The construction industry is booming, with the overall market expected to reach $12.7 trillion globally by 2027. In the US alone, over 712,000 contracting firms brought in $1.4 trillion in revenue in 2021. This massive industry presents a major opportunity for aspiring business owners looking to tap into steady demand.

Launching a successful general contracting firm requires more than just construction know-how. You need to understand bidding, project management, HR, financing, and legal compliance. Building up a solid reputation and network of repeat clients is also essential.

This guide will walk you through how to start a general contractor business. Topics include market research to build a business plan, competitive analysis to learn about market trends, customer focuses to improve brand loyalty, registering your EIN, and more.

1. Conduct General Contractor Market Research

Market research is essential to open a general contracting business. Research offers insight into market trends, your target audience, the right type of business license, where to source materials, and more.

Some details you’ll learn through a general contractor business structure include:

- Residential building leads the construction industry.

- With high demand and low housing inventory, residential contractors should continue seeing steady business.

- Office, healthcare, educational, and public safety structures also offer lucrative opportunities.

- As the economy recovers post-pandemic, commercial construction will ramp up.

- Infrastructure spending by government agencies supports public works projects too.

- Securing government contracts can provide general contractors with major revenue.

- Specialty trades within construction are growing faster than the overall industry.

- Focusing on higher-growth niche markets can thus boost success.

- Becoming an established general contractor still poses challenges.

- Startup costs, licensing requirements, skilled labor shortages, supply chain issues, rising material prices, and intense competition all create barriers.

With proper planning, expertise, and grit, the expansive construction industry can offer financial freedom. Analyzing local market conditions, developing a sound business plan, securing financing, building up operations, and delivering superb service quality are key.

2. Analyze the Competition

Understanding the competitive landscape is critical for any new contractor in their local area. Taking time to thoroughly evaluate established rivals can reveal key opportunities for positioning your firm and going after less saturated markets.

- For brick-and-mortar contractor businesses, drive around town and identify competitors’ signage on active job sites.

- Take notes on the locations, types of projects, size of homes or buildings, and anything that gives hints about their target clientele.

- Search online to find their websites as well, looking for how they market their services.

- Compile a spreadsheet with competitor details like years in business, photos of past projects, number of reviews, services offered, certifications claimed, and any unique selling points touted.

- Evaluating online presence also matters today.

- Search yourself as a customer to see ratings and feedback left for competitors.

- Identify who dominates first-page search rankings for relevant keywords like “home remodels” too, signaling their digital marketing strengths.

- Analyze permit data from sources like Construction Monitor to gauge each firm’s contracting activity over time.

Combining online intel, public data, job site observations, and insider opinions lets you map the competitive landscape surrounding general contractors in your area. Identify potential gaps in the market or subpar players you can improve upon. Also, note the strengths of top firms that you may want to emulate.

3. Costs to Start a General Contractor Business

Starting a contracting company requires significant upfront capital and responsible financial planning to cover ongoing overhead while slowly building up your clientele.

Here is a realistic breakdown of typical expenses aspiring contractors face:

Start-Up Costs

- Licensing & Registration Fees – $200 to $500 You’ll need to pay licensing and permit bonds with your state contractor’s board. Costs vary but typically start around $200.

- Insurance – $3,000 per year A standard general liability policy runs $50k to $100k a year. Product liability and other coverage may be extra.

- Equipment & Tools – $15,000 to $75,000 Expect a major investment in equipment like trucks (box trucks, semis, hot shot trucks, etc.), trailers, loaders, generators, and all the power/hand tools required for your trade and distribution services.

- Office Lease Deposit – $3,000 to $5,000 Unless working from home initially, put at least a few thousand down for the first/last month’s rent on basic office space.

- Legal & Professional Fees – $2,000 Lawyers and accountants cost money when starting a business. Budget accordingly.

- Marketing Collateral – $1,500 Website, graphic design services, printed marketing materials. This gets your branding and name out there.

- Miscellaneous Supplies – $1,000 Office furniture, computers, phone/internet, inventory prep, and other random needs add up.

Ongoing Costs

- Insurance Premiums – $250 to $830 Paying monthly premiums towards your annual liability insurance costs.

- Office Rent – $1,200 to $1,800 Modest commercial unit rents range from $1 to $1.50/square foot monthly.

- Salaries & Wages – $4,000+ per employee. Expect to hire administrative help and laborers to grow. These costs add up quickly.

- Gasoline & Vehicle Maintenance – $750+ Fuel and keeping your fleet running well has ongoing costs.

- Tools/Equipment Maintenance – $500 Construction equipment requires proper upkeep and replacements as things wear out.

- Office Supplies – $250 Misc supplies like paper, pens, postage, cleaning items.

- Utilities – $350 Electricity, water, phone, internet, and other utilities.

- Accounting & Payroll Services – $150+ per month. Outsourcing payroll, quarterly taxes, and accounting tasks costs but saves headaches.

- Insurance Annual Premiums – $3,000+ per year. Some premiums may only require annual instead of monthly payments.

- License Renewals – $100 to $250 per year Stay compliant with all state and local licensing maintenance fees.

- Continued Education – $500 per year Many states require contractors to earn continuing education credits yearly through courses. Budget for class costs and time off.

- Taxes – 30% of taxable income Plan for quarterly estimated income tax payments. You may owe 30% or more of taxable earnings.

As you can see, running a properly equipped, licensed, and staffed contracting business has hefty start-up and ongoing costs. Conservatively project your cash flow needs and secure financing before leaping. Once established, a well-built construction services firm can deliver long-term profitability.

4. Form a Legal Business Entity

To form your own general contractor business, you must first form a legal business entity. The business structure you choose impacts everything from ownership decision-making to liability. The four most common entities include:

Sole Proprietorship

Simplest structure with no formal registration needed beyond licenses. However, no legal separation exists between you and the business. General contractors face substantial liability risks that can bankrupt you personally without protection.

Partnership

Allows sharing ownership and liabilities with a partner. May access greater funding by combining assets and credit. However, any partner’s negligence leaves the other exposed legally and financially. Messy to dissolve if disagreements occur. Rarely suitable for contractors considering hazards.

Limited Liability Company (LLC)

Provides liability protections for members while limiting personal risk only to your investment as an owner. Taxes as a pass-through entity. No double taxation on corporate earnings. Overall best option for shielding contractors from debts and legal claims arising from projects while operating flexibly as a small business. Easy to add members/investors too as you grow.

Corporation

Establishes the contracting firm as a legal entity entirely separate from owners. However double taxation occurs on corporate profits and earnings distributed to shareholders. Significant legal paperwork is needed for formation/dissolution. Works for larger contractor businesses wanting to raise funds via share offerings and have a perpetual enterprise beyond current ownership. But cumbersome for small operators.

5. Register Your Business For Taxes

An Employer Identification Number (EIN) serves as a unique tax ID number for your business to identify it specifically to the IRS. Similar to how your SSN identifies you as an individual for tax purposes, an EIN does the same for a business entity.

As a contractor, legally you must obtain an EIN if you do any of the following:

- Have employees

- Operate your contracting business as a corporation or partnership

- File retirement or excise tax returns

- Have a Keogh retirement plan

If you run your business as anything beyond a sole proprietorship, you likely require an EIN. Some states may also need you to have one before issuing state tax IDs or business licenses.

Applying for an EIN with the IRS only takes a few minutes online. Simply:

- Go to the IRS EIN Assistant

- Answer questions about your business and ownership structure

- Provide basic contact details

- Get your EIN immediately upon submitting the form

The entire application to obtain your federal EIN is free directly from the IRS and gives you an essential tax identifier for operating legally.

You’ll also want to visit your state’s business tax website afterward to register for sales tax reporting needs, which vary by location. Handling both federal and state requirements upfront ensures full legal compliance as a contractor.

6. Setup Your Accounting

Proper financial record-keeping is crucial in the contracting field given large purchase volumes, payroll needs, tax liabilities, and complex project budgets. Getting set up correctly with accounting software streamlines tracking all transactions and expenses.

Hire an Accountant

While programs help organize finances, partnering with an accountant uniquely qualified in contractor operations brings further value through customized bookkeeping, job costing analysis, quarterly sales tax filings, and identifying all allowable deductions you may miss out on. Expect to invest around $200 per month for full reconciliation services up to assistance in preparing year-end returns.

Open a Business Bank Account

Separating business and personal finances also remains critical. Keep expenses clear and compliant by using a dedicated business checking account and credit card solely for company purposes.

Apply for a Business Credit Card

Applying for contractor business cards looks at your company’s financials rather than your credit score. Provide your EIN, time in business, revenue, and other key details. Expect a lower credit limit initially but responsible use builds your business credit.

Accounting Software

With intricate projects, payroll runs, equipment purchases, and material costs, construction accounting gets complex fast. Using the right accounting software streamlines services. QuickBooks is the leading accounting software product to simplify invoicing, payroll, and more.

7. Obtain Licenses and Permits

Operating legally as a contractor requires more than just technical skills – proper credentials mandated by law matter too. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

Failing to comply with any required permitting and licenses can lead to tens of thousands of dollars in fines, inability to pull local permits, legal action from injured parties, revocation of your state contractor registration, or worse. Doing things by the book protects your business just as much as your clients.

Common licenses include:

- Contractor’s License – Issued by a state licensing board after proving technical competence, financial stability, and knowledge of building codes/regulations. Usually requires both a written exam and practical demonstration of skills.

- Home Improvement Contractor Registration – Over a dozen states mandate that contractors specifically doing remodeling projects like kitchens, baths, and additions formally register with state authorities.

- Lead Certification – Federal EPA rules require contractors disturbing paint in pre-1978 homes to obtain Lead-Safe certification for minimizing hazards and safely containing contamination. Mandatory despite costly classes and fees.

- Trade-Specific Licenses – Electrical, plumbing, and HVAC work needs licensed professionals under state laws. Subcontract specialty services until holding these credentials (or don’t provide them illegally).

Secure all mandatory licenses before marketing services, pulling permits, or signing contracts. Renew registrations punctually too and save all credential documents on projects. Skilled trades may require ongoing education as well to uphold licenses over time. Streamline compliance by using tools like LicenseSuite to confirm specific requirements based on your locations and specialties.

8. Get Business Insurance

Securing proper business insurance protects contracting companies from financial ruin when the unpredictable occurs on job sites:

General liability insurance handles 3rd party property damage and bodily injury claims. It shelters you from expenses should a site accident or failure like a collapsed wall hurt someone or destroy belongings. Policies start around $1,000 annually.

Going uninsured threatens your company’s survival through:

- Customer Injury Lawsuits – Say faulty scaffolding collapses and shatters a client’s leg. Their medical bills and lost wages could easily exceed $100k, bankrupting you.

- Employee Injury Claims – You pay worker’s compensation but if lapsed, even one worker falling off a ladder could bring a six-figure liability.

- Client Property Damage – Something as basic as a damaged driveway from a cement truck mix-up could run $50k+ to fix.

Obtain quotes tailored to your trade services and risk profile from providers like Next Insurance and Hiscox. Expect at a minimum:

- General Liability – Covers 3rd party injury/damage

- Workers Compensation Insurance – Shelters payroll workers if injured

- Tools & Equipment – Reimburses stolen/damaged assets

In just minutes you can apply online and secure coverage necessary for operating safely at scale. Don’t gamble everything on avoiding mistakes – get insured properly first.

9. Create an Office Space

An office provides contractors with centralized space for meeting clients, storing documents, managing staff, and housing equipment securely. While starting home-based saves costs, location-based offices prove useful as you grow.

Coworking Space

Shared spaces like WeWork offer cost efficiency with amenities (conference rooms, printing, front desk staff, etc.) he, helpful when meetings arise. Typically $200 to $500 monthly for flexible access. Limitations on storage and noise may interfere with workflow.

Retail Office

Rarely suitable unless also operating a showroom. Customers won’t regularly visit offices when projects happen on-location. Significant overheads like long leases and retail buildouts cut into margins with little upside.

Commercial Office

Leasing basic office space in a business park optimizes professionalism when clients visit to sign agreements and access files. Expect small units (2-5 rooms) to start at around $1,000 monthly plus utilities and telecom costs. Allows room for admin staff and dedicated conference space to showcase your operations best when growth allows for the sizable rent investment.

10. Source Your Equipment

From power tools to heavy machinery, properly equipping a new construction business means encountering major costs. Balancing quality and value when acquiring assets saves money long-term.

Buying New

Shiny finishings may impress but modern tools and fleet vehicles lose significant value immediately. Local dealers offer convenience but high prices compared to discounts online. Use Amazon Business for up to 45% off name brands on large orders.

Buying Used

Previous owners mean wear and tear, but used equipment costs a fraction of new while still performing for years. Scout deals on marketplaces like Craigslist, OfferUp, and Facebook Marketplace. Traveling to inspect the condition first is worth avoiding online scams.

Renting

Long-term rentals make little financial sense but meet temporary spikes in project demands. National chains like Herc Rentals offer contractor rates while mom and pops provide better customer service. Using rentals strategically when buying extra machinery seems wasteful.

Leasing

Pay recurring fees over 3-5 years in exchange for maintenance/repair inclusion from dealers. Ideal for complex machinery like bulldozers or cranes. Credit checks determine rates, so smaller operators may not qualify. Leasing simplifies upgrading later without major out-of-pocket expenses.

11. Establish Your Brand Assets

Crafting a distinctive brand presence fuels recognition and trust in an increasingly crowded contractor marketplace. Investing in professional branding signals operational legitimacy and a commitment to quality to prospective clients from the outset.

Getting a Business Phone Number

Toll-free numbers make far-flung jobs reachable for customers. Cloud-based systems like RingCentral provide customizable greetings, extensions, voicemail, and analytics revealing call volumes and peak times. Expect around $30 monthly for robust features and reliability vital for never missing project inquiries.

Creating a Logo and Brand Assets

Consistent logos, typefaces, color schemes and messaging visually unite websites, trucks, apparel, signs, and other surfaces. Looka’s AI logo maker delivers multiple on-brand concept drafts matching your vision affordably. Opt for icon-driven designs that symbolize your specialty trade for memorable impact.

Business Cards and Signage

Professionally printed cards establish credible first impressions when meeting homeowners and subcontractors. Highlight beautiful past project photos and key contact info concisely. Pair with job site signage so passersby can instantly recall your brand later. Vistaprint offers 500 basic cards affordably.

Purchasing a Domain Name

Domains with your business name instill consumer confidence in search standing out vs rivals. Use .com over alternatives and check trademark conflicts. Namecheap features affordable registration and hosting bundles to then build out your online presence.

Building a Website

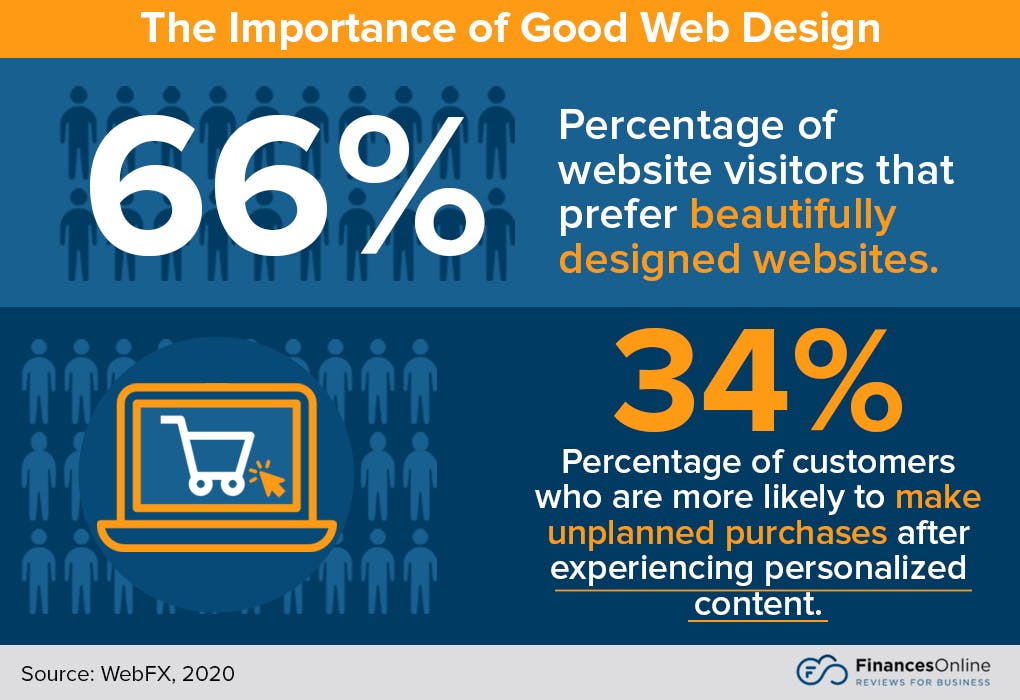

Well-designed websites demonstrate technical competence through visual portfolios and client testimonials. DIY site builders like Wix offer template-based simplicity for under $15 monthly. Or hire a web developer on Fiverr for a more robust custom site if budget allows.

12. Join Associations and Groups

Joining regional construction associations, events and online communities accelerates professional growth through sharing best practices and forming partnerships. Surrounding yourself with fellow trade experts ensures you never stop progressing.

Local Associations

Area chapters of the Associated General Contractors of America offer member contractors exclusive leads, discounts, and access to continuing education/certification programs. Expect annual local dues of around $500.

Local Meetups

Attend nearby networking happy hours, tradeshows, and seminars listed on Meetup to connect face-to-face with fellow contractors and clients alike. The platform helps easily pinpoint frequent regional construction events to regularly keep your network thriving.

Facebook Groups

Industry-related Facebook communities enable asking questions and getting feedback from contractors across your state or country. Join targeted groups like Contractors & Subcontractors and Companies and people who need Contractors to access crowdsourced insights 24/7.

13. How to Market a General Contractor Business

Implementing ongoing marketing expands a contractor’s reach and jobs won far beyond relying solely on word-of-mouth referrals. As no two clients discover services identically, utilizing diverse digital and traditional channels proves necessary, especially early on.

Tap Your Network

Satisfied homeowners become vocal advocates to their peers. Offer referral bonuses or gift cards in return for introductions to new clients. Simple incentives give previous customers that extra nudge to connect you with their inner circles actively.

Digital Marketing Ideas

- Run Google/Facebook ads touting your specialty trade and targeting homeowners within 10 miles. Geo-fencing around affluent neighborhoods boosts exposure. Expect to invest at least $500 monthly to optimize conversions.

- Launch a contractor-advice YouTube channel or podcast covering remodeling processes. Embedding how-to videos onto your site raises viewership and search visibility.

- Write blog posts about recent projects to attract localized web traffic. Optimize content for keywords like “kitchen remodels” and “bathroom contractor.”

- Post before/after photos and customer testimonials consistently on social channels. Audiences connect with the journey.

- List your services on marketplaces like HomeAdvisor and Porch to get hired for leads in your area.

Traditional Marketing Ideas

- Print full-color flyers and mailers showcasing your services for residents in higher-income ZIP codes. Include limited-time percent-off coupons or free design consultations.

- Sponsor booths at home shows and food festivals – they attract engaged attendees. Distribute merchandise for additional impressions.

- Run radio spots on local stations describing offerings. Tailor messaging to programming formats.

- Place targeted billboards along frequently trafficked routes near construction hotspots. Highlight a specialty like kitchen remodels.

- Advertise discounted services on community boards at libraries, rec centers, and churches.

Mix both digital and traditional campaigns while analyzing returns. Doubly focus efforts on referral, social, and localized lead generation for efficiently reaching neighborhood project decision-makers.

14. Focus on the Customer

Providing five-star service ensures every client becomes a vocal advocate who refers dozens more neighborhood projects your way. Home construction and renovations represent highly personal, complex, and costly endeavors for customers.

Consider a kitchen remodel contracted for $35,000 taking two months to complete. By sending weekly email updates with photos documenting progress, resolving any concerns promptly, and leaving the family delighted with their forever home upgrade, you gain a halo client.

The homeowner then enthusiastically shares their experience at neighborhood gatherings, with extended family members looking to also refresh their outdated kitchens, and across social media tagging your company directly. Thanks to going above and beyond you quickly become an in-demand area contractor.

Now imagine this same scenario but multiple delays occur, blunders force changes mid-project and dust/noise disrupt the homeowners’ lives significantly for weeks. Your reputation gets tarnished plus repeat/referral business dries up fast.

Construction competency keeps client costs reasonable but hospitality makes or breaks reputations driving repeat requests. Bond with customers through superior service accelerating profitable growth for years.