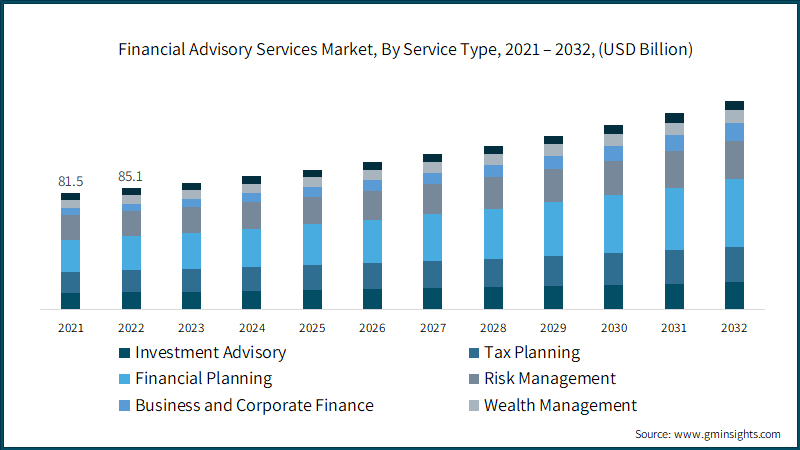

The investment advisory services industry is on the rise. It’s expected to grow at a compound annual growth rate (CAGR) of over 5.5% between 2023 and 2032. With more individuals and businesses seeking professional guidance for their investments, the demand for financial advisors continues to rise.

Whether you dream of running a boutique financial planning firm or building a national wealth management company, now is a good time to start.

This guide will walk you through how to start an investment advisory business. Topics include market research, competitive analysis, marketing, registering an EIN, obtaining business insurance, and more. Here’s everything to know to start your own financial planning firm.

1. Conduct Investment Advisory Market Research

Thorough market research is imperative when starting an investment advisory firm. It provides insights into industry trends, competitive landscapes, target demographics, startup costs, profitability benchmarks, and growth opportunities.

Some details you’ll learn through market research as a financial advisor include:

- Top specializations are retirement planning, wealth management, and portfolio management. Other popular niches include financial planning, estate planning, tax advisory, and insurance services.

- When choosing a niche, also consider target demographics. For example, women now control over 50% of personal wealth in the U.S. representing a major customer segment.

- The financial barriers to launching an RIA firm have also lowered considerably. Startup costs can range from as little as $2,000 for a solo practice to $75,000 or more for larger firms.

- Ongoing overhead expenses are estimated between $40,000 to $280,000 based on company size and services offered.

- Higher revenue potential exists in wealth management and portfolio management niches.

With robust market growth and ideal customer targeting, the financial advisor business industry presents a compelling opportunity for aspiring entrepreneurs. Conducting in-depth market analysis can further help secure a foothold.

2. Analyze the Competition

Understanding the competitive landscape is vital for positioning your advisory firm. Competitive analysis will help develop a thorough financial advisor business plan. Conduct competitor analysis across these key areas:

- Research which investment services local competitors provide. Identify service gaps you could fill.

- Evaluate the target demographics and assets under management (AUM) of competitors using free online tools like BrightScope.

- Establish the average and median AUM figures in your market. Identify any underserved niche demographics you can target.

- Consider private lending services that clients may require analysis with.

- Most registered investment advisors (RIAs) generate revenue through asset-based fees, fixed fees, hourly fees, or retainer fees.

- Benchmark what fee ranges and models competitors follow for the services you will provide using the Kitces financial planning fee survey. This will help you develop competitive pricing.

- A key differentiator will be your ability to provide solid risk-adjusted returns.

- Use sites like Advisory World to compare investment returns of active advisors across 1, 3, and 5-year periods. Make your performance benchmarks accordingly.

- Scan online listings, website pages, content assets, reviews, and social media handles of top firms.

- Gauge what it will take to match or exceed their digital footprint and marketing content through clear unique value propositions and positioning.

The competitor analysis drill equips advisors with intelligence for strategic decision-making around offerings, niches, pricing models, and marketing tactics when starting their RIA firm. It forms the blueprint for long-term positioning and growth.

3. Costs to Start an Investment Advisory Business

When starting an RIA firm, advisors must budget for both initial and recurring expenses. Here is a comprehensive breakdown:

Startup Costs

- Business Formation: Forming a legal business entity like an LLC will cost $500 – $2,000 including state registration fees and licensing.

- Regulatory Registration: Registering as an investment advisor with the SEC costs about $3,000 – $5,000 while state registrations average $700.

- Office Space & Supplies: Leasing basic office space will range from $1,000 – $5,000 per month based on location and size.

- Legal & Compliance Setup: Engaging lawyers to review operating agreements, ensure SEC compliance protocols, and develop client contracts can cost between $3,000 – $10,000 initially.

- Salaries: Hiring even one full-time support staff like an office administrator, broker, or para-planner may cost $45,000 – $60,000 per year.

- Insurance Plans: E&O insurance is essential, costing on average $2,000 – $7,000 annually depending on coverage.

- Marketing: An initial year of inbound marketing via a company website, online directory listings, content, and SEO can range from $15,000 – $30,000 or more. Ongoing marketing is factored into recurring costs.

In total, starting an RIA firm may cost between $40,000 – $280,000+ depending on staff, office space, desired scale, and other elections.

Ongoing Costs

- Marketing Activities: Blogging, SEO services, PPC ads, retargeting campaigns, social media – $2,400 – $4,800 monthly

- Office Rent & Utilities: Depending on commercial lease terms – $5,000+ per month

- Staff Payroll Including Taxes & Benefits: Employee salaries + 20% – 30% for payroll taxes, health plans, other benefits

- Technology, Tools & Software: CRMs, financial planning tools, portfolio analytics, data aggregation – $300 – $1,500 monthly

- Admin, Operations, Finance: Phone systems, tax prep services, bookkeeping, product samples or client gifts/retainers – $2,500+ per month

- Regulatory Fees: Annual SEC fees, state notice filings, licensing renewals – $1,500+ yearly

Ongoing costs for a small RIA firm generally start around $40,000 per annum while larger firms may incur over $250,000+ in annual overhead expenses. The payoff is building an independent, scalable, and highly profitable advisory business.

4. Form a Legal Business Entity

When establishing an investment advisory firm, the legal structure carries major implications for liability, taxation, and business continuity. The four primary options—sole proprietorship, partnership, S-corp, and LLC—have unique pros and cons for RIAs.

Sole Proprietorship

The simplest and most affordable business model in the financial services industry is sole proprietorship. However, the owner assumes unlimited personal liability for company debts, losses, and legal issues of your own firm. Tax reporting is also meshed with personal returns. Only suited for single-employee operations with no growth ambitions.

General & Limited Partnerships

Involve two or more co-owners in a jointly operated advisory firm. A general partnership has equal participation in management while a limited partnership designates general partners overseeing operations. Unlimited personal liability still applies to general partners. Intricate profit/loss sharing arrangements also get complex fast with multiple partners.

S-Corporation

S-corp status offers RIAs liability protection and allows income/losses to pass to shareholders’ tax returns. Save for payroll taxes. Stringent IRS rules around ownership structure and shareholder compensation make scalability a challenge. Extensive record-keeping requirement is a downside for entrepreneurs.

Limited Liability Company (LLC)

The LLC structure uniquely combines the pass-through taxation benefits of a partnership with the liability protections of a corporation. Advisors’ assets remain shielded from any business lawsuits or claims, encouraging entrepreneurial risk-taking. Operationally, LLCs also impose lesser regulations compared to S-corps.

5. Register Your Business For Taxes

An Employer Identification Number (EIN) serves as a business’s tax ID number with the IRS for tax reporting and payment obligations. All investment advisory firms must acquire an EIN within the first few months of founding their LLC or corporation entity.

Obtaining an EIN is free and can be instantly processed online via the IRS website. Simply navigate to the EIN Assistant page and respond to a short Q&A about your entity structure and business activities. Upon submission of the form, your EIN is immediately displayed and emailed to you.

Additionally, investment advisors with plans to sell information products, workshops, or other taxable items must register with relevant state agencies to collect and remit sales tax. The process entails submitting details about your business products/services along with EIN.

Obtain an EIN to get a seller’s permit, sales tax ID number, and certificate of authority to collect statewide sales tax rates.

Most states do not charge registration fees. However, you must file regular sales tax returns to avoid penalties. Consulting a tax professional can help streamline multi-state sales tax compliance requirements as your RIA firm’s offerings and client base expand.

6. Setup Your Accounting

Comprehensive financial planning requires a little financial planning of your own. Robust accounting practices are non-negotiable for investment advisory firms. As RIAs directly handle client assets and investments, meticulous record-keeping, reporting, and auditing protections must be implemented from inception.

Open a Business Bank Account

Begin by establishing separate business banking and credit card accounts to avoid commingling personal and company funds which can trigger IRS red flags. Apply for credit cards designed specifically for small businesses that offer higher limits based on your EIN and entity history rather than personal credit scores.

Accounting Software

Next, integrate cloud accounting software like QuickBooks to automate income/expense tracking, generate financial statements, send client invoices, facilitate payments, and sync data across bank/credit card accounts. Their user-friendly UI helps advisors with no accounting background easily manage finances.

Hire an Accountant

Bookkeeping services are also vital for reconciling transactions, ensuring balances match actual bank statements, providing editable ledgers for taxes, and producing quarterly profit/loss statements. Expect to invest at least 4-6 hours monthly for robust bookkeeping at approximately $50 – $150 per hour.

7. Obtain Licenses and Permits

Before accepting any clients or managing assets, aspiring RIAs must register as investment advisors and obtain all necessary regulatory approvals. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

For RIAs managing $100 million in assets or working with mutual funds, Securities and Exchange Commission registration in the financial planning profession is mandatory. This involves submitting Form ADV paperwork, appointing a chief compliance officer, putting investor protection protocols in place, and usually hiring an independent auditing firm.

Smaller RIAs with $100 million assets under management (AUM) must register through the state they are headquartered in. Form ADV must still be filed but directly with state securities regulators.

For both SEC and state-registered advisors, obtaining an RIA compliance certificate is vital to demonstrate an understanding of ethical guidelines and fiduciary duties in advising clients on investments. Requirements range from passing the Series 65 exam to accredited coursework completion.

Certain niches like insurance, retirement planning, or portfolio management call for additional licenses like Series 6, 7, 63, 65, or 66. Study material and exam fees for these range from $60 – $170 per license. Some states also mandate Investment Banking Representative licenses.

The licensing process provides rigorous training in ethical ground rules and advisor responsibilities around investor interests. Once armed with SEC/state registrations and key specialty permits, RIAs can commence legally serving clients.

8. Get Business Insurance

Starting a new financial advisor business requires insurance to mitigate risks that can derail hard-built success. Being financial stewards of client investments also requires advisors to implement adequate protections for their firms.

Lacking coverage would prove catastrophic for many reasons:

- Should hackers infiltrate client databases and steal personally identifiable information?

- Facing lawsuits, you must pay steep legal fees and settlement costs without insurance.

- If an advisor commits fraud, trades on insider tips, or mishandles client funds, financial and reputational damages ensue with no coverage fallback.

- When natural disasters like floods, storms, or wildfires damage premises and equipment firms face possibly permanent closure.

Ideal insurance coverage includes:

- Errors & omissions (E&O)

- Commercial property

- Workers Compensation

- Cyber

- Umbrella liability plans

E&O shields against negligence claims while cyber protects data assets. Obtain quotes by having an insurer evaluate the firm’s regulatory compliance rigor, security protocols, disaster recovery readiness, and liability exposures. Expect total annual premiums between $5,000 – $20,000 for adequate coverage.

Obtaining business insurance is akin to building organizational resilience. It prepares firms to smoothly handle major liability events, data breaches, and property disasters with financial compensation and legal protections firmly in place.

9. Create an Office Space

Establishing a professional office is pivotal for RIAs to conduct client meetings, securely manage sensitive financial documents, and grow teams as assets under management expand. Some options for an office space for a registered investment advisor include:

Coworking Spaces

Shared offices through providers like WeWork allow solo advisors to start with flexible, low-commitment arrangements. Opting for coworking spaces ranging from $300 – $800 monthly also builds networking opportunities with other entrepreneurs that could lead to referrals. However, being unable to host privacy-dependent client meetings on-site can be a key constraint.

Commercial Office

Dedicated office suites within Class A buildings provide the most professional environment for RIAs to meet and service high-net-worth individuals or institutions. While rents average $3,000+ monthly, the turns key infrastructure, reception staff, conference rooms, onsite parking and credibility with elite clients justify costs as AUMs scale to millions.

10. Source Your Equipment

Outfitting an RIA office with robust technology separates thriving firms from mediocre players. The specialized hardware and software needed fall into four categories, computing devices, cybersecurity programs, portfolio analytics tools, and client relationship management (CRM) systems.

New Equipment

Opting for the latest models with full warranties reassures clients about the firm’s financial stability. Shop business-grade devices with enhanced encryption, firewalls, malware detection, and data recovery features. Expect approximately $3,000 per high-spec laptop/desktop. Check out Best Buy and Office Depot.

Used Equipment

Gently used equipment through auction platforms like eBay cuts acquisition costs by 40% to 60%. Search for off-lease items from reputable manufacturers thoroughly inspected and data-wiped by sellers. Confirm compatibility specs align with software needs before purchase. Try Craigslist and Facebook Marketplace to start.

Rented Equipment

Renting hardware monthly allows advisors to deploy robust systems without major upfront capital. Certain specialty programs are exclusively available via rental from developers. Expect pricing between 5% to 10% of retail costs. While convenient initially, perpetual rents can add up over time.

Leased Equipment

Leasing gives access to cutting-edge equipment via affordable monthly payments over 3 to 5 years backing out the residual value. The lessor assumes the risk and maintenance responsibilities. Ideal for complex IT systems and continually upgrading tech. Adds 20% to 30% premium over outright purchases.

11. Establish Your Brand Assets

Crafting a distinctive brand identity helps investment advisory firms stand out amidst competition while nurturing instant recall value and trust with target clientele.

Getting a Business Phone Number

Acquiring a unique business phone and fax number lends legitimacy over using personal cell contacts for client communications. Cloud-based systems like RingCentral offer toll-free numbers with call routing, voicemail transcriptions, conference calling, and fax/SMS capabilities ideal for advisory operations. Plans start from $20 monthly per user.

Creating a Logo and Brand Assets

A custom logo symbolizing core values, strengths, or specialty areas paired with cohesive visual assets reinforces consistent brand recognition. When designing through affordable services like Looka, advisors can choose from an array of icons, colors, and typography styles matched to their positioning.

Business Cards and Signage

Vistaprint offers cost-effective business cards showcasing advisor credentials, services, and contact information for in-person client meetings and referrals. Plus customized interior/exterior office signage with logos establishes professional visibility. Content is also displayed on their website and mobile apps.

Purchasing a Domain Name

Domains like www.firmnameInvestmentAdvisors.com available through registrars like Namecheap lend authority and amplify SEO efforts. Opt for .com over alternate extensions. Keep names short and easy to remember. Renew for 5-10 years to retain ownership rights. Expect around $15 yearly for domain registration.

Building a Website

Well-designed websites quickly convey advisor value propositions while capturing contact details from prospects. Every RIA needs one. Options include intuitive drag-and-drop site builders like Wix for DIY sites or outsourcing creation to expert freelancers found on marketplaces like Fiverr for complete customization.

12. Join Associations and Groups

Expanding professional networks through industry associations, local meetups, and online forums fuels growth for investment advisors by enabling best practice sharing, referrals, and potentially lucrative partnerships.

Local Associations

Area chapters of leading wealth management bodies like the National Association of Personal Financial Advisors (NAPFA) and the Financial Planning Association (FPA) regularly host workshops, conferences, and networking events attended by top regional RIAs. Expect membership fees of $400 – $850 annually.

Local Meetups

Platforms like Meetup make discovering relevant seminars, mixer events, and skill-building workshops effortless via location/interest-based searches. Attending free meetups keeps advisors abreast of solution innovations.

Facebook Groups

Popular Facebook communities enable advisors to crowdsource guidance from thousands of networks. Learn about niche markets like fee-only planning, exit planning, socially responsible investing, behavioral finance, and other specializations. Check out Funding & Investment Secrets and Value Investments.

13. How to Market an Investment Advisory Business

Implementing multifaceted marketing strategies is non-negotiable for RIAs to consistently attract and convert high-net-worth individuals and institutional clients.

Referral Marketing

While an advisor’s professional and personal networks generate initial clientele, referral programs incentivize existing customers to endorse their services. Offering free credits, gift cards, or donations to their charity of choice for every new client sent establishes goodwill and amplifies word-of-mouth promotion.

Digital Marketing

- Google Ads campaigns targeted by keywords like “retirement planning”, “portfolio management”, and “wealth advisor” help RIAs appear at the top of search results for relevant buyer queries in their geographic area. Expect costs per click between $5 to $15.

- Facebook/Instagram ads showcase niche expertise to hyper-specific demographics filtered by age, income, education levels, and interests. Plan around $100 per month for testing.

- Publishing YouTube explainers establishing thought leadership around market developments, retirement strategies for different generations, and college savings helps content travel virally.

- SEO-optimized blogging discussing industry trends, advisor perspectives, and wealth planning advice improves organic visibility and search rankings when ranking for advisor terms.

Traditional Marketing

- Direct mailers with promotional offers mailed to high-income zip codes still garner respectable conversion rates in certain niches. Budget $2 per mailer.

- Sponsoring community events like golf tournaments and galas frequented by high-net-worth individuals creates networking opportunities. Plan $5,000+ per event.

- Local radio spots build mass reach for name recognition. Expect around $200 for 30 times weekly spot plays.

- Print ads in financial industry trade journals tap directly into large RIA networks open to mergers and acquisition deals.

As trust and credibility anchor business growth in advisory services, marketing should aim to nurture community relationships and convey functional expertise first and foremost.

14. Focus on the Customer

As you learn how to start a investment advisory business, remember your customer comes first. Delivering white-glove service and prioritizing client interests is pivotal for a new financial advisory business.

This involves proactively updating customers on portfolio performance rather than relying on them to inquire. Conducting periodic reviews to realign investment strategies with evolving financial goals also reinforces commitment.

During moments of market volatility assuaging concerns through educational sessions, risk analysis, and adjustment recommendations provides reassurance. Help navigate complex decisions around inheritance planning, stock options, and home purchases.

The exemplary experience at every interaction breeds loyalty even amidst fee changes. Satisfied individuals gladly refer family and friends once the advisor earns goodwill through genuine care for their financial well-being. Over time, the majority of new business stems from word-of-mouth on the back of stellar service.

Ultimately an advisor’s success hinges on the success achieved for customers. The relationships nurtured, knowledge imparted and outcomes secured determine growth. Service with integrity at the core sparks a virtuous cycle benefitting both clients and the firm.