The insurance industry is massive, with a projected annual compound growth rate of 4.9% from 2022 to 2028, so it’s a good time to get involved. As the population continues to grow and people look to protect themselves and their assets, the demand for insurance is only expected to increase.

Operating an insurance agency requires industry expertise, access to carriers, licensing, and compliance, just to name a few. For those willing to do the work, though, owning an independent agency can be extremely lucrative while also providing valuable customer service.

In this article, we will walk through how to start an insurance company. Topics cover business insurance, registering an EIN, forming a legal business entity, marketing, customer focus, and more. Here’s everything you need to open a successful insurance company.

1. Conduct Insurance Market Research

Market research is necessary to form a successful insurance agency. It offers positive insight into your target market, local market saturation, and trends in the insurance industry. All this leads to a thorough business plan for your own insurance company.

Some details you’ll learn through market research include:

- As the economy expands, demand rises for commercial policies covering business interruption, liability, commercial property, and workers’ compensation.

- Auto and home insurance also provide steady revenue streams.

- Flood insurance is highly sought after in flood-prone states (California, Louisiana, Florida, etc.)

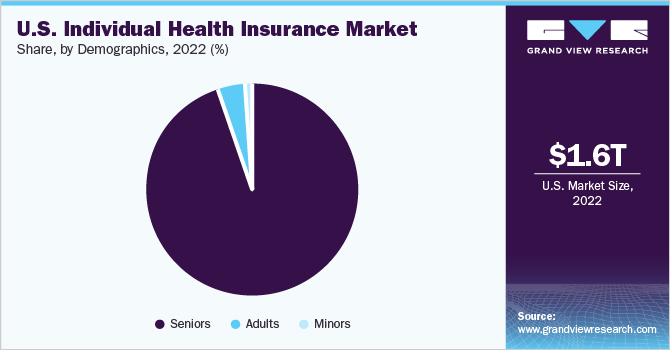

- While the P&C market grows steadily, health and medical insurance represent explosive potential.

- Over 28 million Americans still lack health insurance despite the Affordable Care Act.

- As healthcare costs spiral ever higher, the need for comprehensive major medical plans is expected to surge.

- The aging population’s need to fund retirement and desire to pass on wealth bodes very well for the life insurance niche.

- By focusing on a niche line of business to start, you can develop subject matter expertise to deliver superior service and advice.

While the barriers to entry are surmountable, the insurance industry does have extensive licensing and capital requirements before selling even one policy. But for those passionate about risk management and mitigation, few sectors can match the endurance and growth of insurance.

2. Analyze the Competition

Entering the lucrative insurance industry means quickly analyzing your competition. For regional brick-and-mortar agencies, identify which insurance businesses dominate local market share through state regulatory filings. Review the number of licensed agents, product offerings, and revenue to gauge their foothold and influence.

Some ways to get to know competitor insurance agencies include:

- Drive by locations scouting office space, signage, and proximity to your targeted area. ‘

- Search online reviews plus resources like Better Business Bureau detailing complaints or transparency about their operations.

- For national online insurance platforms, quantify website visitors through SimilarWeb and Alexa rankings.

- Additionally, SEMRush and Google Analytics provide advertising expense estimates and top-performing keywords.

- Evaluate the major carriers they represent, availability in your state, policy options, and price competitiveness.

- Most crucially, telephone mystery shops 10-15 agencies of all sizes to experience their sales process and customer service first-hand.

- Take meticulous notes comparing the quality of needs assessment, product explanations, claims support, and overall responsiveness.

- Take away their strengths and weaknesses to build the ideal customer journey your agency will provide.

- This 360 view arms you to position competitively, select ideal carriers, and create a unique value proposition.

- Continuous competitor analysis also enables agile responses keeping your services and offerings sharp as the market evolves.

- While robust competition signals a viable industry, creative differentiation cements enduring client relationships driving growth and sustainability.

Invest time in planning, and opportunities bloom in insurance. For supporting data check on industry research and trends or for state-level market share filings.

3. Costs to Start an Insurance Business

When launching an insurance agency, the initial costs depend heavily on whether you will operate as a home-based business or lease commercial space. Along with startup capital, you’ll need to pay for ongoing costs like legal fees and accounting. Here’s a breakdown of the costs you’ll encounter as you sell insurance.

Start-up Costs

- In terms of upfront start-up costs, first, calculate approximately $2,500 – $4,000 simply to form your legal business entity and put proper licenses in place.

- Every state has different regulations, but most require a surety bond to protect clients averaging $5,000. Also, budget $2,500 – $5,000 for errors and omissions insurance covering any potential mistakes.

- Factor in rent and capital expenditures to open your office. Average small office lease rates run $15 – $25 per sq ft depending on location and amenities.

- For 1000 sq ft including utilities, budget $20,000 annually or $1,667 monthly.

- Upfitting space requires $15,000 – $30,000 depending on renovations for your lobby, conference room, offices, and layout. This covers demolition, lighting, finishes, bathrooms, and ADA compliance.

- You will also need office equipment and furnishings including desks, chairs, filing cabinets, phones, printers, shredders, and supplies costing approximately $10,000 initially.

- Technology investments like customer management software (CMS), analytics, computer security, and offsite cloud data storage will be around $5,000 first year.

- Order printed marketing material and branded merchandise for another $2,000 – $3,000.

- Factoring permits, cleaning services, and misc costs yield around $100,000 in start-up expenses before hiring staff.

Ongoing Costs

- In terms of ongoing annual costs, rent, and payroll quickly become main drivers. As mentioned already, small office rental space averages $20,000 yearly.

- Payroll for an agency manager, licensed broker, sales agent admin support, and potential interns could run $150,000 – $250,000 depending on experience.

- Tack on another $15,000 for various insurance policies to protect the agency itself.

- Building your book of business requires ample branded giveaways and event sponsorships of around $5,000.

- Continuing education and industry memberships to maintain active licenses cost around $3,000 per person.

- Refreshing furnishings, computers, and tools/tech allocate another $5,000 annually for depreciation.

Other recurring expenses will include:

- Office supplies and services ($5,000)

- Equipment leases like printers/copiers ($3,000)

- Phone and internet ($4,800)

- Business tools and software subscriptions ($10,000)

- Advertising and marketing promotions ($15,000 – $25,000)

- Accounting and legal retainers ($10,000)

Total fixed overhead expenses likely fall between $250,000-$350,000 each year.

4. Form a Legal Business Entity

When establishing your independent insurance agency, choosing the right business structure is critical legally and financially. The four main options for insurance professionals include:

Sole Proprietorship

Sole proprietorships offer simplicity for one owner to get started quickly. However, you assume unlimited personal liability for debts and judgments against the business. Income passes directly to you to claim on personal tax returns as well. While convenient initially, consider evolving once established.

Partnership

General partnerships enable multiple owners to combine expertise and investment centered around written agreements on equity stakes. However similar to sole proprietors, each partner assumes full personal liability. Income also passes proportionally to partner tax returns directly. This framework has the capacity for internal disputes and lacks protections should a partner depart.

Limited Liability Company (LLC)

Unlike the previous two structures, limited liability companies (LLCs) and corporations limit financial exposure only to the capital invested into the company. LLCs in particular represent excellent vehicles for small business owners to protect personal assets. Read more on LLC benefits over other entities from NOLO legal resources.

Corporation

Corporations certainly have a venerable history of providing limited liability as well but indexing as a distinct C corporation or S corporation subjects profits to double taxation. More rigidity comes with ownership percentages tied strictly to stock shares rather than flexible LLC agreements. Unless accessing public markets for liquidity eventually, LLCs predominantly represent the superior choice.

5. Register Your Business For Taxes

An employer identification number (EIN) serves as a key identification number for tax purposes similar to how a social security number functions for individuals. It is crucial when establishing your LLC to apply for an EIN even if you do not plan to take on official employees just yet.

This number enables opening necessary business banking and merchant services accounts properly registered to your company rather than using your SSN which exposes you to risk.

Thankfully obtaining an EIN from the IRS takes just minutes online and does not have any fees associated. Simply navigate to the link above and answer a short Q&A about the type of LLC, responsible party, and basic business details. Providing an official LLC operating agreement is helpful to submit as well as associating the EIN formally with your legal business entity.

Additionally, when licensed and operational, you must pay keen attention to any sales tax requirements within your state. Most states mandate sales tax collection and filings for businesses of a certain size or industry type.

6. Setup Your Accounting

Proper accounting right from the start is crucial when launching your insurance agency to track revenue, manage overhead costs, and safeguard your assets. Unlike personal finances with more flexibility, meticulous bookkeeping, and reporting represent a legal requirement for businesses.

Accounting Software

Thankfully software like QuickBooks drastically eases the accounting workload through automated integration with business bank accounts and credit cards. This seamless synching categorizes everything appropriately minimizing manual entry. QuickBooks also generates indispensable reports on cash flow, sales tax obligations, and Profit & Loss statements and facilitates supplier payments.

Hire an Accountant

Engaging a qualified accountant provides immense value through supplemental services like monthly reconciliations to ensure accuracy, detecting weaknesses early, and consulting on tax strategy. Expect to invest around $200 – $400 monthly if leveraging an accountant for bookkeeping and advisory needs all year.

Open a Business Bank Account and Credit Card

Keep all insurance agency funds completely distinct from your finances through a dedicated business checking account. This demarcation strengthens credibility with carriers and lenders monitoring your balances. A business credit card also proves useful for higher limits.

7. Obtain Licenses and Permits

Launching an insurance agency demands strict adherence to licensure, including a general business permit for independent agents. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

Foremost this entails passing rigorous state exams testing competency across property, casualty, life, and health insurance policies after extensive credited coursework. Respective licenses must be issued before directly advising, selling, or servicing any insurance products. You should also check with your state insurance commissioner’s office for further requirements.

While not all states require it, applying for optional NAIC (National Association of Insurance Commissioners) agent/broker certifications signals credibility. This demands completing ongoing education modules annually plus ethics training reinforcing up-to-date technical expertise across your niche. Certifications also streamline reciprocity should you aim to expand regionally later.

Your newly formed LLC must also formally register with state regulators through detailed financial, ownership, and surety bond filing documents. The rigor varies by location but commonly includes submitting 3 years of projected financials tied to capitalization minimums based on the policies you aim to provide. The Small Business Administration has all the details.

While not leaping straight to mind often, additionally check local county/city statutes related to zoning codes and business licenses connected to office lease agreements in commercial areas.

8. Get Business Insurance

Insurance providers need insurance too. You may be able to use your products but can choose from other insurance carriers as well. Lacking proper coverage could wipe out your company quickly through just one oversight. Consider an agency denial of a valid claim or missed renewal notice eroding community trust.

Imagine a burst pipe flooding your office overnight destroying equipment, and files and rendering the space uninhabitable for months. Or a large commission billing error resulting in a detrimental lawsuit against the company. Maybe an electrical fire sparked from faulty wiring or a device chars the suite next door endangering other tenants.

In all scenarios without ample insurance, the agency faces crippling rebuild expenses or legal judgments far surpassing cash reserves. However certain policies mitigate such disasters before they bankrupt operations.

General liability insurance assists in covering 3rd party bodily injury, property damage, and also personal injury claims like libel or slander. For the physical office, specialized business property insurance covers equipment, furniture, tools, and inventory should disasters strike.

Along with commercial property insurance and professional liability insurance, agents may want to invest in commercial auto insurance for company cars.

Ensure specialty protection for data breaches compromising client information or valuable records. Having robust coverage encourages swift recovery minimizing any downtime.

9. Create an Office Space

Securing office space represents a pivotal decision when launching an insurance agency to meet with clients and conduct daily operations. The ideal location projects professionalism and convenience while working within early-stage budgets.

Coworking Office

For building in-person community connections, a vibrant co-working environment like WeWork enables a thrifty small space rental with flexible month-to-month agreements. These run approximately $300 – $800 monthly for a private office plus access to shared spaces like conference rooms, lounges, and kitchens to collaborate.

Retail Office

As the agency grows, leasing a traditional street retail space in a plaza or downtown storefront conveys an accessible neighborhood presence of around $2,000 monthly. Extensive build-out investments are required for permitting, compliance, and accessibility. Carefully scrutinize zoning laws for professional services within the area.

Commercial Office

Long term though, the premium visibility and infrastructure of a commercial office space help attract top talent and clientele expecting a polished headquarters. Class A buildings with ample parking and conference facilities project enterprise stability that seals deals. Expect lease rates around $20 per square foot in suburban regions, equating to $2,000 monthly per 100 square feet.

10. Source Your Equipment

Launching an insurance agency primarily requires office furniture and technology more than specialized gear. With a lean startup mentality, buying quality used equipment or flexible rentals keeps overheads low while remaining professional.

Buy New

When buying new, local office supply stores like Staples and Office Depot offer desks, file cabinets, chairs, and basic tech affordably, expect around $5,000 initially. For higher-end furnishings, look to dealers like Hon and Allsteel scoring durable pieces for client meetings running $15,000.

Buy Used

Buying used through aggregators like Facebook Marketplace and Craigslist discovers serious savings of around 50-70% off retail, invaluable during tight cash flows early on. Expand searches beyond geography for the best selection. Expect around $2,000 in procuring solid wood desks, reception seating, and conference tables.

Rent

Renting smaller equipment also provides flexibility as needs evolve. Copiers essential for policy paperwork run $150+ monthly through vendors like Xerox. Marketing material printers rent affordably from Providers like Tempest.

Lease

For office space itself, the ability to lease and then sublease once stabilized keeps things asset-light initially. Some commercial spaces now even rent workstations all-inclusive with tech and supplies monthly starting at around $250 per employee.

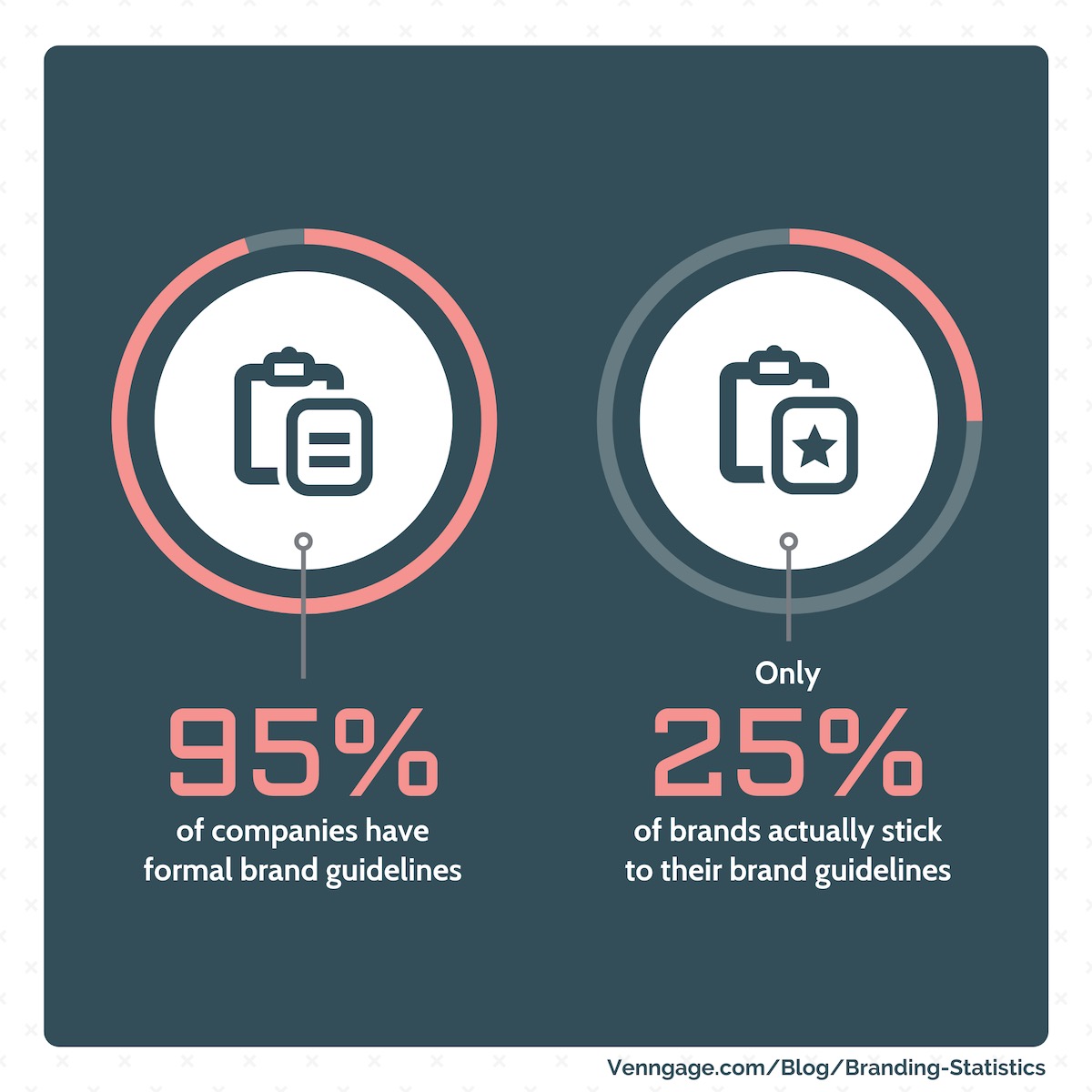

11. Establish Your Brand Assets

Establishing a distinctive brand presence fuels recognition, referrals, and retention for an insurance agency. While tedious initially, thoughtfully crafted visual identity and branded touchpoints make lasting first impressions with clients.

Get a Business Phone Number

Centralizing communications under a dedicated business phone number adds legitimacy to using providers like RingCentral. Call flows easily redirect across staff cell phones with customizable greetings and on-hold messaging reinforcing branding.

Design a Logo

Creating a sleek, memorable logo also makes it recognizable at a glance. Logos encapsulate brand values quickly through color schemes, fonts, icons, and shapes. Services like Looka craft options based on your vision and industry. Vector files scale print materials while pixel iterations enable digital usage across websites and social media.

Print Business Cards

With a color palette and logo established, order professional business cards showcasing credentials prominently from convenient printers like Vistaprint. These come clutch while networking events, trade shows, and client meetings. Title hierarchy, contact info, and taglines incite conversations.

Get a Domain Name

A branded web presence proves vital as well, hence purchasing an intuitive domain name containing your agency name or keywords raises awareness. Providers like Namecheap make registering .com domains affordable for the long haul.

Design a Website

Building out pages, website builders like Wix requiring no coding skills deliver stunning results through premade industry templates and SEO optimization. For fully custom designs, Fiverr freelancers provide affordable packages. Start with highlighting your expertise, carrier partners, policy guide, and contact page.

12. Join Associations and Groups

When starting an insurance agency, tapping local connections both in-person and online delivers an invaluable support system. Industry associations, networking events, and digital communities provide hard-won advice from fellow business owners navigating the trenches daily much like you.

Local Associations

Joining respected groups like your regional Association for Independent Agents chapter opens referral pipelines through member directories while keeping licensing requirements current. Expect nominal annual membership fees of around $200. Learn more about their 200 chapters nationally. Check out any national association that catches your eye as well.

Local Meetups

Attending monthly trade organization meetups also encourages organic relationship building that blossoms into reciprocal referrals over time. Use Meetup to find gatherings of agents, risk advisors, and financial professionals nearby. Most host presentations on trends alongside open-agenda mingling cementing bonds. Expect some $5 event fees and potential memberships.

Facebook Groups

If unable to attend live conferences, industry-specific Facebook groups enable crowd-sourcing guidance on everything from recommending E&O policy carriers to marketing campaign feedback from thousands nationwide. Join the Insurance Agent Opportunities and Insurance Professionals to start getting to know others in your field.

13. How to Market an Insurance Business

Implementing marketing initiatives consistently primes an insurance agency to sustain new client growth and retention. While word-of-mouth referrals remain invaluable, laying digital and traditional foundations proactively builds visibility.

Personal Networking

Tap your inner circle excitedly sharing this entrepreneurial milestone on social channels. Offer followers an exclusive friends & family discount on policies to incentivize conversions while getting testimonials. Spotlight these reviews on your website and Google Business profile.

Digital Marketing

Digital marketing thereafter enables scalable lead generation with detailed reporting. Consider:

- Launching a Google Ads campaign with geo-targeted keywords around customized coverage for niche demographics

- Running retargeting ads on Facebook to website visitors yet to convert to capture more sales

- Starting an educational YouTube channel or podcast discussing specialized policies

- Guest blogging for local financial advisors highlighting career partners

- Publishing quarterly policy explanation videos on Instagram Reels and TikTok

- Sending direct mailers to existing clients with policy reviews and additional options

- Trying billboard or radio ads in your very local community announcing new agency

- Sponsoring Little League teams and community events to support the area

Traditional Marketing

While digital channels typically deliver the best return on investment, never overlook traditional techniques in the area directly around your office. Mailers, flyers, event sponsorships, and signage trigger curiosities often converting sales simply from familiarity built through months of subtle exposure.

The most effective marketing naturally combines digital and traditional while focusing on very specific neighborhoods and demographics. Continually test new messages and offers while phasing out any underperforming assets quickly. Let the data dictate strategies in launching this exciting venture!

14. Focus on the Customer

Providing five-star customer service must remain the cornerstone when launching an insurance agency targeting growth. In an industry historically perceived as sales-driven, establishing genuine value and care around clients sets you apart. This gravitational approach pulls in referrals continuously.

For example, during policy renewals take time to explain newer coverages and limits that protect families further as their assets and incomes increase. Or advise reviewing insured valuations on homes appreciating in hot markets to avoid underinsurance threats. Guide customers to tailored life insurance updates ensuring coverage suits growing families properly.

Little thoughtful touches like sending birthday cards to policyholders fuel connection beyond just premium payments. Such conscientious service earns incredible word-of-mouth praise. A customer wowed by your meticulous analysis of their assets across insurance, investments, and retirement planning eagerly refers to other friends seeking similar attention to detail.

Insurtech platforms made self-service quote comparisons easy. Competing on price alone becomes impossible over the long term. However, no algorithm can replace human compassion, expertise, and genuine relationship building. An exceptional experience during claims resolution also bonds customers for life.