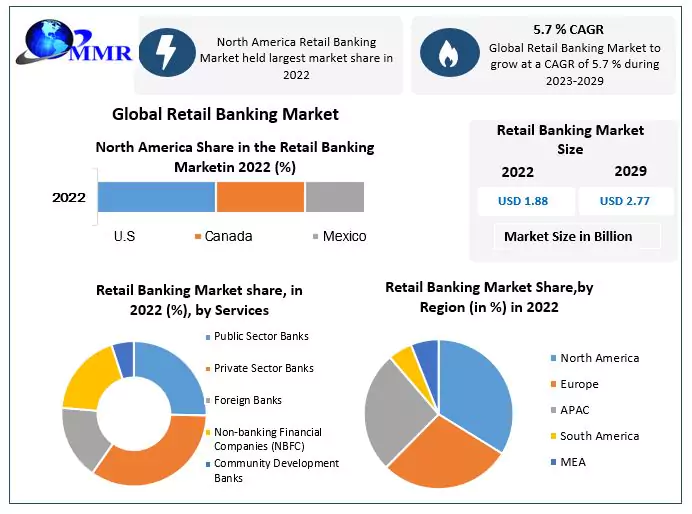

The banking industry is growing and evolving in the United States. The current compound annual growth rate (CAGR) is 4.44% from 2023 to 2028. This could bring the banking industry from $4.79 trillion in 2023 to $6.76 trillion in 2028.

In this comprehensive guide, we’ll provide key information to learn how to start a bank. You’ll learn the different types of banking charters available, capital requirements, regulations, licensing processes, choosing a location, developing products and services, building a team, marketing strategies, and more.

Whether you want to establish a community bank, regional bank, or even an online-only bank, this guide will help. By the end, you’ll have the knowledge and confidence to turn your dream of owning a bank into reality. Let’s start building!

1. Conduct Bank Market Research

Market research is essential to open your own bank. It offers insight into important data about other financial institutions, popular banking services like checking and savings accounts, risk manager infrastructure, and the federal reserve.

Some details you might learn through market research include:

- Modern banking practices: Digital banks now compete for digitally-savvy consumers. This presents an opportunity for new entrants with slick mobile apps, innovative features, and excellent user experience. Incumbents must digitize to retain customers.

- Untraditional banking: Another growth area is serving the underbanked, lower-income consumers often denied access to traditional financial services. New players like Chime prosper through broader inclusion.

- Business banking: The pandemic propelled digitization among small and midsize enterprises (SMEs). They now expect seamless digital services and hyper-personalization once limited to consumers.

- Geographic expansion: Geographic expansion also offers potential, especially in developing markets undergoing rapid modernization. Asia Pacific in particular will drive growth, with over 70% of global banking revenue coming from the region by 2026.

To capitalize on these trends, focus on mobile-first platforms, data-driven personalization, and frictionless digital banking. Market research helps further develop a strong business plan to serve your bank customers.

2. Analyze the Competition

Understanding the competitive landscape is crucial when starting a bank. Begin by identifying direct competitors, the largest national and regional banks operating in your geographic area. Analyze their branch locations, service offerings, fees, rates, and target customers.

Some ways to get to know the financial services industry competition in one banking and personal financial services include:

- For brick-and-mortar banks, visit nearby branches in person. Evaluate their layout, in-branch technology, staffing, and customer service experience.

- Identify potential advantages your bank could offer. Also, consider indirect competitors like credit unions and digital banks competing for customers.

- Evaluate competitors’ digital presence and features.

- Review their website design and mobile apps in app stores, comparing ease of use, functionality, and ratings.

- Sign up for startup bank accounts to test their account opening process and everyday banking experience.

- Look for pain points and unmet needs your bank could address, such as mobile banking, online banking, and other target market requirements.

- Analyze competitors’ social media presence and marketing.

- Follow their pages to see engagement levels, special offers, and events that attract customers.

- Search brand hashtags to find feedback and complaints you can learn from.

- Marketing spend data from similar web provides benchmarking.

By benchmarking competitors across all channels, you gain invaluable insight into customer preferences, pain points, and market white space. Use this analysis to differentiate your bank’s value proposition, location/geographic strategy, products, and digital presence.

3. Costs to Start a Bank Business

Starting an in-person or online banking business takes money. There are startup and ongoing costs you’ll encounter as bank startup entrepreneurs.

Start-up Costs

Starting a new bank involves substantial upfront investment. Before even opening for business, expect considerable costs for licensing, legal fees, technology, hiring, facilities, and more.

- Licensing and Legal – Just obtaining a bank charter can cost $2 million or more in legal fees, processing fees, and state requirements. Ongoing legal assistance for compliance may require an additional $200k+ annually.

- Technology – Core banking software, security systems, and digital platforms require an initial outlay of at least $5 million. Some turnkey solutions like Alkami offer SaaS pricing from $4000/month. Q2 charges enterprise pricing on a custom quote basis. Ongoing tech maintenance and support add another $500k+ per year.

- Staff – Expect initial hiring costs for executive and key support roles 6-12 months pre-launch. With competitive fintech salaries, budget $2 to $3 million in first-year compensation to build a lean team.

- Facilities – Minimum 5,000 sq. ft. for back office and customer banking space can run $30/sq.ft initially to buy/build and $5/sq.ft for annual lease in suburban locations.

- Initial Marketing – Pre-launch marketing including digital channels, print/radio ads, and launch events requires at least a $500k budget.

- Capital Requirements – Regulators require at least $20-30 million in capital reserves upfront, potentially millions more to fund early operations before securing deposits.

- Other expenses – Budget for utilities, insurance, office supplies, printers, security systems, and other basic costs of operation amounting to around $500k first year.

In total, expect start-up costs to reach $50 million or more before opening your doors.

Ongoing Costs

- Staff – Assuming a team of 25 by year 2, payroll will exceed $5 million including executive salaries and employee benefits.

- Facilities – If leasing branches, commercial space runs $25-50/sq.ft in most markets. With 5 locations budget of over $500k annually.

- IT – Maintaining digital infrastructure, security, and software requires an IT budget of $1-2 million annually.

- Marketing – Ongoing promotion costs at least $5 million per year through digital, print, and event marketing.

- Legal/Compliance – Regulatory needs and legal support requires $500k+ per year minimum.

- Customer Acquisition – In fintech, the cost to acquire a customer now exceeds $300 per account on average. With a goal of 20,000+ new accounts in year 1, budget upwards of $6 million.

- Interest Costs – Providing competitive deposit rates and lending capital has high funding costs, especially with ongoing rate hikes. Budget $3-4 million for interest expenses.

- Other – Additional budget for utilities, capital expenditures, insurance, supplies, travel, and other costs of at least $1 million annually.

While exact costs vary by location, regulators, and business model, most new banks should be prepared to invest over $50 million pre-launch and an additional $25 million in year 1 operations before becoming profitable.

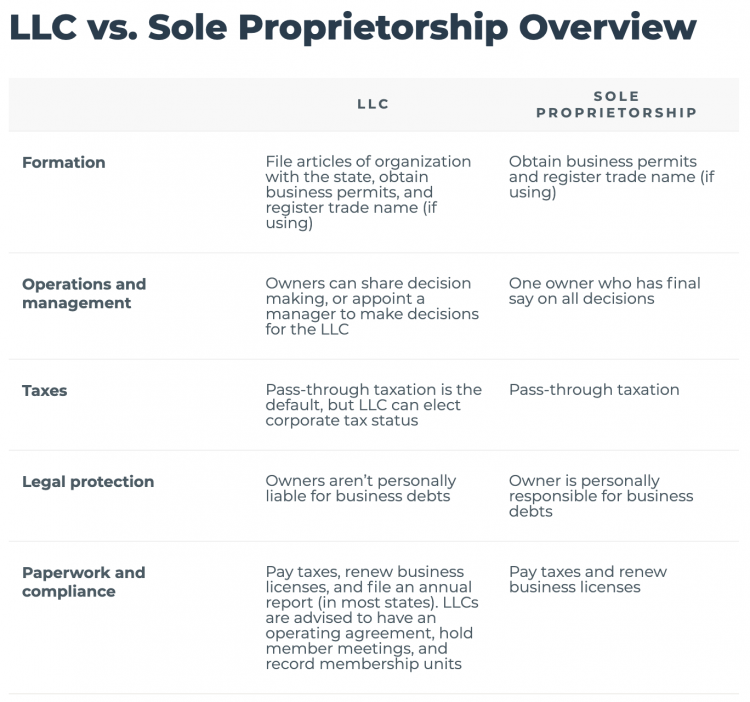

4. Form a Legal Business Entity

When launching a new bank, the legal structure you choose determines taxes, liability, and ease of operation.

Consider these options:

Sole Proprietorship

A sole proprietorship is the simplest structure – you alone own and operate the business. However major risks exist. As a sole proprietor, you are personally liable for all debts and legal actions against the bank. Your assets can be seized to satisfy business obligations. This unlimited liability makes a sole proprietorship ill-advised for a bank.

Partnership

Forming a general partnership shares liability risks among partners. However, each partner can still be held personally responsible for the activities of the other partners. One partner’s negligence could bankrupt you all. Partnerships also lack continuity – the business must be dissolved if a partner departs.

Limited Liability Company (LLC)

A better option is forming a limited liability company (LLC). This protects your assets from business liabilities and debts. Only assets invested in the LLC are at risk. An LLC also allows tax flexibility – you can choose to be taxed as a sole proprietorship, partnership, or corporation. Simple to establish with minimal ongoing paperwork, an LLC provides legal protections with less administrative burden than a corporation.

Corporation

Forming a corporation or S-corp establishes a separate legal entity that can offer liability protection. However significant legal compliance is required for corporations. You must hold shareholder meetings, keep corporate minutes, and elect directors and officers. Administrative complexity makes a corporation unsuitable for a new bank’s early days. Converting to a corporation later on as the bank grows can make sense.

5. Register Your Business For Taxes

Before opening your bank’s doors, you must obtain an Employer Identification Number or EIN from the IRS. This unique identifier is like a social security number for your business. It’s required to open business bank accounts, apply for licenses and permits, hire employees, and file taxes.

As a new bank, you must have an EIN even if you won’t initially have employees. It’s the key to interacting with regulators, vendors, and customers as an official business. Fortunately obtaining an EIN is fast and free through the IRS website.

To apply online, first review the requirements and gather any information needed. Generally, you’ll need basic information like name, address, ownership details, and reason for applying.

Next, navigate to the EIN Assistant and follow the steps. You’ll provide info, verify your identity, and then get an EIN immediately upon submitting the form.

The entire process typically takes less than 15 minutes. Once you have the EIN, keep it secured along with any IRS correspondence. This number unlocks access to business services you’ll need to operate a bank.

Additionally, register with your state revenue agency for any required sales tax permits and business licenses. Costs vary by location and business activities. Proper licensing prevents issues in collecting sales tax or dealing with state regulators.

6. Setup Your Accounting

Maintaining accurate financial records is crucial for any bank, given the highly regulated nature of the industry. Investing in the right accounting tools and expertise early on saves headaches down the road.

Open a Business Bank Account

Start by establishing dedicated business banking and credit accounts, separate from personal finances. This simplifies record keeping and helps avoid piercing the corporate veil if the business is sued. Apply for company accounts once you have registered your EIN and business legal structure.

Accounting Software

Leverage cloud accounting software like QuickBooks to automatically track income, expenses, account balances, and taxes. QuickBooks sync with bank accounts and credit cards, code transactions, and generate financial statements. This automation provides real-time visibility into the health of your business. Estimated cost is $10-$50 per month.

Hire an Accountant

It’s smart to also partner with an accountant to ensure tax compliance and accurate reporting given the financial stakes. A certified accountant offers services like:

- Bookkeeping – Recording transactions, reconciling accounts

- Cash flow analysis – Monitoring income and outlays

- Tax preparation – Filing quarterly/annual state and federal taxes

- Audit support – Assisting with documentation if audited

Expect to invest at least $1,000 annually for an accountant on retainer for consultation and tax filing. More comprehensive services like monthly bookkeeping range from $2,000-$5,000 per year. But this expertise saves money in the long run by avoiding tax penalties or legal issues.

Apply for a Business Credit Card

Applying for business credit cards also builds your bank’s credit profile and provides flexibility. Issuers weigh factors like revenues, time in business, and personal credit scores to determine credit limits. New businesses can often qualify for $10,000 in initial business credit.

7. Obtain Licenses and Permits

Before welcoming your first customers, every new bank must ensure they have obtained the required permits and licenses. Federal license requirements are available through the U.S. Small Business Administration. The SBA also has local regulations listed through its local search tool.

- Bank charter – This authorization from state or federal regulators is essential to operating legally as a bank. The Office of the Comptroller of the Currency oversees national bank chartering. Each state also has its own banking/financial regulators to apply with for state-chartered banks.

- Sales tax permit – While financial services are not subject to sales tax, you still must register with your state’s taxing authority for a sales permit number. This allows you to purchase tax-exempt items for resale and avoid tax issues.

- Local business banking license – Most cities and counties require a general business license for operating within their jurisdiction. Fees are generally modest. Check each location where your bank has a physical presence.

In addition to licenses, banks must comply with extensive federal regulations including:

- Bank Secrecy Act – Requires reporting suspicious activity to fight fraud and money laundering. Banks must implement Know Your Customer practices as part of an anti-money laundering program monitored by the Treasury.

- Community Reinvestment Act – Under CRA rules banks must meet the credit needs of low to moderate-income neighborhoods. Performance impacts ratings.

- Truth in Lending Act – Banks must fully disclose interest rates and terms for lending products to consumers in a standardized way.

- Fair lending – Banks cannot discriminate on unlawful biases in lending and must ensure equal access to credit.

Staying current on federal and state banking compliance takes dedicated in-house legal resources and/or consultancy partnerships. But meeting these obligations keeps your bank in regulators’ good graces as you build community trust. Don’t open those doors until licensing and compliance are secured.

This sentiment is the same for any sort of business in the banking industry, including starting an ATM business or even a Bitcoin ATM business. You’ll have to take great care making sure you fulfill all of the requirements and pass all the regulations with no issues.

8. Get Business Insurance

Operating a bank carries significant risks that make business insurance essential from day one. Lacking adequate coverage opens the door to potentially catastrophic liabilities. Consider these scenarios:

- A customer slips and falls in a branch, suffering serious injuries. Without liability insurance, their lawsuit could force the bank into bankruptcy.

- A cyber attack exposes thousands of customers’ data. The costs of breach notification, credit monitoring services, and regulatory fines could run into the millions without cyber insurance.

- A natural disaster damages multiple branches. Rebuilding and replacing equipment without insurance could require expensive loans or investors.

Policies like General Liability, Directors and Officers Liability, and Cyber and Property Insurance protect against these threats. Work with a commercial insurance broker to secure customized policies that fit your business model and geographic footprint.

The broker will guide you through the application process:

- Determine needed coverage types and limits based on operations. Requirements depend on services, branch locations, customers, and more.

- Provide details on operations, controls, and risk management to insurers. Stronger controls mean lower premiums.

- Select carrier(s) and undergo underwriting. Insurers will assess risks through documentation review, site visits, and interviews.

- Negotiate tailored policies meeting your needs and budget. Don’t skimp on coverage limits despite high costs.

- Pay premiums and complete any final requirements to bind policies.

- Review policies closely and report any changes that could impact coverage.

While the broker facilitates applications, you must provide thorough disclosure. Hiding details or risks could allow insurers to deny claims down the road. Be transparent to lock in truly comprehensive coverage.

9. Create an Office Space

Securing office space is an important first step when launching a new bank. The right facilities provide room to conduct essential back-office operations and host customers in a professional environment.

Home Office

For the first months, a home office can provide a cost-effective option if allowed by local zoning laws. This supports basic startup needs like paperwork, licensing, hiring, and systems setup without major expense. However, home offices lack the image and amenities needed for the long term.

Retail Office

For banks with extensive branch networks, opening retail locations in the community is standard. High foot traffic spaces project stability and convenience when courting customers. But for digital banks or those starting small, retail branches can be cost-prohibitive at first.

Coworking Office

A flexible coworking space like WeWork bridges the gap between home office and traditional commercial real estate. Coworking offers configurable offices, meeting rooms, and shared amenities without large upfront costs. All-inclusive monthly memberships start at around $300 per month per desk. This grants flexibility to test locations and expand on demand.

Commercial Office

Eventually, most banks require full-scale corporate offices and back office buildings for security, capacity, and stability needs. Expect to invest millions in commercial space leases or property long term. But coworking spaces help fledgling institutions project professionalism without the major capital outlay during launch.

10. Source Your Equipment

Launching a bank requires considerable investment in equipment even before opening the doors. From office furniture to security systems, here are some options for acquiring the necessary materials:

Buying New

For the latest technology and custom configurations, buying new Equipment is ideal. Vendors like Hamilton offer comprehensive lines of lobby furniture, security tools like vaults/alarms, and tech-like interactive kiosks. Expect premium cost, budgets into the millions are common for outfitting all facilities.

Buying Used

Gently used office furniture, computers, and other equipment offer major savings over new ones. Check used office liquidators, auctions, and commercial brokers. With careful inspection, used can provide quality at 50% or more off retail. Consider used especially for standard items like desks, chairs, and shelves.

Renting

Equipment rental through vendors makes more sense for certain short-term or infrequent needs. For example, renting currency counters temporarily during launch or for special events vs. buying outright. Rental costs a fraction of the purchase price. Useful for equipment needed only occasionally.

Leasing

Long-term equipment leases allow spreading costs over time rather than one-time capital purchases. For essentials like photocopiers, servers, and phone systems, leasing simplifies upgrading later. Typical leases run 3-5 years. Watch for high interest rates and early termination fees, however.

Online Marketplaces

Sites like Craigslist and Facebook Marketplace are great resources for deals on used office and banking equipment from local sellers. Search frequently for desks, safes, technology, and more. Meet to inspect items before purchasing.

11. Establish Your Brand Assets

Developing a strong brand identity is key for any new bank seeking to attract customers and stand out. An intentional approach to your branding conveys professionalism and builds recognition.

Get a Business Phone Number

Start with securing a dedicated business phone line using a service like RingCentral. Choose a local number customers can call with questions and concerns. A proper business line projects legitimacy and keeps business separate from personal calls.

Design a Logo

Work with a designer to create a polished logo that encapsulates your brand. Consider an abstract mark, letterform, or illustrative logo. Looka’s AI logos provide fast and affordable options starting under $50. Optimize the logo for both digital and print use.

With a logo established, develop complementary brand assets including:

- Color palette – 2-3 brand colors for visual cohesion

- Typography – Fonts matching your style

- Graphic elements – Icons, imagery reinforcing branding

Maintain this consistent look across all customer touchpoints – online, branches, marketing materials, and more. Recognition depends on a unified visual identity.

Print Business Cards

Order professionally printed business cards and signage from Vistaprint. Business cards enable quick sharing of contact information with prospects when networking. Branded apparel like polos and hats visibly display your brand at community events.

Buy a Domain Name

Before marketing begins, purchase your domain name through a registrar like Namecheap. Choose a short, memorable .com address matching your brand name when available. Redirect similar domains to strengthen your online presence.

Design a Website

With a domain secured, build out an informational website via a DIY site builder like Wix or by hiring a web developer on Fiverr. Your site should communicate your value proposition, services, rates, and more while reflecting brand visuals. This digital presence establishes credibility and trust with site visitors.

12. Join Associations and Groups

Joining local banking and business associations provides invaluable connections when starting a new bank. Surround yourself with fellow professionals who can share hard-won experience and industry insights.

Local Banking Associations

Most states have an affiliation of community banks and banker’s associations. For example, the Florida Bankers Association. Membership grants access to events, advocacy, and resources tailored to local banking needs.

Your local Chamber organizes networking events, promotes business interests, and provides valuable startup guidance. Connect with fellow entrepreneurs across industries for cross-promotion opportunities.

Local Meetups

Beyond official associations, attending local banking meetups and tradeshows facilitates networking with peers. Meetup event listings help you find upcoming gatherings. In-person forums foster relationships with potential mentors, partners, and even customers.

Facebook Groups

Online communities further enable connecting with the broader banking ecosystem. For example:

- Banking & Bankers – 98.9k member FB group for bankers worldwide to discuss trends.

- Finance Professionals – 5k member community focused on advancing women in finance.

- BANKER’S GROUP – 44k members interested in fintech and digital transformation.

Embedding yourself locally while also plugging into national groups provides support at each stage of the journey. Learning from fellow bankers helps avoid pitfalls and identify growth opportunities. Surround yourself with the tribe.

13. How to Market a Bank Business

Marketing is crucial for getting the word out and attracting customers as a new bank. Leverage both digital and traditional techniques to build awareness and drive growth.

Tap Into Your Network

Existing connections provide the most fertile ground for referrals, especially early on. Offer incentives for customers to refer friends, like cash bonuses or fee waivers. Nothing fuels growth like word-of-mouth from satisfied members.

Digital Marketing

Online, focus on discoverability and engagement:

- Search Engine Optimization – Optimize website copy, metadata, and backlinks to rank highly for local searches like “bank [city]”. Most prospects search online first.

- Google/Facebook Ads – Targeted local ads raise awareness and drive site traffic to convert visitors into customers.

- Email Marketing – Send emails with personalized offers to website subscribers. Nurture interest and maintain relationships.

- Social Media – Post locally relevant content and specials on platforms like Facebook and Instagram. Build community through engagement.

- YouTube – Share videos on topics like how to open an account. Educational content brings in search traffic.

- Blogging – Publish articles on money management, small business tips, and more to attract search traffic.

Traditional Marketing

Traditional techniques also help expand reach:

- Direct Mailers – Promotional mailers to local homes and businesses make an impression on recipients. Best for grand openings or new location launches.

- Local Events – Sponsoring local races, fairs, and community events raises brand visibility. Have a booth to collect leads.

- Signage – Digital billboards, posters, and other outdoor signage target foot and vehicle traffic. Useful for branch locations.

- Radio – Local radio ads play well with older demographics who still rely on radio. Branding-focused messages work best.

- Print Ads – Newspaper and local magazine ads reach engaged readers. Limit given declining readership.

While digital marketing delivers better targeting and metrics, traditional options help round out promotional efforts with localized awareness building. Evaluate opportunities across both as you get the word out.

14. Focus on the Customer

Providing an exceptional customer experience is crucial for any bank seeking growth and loyalty. In a commoditized industry, service stands out.

- Make account opening and onboarding smooth and personalized. Greet new customers by name and guide them through each step. Follow up after signup to ensure complete satisfaction.

- When issues inevitably occur, resolve problems promptly, politely, and fairly. Empower staff to provide refunds, waivers, or other remedies when appropriate.

- Surprise and delight with small touches like follow-up handwritten notes, personalized rewards, or birthday calls. These reinforce that each customer matters.

- Equip staff to handle complaints with grace. A polite, helpful response transforms frustrations into renewed faith in your bank.

- Implement 24/7 call, chat, and email support with minimal hold times. Make it easy to get assistance whenever needed.

- Follow up with VoC surveys to monitor satisfaction and improve. Solicit honest feedback regularly.

Make customer service a true competitive advantage. Hire for empathy. Train for problem resolution. Empower staff to delight. When you exceed expectations consistently, customers become your best promoters.