The global brokerage industry is expanding rapidly, reaching $189 billion in 2023. With a compound annual growth rate (CAGR) of 4.23% from 2023 to 2028, it’s a great time to get involved and start your own brokerage firm.

Technological innovations have made operating trading platforms and clearing trades more affordable than ever. Aspiring entrepreneurs can now realistically launch online brokerages or boutique financial advisory firms. Success ultimately hinges on the ability to identify an underserved niche and deliver value through specialized services.

This guide expresses how to start a brokerage firm. Follow along with topics including market research, registering as a limited liability company (LLC), obtaining business insurance, competitive analysis, customer outreach, and more. Here’s everything to know about working with the Securities and Exchange Commission as a stock brokerage firm.

1. Conduct Brokerage Firm Market Research

Market research is an important element of working in the brokerage business world. Whether brokering in a real estate business, or the financial markets, market research tells you about your target market, local market saturation, trends in services and products, and other details for your business plan.

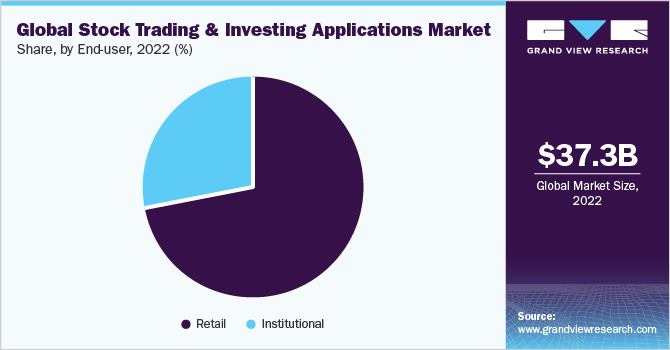

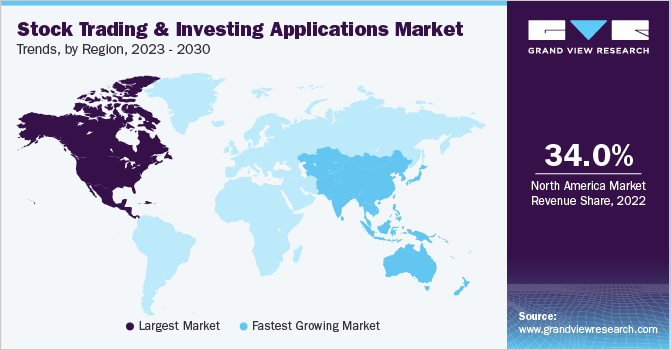

- Democratized access to financial markets is also propelling growth.

- Reduced barriers to entry have paved the way for low-cost online brokerages like Robinhood.

- Incumbent players are being pushed toward lower or zero trading fees as well.

- Wealthfront, Betterment, and Acorns are gaining share through automated investment solutions.

- Niche opportunities abound given the diversity of investors and the range of assets now accessible.

- Specialized brokerages can concentrate on particular customer segments, geographic locales, or asset classes.

- Providing tailored, high-touch services to underserved markets allows for capturing a greater wallet share per client.

- Regulatory compliance remains a hurdle. Broker-dealers must register with FINRA and the SEC.

- Meeting capital reserve requirements can prove challenging for upstarts.

- Partnerships with third-party clearing firms also ease operations and regulatory burdens.

In summary, the growth story for the brokerage industry remains strong. Barriers to entry are lowering, even given regulatory considerations. Business models centered around modern technologies and specialization continue gaining traction.

2. Analyze the Competition

Understanding the competitive landscape is crucial when launching any new business. This holds when trying to break into the vast brokerage industry as well.

Here are some steps to take while investigating competitors to your own real estate brokerage or stock brokerage firm.

First, identify direct competitors using licensing databases. FINRA provides a BrokerCheck tool that lists all registered brokers and brokerage firms. Review profiles of firms that align with your target market and offerings. Note services, platforms, and pricing.

Examine competitors’ digital presence too. Search online advertising and organic rankings. Analyze websites/apps for functionality, content, reviews, and more. Social media following and engagement indicate brand awareness.

For location-based brokers, physically visit offices. Get a feel for the office environment and advisory approach. Collect sales materials to review offerings. Ask for asset minimums and fee structures. Take notes on strengths and weaknesses.

Thorough competitive analysis illuminates differentiation opportunities within your niche. Identify service gaps unable to be filled by incumbents due to size or business model constraints. Fintech solutions can also set you apart if lacking from legacy players.

Ongoing tracking of competitive intelligence then monitors new entrants, closures, service changes, and more. Integrate search alerts, news scans, reviews analysis, and similar solutions.

3. Costs to Start a Brokerage Firm Business

Starting a brokerage involves significant upfront investment before opening for business. Exact capital requirements vary based on services offered and company structure. However, the following estimates provide a realistic guideline for business expenses as a registered investment advisor with your broker-dealer firm.

Start-up Costs

- Incorporation paperwork, licensing, and legal fees can cost between $2,500 to $5,000 initially.

- Registering as a broker-dealer with FINRA runs $5,000-$10,000 including exams.

- SEC registration fees are at least $1,100.

- Attorneys assist with documentation needed for licensing applications with most charging $200-$500 per hour.

- Outfitting a physical office space requires capital if pursuing a brick-and-mortar brokerage.

- High-end office spaces in major metro areas can command rents from $35 per square foot annually.

- A 1,000-square-foot space would thus run $35,000/per year or $2,900 per month.

- One-time buildout and furnishing expenses range from $20,000 to $100,000+ depending on luxury finishes.

- Critical technology infrastructure also necessitates significant upfront costs.

- Industry-specific CRM platforms like Salesforce Financial Services Cloud or Addepar start at $25 per user monthly.

- Data terminals such as Bloomberg or Refinitiv Eikon run $600+ in monthly subscriptions each.

- Custom development of trading platforms, apps, or websites can hit six figures easily.

- Servers, backup systems, and cybersecurity tools need financing as well.

Ongoing Costs

- Ongoing overhead expenses include payroll, compliance, product offerings, and marketing.

- Employee salaries represent a brokerage’s largest recurring cost center.

- Top-tier advisors with established books command commissions exceeding seven figures.

- Support staff ranges from $40k-$90k in annual salary depending on experience.

- Employee insurance/benefits packages add 25% or more on top.

- Regulatory fees tally between $150 to upwards of $1 million annually depending on the types of securities offered and transaction volume. Audits run $7,500.

- Product inventory, continuing education, memberships, and third-party data/services comprise additional fixed costs each year.

- While launching any new business requires grit and tight budget management, ample pathways exist today to start a brokerage firm without outsized capital requirements relative to revenue potential.

- Costs continue falling thanks to technological progress.

- Success ultimately comes down to managing overhead, hiring the right talent, and relentlessly focusing on value delivery.

Let me know if you need any other specifics on the startup or operating costs related to getting a brokerage business off the ground. I’m happy to research additional expense categories as needed to build out a comprehensive pro forma financial plan.

4. Form a Legal Business Entity

When starting a brokerage firm, selecting the right legal structure critically impacts taxation, liability exposure, and operations flexibility. Sole proprietorships offer simplicity but lack liability protection. Partnerships enable shared ownership yet introduce legal complexities around profit allocations and investor rights.

Sole Proprietorship

Sole proprietors report brokerage profits/losses on personal tax returns. No formal registration is required. Owners have complete autonomy over decisions. However liability protection is nil – owners’ assets can be seized for company debts or lawsuits. Adding employees or investors is difficult within a sole proprietor structure. While simplest, significant risks exist when exposing personal finances.

Partnership

Partnerships allow the pooling of resources and talents between two or more owners through a formal partnership agreement. Profits/losses pass through to partners for tax purposes. However, liability protection remains limited and complex to establish contractually.

Decision-making authority and profit distributions require tedious negotiation. Partner disputes can dissolve entities entirely. Paying estimated taxes quarterly also proves burdensome for active traders.

Corporation

Conventional C-corps provide the highest level of owner liability protection but double taxation often erodes profitability. Gains taxed at the corporate rate undergo a second round of personal taxation when distributed as shareholder dividends.

Limited Liability Company (LLC)

Forming a brokerage as an LLC combines pass-through taxation with strong liability protection. LLC owners aren’t personally responsible for company debts or legal judgments. No limitations exist on ownership quantity. LLCs divide profits per the operating agreement without double taxation. Fewer formalities than S-corps reduce administrative overhead.

5. Register Your Business For Taxes

Forming a legal business entity like an LLC requires obtaining an Employer Identification Number, commonly known as an EIN. The Internal Revenue Service issues EINs for tax reporting purposes. Operating a brokerage without an EIN exposes the owner to penalties and business disruptions.

Unlike Social Security numbers used for personal taxes, EINs uniquely identify business entities for specific federal tax situations related to hiring employees or filing as a corporation or partnership. Even sole proprietors should acquire an EIN when establishing brokerages or other formal companies.

Applying for an EIN is free directly through IRS.gov. The entire process from submitting form SS-4 to receiving your EIN should take just 5-10 minutes. Sole proprietors can immediately acquire their EIN online after answering basic questions about the legal company name, address, and ownership structure.

When applying, ensure all business entity documentation matches the Legal Name and County fields entered on the SS-4. Using the official LLC name as registered with the state assists in matching federal EIN records later to your state tax ID and licenses.

Speaking of state requirements, those establishing broker-dealer businesses must also complete state-level licensing steps separately from obtaining a federal EIN. State protocols include registering for applicable sales tax permits, opening dedicated business bank accounts, and filing a fictitious business name or “Doing Business As” designation. Most states impose minor fees of around $50 or less for this administrative registration.

6. Setup Your Accounting

As an SEC-registered entity, meticulous recordkeeping and transparent financial reporting are legally obligated for broker-dealers. Even minor accounting discrepancies or sloppy documentation can spur fines, license suspensions, or worse from regulators. Mundane as it seems, dialing in rock-solid accounting early allows properly managing risks and optimization opportunities.

Accounting Software

Implementing small business accounting software provides the foundation. Platforms like QuickBooks track income, expenses, account balances, and payroll all in one place. Seamless connectivity with business bank/credit card accounts enables automatic feeds of transaction data. This eliminates manual entry while ensuring accuracy.

Hire an Accountant

Supplementing with an experienced accountant adds further value for brokerages. Common monthly tasks like bank reconciliation, bookkeeping, and expense categorization free up a broker’s time for revenue-generating activities with clients. Especially during year-end tax preparation or the event of an audit, accountants adeptly handle communications.

Open a Business Bank Account

Strict separation of personal and business finances rightfully earns IRS scrutiny if co-mingled. Depositing client checks or trades into personal bank accounts must be avoided. Open dedicated business checking/savings accounts in the company’s name using the registered legal entity details and EIN.

Apply for a Business Credit Card

Applying early for a business credit card further separates brokerage funds from personal finances. Underwriting factors in the legal business entity’s creditworthiness rather than depending solely on the owner’s score. Limits often range from $1,000-$25,000 for new businesses.

7. Obtain Licenses and Permits

Before conducting securities transactions or offering investment advice, registration with FINRA and membership with SIPC prove obligatory for all broker-dealers. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

At the federal level, the Financial Industry Regulatory Authority, FINRA dictates rules and supervises brokerage market conduct. Passing the General Securities Representative Exam (Series 7) demonstrates proficiency in advising on common stock, bonds, and options trades.

The SEC requires separate registration for certain firm activities like investment advising or holding customer assets. The Series 65 exam qualifies financial advisors lacking Series 7 certification for non-commission fee structures. Series 24 applies to principals supervising trades and daily operations.

Importantly, FINRA membership further necessitates buying Securities Investor Protection Corporation(SIPC) coverage protecting clients if a firm fails financially. SIPC insures up to $500,000 in securities including a $250,000 cash limit per customer. Coverage above SIPC limits can be purchased additionally from private insurers.

Nearly every state imposes licensing requirements on broker-dealers conducting business within state borders or with resident clients. Common criteria include an in-state branch office, a minimum number of transactions for citizens each year or explicitly marketing to state residents.

For example, California requires broker-dealers to file a Statement of Identity and Questionnaire detailing business activities in the state. Louisiana mandates a hard copy of Form S-1 and a felony-free criminal background check. Such registrations often run less than $200 initially with modest annual renewals.

Municipalities and counties frequently require business licenses too covering the physical office addresses from which brokers operate. Local real estate brokers, accountants, and attorneys can best advise registration needs based on geography and planned services.

Skirting legally required licensing opens firms to SEC fines beginning at $5,000 per violation with repeated issues resulting in revoked trading privileges. State penalties for non-compliance also commonly exceed thousands in initial sanctions with follow-on litigation likely.

8. Get Business Insurance

Beyond meeting capital requirements, adequate insurance enables broker-dealers to transfer financial exposures that could otherwise devastate small firms. While not formally mandated, lacking coverage represents a glaring risk in professional and personal liability.

For example, failing to detect fraud or mismanaging a portfolio could open the firm up to expensive lawsuits. Without insurance, legal judgments directly hit liquid company assets and owner equity.

Even physical disasters like fires or floods within office premises put client data, paper records, and critical equipment in jeopardy if underinsured. Lost revenue potential alone during rebuilding would severely impact small brokerages without insurance reimbursements. Comprehensive business insurance fills this liability gap.

Brokers aim for well-rounded policies encompassing general liability, professional liability errors & omissions (E&O), cyber and umbrella coverage. Starting points to get insured:

- Document detailed company information like legal name, address, ownership structure, and license/permit details. Confirm annual revenue projections.

- Define all services to be offered to demonstrate business activities for underwriters. The firm website and marketing materials should align.

- Research specialty brokerage business insurance agents matching needs. Quotes are often free but more complex policies incur underwriting fees.

- Provide past claims history if applicable plus projections around trading volumes, transaction frequency, and planned asset growth.

Being underinsured proves riskier than remaining a sole proprietorship for new brokerage ventures. Protect the business and personal assets through this four-step insurance process before launch.

9. Create an Office Space

Establishing a professional workspace lends legitimacy when meeting prospective clients and partners. Storefront offices also provide room for employees as the brokerage scales. Weighing options balanced against budget constraints allows you to pick the right environment when you lease office space.

Home Office

Many solopreneurs initially operate brokerages from home offices when launching. Deductible expenses include proportional rent/mortgage costs, utilities, internet, and furniture. Conducting client meetings at personal residences risks seeming less than fully professional. Expanding staff also quickly necessitates upgrading. Expect a home office budget of around $200 monthly.

Coworking Office

Coworking spaces like WeWork offer convenient flexibility between DIY setups and conventional office leases. Customizable plans with dedicated desks or private offices give broker soloists room for client meetings starting at around $300 monthly. Conference rooms, printers, events, and networking optimally support client-facing consultants.

Commercial Office

Seeking a standalone professional persona motivates many advisory firms to take on conventional office spaces, either retail storefronts or Class A buildings. Retail offices in mid-sized cities run $15-$30 per square foot. A 1,000-square-foot location totals $15,000-$30,000 annually or $1,250-$2,500 monthly after furnishing.

10. Source Your Equipment

Launching a brokerage necessitates outfitting office spaces with furniture, computers, data/telecom links, and industry-specific software. Balancing budget limitations against quality and durability determines the ideal mix of new purchases, used deals, and temporary rentals.

Buy New

Buying new ensures the latest technologies, warranties, and custom configurations suiting workflow needs. Dell, HP, and Apple offer small business discounts below 10+ unit enterprise pricing. However, Cash flow rarely permits lavish upfront capex. Financing options ease budget pain but saddle debt obligations.

Buy Used

Scouring the usual secondhand suspects helps secure major savings on high-quality gear. Facebook Marketplace and Craigslist commonly list commercial inventory from offices downsizing or upgrading. Items like desks, chairs, and cubicles cost 90% less than retail with gentle usage signs.

Rentals

Shorter-term equipment rentals bridge operational gaps while allowing gear evaluation before longer-term buying. National chains offer daily/weekly/monthly rates for copiers, computers, office furniture, and more with free delivery/setup and flexible terms. This facilitates getting brokerages moving quickly.

11. Establish Your Brand Assets

Crafting a distinctive brand personality broadcasts quality and trustworthiness amid a crowded financial services landscape. Memorable names, logos, and marketing materials remind prospects to choose your boutique firm over national chains or online disruptors. Investing in brand building early attracts assets to manage.

Get a Business Phone Number

Start by securing a dedicated business phone line with a reputable provider like RingCentral. Choose sophisticated greetings and professionally record voicemail prompts. Bundle mobile app messaging for flexibility across devices. Expect basic service from $30 monthly per user.

Design a Logo

Design visual brand assets that consistently represent expertise. Creating a symbolic yet intuitive logo can utilize AI-powered services such as Looka to explore millions of combinations matching specified concepts within minutes. Expect to budget $50+ for custom logo ownership rights.

Print Business Cards

Print glossy marketing brochures, signage, and stationery for trade booth events or client welcome packets. Upload finished brand assets for affordable, high-quality business card printing from Vistaprint. Remember to collect cards from strategic partners and Center of Influence contacts early.

Get a Domain Name

Secure matching domain names across .com and .finance to elevate online positioning. Registrars like Namecheap make buying and configuring domains easy with free WHOIS privacy. Expect annual costs of around $15 per extension.

Design a Website

Well-designed websites demonstrate competence while providing 24/7 access for prospects. Leverage DIY website builders such as Wix for drag-and-drop simplicity including SEO best practices. Or hire web developers on Fiverr to custom craft sites from $500. Integrate lead capture forms to grow email lists.

12. Join Associations and Groups

Expanding professional connections within local finance circles accelerates attracting the first clients while navigating early hurdles as an entrepreneur. Trade organizations, niche meetups, and online communities provide support.

Local Associations

Industry associations like the National Association of Personal Financial Advisors (NAPFA) and Financial Planning Association (FPA) offer continuing education, tools/resources plus regional networking. Most levy annual membership fees under $500. Attend local chapter meetings or sponsor events to gain visibility.

Local Meetups

Neighborhood networking events uncover direct referral opportunities from allied professionals including accountants, attorneys, and bankers. Websites like Meetup facilitate finding regional groups to join. Expect to budget $50-$150 monthly for event attendance to nurture community connections.

Facebook Groups

Industry-focused Facebook groups like Stock Trading and Stock Option Traders – 2023 enable crowd-sourcing answers from national peers on technical product questions or strategic concerns. Most limit promotional content to keep conversations focused on member needs rather than pitching services.

13. How to Market a Brokerage Firm Business

Promoting advisory brands across digital and traditional channels attracts prospects already seeking financial guidance. Budget-conscious marketing drives conversions more profitably than buying expensive lists or untargeted ads. Prioritize networking referrals supplemented with automated funnels.

Personal Networking

Tap professional and personal contacts as the most promising lead source early on. Thank satisfied customers for asking if they know others seeking retirement or investing advice. Offer incentives like $100 restaurant gift cards for qualified introductions. Many were eager to vouch for advisors who surpassed expectations.

Digital Marketing Campaigns

Digital platforms efficiently reach specialized audiences ideal for niche boutiques. Target locally on Google and Facebook by job titles, employer, age, and interests. Expect to budget $500 monthly testing various offers and creatives while refining messaging.

- Run LinkedIn-sponsored posts showcasing expertise to connection networks.

- Launch Google Ads campaigns focused on relevant keywords around advisory services sought.

- Build lead flows with Facebook/Instagram by creating Free tips content and messengers bots.

- Start an educational YouTube channel or Podcast to raise awareness.

- Blog regularly sharing market perspectives attracting organic traffic.

Traditional Marketing Campaigns

Traditional approaches better suit well-funded roll-up firms seeking a mass appeal. Still, opportunities exist to reach valuable consumer segments.

- Print trifold brochures and run direct mail campaigns to high-net-worth neighborhoods.

- Take out ads in local finance and business journals.

- Sponsor events, seminars, and golf tournaments aligning with ideal client personas.

While most nascent financial advisors lean heavily on referrals and digital presence when starting, some blend select traditional techniques for niche targeting. The most successful commit to rigorous testing and analytics across all channels rather than spraying and praying budget hoping something sticks.

14. Focus on the Customer

Delivering white glove service distinguishes thriving advisory firms from transactional sellers in a competitive landscape. Client-centricity earns loyalty and referrals fueling sustainable growth. Enhance customer focus in the financial services industry, and within your own business by:

- Proactively reminding customers of key tax deadlines or strategy adjustments amid market volatility shows proactive care beyond chasing commissions.

- Analyzing portfolios across households to highlight consolidation or inheritance planning opportunities takes relationships deeper.

- Introducing clients to specialized lending partners to finance practice acquisitions or commercial real estate investments establishes a trusted advisor role spanning beyond portfolio returns alone.

This level of tailored, accountable guidance sticks with investors across decades as life priorities evolve. They will gladly introduce friends and family members to advisors who lifted obstacles others missed or minimized.

Conversely, lackluster customer service risks assets walking out the door during occasional inevitable portfolio losses or service hiccups. Neglecting personal touches makes national toll-free number firms or mobile apps seem similarly appealing.