The personal finance coaching industry has exploded in recent years. Between the overall task of financial advising and the niche of budgeting, there’s plenty of ground to cover. The market continues to expand, with an estimated compound annual growth rate (CAGR) of more than 5.5% from 2023 and 2032.

If you have a knack for budgets and personal finance, starting a business as a budget coach can be an incredibly rewarding endeavor. You get to set your hours and fees, work remotely with clients worldwide, and make a meaningful impact on people’s financial lives.

This guide will walk you through how to start a budgeting coach business. Topics include market research, competitive analysis, registering an EIN, obtaining appropriate business insurance, sourcing materials, and more. Here’s everything you need to become a successful financial coach.

1. Conduct Budgeting Coach Market Research

Market research is essential for starting a financial coaching business. It provides much-needed insight into your target market, trending financial coaching services, and other important details for your business plan.

Some of the information you might learn through market research as a financial coach includes:

- The rapid growth of this industry is fueled by mounting consumer debt and consumer desire to reach money goals.

- This expanding market represents a massive opportunity for skilled budget coaches.

- As both individuals and businesses alike seek help, demand for budgeting and money-coaching services continues rising steeply.

- There is also ample room in the market for new specialty budget coaching niches such as retirement planning, college savings strategies, debt payoff methodologies, and budgeting psychology.

- Additionally, particular demographics like minorities, seniors, middle-income families, and small business owners remain underserved currently and prime targets for coaches.

- Budget coaches have delivery model flexibility as well.

- Because budget coaching is primarily advice-centered, digital delivery platforms lend themselves well to serving national and even global clientele in addition to local in-person coaching.

Low barriers to entry combined with the ability to scale client reach through technology make this sector highly attractive for aspiring coaches. Specializing in and targeting particular niches and demographics can further expand the available market share and clients.

2. Analyze the Competition

When launching a budget coaching business, comprehensively analyzing your competition is crucial for positioning yourself in the market. This applies to both digital competitors as well as local in-person finance coaches.

Some ways to get to know local financial advisors in your area include:

- Identify coaches in your city and state along with those serving your targeted niche nationwide.

- Document key details like services, prices, specializations, ideal clients, branding, and reviews.

- Dig into their digital presence, searching their website pages and profiles across social media platforms like Instagram, TikTok, Twitter, Facebook, LinkedIn and YouTube.

- Compile intel on services offered, content marketing funnels and lead magnets used, client testimonials, knowledge resources provided, and personal branding techniques leveraged.

- Identify which platforms your competitors are most engaged and active on.

- Gauge overall online visibility through tools like SEMrush, Ahrefs, and Moz which provide metrics on domain authority, rankings, traffic estimates, keyword targeting, and backlinks.

- The stronger the online presence and search visibility, the more competitive the threat posed.

- Local budget planning coaches without an online presence offer less direct competition for those marketing digitally.

Compiling competitive research allows for creating differentiation and unique positioning. Identify underserved niches, gaps in educational content areas, opportunities for specialization, ways to stand out in branding, avenues to improve client onboarding workflows, pricing gaps, and more.

3. Costs to Start a Budgeting Coach Business

As you start a financial coaching business, you’ll run into startup and ongoing costs. The ability to operate virtually helps minimize expenses substantially. Here is an overview of typical startup and recurring monthly/annual costs:

Startup Costs

Initial outlays when formally establishing your coaching practice include:

- Business Entity Formation – $100-$800 Filing paperwork for establishing a LLC or S-Corp

- Website Development – $300-$2,500 Hiring a designer to build a custom site or using a DIY platform like Squarespace or Wix

- Branding Assets – $100-$500 Logos, color palettes, graphic elements, etc.Either DIY or hiring a graphic designer

- Education & Training – $500-$5,000 Enrolling in money coaching certification programs and related business courses like accounting, marketing, etc.

- Technical Equipment – $500-$1,500 Laptop, video gear for remote sessions, finance software, etc.

- Marketing Collateral – $100-$500 Business cards, flyers, ads, etc. for initial promotions

Total startup budgets can range from around $1,500 on the very low end up to $10,000+ for those investing heavily upfront in branding, site, training, and equipment. But with DIY efforts, costs can be minimized substantially.

Ongoing Costs

Regular monthly and annual expenses to account for after launch include:

- Virtual Office Subscription – $10-$100 per month for video calls, file sharing, calendars, etc

- Software Subscriptions – $15-$100 per month Finance tools, project mgmt apps, marketing platforms (email services, social media schedulers, and ad accounts)

- Professional Associations – $25-$100 per month Industry groups and coach certification renewal fees

- Marketing Spend – $100-$500 per month Ad budgets for continually acquiring new clients

- Liability Insurance – $400-$1200 per year Professional coverage protecting from risks associated with financial advice

- Continuing Education – $500-$2000 per year Enrolling in industry events, coach development programs, seminars, and courses

- Legal & Professional Services – $300-$2000 per year Accounting help, lawyers for contracts, loan signing agents, and agreements (as needed)

- Taxes – 15-20% of revenue Quarterly estimated payments and annual tax filings

Other more intermittent or variable costs may include travel/lodging for in-person client meetings, subcontracting associate coaches as you scale, miscellaneous equipment upgrades or replacements, and financing fees if accessing small business credit or loans.

4. Form a Legal Business Entity

Deciding on the proper legal entity for your own financial coaching business is important. The entity type formally defines company structure, taxation framework, and legal liability. There are four types of business entities for a financial advisor to choose from, including:

Sole Proprietorship

A sole proprietorship is an unincorporated business fully owned and led by one individual. Easy setup and full control over operations are pluses. However sole proprietors receive unlimited personal liability for debts, obligations, lawsuits, or claims associated with the business.

Partnership

Partnerships enable multiple budget coaches to jointly own a firm. A formal partnership agreement governs ownership percentages, responsibilities, processes for handling disputes, and defining exit strategies. General partnerships still involve unlimited liability while LPs and LLPs limit risk to partners’ financial stake.

Limited Liability Company (LLC)

Many solopreneurs launching a budgeting consulting operate initially as sole proprietors before migrating to an LLC structure for liability safeguarding as the business grows. LLCs fuse the positives of partnerships and corporations with less administration rigmarole. They limit legal and financial liability to business assets.

Corporation

A corporation provides the most extensive protection for financial coaches. Like an LLC, a corporation protects your personal assets, separating them from the business. Corporations are expensive and complicated to register, making them best suited for large businesses.

5. Register Your Business For Taxes

Every successful financial coaching business must register with federal and state tax authorities. An EIN (employer identification number) establishes your business identity with the IRS for tax purposes and other crucial financial transactions.

Acquiring an EIN is quick, free, and can be instantly obtained from the IRS website. Simply navigate to the Online EIN Assistant and answer a short questionnaire about your LLC entity structure and business activities. On successful submission, your EIN will be displayed and mailed to the business address provided.

With your EIN, open a dedicated business bank account to keep coaching income and expenditures separate from personal finances. This makes documenting business revenues, expenses, deductibles, and profit/loss dramatically easier for tax time through clean financial statements.

EINs also facilitate accepting client retainers through payment processors like Stripe that integrate seamlessly into your coaching website. These validate business identities using EINs before allowing the activation of payment functionalities.

The next step is registering with your state revenue or taxation department to collect and remit sales tax where applicable. In most states, the sales tax registration process can be initialized on the entity formation paperwork filed when structuring your coaching LLC business.

However, additional tax paperwork specifically tailored to service providers may need to be completed after the fact to comply with state laws around assessing applicable sales taxes. Carefully review the business tax guide published on your state’s tax website.

The sales tax registration steps are unique for each state but typically require submitting details on business activities, projected revenues, ownership structure, bank accounts, managing members, and locations where services are rendered.

There are no registration fees but budget coaches must collect and remit sales taxes to state authorities at year end. This will require interfacing tax returns for EIN-registered business activity with personal returns for those operating as pass-through entities.

Registering for both federal (EIN) and state tax IDs institutes crucial financial frameworks and protections for formally operating a compliant budget coaching LLC. Both processes can be readily completed through streamlined online applications.

6. Setup Your Accounting

Properly managing finances should come naturally to budget coaches. Setting up a scalable accounting framework from the outset ensures your coaching practice not only walks the talk on money management but operates in a legally compliant manner.

Accounting Software

Begin by establishing dedicated QuickBooks accounting profiles to manage income and expense flows tied to your coaching. QuickBooks seamlessly syncs with business bank and credit card accounts to automatically track billing, payments, tax liabilities, invoices, profit and loss, etc.

Hire an Accountant

Supplement DIY software with professional accounting assistance. Hiring an accountant initially for advisory services related to structuring your coaching business offers helpful financial blueprinting for long-term needs around quarterly taxes, payroll if you expand staffing, annual filings, and navigating any IRS issues.

Open a Business Bank Account and Credit Card

Open dedicated business checking accounts and credit cards exclusively for coaching activity, never mingling with personal finances. This streamlines categorizing transactions related to your practice across bank statements, accounting software, and tax returns.

7. Obtain Licenses and Permits

While budget coaches primarily offer advisory services, multiple regulatory and compliance considerations still apply when formalizing your business. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

At the federal level, budget coaching likely falls under Rule 203 requirements outlined in the Investment Advisers Act of 1940. This mandates registration with the SEC for financial planners managing over $100 million in client assets or advising registered investment companies.

Each state governs financial or investment advisor laws differently. Around 33 states require some form of license, registration, or permit for budget consultants dispensing money guidance. New York requires all fee-based advisors to complete Form ADV paperwork even with no assets under management.

Complying often involves registering your LLC entity as an IAR (Investment Advisory Representative) and either you and/or key staff completing necessary licensed examinations like the Series 65. Some locality rules designate between personalized coaching guidance vs broad-based seminars and education.

Carefully assess if coaching services trigger compliance with SEC or state investment statutes. Also review complementary state licenses around tax preparation, credit counseling, or financial planning that apply to your budget methodologies.

Though unlikely, municipalities may impose miscellaneous permits, zoning licenses, or operational rules depending on the physical location where your budgeting coaching occurs. For virtual practices, home business ordinances may require special use permits for semi-commercial activities originating from residential areas in some counties.

Mind due diligence across local, state, and federal statutes at the unique intersection of financial consulting and credit guidance to launch legally. Budget thoroughly for hundreds in fees and prep costs like bonding, equipment, supplementary insurance, and testing associated with certain trade permits.

8. Get Business Insurance

Insuring your budget coaching business safeguards from unexpected scenarios that could devastate your nascent firm. Though online entities with few fixed assets and no storefronts may waive insurance initially, coverage becomes essential once clientele and revenues scale.

Without adequate policies, a range of scenarios pose dire risks from accidental copyright infringement during educational activities or webinars exposing you to crippling statutory damages, to cyber incidents compromising sensitive customer data triggering hefty notification and remediation costs under breach notification laws.

While the information covered under coaching engagements may be generalized, you still dispense particularized advice tied to a customer’s finances. If recommendations result in investment losses, or worsened debt obligations, disgruntled clients may pursue legal action.

Without liability coverage, even nuisance suits can sink solopreneurs lacking resources to mount legal defenses. Find affordable coverage through platforms like CoverWallet starting at around $50 monthly. Tailor higher limit packages spanning general, professional, liability, and cyber policies based on risks.

Select package policy limits adequate for assets you own while balancing premium costs and expected client roster size. Schedule recurring payments while keeping coverage active. Revisit insurance needs whenever launching new services, bringing on associate coaches, or crossing milestones like 100+ active monthly clientele.

9. Create an Office Space

While budget coaches primarily work remotely, having a professional office space facilitates in-person consultations, recording educational content, interfacing with clients, and separating work/life boundaries. The right workspace balances visibility, accessibility, amenities, and affordability.

Home Offices

Converting a spare bedroom or basement into a home office works well for bootstrapped coaches getting started. With minor upgrades like ergonomic furniture ($300-$1000), lighting kits ($100-$500), and video gear ($200-$2000), home spaces provide quiet, convenient and cost-effective operations bases.

Coworking Spaces

As coaching revenues grow, leasing desk space at trendy WeWork coworking offices offers enhanced professionalism and networking. These spaces lease shared access to turnkey amenities like conference rooms, printing, events, community parks, and front desk staff.

Commercial Office

Spaces Over the long term, ambitious coaches running seven-figure firms may wish to acquire standalone brick-and-mortar offices downtown to host coaching staff. Expect commercial buildout and remodeling costs to start around $100 per square foot.

10. Source Your Equipment

Budget coaches require only basic technical setups including laptops/tablets, video gear, financial software, and miscellaneous accessories to deliver engaging coaching online or in-office. Evaluate new, used, and rental options when sourcing must-have gear.

Buying New

For the latest model computers and accessories, Apple and Dell outlet deals can salvage 20-30% off market prices starting at around $800 for capable laptops. Finance new equipment interest-free using 0% credit cards or lines before transitioning costs to business as revenues scale.

Buying Used

Those seeking value can save 50% or more buying used electronics through Gazelle, Swappa, and uSell which offer lightly used MacBooks ($400+) and PCs ($200+) which easily last 3-5 years. Facebook Marketplace and Craigslist also feature local sellers.

Renting

Need short-term access to equipment fast avoiding large upfront costs? National chains like Rent-A-Center offer flexible leases on laptops ($60+/month), DLSR cameras ($89+/month), and other electronics accessible for days to years. Useful when testing gear before purchasing long-term.

11. Establish Your Brand Assets

Crafting a distinctive brand identity helps budget coaches stand out amid competitors, build awareness, and attract aligned clientele. Essential brand assets require an upfront investment but constitute invaluable marketing cornerstones as you scale.

Getting a Business Phone Number

Acquire a dedicated business line via cloud-hosted platforms like RingCentral. Enjoy unlimited calling, SMS text messaging, virtual faxing, voicemail transcriptions, and auto-attendants starting at $20/month. Port numbers anytime while presenting a professional unified presence across devices.

Creating a Logo and Brand Assets

Hire designers on Looka to craft custom logos from $20 encapsulating your vision. Explore their gallery finding inspiration from shapes, motifs, and color palettes speaking to money mindfulness coaching. Finalize vector files easy to reproduce at any size across websites, merchandise, and signage.

Creating Business Cards and Signage

Business cards establish credibility during client meetings and networking events. Order 500 to 1000 cards affordably from Vistaprint starting around $10 customized with logos, taglines specializations, and contact info.

Purchasing a Domain Name

Secure the perfect .com domain name for your website and email addresses using ICANN-accredited registrars like Namecheap for under $15/year. Opt for auto-renewal and private registration. Ideal names succinctly describe offerings in a memorable way like MoneyClarityCoaching.com.

Building a Website

Consider DIY site builders like Wix providing free hosting, extensive templates, and integrated SEO made for non-technical users. Prefer custom aesthetics or functionality? Hire web developers affordably through marketplaces like Fiverr with comprehensive portfolios and hundreds of 5-star reviews indicating quality work.

12. Join Associations and Groups

Joining key professional associations, community meetups, and online forums jumpstarts networking and mastermind opportunities for fledgling budget coaches. Surround yourself with fellow finance aficionados to trade ideas, strategies, and experiences accelerating your coaching competencies.

Local Associations

In most major metros, chapters of national groups like the Financial Planning Association convene periodically for members to share industry trends, and client experiences and practice building tactics relevant regionally. Annual dues for local association chapters average $500.

Meetups

Actively RSVP for money coaching workshops and financial literacy events in your city listed on platforms like Meetup. From boutique seminars of 25 attendees to major conferences hosting 1000+ finance folk, tap into the collective wisdom from speaker panels and presentations.

Facebook Groups

Dive deeper into niche discussions around your specific budgeting coaching focus areas by joining relevant Facebook communities. Popular relevant groups include Finance Professionals and Budgeting 101.

13. How to Market a Budgeting Coach Business

Implementing an omnichannel marketing strategy combining digital promotion and offline outreach ignites visibility and client acquisition for fledgling budget coaches. As an authority dispensing specialized money advice, conveying competence and accessibility factors heavily in winning new business.

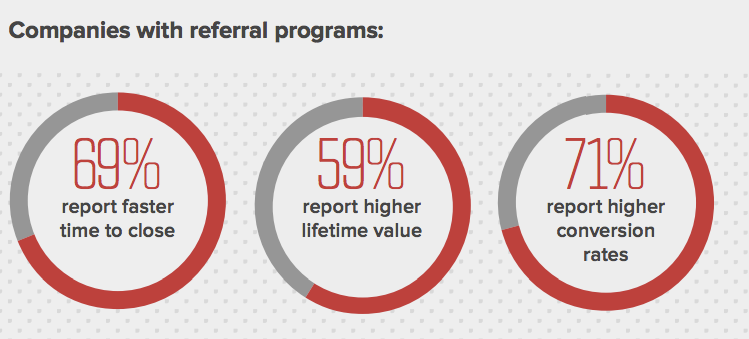

Referral Marketing

Start by activating warm referrals within existing personal networks and circles of influence. Offer current clients incentives like account credits or gift cards to enthusiastically refer friends and contacts interested in budget coaching.

Digital Marketing

- Launch Google and Facebook ads geo-targeting relevant keywords like “budget coaching near me” within a set mileage radius of operation. Expect to invest at least $300 monthly in optimizing and testing ad variants.

- Start an email list to push webinar, video, and blog content then nurture subscribers towards free consultations to discuss needs.

- Launch a YouTube channel sharing short animated videos explaining budgeting concepts. Link back to site driving traffic.

- Guest post articles and podcast interviews on niche sites discussing money mindfulness tips further displaying expertise.

- Run LinkedIn-sponsored posts spotlighting client success stories and leads feed directly into your CRM system. Expect costs between $2-$10 per click.

Traditional Marketing

- Print flyers and distribute them at local libraries, community centers, career coaching offices, and coffee shops frequented by professionals.

- Take out ads in local newspapers and magazines like regional business journals, local Chamber of Commerce newsletters, and alumni association emails.

- Leverage radio by sponsoring financial advice shows on public radio during pledge drives granting airtime for segments.

- Host public weekend seminars at the local library, community college, or rec center attracting those interested in group coaching rates.

The most effective client acquisition channels will depend largely on budgeting niche, geographic locale, and target demographics. Continually test new formats assessing response rates and conversion relative to spending.

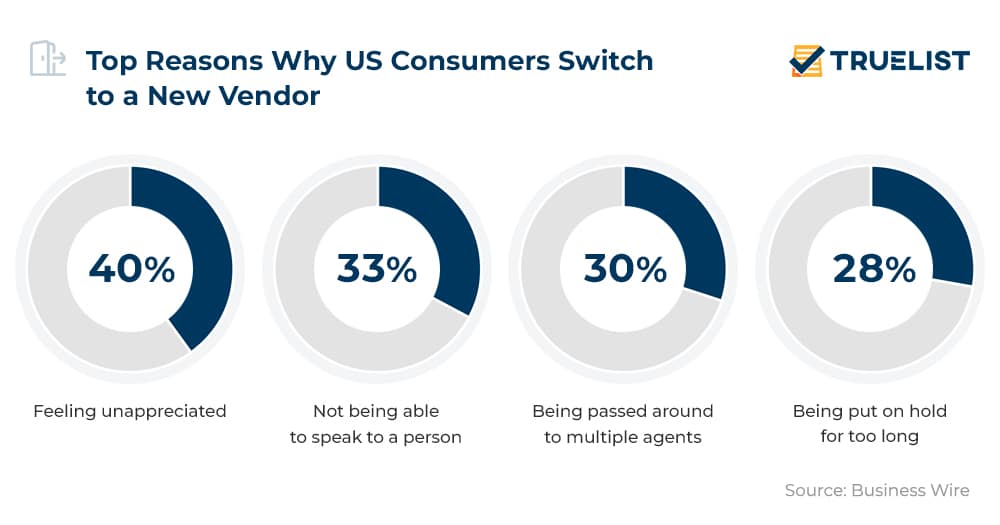

14. Focus on the Customer

Delivering exceptional money coaching customer service cements satisfaction ensuring clients complete programs and refer friends. Whereas poor experiences risk derailing retention. Prioritizing service-centric policies and personalized care retains roster spots other coaches would love to capture.

Some ways to implement enhanced customer focus include:

- Customize weekly check-in calls adjusting to individual communication preferences whether video conferences, phone, email, or text.

- Proactively update progress dashboards in shared portals commenting on milestone achievements.

- Send handwritten cards celebrating debt payoff accomplishments or special occasions like birthdays.

- Evaluate preferred learning modes and tailor lesson deliveries and examples suiting visual, auditory, or kinetic inclinations.

- Train any associate coaches brought aboard on the importance of empathy, compassion, and accountability when guiding clients through vulnerable money transitions such as money transfers or paying off debt.

- Implement CS improvement feedback loops via post-program surveys and stay interviews to continually refine guidance approaches.

By focusing first on nurturing positive helpful client relationships, not invoice totals, you organically build a tribe of enthusiastic supporters. They then eagerly refer friends and colleagues to an advisor improving financial situations so profoundly through patient principled coaching.