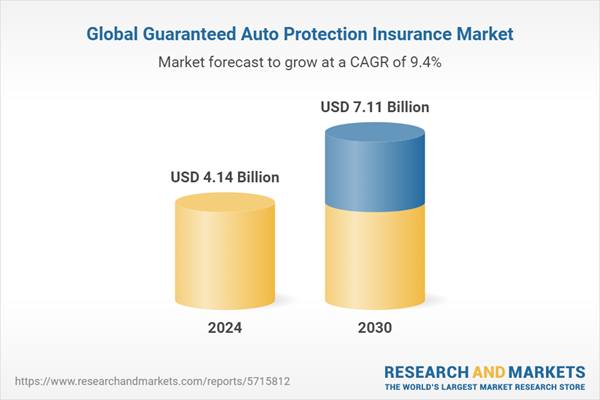

The global auto insurance industry reached $810 billion in 2022. With cars being essential for most Americans and auto insurance required by law, the industry enjoys steady demand. The market is dominated by large, established national carriers like State Farm, Geico, and Progressive.

Entering the commercial auto insurance industry requires significant investment and regulatory compliance. For those with capital and insurance experience, opening an independent insurance agency or brokerage may be rewarding. Agents and brokers act as middlemen, providing quotes and policies from multiple insurance companies to consumers and businesses.

This guide will walk you through how to start an auto insurance company. Topics include registering an EIN, obtaining business insurance, forming a legal business entity, market research, customer focus, accounting, and more.

1. Conduct Auto Insurance Market Research

Market research is essential to starting a successful insurance company. It provides important details about your target market, trends in insurance industry services and insurance products, and local market saturation. Market research supports a thorough business plan as you start an insurance company.

Some information you’ll learn through market research includes:

- Despite its size, the car insurance market remains fragmented.

- New auto insurance providers can compete by focusing on customer experience.

- Many consumers perceive the top insurers as impersonal. Newer players can offer specialized, customized coverage and superior claims resolution.

- Independent agents often match or beat prices from famous advertised brands.

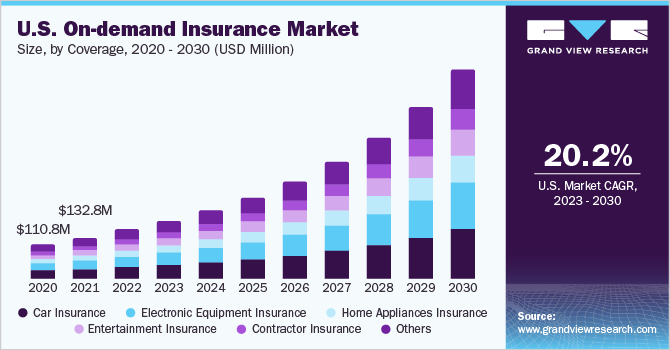

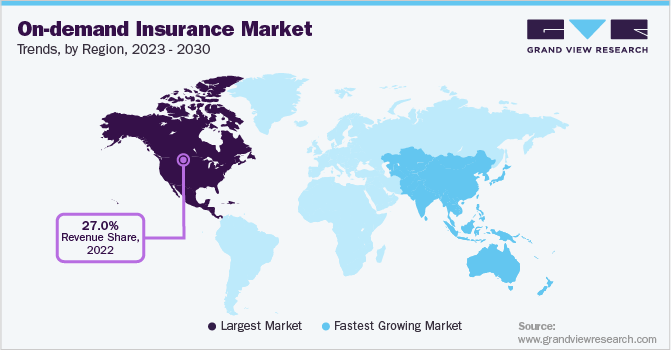

- The best growth opportunities exist in states like California, Florida, and New York which have the most cars on the road.

- Fast-growing states further west and south also merit attention despite currently having fewer vehicles.

- Targeting specific customer segments by age, vehicle type, driving usage, and risk profile allows maximizing loss ratios too.

- Specialty niches like classic car insurance, usage-based coverage, and rideshare insurance offer differentiation too.

The steady upward trajectory in vehicles requiring coverage, market fragmentation among large and small insurers, and product customization abilities create avenues for new competitive entrants in the vast U.S. car insurance industry.

2. Analyze the Competition

Given fragmentation, entering auto insurers must research existing competitors thoroughly. Knowing what other insurance businesses offer and how much allows you to create a more realistic business plan. Assess both larger carriers and independent car insurance companies in their target locale.

Some ways to get to know the local competition include:

- Evaluate competitors’ online presence and digital marketing first.

- Search brands’ names to analyze paid ads and organic rankings.

- Review their websites for types of policies offered, customer service touting, and use of data to personalize options.

- Download mobile apps to gauge ease of use for customers.

- Check reviews on third parties like J.D. Power for consumer sentiment.

- For pricing intelligence leveraging data analytics, visit competitor quote comparison sites like TheZebra and EverQuote.

- Input sample driver profiles to collect rate quotes across major insurers in the geography.

- Apply to become an affiliate partner to directly access competitor rate data APIs for continued monitoring.

- For offline agency presence, drive around the neighborhood and catalog existing shop locations.

- Search state regulatory filings for licenses, years in business, and several policies in force.

- Ongoing competition tracking informs both new market entry strategy and book acquisition for agencies looking to expand via roll-up.

Monitoring both digital engagement and brick-and-mortar footprint provides a comprehensive view of competing for the many local opportunities within the vast auto insurance industry.

3. Costs to Start an Auto Insurance Business

Starting an independent insurance agency that sells auto policies along with other P&C offerings involves considerable upfront investment and ongoing expenses. To secure financing through investors or a business loan, you need a well-researched budget. Here’s a look at some costs you can expect:

Start-Up Costs

- Licensing & Bonds: $2,000 Every selling agent must pass state licensing exams and secure an annual surety bond for claims payment guarantees.

- Agency Management Software: $5,000 – $10,000 Robust software like Vertafore or Applied Systems enables quoting, policy management, billing and agency/book of business reporting essential for efficiently running operations.

- Office Lease or Purchase: $2,500 per month Storefront locations in strip malls average $30 per square foot. A small 800 sq ft office would run around $2,500 monthly. Buying a standalone building costs substantially more.

- Furniture & Supplies: $15,000+ Outfitting the office with desks, phones, filing cabinets, supplies, and decor usually exceeds $15,000 depending on size.

- Staffing: $60,000+ Hiring an office administrator and additional sales staff to provide quotes and service accounts requires budgeting at least $60,000+ annually for reasonable salary, benefits, and employment taxes for employees.

Ongoing Costs

- E&O Insurance: $3,000 Errors & omissions liability coverage averages about $3,000 per year.

- Company Health Insurance: $6,000 per employee Providing basic medical plans, dental, and vision as part of compensation costs approximately $500 monthly per staff member.

- Advertising: $20,000+ Marketing across digital channels, print mailers, events sponsorships and more requires substantial, consistent promotions investment to grow the book of business.

- Continuing Education: $2,000 Maintaining industry expertise and state licensing necessitates ongoing professional education expenses.

In total, starting an independent agency demands around $100,000 in start-up costs, not including extra operating capital to cover potential underwriting losses in the first few years. Succeeding long-term requires corralling significant start-up funding, maintaining stringent expense controls, and investing.

4. Form a Legal Business Entity

Before you even start dealing with the state insurance commissioner’s office to form your own insurance company, you need to select a legal business entity. For a car insurance company, there are four main entities to choose from, including:

Sole Proprietorship

A sole proprietorship is the simplest and cheapest way to set up an independent insurance agency for one owner. No formal registration is required beyond standard business licenses. However, the owner assumes unlimited personal liability for debts and claims. Their assets can be seized to settle with creditors and plaintiffs. This massive risk exposure makes sole proprietorships inadvisable despite the ease of formation.

Partnership

A general or limited partnership allows multiple owners to share management duties and equity. But it offers little liability protection – partners can still be personally sued for agency errors. The partnership dissolves if a partner dies forcing reformation. These downsides limit appeal versus limited liability companies.

Limited Liability Company (LLC)

Forming an LLC offers independent agency owners the best of both worlds. It limits personal liability similar to a corporation so owners’ assets are shielded. It also provides tax advantages of a partnership with pass-through income. LLCs afford immense flexibility to admit new investors through unit issuance, unlike S-corps.

Corporation

C-corps and S-corps also reduce owner liability exposure but come with more complex regulations, expenses, and tax considerations. For example, S-corps can only have one class of stock restricting investor options. C-corps are subject to “double taxation” with profits taxed at the corporate level and shareholder level.

5. Register Your Business For Taxes

As a resident business entity, your auto insurance company requires an Employer Identification Number (EIN). This serves as a business’s tax ID number with the IRS for tax reporting purposes. Independent insurance agencies must obtain an EIN even if they do not have employees.

An EIN identifies the business entity and enables the legal opening of business bank accounts, applying for licenses, and filing state sales tax returns.

Applying for an EIN is free and fast directly through IRS.gov. The online application only takes minutes to complete. Simply navigate to the EIN Assistant and provide basic information:

- Legal business name and address

- Reason for applying (started new business)

- Responsible party info (owner/officer name + SSN)

- Entity type (LLC, partnership, etc.)

Submitting online generates the EIN immediately on the screen to use for federal tax documentation.

After securing your federal EIN, check your state Department of Revenue’s website to register for sales tax collection reporting and remit state payroll taxes if hiring W-2 employees down the road. Many states let you integrate the application to capture the EIN. State registration costs usually less than $100 one time.

Having an EIN is indispensable for opening commercial bank accounts, transacting with carriers, and managing taxes smoothly. The online EIN Assistant makes this easy first step enabling proper insurance agency setup.

Obtaining permits to collect sales tax does create more paperwork but keeps the agency compliant. With the proper planning and entity structuring upfront, managing legal and tax obligations becomes fairly straightforward for a new auto insurance provider over time.

6. Setup Your Accounting

As an independent insurance agency, diligent bookkeeping and accurate financials are imperative. This ensures proper revenue recognition, expense monitoring, and tax documentation to avoid IRS issues down the road.

Accounting Software

Using small business accounting software like QuickBooks streamlines the entire process. QuickBooks integrates directly with bank and credit card accounts to automatically import and categorize transactions. This eliminates manual entry and reconciliation busy work. The system tracks customer accounts, policies sold, accounts receivable, and payments due.

Hire an Accountant

Supplementing DIY software with an outside accountant adds further value. A certified accountant provides advisory services like cash flow analysis, budgeting guidance, and growth planning beyond basic bookkeeping. This grants you an experienced finance professional’s perspective on profit improvement opportunities.

Open a Business Bank Account

Separating business and personal finances prevents commingling which raises IRS scrutiny. Open dedicated small business bank accounts and credit cards solely for agency operating expenses.

Apply for a Business Credit Card

Applying for a business credit card requires the company’s legal formation documents, EIN, and owner’s SSN. Credit limits equal a portion of estimated annual revenue. Cards build commercial credit history and supply flexibility by managing periodic short-term cash crunches.

7. Obtain Licenses and Permits

Launching an independent insurance agency demands compliance with numerous state licensing and regulatory obligations. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

The central requirement involves maintaining an active state producer license for every agent affiliated with the agency. This mandatory clearance authorizes transacting insurance business legally on behalf of policyholders. The U.S. Small Business Administration and local insurance commissioners will help you recognize what you need in your state.

To qualify for a resident producer license, candidates must pass a licensing exam covering insurance fundamentals through providers like Kaplan Financial. Exams cost $100 on average. The license application itself ranges from $0 to $300 depending on your state Department of Insurance’s fees.

Along with a general business permit, agencies must also register for an Agency License to transact business under their established legal name. This secures your commercial identity associated with carrier appointments and policy transactions.

Given the integral nature of customer vehicles in auto insurance, agencies often obtain Motor Vehicle Reports access with state DMVs. This allows quoting and underwriting analyses based on driver records.

Seeking approval to offer flexible premium financing for customers’ policies also smooths cash flow for smaller agencies. Premium finance companies provide this working capital after vetting the agency.

8. Get Business Insurance

Even as an insurance provider yourself, securing business coverage protects your independent agency’s operations and assets. Policies buffer against lawsuits, employee injuries, natural disasters, and crime that could otherwise bankrupt your company. Think about commercial property insurance, professional liability insurance, general liability insurance, and more.

Without adequate insurance, a minor water leak destroying your office’s electronics could lead to tens of thousands in replacement costs and lost revenue. Or an angry customer slipping on a wet floor could sue for substantial pain and suffering damages without liability protection.

The good news is obtaining suitable policies is straightforward. First determine your risks needing mitigation like property damage, commercial auto, general liability, workers comp, cyber security, and E&O. Then access small business insurance quote-comparison sites like Cover Wallet to browse available plans and pricing.

Having appropriate safeguards prevents avoidable catastrophes from paralyzing operations. The adage “cobbler’s children have no shoes” applies – even insurance agencies need insurance themselves!

9. Create an Office Space

Having a professional office lends credibility to independent agencies selling policies face-to-face within their community. It also supplies meeting space to counsel customers on coverage. An established location signals permanency versus a fly-by-night operation.

Coworking Office

Shared offices through providers like WeWork offer both mailing addresses and meeting rooms from $300-500 monthly. While flexible and affordable, the environment lacks privacy for sensitive customer conversations regarding policy options and pricing.

Retail Office

Leasing a traditional 800-1,000 square foot retail space in a plaza costs approximately $2,000-$3,000 monthly. Benefits include walk-in exposure, signage for branding, and unlimited access for customers. The significant cost requires securing substantial revenue to sustain, however.

Commercial Office

Commercial Office Renting smaller Class B/C suite space reduces rental rates substantially over retail locations to around $1,000-$1,500 monthly. This gains professional meeting space for customers without excessive build-out and branding costs.

10. Source Your Equipment

Launching an independent insurance agency demands outfitting office space with essential furnishings and tech for customer service and sales. Fortunately, equipment needs remain modest compared to other industries.

Buying New

Staples, Office Depot, and Amazon supply everything from file cabinets and office chairs to laptops and printers affordably. Expect around $15,000 furnishing a basic 800 square foot space. Financing options help offset upfront costs.

Buying Used

Substantial savings come from picking up gently used desks, phones, and cubicle dividers from sellers on Facebook Marketplace and Craigslist. Also, check local auction listings and estate sales. This reduces spending closer to $5,000-$7,000 while still gaining professional-grade materials.

Rent

Renting Rent-to-own stores like Aaron’s allows spreading smaller monthly payments for office furnishings and electronics over 2-3 years. There’s also no credit check or long-term obligation. While total fees run higher than buying over time, this preserves capital for the agency in the early years.

Lease

Leasing Office furniture leasing through national vendors like CORT Events furnishes space while upgrading every few years. However, total lease costs often exceed outright purchases unless you want regular furniture refreshes. Leasing works better for costlier tech like servers and specialized software.

11. Establish Your Brand Assets

Crafting a distinctive brand identity enables making a memorable first impression on prospective customers in your area. This fuels referral business and repeat sales critical for independent agency success.

Get a Business Phone Number

Central to branding is securing a professional business phone line using a service like RingCentral. Their cloud phone technology provides call routing, tracking, SMS texts, voicemail transcriptions, and more on an easy online dashboard. Packages start at around $30 monthly per user.

Design a Logo

Creating a logo through DIY sites like Looka also brings your vision to life affordably. Looka’s AI generates tailored insurance logo ideas in minutes matching your vision. Logos lend authenticity across marketing materials from stationery to yard signs.

Print Business Cards

With a brand image set, order professional business cards, brochures, banners, and front door decals from Vistaprint. Their online design tool simplifies incorporating logos, taglines, and contacts. Business cards establish credibility when meeting clients, networking events, and community functions. Yard signs and banners advertise current offerings directly to passing motorists.

Get a Domain Name

Owning your domain solidifies your brand identity as well. Domain registrars like Namecheap make registering your agency’s dot-com easy for under $20 annually. This enables professional email addresses tied to the brand too. Ideally, your domain matches the agency name exactly.

Design a Website

Building a website establishes an online presence where prospective policyholders can explore coverages and request quotes. Using DIY website builders like Wix streamlines creating pages showcasing your unique agency story, staff bios, customer testimonials, policy options, and contact forms for lead gen. For more complex sites, Fiverr freelancers provide affordable custom site development services too.

12. Join Associations and Groups

Plugging into insurance-focused trade organizations, local meetups, and online communities equips new agencies with industry knowledge and connections for succeeding long-term.

Local Associations

State and national insurance agent associations like the National Association of Insurance Commissionaires facilitate networking, education, and advocacy initiatives. Joining grants access to conferences, training workshops, policy templating services, and group insurance rates. Membership fees run a few hundred dollars annually.

Local Meetups

In-person events hosted on sites like Meetup enable connecting with other area agencies to swap best practices. Casual forums to share real-world insights prove invaluable. Discussion ranges from prospecting tactics to software tips to selling niche policies profitably. Bonds forged over coffee spawn referrals.

Facebook Groups

Industry-specific Facebook groups supply 24/7 access to peers across geographic boundaries. For auto insurance focus, groups like Insurance Agents USA provide advice on answering policyholder questions and overcoming underwriting roadblocks. Broader groups like I Love Insurance serve both personal and commercial lines agents.

13. How to Market an Auto Insurance Business

Implementing ongoing marketing proves vital for independent agencies battling ingrained national brands. Promoting your distinctive offerings and superlative service begets conversions.

Personal Networking

Initially turn to existing personal and professional contacts as seeds for referral growth. Offer discounts or gift cards to delighted customers who recommend friends and family. Word-of-mouth remains the best advertising.

Digital Marketing

- Run Google Ads campaigns focused locally with ads appearing for relevant searches like “Springfield auto insurance” in your geographic target.

- Facebook remains massively popular in the 35-65 age range aligning with typical policy buyers. Create ads educating on policy options and the agency’s specialization.

- Publish helpful insurance info and recent community involvement on the agency blog to build SEO and provide value.

- Start an Explainer YouTube Channel discussing coverage types, restrictions, and common claims in 3-5 minute videos. Embed on your site.

- Retarget past website visitors with customized email drip campaigns through MailChimp discussing specials.

Traditional Marketing

- Direct mail postcards to specific neighborhoods prime for new teen drivers and new homeowners needing better auto + umbrella coverage.

- Sponsor local events like charity golf outings and 5Ks placing banners and gaining booth space to meet prospective clients.

- Print brochures and flyers placed in area realty offices, body shops, hospitals, and various retailers frequented by your audience.

- Run 30-second radio ads on popular commuter stations touting offerings and calling listeners to action.

- Advertise on city buses, benches, and billboards (outdoor ads) with branding, memorable slogans, and contact info.

The most effective marketing incorporates both digital and traditional channels to repeatedly place your agency identity, messages, and offerings in front of local prospects. This ultimately earns their business.

14. Focus on the Customer

Delivering exceptional service distinguishes independent agencies from the 800-number experience of national carriers. This shapes enduring community relationships and referrals.

For instance, proactively reaching out to policyholders identified as having higher accident risks through their motor vehicle record offers tremendous value. Develop driving safety action plans catered to their needs. Guide them on additional training courses to reduce incidents and lower premiums.

Similarly, when underwriting new applicants initially declined elsewhere for issues like license suspensions, take time to discuss their situation and match with specialized high-risk companies. Find opportunities to say yes with restrictive policy types that national online quote engines cannot.

During the claims process, provide white glove assistance expediting approvals, arranging vehicle repairs, and updating constantly on status. Avoid off-putting, impersonal auto-responses that make people feel like claim numbers.

Supplying this degree of customized service earns you the community’s trust and sets the foundation for lasting success.

Delighted customers become enthusiastic brand advocates referring their family, friends, and social circles. They post online reviews and testimonials aiding credibility with prospects. Just a handful of enthusiastic supporters seeds exponential growth.