research

Market research is an important part of starting a thrift store business. Research offers insight into building a business plan to develop a successful thrift store. Learn about your target market, trends in thrift store products and services, and local market saturation.

Some details you’ll learn through market research for your own thrift store include:

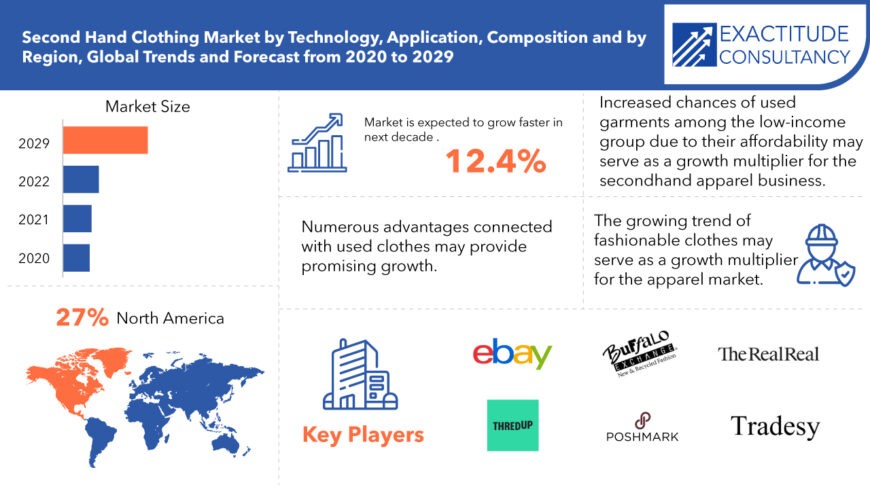

- Growth in the market is attributed to increasing consumer awareness of fashion sustainability and rising fast fashion prices that make buying secondhand more appealing.

- The growth of peer-to-peer resale through apps and social commerce also removes friction from secondhand transactions and shifts views of used goods from stigma to savvy.

- Poshmark and ThredUp have over 150 million users combined, many of whom started reselling items from their closets.

- The ease of entry for individual sellers lowers barriers and expands product selection online.

- Brick-and-mortar thrift stores stand to benefit from heightened interest, increased donations, and shifting perceptions driven by the sharing economy.

- Consider which clothing items and pieces of inventory sell best (t-shirts, shoes, jackets, plus-size clothes, etc.). Sunglasses are also highly popular.

- With strong forecasted growth, demographic tailwinds, and low existing penetration in the total apparel market, the thrift industry has sizable potential.

Both physical thrift stores and digital resale face expanding open terrain. Strategically located stores, merchandise specialization, creative marketing, and community engagement will be key opportunities for those looking to capitalize on reuse.

2. Analyze the Competition

Competitive analysis helps new thrift shop owners develop a thorough thrift store business plan. Learn about pricing guides, top marketing avenues, and even the right business bank account to open.

When assessing the competitive landscape for a new thrift store, analyzing existing brick-and-mortar reuse retailers within a 15-20 mile radius is key. Pairing geographical data with income statistics and population density heatmaps from Esri reveals ideal site selection and white space opportunities.

Monitoring competitors’ social media follower counts, engagement levels, promotions, and events are also valuable for positioning. This sentiment and traffic analysis should include assessing reviews on Google, Facebook, and Yelp to surface potential gaps in donor relations or customer service to be improved upon.

Sites like SimilarWeb provide web traffic analytics for competitor e-commerce presences, while Google Trends yields search volume insights for benchmarking digital visibility. Customer data analytics platforms like Shopify readily integrate with POS systems to track purchasing habits and demographics for smarter inventory and marketing.

Ongoing competitive analysis combined with customer intelligence allows new thrift stores to strategically carve out their niche. Specializing in vintage fashion, luxury handbags, music memorabilia or funky decor establishes differentiation.

3. Costs to Start a Thrift Business

When launching a thrift store, initial investments vary widely based on size, location, and offerings.

Start-up Costs

Most stores can expect around $50,000-$150,000 in upfront costs, such as:

- Rent and build-out for a small 1,000-2,500 sq ft shop spans $2,500-$7,500 monthly, so securing at least 6 months of capital for this fixed cost is advised before signing a lease.

- Store layout and displays may require $15,000 or more depending on complexity, especially if creating changing rooms.

Other start-up costs include:

- Incorporation fees (~$800)

- Business license (~$50-$100)

- Accounting software (~$70+/mo)

- POS system (~$1,500 hardware, additional monthly fees)

- Inventory and tag management system (~$1,000, ~$50+/mo)

- Bulk barcode scanner (~$250)

- Office computer, printer, supplies (~$1,000)

- Base inventory/opening merchandise ($5,000-10,000)

- Theft protection systems ($2,000+)

- Website/online platform setup ($300)

- Initial marketing activities ($2,000+)

Ongoing Costs

Ongoing monthly expenses to operate typically fall around $15,000-25,000 depending on whether rent is already covered. These include:

- Rent + utilities ($2,500+)

- 2-4 part-time staff at ~$15/hour for 60 hours weekly ($3,600)

- Insurance (general liability + property ~ $150+) Software/tech subscriptions ($100)

- New inventory purchases ($2,000+)

- Supply/equipment replenishment ($500)

- Advertising ($500+)

- Accounting fees ($200+)

- Credit card processing fees (2-4% of revenue)

- Miscellaneous expenses ($500)

- Accounting services ($1,200+)

- Register maintenance/updates ($500+)

- Technology troubleshooting ($300+)

- Marketing campaigns ($3,000-5,000+)

- Interior maintenance for flooring/paint ($1,500+)

- Exterminator services ($300)

- Parking lot repair (variable)

- Seasonal storage space ($900+)

Launching an e-commerce site or selling through third-party platforms also incurs additional fees, such as $0.20 to list plus 10-20% of the final value for the item. Shipping/handling and payment processing add further marginal costs that impact overall net profit.

4. Form a Legal Business Entity

Every successful business starts by forming a legal business entity. Many thrift shops go with a limited liability company (LLC) structure. Let’s look at the four main options to choose from.

Limited Liability Company (LLC)

LLCs limit owners’ assets from business debts and judgments (LLC liability protection). For fledgling reuse retail with unpredictable liability risks from donated inventory or customer incidents, securing personal finances is prudent. This enables adapting to profitability levels year-over-year – beneficial for thrift’s variable margins.

Sole Proprietorship

Sole proprietorships offer quick, affordable formation and pass-through taxation like LLCs. However, the owner assumes full liability for debts and legal claims. Thrift operators regularly confront risks from fire hazards, injuries, or damaged goods, heightening exposure. Sole proprietors also have limited options for injecting capital from creditors or investors to scale.

Partnership

The partnership enables several thrift operators to jointly own stores in a cheaper, equitable fashion than corporations. However, all partners share in legal and financial risks without shielding personal assets. Messy buyouts or partner disputes can also trigger dissolution.

Corporation

Forming a corporation ultimately suits expanding chains with multiple investors and stores. The complex structure, taxes, regulations, and record-keeping pose overkill burdens and bills for bootstrapping owners. However, large thrift enterprises like Goodwill leverage corporations’ perpetual existence, fundraising versatility through share sales, and enhanced public profile.

5. Register Your Business For Taxes

An Employer Identification Number (EIN) serves as a unique tax ID for any business entity, similar to how a Social Security Number identifies individuals. All thrift stores must obtain their own EIN even if operating as sole proprietors.

Applying takes only minutes online through the IRS website. Simply navigate to the EIN Assistant page and select the option indicating you are starting a new business, Apply for free EIN. To apply, you’ll need the primary owner’s Social Security Number, full business legal name, address, and an indicator if you have employees.

The online tool then runs verification questions about the business structure and purpose of the EIN. Once submitted, the IRS instantly issues the EIN. This also automatically registers your business with state and federal authorities for tax compliance. Registering early in the launch process ensures meeting all requisite business license stipulations before accepting sales.

Along with the EIN, thrift stores retailing tangible goods must also obtain state-level seller’s permits or sales tax ID certificates for charging, collecting, and remitting local sales taxes. For example, opening up shop in Los Angeles triggers both city and California taxes totaling 9.5%, requiring valid resale certificates on file.

Taking these foundational steps legitimizes the business across banking, supplier, and landlord relationships critical for nascent operations. The EIN and tax IDs professionalize conduct for customers while unlocking advantageous wholesale inventory sourcing.

6. Setup Your Accounting

Managing finances represents a critical backbone of any retail enterprise, particularly for pre-owned goods stores with tight margins. Carefully tracking sales, expenses and inventory flow is paramount.

Accounting Software

Using small business accounting software like QuickBooks maintains organized books across bank/credit card accounts, payroll, invoicing, and taxes in one integrated platform. The automation creates Rick efficiencies by syncing transactions rather than manual entry. This frees up bandwidth for merchandising and donor development.

Hire an Accountant

Most thrift shops benefit by partnering with a bookkeeping professional or certified public accountant. The estimated $150 monthly investment furnishes accurate reconciliation, financial reporting, and advisory on minimizing tax obligations legitimately. Even filing taxes properly for a retail LLC across sales, employment, payroll and business asset taxes generates hundreds in prep fees.

Open a Business Bank Account

Separating business finances from personal banking and credit remains imperative as well. Commingling records invite IRS scrutiny that assumes all activity stems from the business unless delineated. Business checking accounts demarcate working capital, helping track overhead and net profits accurately. Partners can also be granted access easily for transparency.

Apply for a Business Credit Card

Obtaining a dedicated business credit card also proves useful for rewards points on advertising, securing convenient credit during seasonal inventory buildups, and building a commercial credit history. Providers like American Express leverage industry spending data so offer higher limits – commonly over $25,000.

7. Obtain Licenses and Permits

Before welcoming any customers, thrift stores must register with state and local agencies to comply with business operation, health, and safety regulations. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

At a minimum, used goods retail triggers standard zoning permits, particularly for strip mall locations also inhabited by restaurants with stricter property usage rules. Any site build-outs for display fixtures or back offices also necessitate construction authorizations and inspections once completed.

For any refurbishing or repair of electronics, appliances, or furniture on-site before resale, air quality control registration applies depending on inventory volume and chemical usage. Disputing restrictions only risks Five-figure non-compliance settlements from surprise environmental agency audits.

Similarly, improper storage or disposal protocols for unsold chemical or beauty products trigger EPA violations. Used goods stores also commonly attract nuisance fines for any noise, odor, or waste overflow bothering adjacent tenants if correct protocols aren’t instituted preemptively.

In jurisdictions with luxury resale activity like designer apparel or premium electronics, secondhand dealer regulatory filings ensure legitimate sourcing and sales conduct. Officials scrutinize purchases especially from individual proprietors, requiring careful recording of supplier details, inventory invoices, and sales receipts to satisfy product origins oversight.

8. Get Business Insurance

As with any customer-facing operations, securing adequate business insurance lays a crucial foundation for thrift stores to safeguard against unpredictable liabilities. Even the most meticulous risk prevention fails to eliminate accidents. Lacking proper coverage exposes personal assets and the company’s future to potentially company-ending drains.

Without insurance, severe property damage from burst pipes, storms, or electrical fires could saddle retailers with six-figure reconstruction costs and income loss exceeding profitable years’ earnings. Inventory loss alone often crosses $100k for some specialized shops.

Public accident incidents also frequently trigger plaintiff lawsuits well exceeding half a million dollars without proper liability limits. Even frivolous suits incur hefty legal bills to dismiss if lacking representation.

Obtaining adequate coverage begins by taking detailed equipment and merchandise inventories with precise valuations, as most business property policies are payout-limited. Gaining landlord acknowledgment of tenant improvement asset values also maximizes reimbursement eligibility should a covered loss occur.

Independent brokers like CoverWallet leverage insurer data to optimize recommendations balancing premium costs and risk coverage. Comparing personalized plan options accounting for used goods handling exposures assists cost-benefit evaluation given lean operating margins. Typical starting points encompass:

- General liability coverage from $1 million+ limits – from $50/month

- Professional liability to cover incidents caused by employees/contractors – from $40/month

- Umbrella coverage for higher claim value risks – from $150/month

- Workers Compensation (if adding staff) – from $100/month

Evaluating inclusions for cyber liability, commercial auto, and directors & officers liability should happen once establishing operations. However, securing core protections upfront enables stability and pivot capacity if risks emerge in an inherently fluid reuse environment.

9. Create an Office Space

Thrift stores benefit immensely from dedicating office areas to customer-free activities like bookkeeping, marketing administration, and inventory sorting. Office approaches scale from basic home setups to full commercial spaces with corresponding cost variability:

Home Offices

Launching thrift founders can bootstrap operations rent-free initially using existing residential spaces for cataloging donations and handling behind-the-scenes process flows ($0 besides utility increases). Storage closet build-outs even shelter bulk supplies. However, welcoming customer or donor traffic risks local zoning issues. Data protection also suffers without commercial-grade cybersecurity.

Coworking Offices

Once securing storefront leases, collaborating offsite at WeWork bridges professional office perks with financial flexibility from month-to-month terms ($200-$500 based on market rates). The creative community energy and networking also spark display inspiration and mentoring opportunities.

Retail Offices

Furnishing private employee-only areas within store premises promotes seamless cross-functional coordination once sales volume supports build-outs (10-15% of the retail zone). On-site offices enable centralized inventory oversight and rapid floor updates while protecting payroll confidentiality. However, securing permissions could demand longer lease terms or prohibitive construction allowances from skeptical landlords.

Commercial Offices

Mature operations with multiple locations eventually warrant dedicated commercial offices for executive strategy functions, buyer hubs for disparate outlets, and centralized e-commerce fulfillment workflows ($2-$4 per square foot monthly). The ample room for enterprise activities and professional environment poise companies for investments and controlled overhead expansion support.

10. Source Your Equipment

Fundamentally outfitting any brick-and-mortar thrift enterprise necessitates display fixtures, racks, cash registers, and point-of-sale (POS) systems for seamless operations. While new systems provide reliability assurances, buying quality refurbished or excess gear grants big savings:

New Equipment

Sourcing brand-new equipment ensures peak performance but strains startup budgets quickly. Consider cherry-picking certain sensitive electronics while furnishing the rest from used marketplaces. Leading wholesalers like Store Supply Warehouse offer tiered pricing on new retail essentials like racks and hangers based on bulk orders ideal for multi-location owners.

Used Equipment

Alternatively local liquidation auctions and secondhand small biz marketplaces like BizBuySell host reliable pre-owned fixtures often from regional store closures at 60-80% discounts. Facebook Marketplace also connects local buyer/seller pairings. Have an electrician thoroughly inspect any wiring before committing however to avoid safety issues.

Rented Equipment

Many equipment rental outlets now cater to extended multi-month leasing popular for capital-conscious entrepreneurs ($100-$300 monthly). This allows testing layout viability before large investments using top gear. Flexible return policies also support reconfiguration freedom responsive to initial customer feedback.

Leased Equipment

Leasing proves costlier than renting but offers fixed monthly rates over 3-5 years before $1 buyout options. This helps stabilize overhead for reliable financial planning while enabling the latest equipment upgrades. However strict cancellation penalties apply so base terms on realistic growth projections and location commitment levels.

11. Establish Your Brand Assets

Cultivating a distinct brand identity cements repeating loyalty in an increasingly crowded reuse retail sector. Beyond conveying the unique value proposition, memorable branding signals local community goodwill, sustainability principles, and shopping inspiration encapsulated in in-store aesthetics.

Getting a Business Phone Number

Acquiring a unique local phone number through providers like RingCentral furnishes reliable customer support contact and branding reception ($30+ monthly). Sophisticated call routing to store devices enables personal assistance responsiveness while projecting competence to local shoppers.

Creating a Logo and Brand Assets

A custom, creative logo crystallizes indelible first impressions across channels. Collaborative design marketplaces like Looka offer fast genre-appropriate emblem creation leveraging fonts and icons that reinforce merchandising themes. Distinct colors and symbolic shapes with taglines convey the essence of operations.

Creating Business Cards and Signage

Hard copy business cards from Vistaprint establish convenient referrals and vendor introductions when sourcing specialty items or recruiting location scouts. Professional designs aligning with other visual touchpoints signal focused retail leadership to landlords, donors, and job candidates. Prominent store signage in matching schemes solidifies consistent identification.

Purchasing a Domain Name

Owning the perfect .com web domain eliminates confusion, strengthens search visibility, and conveys growth ambitions to early supporters. Recommendations include keeping under 15 letters, avoiding overused terms like “shop”, and picking keywords like “thrift”. Registration runs $12 annually via trusted platforms like Namecheap.

Building a Website

Leveraging online store builders like Wix to launch information-rich websites imparts digital fluency and omnichannel convenience for nominal subscription fees. Templates, SEO tools, and integrated payment processing enable showcasing mission, merchandise, and promotions. Alternatively, Fiverr freelancers provide customized coding and graphic design skills.

12. Join Associations and Groups

Expanding professional connections regionally seeds invaluable growth insights for new thrift entrepreneurs through established peers navigating similar consignment challenges. Local groups build community stewardship while national associations unlock merchandising ideas and policy advocacy.

Local Associations

Area reuse retail alliances like the Association of Resale Professionals share important information on forming your local shop. Members also trade notes on regional supplier partnerships for hard-to-find items and how to determine your thrift store worth.

Local Meetups

Local Meetups Frequent gatherings hosted on sites like Meetup enable one-on-one access to veteran owners. Get together at informal networking events or local tradeshows and talk shop. You may also attend formal presentations on transitioning to ecommerce channels, and other important industry details.

Facebook Groups

Digital communities like Community Thrift Store offer 24/7 idea exchanges on display planograms for highlighted categories, tips for photographing rare items, and discussion of POS system integrations (Free to join). More niche groups like Thrift Shop Junkies detail strategies for sourcing the best secondhand couture.

13. How to Market a Thrift Business

Strategic promotion spotlights distinct merchandise strengths and store personalities to attract recurring local shoppers amidst expanding reuse competition. Balancing digital discovery and community goodwill fosters sustainable loyalty and word-of-mouth momentum.

Personal Networking

Tapping existing networks maximizes initial grand opening awareness. Offering 10% off coupons to happy first-month patrons who refer friends also rewards supporters. Special weekend “flash sales” advertised through advocates prompt viral attention and buyer urgency.

Digital Marketing

- Google/Facebook paid ads geo-target nearby households to build local visibility across devices when searching categories carried ($100 per month minimum budget)

- Instagram business profiles visually showcase rotating selections and behind-the-scenes operations while optimizing vintage finds for Gen Z appeal

- TikTok channel cultivates “thrift flipped” restoration tips and shop peeks to entertain and inform video-centric audiences

- Daily eBay product listings draw national buyers for premium or rare discoveries

- Retail podcast co-hosted with local business leaders or historians spotlights community

- Influencer consignment and donation partnerships generate publicity from loyal followers unboxing

- A loyalty punch-card app clocks visit and notifies repeat customers of flash deals

Traditional Marketing

Traditional approaches like newspaper ads, printed a-frames sidewalk placards and direct mailers still furnish value for older demographics less reachable online. However, tracking effectiveness lags digital. Consider blending both techniques to provide omnichannel exposure. Examples include:

- Placing categorized inventory ads in weekly Pennysavers

- Bulletin board flyers at community centers and colleges

- Catchy radio spots on local public stations

- Eye-catching reader boards touting daily discounts off Highway exits

- Chamber membership securing referrals from neighboring proprietors

Overall sustaining consistent digital engagement and customer appreciation unlock referrals and reviews rivaling bigger budgeted promotion campaigns. Specializing merchandise and creatively partnering with media supporters spotlight niche authority cementing loyal bonds between shoppers and thrift owners.

14. Focus on the Customer

Delivering exceptional service keeps shoppers returning and spreading positive word-of-mouth as they proudly share their latest pre-owned finds with friends. Thoughtful assistance in converting first-timers into regulars also grows average transaction values.

For example, thrift stores should train staff on properly inspecting donations to accurately gauge conditions when pricing items. Taking time to test electronics functionality, assess furniture tears, and research vintage fashion eras reduces mislabeled offerings that disappoint patrons.

Additionally, creative merchandising to simplify browsing inspires bigger baskets. Regularly reorganizing displays by style, color, and category makes uncovering hidden gems more enjoyable. Featured deal sections also spotlight new arrivals and ever-changing options, unlike mass retailers. Clothes from sewing businesses that feature timeless styles are also highly popular.

Getting to know repeat visitors to proactively showcase items matching their interests leaves lasting impressions. Providing tailor and repair recommendations for particularly valuable vintage materials further elevates service.

Consistently exceeding expectations creates vocal brand advocates. Nearly 70% of thrift store consumers prefer to buy from local suppliers rather than anonymous chains. Personalized assistance, community initiatives, and sustainable operations encourage return shoppers.