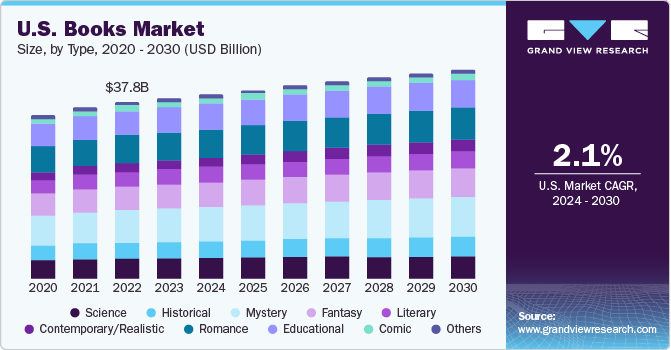

The U.S. book industry has seen a rise in success. As of 2021, the book industry reached $138.35 billion. With a compound annual growth rate (CAGR) of 2.2% from 2020 to 2030, now is the time to get involved.

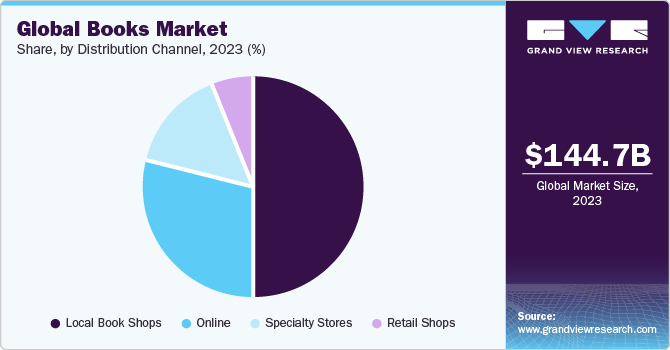

The industry faces competition from mega online retailers like Amazon, which accounts for over half of all book sales. Still, locally-owned independent bookstores saw sales increase by over 1% last year, showing there is still demand for the in-store browsing experience and community hub that local booksellers provide.

This guide will walk you through how to open a bookstore. Topics include market research, opening a business bank account, the best social media accounts to market through, registering an EIN, obtaining business insurance, and everything else you need for your retail business plan.

1. Conduct Bookstore Market Research

Market research is essential to every bookstore ownership. It offers insightful details relevant to your business plan, including information on your target market, pricing guide, and local market saturation.

Some of the information you’ll learn through market research as you start your own bookstore include:

- The best opportunities in this market may lie with opening an independent bookstore in an affluent metro area that lacks existing competition.

- Ideal target locations have over 50,000 residents, high education levels, and pedestrian-friendly downtowns.

- Expertise in navigating inventory, pricing, event planning, and community networking will be key competencies for success.

- Profit margins for independent bookstores average around 3-4%, requiring lean operations and multiple revenue streams beyond just book sales, according to Forbes.

- Most independent bookstores derive around 60% of revenue from book sales, 30% from non-book products like gifts, gift cards, and stationery, and 10% from events/services, according to an analysis in Forbes.

- Additional growth opportunities include expanding into used/rare books, corporate sales, comics, self-publishing, and e-commerce.

- Ongoing expenses like payroll, rent, utilities, and inventory replenishment account for around 57% of an average store’s operating costs according to industry data on AZCentral.

- Securing small business financing and planning capital reserves is essential before leaping to open a store.

Given razor-thin margins, many bookstores fail within their first few years without adequate planning. However, for book lovers equipped with sharp business acumen and access to financing, an independent bookstore or book business can provide a rewarding opportunity to turn your passion into a career.

2. Analyze the Competition

Competitor analysis is crucial when assessing the viability of a bookstore in a given location. For brick-and-mortar stores, identify existing booksellers in the area through online directories and observation. How many direct competitors are there, and how do their selection, price points, and ambiance compare? This competitive analysis can reveal market saturation or gaps you could fill.

Some ways to get to know more about other bookstores in the local community include:

Evaluate foot traffic numbers if possible, for both pedestrians and vehicles. Higher traffic areas enable more spontaneous shoppers to discover you.

- Tools like Esri’s Tapestry Segmentation database also classify neighborhood demographics like household income and consumer habits to gauge book-buying potential.

- Online competitors go beyond physical stores nowadays.

- Research the Amazon and big box book market share for context, since they dominate overall book sales through aggressive discounts and vast inventory.

- More importantly, search the web for bookstores with an existing e-commerce operation local to your target area.

- Review their web traffic analytics through SimilarWeb and SEMrush to assess traction. This determines baseline digital visibility to inform your online strategy.

- While daunting, analyzing both physical and digital competitors equips you with valuable intelligence. It could reveal lucrative niches in your region lacking focused bookstore coverage.

- It also sets achievable benchmarks for foot traffic, revenue, inventory, and web presence at launch based on those already operating successfully.

With rigorous competitive analysis, your eventual positioning and promotions directly counter existing options’ limitations.

3. Costs to Start a Bookstore Business

When starting an independent bookstore, the majority of initial start-up costs stem from inventory, location establishment, and any built-out construction/renovations needed.

Start-up Costs

- Inventory is typically the largest expense, averaging around $35,000 for an initial stock of 2,500 to 6,000 book titles.

- It’s advised to open with at least 2,500 carefully curated book titles. Genres should be focused on assessed community interests and local author works.

- Budgeting $12-15 per book allows for wholesale discounts and a good profit margin.

- Securing an affordable retail space in a location with strong foot traffic will influence start-up costs too.

- The average small retail space of 1,200-1,500 square feet commands a price per square foot from $15 on the low end, up to $35 in highly desirable areas.

- With build-out costs, first and last months rent, and security deposit, expect an upfront investment of $25,000-$45,000 to secure a space.

- Any contractor construction, permits, furniture, furnishings, and decor will also vary widely depending on renovation needs.

- Budget $15,000-$30,000 for basic updates like flooring/walls, lighting fixtures, and display tables/shelving. Used furniture and decor also keep costs down.

Operational expenses during the launch include areas like:

- Business registration fees and licenses – $2,000

- Lawyer fees to review paperwork – $500

- Accountant fees to advise on setup – $300

- Retail inventory software – $1,500/year

- E-commerce platform fees – $500/year (base Shopify plan)

- POS equipment/receipt printer – $300

- Website design – $3,000 basic site

All total, expect around $80,000-$150,000 in start-up costs when funding your inventory, location, build-out, and core infrastructure. Many prospective bookstore owners seek small business loans and grants through the SBA.

Ongoing Costs:

- Payroll expenses at $25/hour with 1-2 employees – $48,000/year

- Rent payments at $3,000/month for 1,500 sq ft – $36,000/year

- Repaying small business loan debt

- Monthly utilities like internet and electricity – $500/month

- Insurance policies like business interruption & liability – $1,200/year

- Inventory replenishment and new titles – $20,000/year

- Funds allocated for author events/marketing – $5,000/year

Careful financial planning and projections establish adequate funding to operate through the first 1-2 years post-launch. This covers overhead until it reaches stable profitability. Expect combined monthly operating expenses of around $7,000-$10,000 on average.

4. Form a Legal Business Entity

When establishing a bookstore, choosing the right legal structure impacts everything from day-to-day operations to personal liability exposure. The most common options entrepreneurs face are sole proprietorships, partnerships, corporations, or LLCs.

Sole Proprietorship

As a sole proprietorship, you retain complete control and avoid corporate taxes. However, your assets remain vulnerable to any business debts or lawsuits. Sole proprietorships also limit financing options for expansion. While easy to initially establish, a sole proprietorship has high risks for fledgling bookstores.

Partnership

Forming a partnership could alleviate capital constraints by bringing aboard a co-owner to share costs. However, conflicting visions and unclear decision-making authorities strain even close partnerships over time. Partnership disputes that require buying out an owner’s stake could also sink an early bookstore.

Corporation

Many established chains register as corporations, which enables selling stocks to raise funds from shareholders rather than loans. However, corporations require regular shareholder meetings, extensive record-keeping, and double taxation. For a bookshop just gaining its footing, maintaining corporate compliance has high time costs for minimal benefit.

Limited Liability Company (LLC)

Registering as a limited liability company (LLC) combines the simplicity of sole ownership with protection from liability claims. Unlike sole proprietors, LLC status shields your house, car, and savings if the business faces a lawsuit. An LLC limits record-keeping requirements and allows an easier transition to add new co-owners down the road.

5. Register Your Business For Taxes

An Employer Identification Number, known as an EIN, essentially functions as an SSN for your business entity. All bookstores need to obtain their own unique EIN from the IRS, even if they don’t plan to immediately hire employees.

The EIN designation allows you to open business bank accounts, apply for specific licenses and permits, and file tax returns for your store’s earnings separate from your returns. Obtaining an EIN only takes minutes through the IRS website.

To apply, first gather personal identification details like your name, address, date of birth, and SSN. Then visit the IRS EIN Assistant page at irs.gov to begin:

Answer a short Q&A, entering your chosen business name and structure. Specify the type of operation as “Other” for a bookstore. Provide your SSN when asked.

After submitting through the online portal, your EIN gets issued immediately. Make sure to record this number for safekeeping along with any confirmation notices. Officially establishing your business entity with an EIN also means you must start collecting and remitting state/local sales tax from customers once retail operations launch.

State requirements vary, but generally, you must register your bookstore for sales tax collection through your State Revenue office if making over $100,000 in annual transactions. The thresholds and paperwork differ by location – your Secretary of State’s website details the next steps to comply based on projected revenue.

Altogether an EIN only requires about 15-20 minutes to acquire online. Take the time upfront to register your store properly at federal and state levels before opening doors to the public. Doing so ensures your independent bookshop operates legally as its entity, separating your company’s taxes and finances from personal liability.

6. Setup Your Accounting

Maintaining organized financial records is imperative, yet often overlooked when launching a bookshop. Poor accounting easily sinks budding businesses. Using accounting software streamlines the categorizing of income, expenses, account reconciliation, and tax document collection in one dashboard.

Accounting Software

QuickBooks integrates directly with your sales platforms, POS terminals, and bank/credit accounts. In one glance you can assess daily sales performance, pay bills, and have data automatically populate tax forms. QuickBooks plans start around $25/month for core features like automated invoicing and cash flow forecasting that save hours of manual calculations.

Hire an Accountant

Ongoing services like monthly bookkeeping and sales tax guidance also provide robust financial insights compared to tackling everything solo. Expect to invest around $200 per month for such standard accounting support. Come tax season, an accountant proves their worth by assisting with corporate and personal return filings, at about $800 annually.

Open a Business Bank Account

Strictly separating all store finances from your accounts prevents muddying the waters. Open dedicated checking/savings and business credit cards where every bookshop transaction flows through. Never combine company budget with household spending.

Apply for a Business Credit Card

Applying for a small business credit card not only augments reporting but also enables building your store’s credit history. Issuers determine limits based on time in business and reported income rather than your credit score. Manage repayments responsibly to establish helpful access to revolving credit for a rainy day.

7. Obtain Licenses and Permits

Beyond formally registering their business entity, booksellers must educate themselves on licenses and permits required by their jurisdiction before opening doors to customers. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

At the city level, confirm zoning regulations allow retail book sales from your desired location. Special use permits may be needed if based in a multi-use development or to stock niche items like rare books. Zoning approval costs around $100 on average.

Additionally, acquire a standard seller’s permit for moving physical products and occasionally serving beverages during author events. These municipal business licenses run $50-100 annually depending on special classifications like an antiquarian focus.

Your local police department must formally approve liquor licenses for select book talks or writing workshops where wine gets served. Banquet permits per event are simpler to obtain than ongoing liquor certification in many areas.

For physical stores, occupancy capacity and ADA accessibility rights must be showcased through prominently posted building permits and certificates aligned to fire codes. Architectural renovations like adding a cafe also require specific building and plumbing authorizations unique to bookshops.

Besides location requirements, proprietors and key staff need federally approved identification badges designating roles for store management oversight and shipping rare literary items. Register through the CBP’s Trusted Traveler programs. Enrollment runs $85 per applicant.

Don’t tackle licensing solo. Local Small Business Development Centers offer free guidance identifying permits often overlooked by first-time entrepreneurs. They also provide discounted application processing services to ameliorate costs and red tape for qualifying startups.

Cut through the bureaucracies early when establishing operations. Obtain permits before signing a lease or listing job openings to avoid unexpected barriers down the road. Then proudly display evidence of current credentials in customer-facing areas once open.

8. Get Business Insurance

Operating an independent bookstore carries innate risks that make insurance coverage essential. Unforeseen damages, liability claims, or inventory loss threaten devastating financial blows without proper protections.

Consider a pipe bursting overnight and flooding your store, destroying thousands of wares. Or a customer slipping on a newly mopped floor, demanding reimbursement for medical bills from resulting injuries. Even crimes like robbery or vandalism present constant dangers.

In all these scenarios, inadequate insurance exposes owners to crippling repair costs and legal judgments from a single incident. However, comprehensive small business policies allow recouping covered losses without assuming the full brunt personally.

Gaining coverage begins with assessing needs and requesting quotes. Define property dimensions, location hazards, inventory value, and projected gross annual revenue. Visit sites like Cover Wallet or Next Insurance to get free rate estimates matched to your bookstore’s circumstances.

Compare plans from providers like The Hartford. Prioritize guaranteeing fixed assets and liability with Property and casualty insurance first. Top-tier plans also include Business Interruption that covers income losses if forced to temporarily close after disasters. Adjust deductibles based on your budget and risk tolerance.

Follow up directly with favorable carriers to activate policies. Provide documented evidence of security systems, established business protocols and ownership structures insurers require to bind coverage. Expect the underwriting process to take 2-4 weeks before certified finalization.

9. Create an Office Space

Operating a bookstore necessitates administrative work beyond public browsing areas. An office supports functions like inventory management, accounting, event coordination, and online sales.

Home Office

Utilizing part of your home saves substantially on real estate. Expect costs of around $2,000 to furnish a basic desk and supplies for paperwork, phone calls, and digital listing maintenance monthly. However, distractions from family members can hamper productivity.

Coworking Office

Renting remote desk space in a shared coworking space like WeWork provides professional infrastructure and networking for $300 monthly. Enjoy high-speed internet, printing, conference rooms, and community events that amplify growth. But set hours hinder omnichannel retail.

Retail Office

If space allows, secure on-site storage and utilities for e-commerce processing/shipping. Budget $800 monthly for 500 usable square feet including a computer station and packaging materials. The backroom also aids incoming inventory logistics and paperwork overflow.

10. Source Your Equipment

Launching a bookshop requires outfitting the space with core retail infrastructure like shelving units, a sales counter, POS systems, and seating areas. While buying brand new maximizes durability, significant cost savings exist when buying quality used fixtures or negotiating short-term rentals.

Buy New

Purchasing new furnishings directly through retailers like WebstaurantStore enables customizing dimensions and materials like industrial steel shelving or solid wood coffee tables to suit your floor plan. However, with standard 6’ shelving units costing around $100 each and individual tables from $200-500, expenses add up fast.

Buy Used

Scour used office liquidators like ANEW Office Furniture to purchase fixtures owned by other businesses at 70-80% discounts. Facebook Marketplace and Craigslist also list local desks, shelves, and display cases from $25-100 available for convenient pickup. Just scrub carefully before placing items on your sales floor.

Rent

If you prefer not to make large upfront equipment purchases, renting month-to-month also works. National chains like CORT Furniture Rental offer short-term leases on furniture packages including shelves, lights, chairs, and more with free delivery/setup. Or find locals renting out tables via sharing sites like Neighbor Goods.

Lease

Likewise, essential POS, barcode scanners, and receipt printer systems necessary for ringing up customers sell outright for $300-500 each. Quality used units run around $100-150 through secondhand sites like eBay. Big box stores also rent checkout kits for about $50 monthly.

11. Establish Your Brand Assets

Establishing a consistent brand identity makes your indie bookshop memorable amidst chains and online algorithms. It signals an inviting space for browsers to discover new reads. Cohesive logos, color schemes, and messaging woven through the customer journey become the personality of welcoming patrons.

Get a Business Phone Number

Acquiring a unique business phone line via a provider like RingCentral professionalizes outreach. Expect a separate number with a custom greeting for about $30 monthly. Whether answering inquiries about inventory or confirming author event RSVPs, let callers reach a live team member dedicated to that location.

Design a Logo

Having a sleek yet meaningful logo also amplifies retention. Looka’s AI generates tailored iconography and letter marks capturing the essence of your niche, pricing as low as $20 per design. A neoclassical monogram matching antique decor or bold serif font signaling a progressive lean make impressions. Consider embroidering the mark on staff shirts as well.

Print Business Cards

Vistaprint produces affordable, quality business cards, signage, and branded merchandise that staff can share when hosting pop-up booths, securing consignment deals, and attending regional conferences. Expect around 250 basic cards for $20 featuring the handles for the store’s chosen web presence.

Buy a Domain Name

Purchasing the URL during the naming process prevents future hijacking while cementing SEO authority. When buying domains through Registrars like Namecheap for under $15 yearly, consider both primary and alternate phrasings in case the first choice sells out fast.

Design a Website

Building that online home requires deciding between convenient DIY platforms like Wix and hiring expert developers. Wix empowers novices to launch responsive sites through premade templates and user-friendly editors (around $150 annually). However, custom interactive features benefit from Fiverr pros charging $500+ per bespoke project.

12. Join Associations and Groups

Navigating the bookselling landscape solo quickly overwhelms fledgling owners. Instead, lean on groups like regional The American Booksellers Association and National Global Reading Network for camaraderie and counsel.

Local Associations

Most states host ABA affiliate chapters providing marketing guidance, staff training, and legislative advocacy tailored to that area. Joining grants access to wider industry developments, mentorship programs, discounted supplies through sponsor perks, and localized trend insights you’d otherwise lack.

Local Meetups

Meetup surfaces recurring chances to physically connect with fellow book enthusiasts and merchants nearby through its platform. Local enthusiast gatherings, niche genre talks, regional small business mixers, and mastermind roundtables abound for nominal attendance fees.

Facebook Groups

For business owners who can’t reach events in person, free online resources through Facebook groups are invaluable. Groups like Books Books and More Books, and The Rare and Collectable Books share ideas across a dispersed trade. Obtain rare copies, or connect with a small independent bookstore in your area.

13. How to Market a Bookstore Business

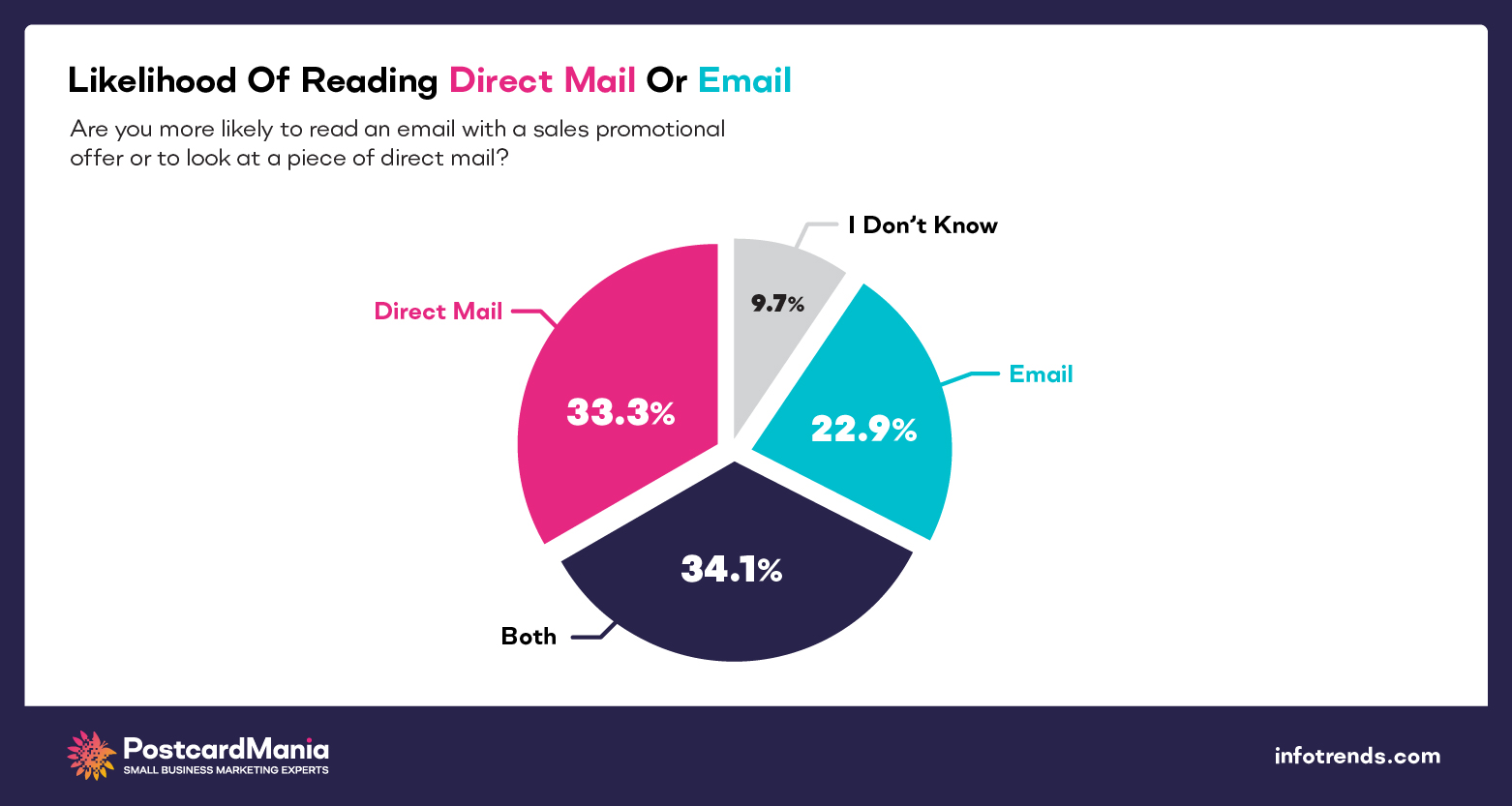

Cultivating an initial customer base is fundamental, but marketing expands visibility beyond just neighborhood regulars. Promotions make impressions that nurture patron loyalty even amidst online convenience. Invest consistently, leverage multiple channels, and encourage referrals to sustain growth.

Referral Marketing

Satisfied booklovers are your strongest advocates. Entice endorsements by offering signup incentives like members-only coupons to refer friends. Send exclusive previews of upcoming titles. Designate a VIP seating area for top reviewers’ book club gatherings in your book store.

Digital Marketing

Digital channels create conversions through:

- Google Ads geo-targeting local fiction enthusiasts with custom graphic text ads

- Facebook/Instagram posts showcasing staff picks and spotlighting visiting authors

- TikTok book haul partnership campaigns with BookTok darlings

- Goodreads profile connecting your inventory to wider reading communities

- Email newsletter previews of just-arrived releases sent to subscribers

Traditional Marketing

Traditional options cement place-based loyalty:

- Indie bookseller bookmark packs distributed in area Little Free Libraries

- Donating signed copies for school fundraiser auctions

- Sponsoring awards at regional writing competitions like spelling bees

- Public radio underwriting spots before NPR book reviews

- Print ads in locally-owned newspaper’s weekend culture section

Sustained, multi-dimensional campaigns make your shop share top-of-mind. The most effective outreach inspires book lovers to trace your URL after encountering sidewalk signage for an evening program. See them peek in the window another day and decide to finally come browse the shelves.

14. Focus on the Customer

Bookselling, though a product-driven business, hinges on authentic human connection and recommendations. The joy of discovering unexpected stories emerges from rich discourse with fellow readers. Investing in customer service thus breeds loyalty even amidst online convenience.

Staff should intimately know regional interests and niche genres. Tasteful recommendations elevate each patron’s experience while demonstrating your team’s qualifications. Send thank you notes when regulars refer friends.

Upselling through bundles and memberships increases order values and retention. Share previews of autographed copies arriving next month. Spotlight personalized niche subscriptions aligning new releases to documented preferences.

Consistent outreach earns referrals as devotees recognize your shop’s central role in their reading journey. They’ll proudly mention the neighborhood treasures in their communities. Soon your register rings with new faces who “just had to check the place out” after hearing unprompted peer endorsements.