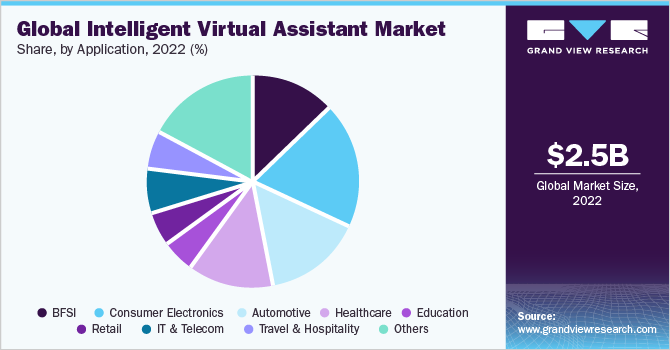

The virtual assistant industry has seen rapid growth in recent years. According to research, the global market for virtual assistants reached $2,571.6 million in 2023 and is projected to expand at a compound annual growth rate of 22.3% from 2023 to 2029. Several factors are driving this growth, including the rise of remote work and increased outsourcing of administrative tasks by businesses and individuals.

As more people work remotely, there is a high demand for skilled virtual assistants who can provide administrative support off-site. Tasks like email management, calendar scheduling, travel coordination, and customer service are well-suited for virtual outsourcing. This creates an excellent business opportunity for those interested in starting a virtual assistant company.

This guide will walk you through how to start a virtual assistant business. Topics include market research, competitive analysis, sourcing office materials, obtaining business insurance, registering an EIN, and forming a legal business entity.

1. Conduct Virtual Assistant Market Research

Market research is essential to opening a business in virtual assistant services. Research offers insight into your target market, the best social media accounts for marketing purposes, trends in services, and local market saturation. Market research helps build a thorough business plan.

Some details you might learn through market research for your own virtual assistant business include:

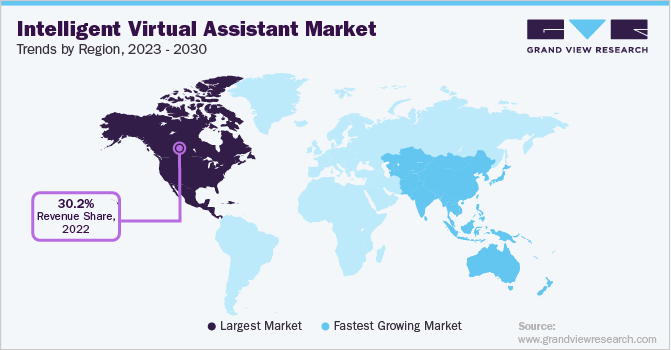

- North America dominates the current market.

- Rising disposable incomes and tech adoption in countries like India and China are driving increased demand.

- Most clients that recruit virtual assistants are solo entrepreneurs, startups, and small business owners.

- Administrative tasks like email, calendar management, travel coordination, and customer service support are commonly outsourced.

- Key drivers spurring market growth include increased remote work and flexible schedules, access to skilled talent globally, and small businesses seeking cost savings.

- Utilizing virtual assistants for administrative tasks allows employees and business owners to focus on revenue-generating priorities.

- For skilled VAs, it provides location-independent income opportunities.

- The low startup costs involved make the virtual assistant industry highly attractive for new entrepreneurs.

- The main requirements are a computer, internet access, productivity software, and specialist VA training.

- Useful skills include communication, task management, customer service, writing, marketing, and technical abilities like web design or data entry. Most independent VAs charge $30-$50 per hour initially.

- Ideal clients include entrepreneurs, startups, small business owners as well as executives, and high-net-worth individuals needing personal assistance services.

- Many VAs double as social media management agents.

- The rise in influencer marketing also presents opportunities for assisting social media personalities and content creators with administrative needs.

- Celebrity personal assistants can discreetly manage busy schedules and a public lifestyle command very high incomes.

While growth estimates for the industry remain strong long-term, economic challenges have created hiring freezes and budget cuts at many businesses over the past year. This may temporarily dampen demand. Small businesses driving much of the virtual assistant market are likely to retain services allowing them to handle growing workloads cost-effectively.

2. Analyze the Competition

Understanding the competitive landscape is key for successfully launching any new business, including a virtual assistant company. Performing thorough competitive analysis should examine both online and brick-and-mortar players to identify market gaps, set accurate pricing, and establish a competitive edge through the differentiation of services.

Some ways to get to know competition in the virtual assistant services industry include:

- For online competitors, start by identifying established virtual assistant agencies managing multiple clients, and independent contractors targeting the same customer segments.

- Use web searches and marketplaces like Upwork.

- Analyze the services portfolio offered by competitors along with pricing models and marketing messaging.

- Search online customer reviews of competitors to ascertain satisfaction levels and identify any recurrent complaints.

- Pay attention to the digital marketing strategies competitors deploy and the channels used to reach customers.

- Running Google or social media advertising insights reports will indicate the spend levels, creatives, and landing pages used by rivals to generate leads and sales.

- For brick-and-mortar players, businesses like HR outsourcing agencies offer some comparable services such as payroll processing and benefits management.

- Research which tasks they provide virtually along with their pricing and security credentials.

Gauging the competitive landscape requires regularly updating the analysis above over time as new players emerge or established companies pivot strategies. Meticulously examining these elements before launching arms of new virtual assistants with competitive pricing, superior services, and marketing finesse.

3. Costs to Start a Virtual Assistant Business

Starting a virtual assistant (VA) business has relatively low start-up costs compared to other ventures thanks to minimal equipment needs and zero expenses for physical premises. Most administrative support services can be provided entirely online.

Start-up Costs

Key start-up costs involve obtaining the necessary hardware, and software, establishing a legal business entity, and funding initial marketing efforts.

- A suitable laptop or desktop computer capable of installing platforms like Zoom for meetings can cost around $800-$1,200.

- Useful productivity software like Microsoft 365 has monthly subscriptions from $7 but upfront annual payments around $100 are more economical.

- Investing in packages like Adobe Creative Cloud ($600 per year) expands service offerings for VAs adept at design, writing, or social media.

- While office space is unnecessary, a functional home office is ideal.

- Dedicated desks, ergonomic chairs, headsets with microphones, webcams, and high-speed internet access facilitate the needed technology backbone.

- Budget around $300-$500 for these home workspace basics.

- Minor registration, licensing, and insurance fees also apply depending on location.

- Establishing a formal legal business entity provides credibility while limiting personal financial liability.

- Registering as a limited liability company or incorporation process costs approximately $200 when using an online legal services platform like LegalZoom.

- VA businesses should invest in general liability insurance too, which is fairly affordable at around $500 annually.

- Developing processes for administrative tasks through frameworks like QA Madness ($297) and obtaining useful certifications will run $200-$500 depending on specialty.

- Investing in superior virtual assistant training courses allows tailoring services better to in-demand skills.

The most significant start-up costs involve digital marketing activities that attract clients, the VA business’s lifeline. Website design, hosting, and integrating useful plugins like online booking systems require an investment of $1,500-$5,000 depending on complexity.

Ongoing Costs

Ongoing operational expenses remain fairly low and scalable for established virtual assistants working independently or with a few team members.

- Popular SaaS CRM tools like Zoho and Freshworks have monthly subscription costs ranging from $12 per user upwards, with premium plans of $100+ for additional functionality.

- Performance monitoring software like Time Doctor ($7 per user monthly) manages remote teams.

- Payroll processing fees also accrue rapidly for larger groups.

- Employing an in-house accountant for around $50,000-$60,000 annually manages finances professionally.

The virtual nature of most administrative tasks keeps overheads like rent, utilities, and supplies minimal. Scaling teams work best via an outsourcing framework where freelance talent is leveraged on a project basis rather than employees. This allows better cost control when demand fluctuates.

4. Form a Legal Business Entity

When starting a virtual assistant (VA) business, selecting the right legal structure is an important foundation. The four primary options each have advantages and drawbacks to weigh regarding liability protection, taxes, and ease of management.

Sole Proprietorship

Sole proprietorships represent the simplest but riskiest choice. There are essentially no formation requirements – you can immediately begin operating. However, the owner is personally responsible for all business debts and liabilities. Virtual assistants also must report all income and expenses for tax purposes on Schedule C of their returns. An advantage is avoiding corporate taxes, but complex tax deductions may require professional guidance.

Partnership

Partnerships allow the combining of resources and expertise between two or more virtual assistant owners. However, each partner can still be held personally liable for obligations like another partner’s misconduct or negligence. Income allocations require carefully drafted agreements, or conflicts can arise. Partnership interests can be difficult to value or divest from as well.

Limited Liability Company (LLC)

Given its benefits outweigh the above options for most virtual assistants, forming a limited liability company (LLC) is typically recommended. LLCs separate your assets from company financial obligations, preventing personal risk if the business fails. Only your investment in the VA company is endangered. Taxes as an LLC are also convenient, with pass-through treatment where personal returns account for profit/losses.

Corporation

Compared to corporations, LLCs involve fewer record-keeping requirements and regulations to comply with. Shared management and mixed participation are simplified for those starting as solopreneurs but expanding virtually over time. The main LLC drawbacks revolve around raising capital and equity management. Transferring ownership stakes can be complex.

5. Register Your Business For Taxes

An employer identification number (EIN) serves as a unique tax ID number for business entities, similar to how a social security number identifies individual taxpayers. The IRS requires all LLCs and corporations to obtain an EIN for tax administration purposes.

As most virtual assistants should form an LLC to obtain liability protection, applying for an EIN is essential. The good news is the process is straightforward and can be completed online in minutes for free via the IRS website.

To apply:

- Gather basic information handy like your LLC’s legal name, address, ownership details, and formation date.

- Navigate to the EIN Assistant

- Select “View Additional Types, Including Tax-Exempt and Governmental Organizations”

- Choose the option for “Limited Liability Companies”

- Click “Apply Online Now”

You will need to create an IRS account if you do not already have one. After logging in, the application involves answering a short eligibility questionnaire and providing details like your LLC ownership structure and primary activity category. The system auto-generates your EIN instantly upon submitting the form.

The EIN serves as your official business tax number utilized on any tax paperwork like schedules documenting LLC profits/losses. It is also required when opening a designated business bank account. Some states mandate including the EIN on official invoices to clients for services rendered as a virtual assistant when sales tax applies.

Those running a virtual assistant business must understand state and local jurisdiction regulations for any services or products sold. Charging sales tax typically applies whenever your LLC has a physical presence within a state. Most home-based LLCs only need to collect local sales tax but double-check rules to avoid non-compliance penalties.

6. Setup Your Accounting

Carefully tracking income and expenses is crucial for understanding the profitability of administrative services performed. Solid accounting practices ensure streamlined filing come tax season. There are many ways to manage expenses and income when running your own business.

Accounting Software

Accounting software integrates with bank/credit card accounts to automatically categorize transactions, generate financial statements, and simplify taxes. For small service businesses like virtual assistants, QuickBooks plans to start around $20/month. Features like invoicing, expense tracking, customizable reports, and automated sales tax calculations provide transparency on cash flow.

Hire an Accountant

While accounting platforms reduce manual work, partnering with a skilled accountant optimizes financial compliance. Average fees range from $150-$200 monthly for bookkeeping assistance, rising closer to $500 monthly for CFO advisory services at larger virtual assistant agencies. Come tax season, expect costs between $700-$2,500.

Open a Business Bank Account and Credit Card

Separating personal and business transactions is essential for proper reporting. Maintaining a dedicated LLC business checking account and credit card simplifies this classification. Business credit cards often offer rewards tailored to service providers like cash back on advertising spend. Approval decisions emphasize annual revenue and projected expenses rather than personal credit scores.

7. Obtain Licenses and Permits

Operating a virtual assistant business from home keeps overheads minimal, but paying attention to required licenses and permits remains important for legal compliance. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

Unlike location-dependent fields like restaurants, the remote nature of offering administrative support limits licensing needs. Virtual assistants provide services virtually across states or countries, restricting bureaucracy. It still pays understanding jurisdiction obligations.

For example, independent contractors and single-member LLCs may require local business permits even when running home-based ventures part-time around $50-$100 annually. Municipal codes vary – those operating within city limits rather than rural locations may endure more.

Unincorporated towns also impose less red tape typically. But ignorance won’t suffice if non-compliance penalties arise later. Checking county and city halls for virtual service provider regulations is wise.

Data security and privacy represent another area needing attention for virtual assistants managing sensitive client information online. While legislation in Europe sets strict data protection standards, the US lacks federal laws. However, states like California prohibit the sharing of personal details.

Reviewing services offered against different data and cybersecurity protocols even if not mandatory can still prove prudent. Consider running background checks before collaborating with overseas contractors too.

Conducting specialized services like medical appointments via telehealth links does require verifying appropriate telemedicine licenses. The same applies before claiming expertise in restricted advisory realms like legal, financial planning, or mental health consulting.

Double-checking occupancy codes and homeowners association rules also makes sense for home-based ventures particularly if client meetings occur on-site occasionally. This low likelihood still needs awareness in case local ordinances prohibit running enterprises from residential areas without exception requests.

8. Get Business Insurance

Operating a virtual assistant business from home keeps overheads minimal, but having proper insurance coverage remains vital. While risks seem limited in providing administrative services through online mediums, legal liabilities exist requiring precaution. Here is an overview of securing coverage plus potential claim scenarios:

The predominant recommendation involves obtaining Errors & Omissions (E&O) insurance, also referred to as professional liability insurance. This protects against third-party claims alleging mistakes like missed deadlines, incorrect advice, or breaches of confidential data from negligence. With limits starting around $1 million, annual premium costs are fairly reasonable at approximately $600.

Without protection, a single claim against a virtual assistant could lead to disastrous consequences. Envision was sued by a client for violating HIPAA laws when medical records were leaked via an insecure cloud storage login shared unwittingly. six-figure defense lawyer fees rapidly accumulate.

Cyber insurance works similarly to cover the costs of hacked systems, data recovery, and legal services. However, premiums often run $5,000+ making individual policies unviable for independent contractors. Reviewing the limits included in various business owners’ policies can provide alternatives potentially.

General liability coverage on valuable assets like computer equipment makes sense too, starting below $500 yearly. Accidents happen – spilling coffee over a laptop denies business continuity when relying on personal devices. Property protection via renters or homeowners insurance likely suffices already though.

Comparing business insurance quotes online through sites like CoverWallet simplifies finding tailored E&O policies. Answer a quick eligibility survey on services offered, years in business, location, and revenue. Receive quotes instantly from leading commercial insurers like The Hartford suitable for administrative professionals. Consider extras like tax audit protection too.

9. Create an Office Space

While conducting meetings or interviews via video conferencing works fine day-to-day, having an impressive office location ready for important in-person client dealings proves strategic. Envision pitching a high-value corporate services contract – receiving visitors at home risks perceptions of small-scale or amateur operations.

Home Office

Home offices still rank the most budget-friendly option starting at $250 for basic desks and ergonomic chairs. Dedicating space for administrative duties alone evades family interruptions. Noise-canceling headphones reduce background disruption further for under $100. However, hosting clients on-site remains unrealistic.

Coworking Office

Using co-working spaces like WeWork flexibly solves professional location needs while enjoying amenities like printing, events, and community networking. Hot desk bookings cost around $30 per day or private offices from $500 monthly. Meeting room rentals average $100 hourly – perfect for local client pitches or interviews with remote talent. However, space access varies by site and background noise can intrude.

Commercial Office

Renting small private offices in commercial buildings represents the most dependable option for consistent professional surroundings secured 24/7. While minimum 12-month leases keep things less flexible, expect around $600 monthly inclusive for a 120 sq ft office. Use expands confidently for sensitive meetings, storage needs, or solo focus time.

10. Source Your Equipment

Finding the best equipment is important for a virtual assistant. A reliable internet connection, top-tier project management tools, and high-performance hardware are all important. Here are a few ways to obtain the equipment you need to start a successful virtual assistant business.

Buy New

Buying new computers, printers, and accessories ensures the latest specifications suiting performance-intensive programs sometimes used. Dell, HP, and Lenovo sell powerful Windows laptops with long battery life ideal for meetings starting around $700. Apple’s iMac and MacBooks facilitate using platform-exclusive tools like iMovie for client video creation projects too.

Buy Used

Seeking used devices saves substantially while still gaining ample capability for typical needs. Facebook Marketplace and Craigslist frequently list capable business laptops under $300 from sellers upgrading equipment. Refurbished current-generation desktops and monitors sell on eBay for under $400 routinely.

Rent

Renting PCs monthly allows accessing robust hardware like Mac Pro workstations exceeding $2,000 new for only $100-$150 monthly. Heavy multimedia editing benefits from upgraded specifications rented short-term as-needed versus full purchase costs.

Lease

Leasing over longer 12-36 month periods makes sense acquiring premium hardware like ultra-high resolution tablets and 2-in-1 hybrid devices benefitting extensive field usage. Expect between $40-$80 in monthly fees gaining perpetual ownership following lease completion. Useful for the latest iOS systems and touchscreen or stylus-based tools facilitating workflow mobility.

11. Establish Your Brand Assets

Consistently displaying visual assets like logos, contact details, and online platforms allowing client inquiries conveys business legitimacy critical amidst a crowded administrative services market. Investing in branding also enables communicating niche specialties and values aiding relationship building.

Get a Business Phone Number

Acquiring a unique RingCentral business phone number instead of relying solely on personal mobiles demonstrates commitment. Expect between $20-$45 monthly for dedicated lines, voicemail, and call routing features. Listing these on all materials adds a touch of authority during client interactions.

Print Business Cards

Business cards and signage are integral to traditional marketing techniques. Order 500 Vistaprint business cards starting at around $20. Swapping cards face-to-face when attending conferences or client meetings makes memorable first impressions.

Design a Logo

Displaying a polished company logo also accelerates familiarity. Looka‘s logo maker helps craft icons, color palettes, and typefaces aligned to brand identities for $60. Scalable vector versions adapt seamlessly when creating letterheads, proposals, and product packaging if selling merchandising.

Buy a Domain Name

A domain name is another major step in branding your business. Choose a .com address that makes you recognizable and memorable. Securing matching domain names via sites like Namecheap for under $20 annually prevents impersonation while conveying know-how.

Design a Website

Well-produced online presences demonstrate technical prowess and design aptitude certain clients value highly from service partners. Build a top-of-the-line website using Wix‘s drag-drop editor or custom-designed on Fiverr for $100.

12. Join Associations and Groups

While conducting administrative duties from home offices keeps virtual assistants productive, joining local networks and associations facilitates mentorship opportunities which accelerates success through shared wisdom. Here are 473 words on resources aiding visibility and community building regionally:

Local Associations

In most cities, chapters of the International Association of Administrative Professionals (IAAP) organize frequent seminars. Discover contacts in your metro via the IAAP website. Joining a local association puts you in touch with like-minded business owners, offering unique insight into niche tools and highlights.

Local Meetups

Arranging in-person gatherings works efficiently. Leverage the Meetup app’s database of 130,000 professional networking groups of all varieties globally. Narrow by “virtual assistant” plus your neighborhood to uncover events facilitating valuable introductions. The platform’s free to use with paid memberships from $60-$150 annually.

Facebook Groups

Online communities specific to administration careers offer constant connecting without leaving home. Popular Facebook groups like Virtual Assistant Tips, Tricks & Advice, and The Virtual Assistant Village have tens of thousands of members discussing relevant industry topics daily. Monitor discussions to discover unmet needs ripe for new offerings.

13. How to Market a Virtual Assistant Business

As virtual assistants deliver services remotely, strategic marketing proves pivotal for establishing brand familiarity and trust in your expertise. Satisfied early customers provide crucial validations when organically touting your assistance publicly across their professional networks.

Referral Marketing

Offering incentives like service discounts for existing relationships referring new accounts is a proven tactic stimulating word-of-mouth advocacy. For example, provide complimentary access to online scheduling tools or CRM dashboard creation usually commanding premium add-on fees for mutual contacts signing multi-month VA partnerships.

Digital Marketing

Digital platforms present efficient channels connecting your personalized services to relevant audiences through tactics including:

- Google Ads campaigns targeting niche keywords like “corporate virtual assistant” in metro regions you operate, budget from $100 monthly assessing cost per lead

- Facebook ads showcasing expertise via free educational webinars driving registrations, spend $10 daily reaching local professionals

- Launch a YouTube channel sharing 2 weekly vlogs detailing administrative tips gaining organic views over time

- Guest blog for industry publications aligning with your specialization driving traffic back to the site

- Leverage SEO optimizing online content and page metadata for visibility

Traditional Marketing

While digital promotion scales easier, localized real-world marketing exposure retains influence still among traditional decision-makers:

- Sponsor relevant chamber of commerce networking events to interface with other entrepreneurs directly, budgets range from $500+ per event

- Negotiate small features in regional business journals to communicate services innovatively to established owners, expect around $800 per placement

- Distribute personalized mailer campaigns to offices strategically, design and printing costs start from $300 per 1,000 copies

Monitor penetration across channels using secret shopper surveys. Assess client retention rates over 3-6 month engagements guiding where to double down on successful elements while pivoting away from underperforming components cost-ineffectively.

14. Focus on the Customer

All virtual assistants start their businesses by connecting with their clients. Owning your own VA business means connecting with all your clients in one way or another. Fortunately, there are many ways to show business owners and entrepreneurs seeking your services that you have their best interests in mind.

Specialize your administrative expertise and convey reliable availability. Set clear expectations from onset around typical response times. For example, identify if you’ll tackle inquiries within 2 hours or the next business day.

Share proactively any planned time off or away messages helping clients plan around known unavailability. Make personal contact details accessible including phone/text also for urgent matters needing real-time coordination.

Resolve issues empathetically if mistakes happen too like missed appointments or reporting delays. Send handwritten notes or small credits to convey genuine accountability clients remember when endorsing you to wider networks.

Monitor satisfaction levels consistently also through short periodic surveys allowing course correcting before frustrations escalate silently. Tools like Typeform or SurveyMonkey simplify creating branded templates recirculated with each project completion. This proactivity earns major trust through transparent improvements over time.

Virtual assistants thriving long-term recognize impeccable customer service outshines niche qualifications when initially gaining local footholds. There are always competitors with similar core competencies. However conveying responsive, caring, and dependable support daily differentiates businesses as partners invested in mutual success.