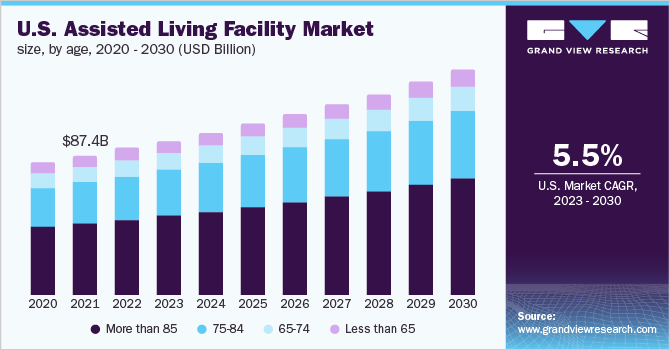

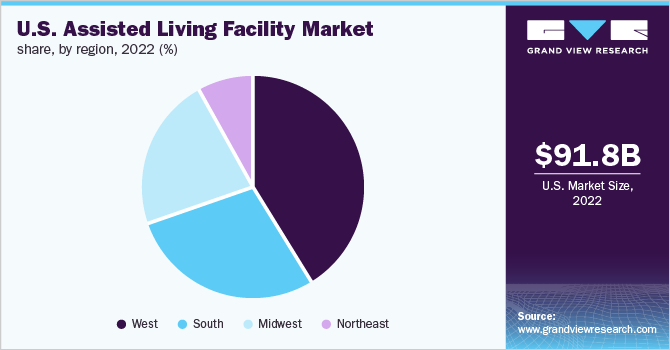

The assisted living facility industry is on the rise, reaching a $91.8 billion evaluation in 2022. With a compound annual growth rate (CAGR) of 5.53% from 2023 to 2030, now is a great time to start your own assisted living facility.

Opening an assisted living facility can be a rewarding endeavor for entrepreneurs or investors looking to capitalize on this demand. Assisted living facilities provide personal care and safety to those in need, making them especially important in aging populations.

In this guide, we’ll explore how to start an assisted living facility. From conducting market research to obtaining licenses and financing, you’ll learn strategies for launching an assisted living facility optimized for profitability and delivering quality care.

1. Conduct Assisted Living Facility Market Research

Market research is essential to starting an assisted living business. From understanding licensure and certification unit requirements to finding your target market and uncovering market trends, nursing home research is a big help.

Some details you’ll learn through market research include:

- With seniors representing over 90% of assisted living residents, this presents a major market opportunity.

- Capitalizing early allows positioning facilities in prime locations to capture upcoming demand.

- Competition varies significantly across states and metro areas but remains relatively fragmented overall.

- Start-up costs range widely based on factors like location, size, and services offered.

- Smaller operations can launch for under $1 million, while larger-scale communities with 100+ beds often require investments of $10 million+.

- Understanding the local competitor landscape is essential for positioning new facilities appropriately to balance capital costs with projected occupancy and pricing.

- With rising dual-income households and geographic mobility, family caregiving is declining, further fueling assisted living demand.

- Over two-thirds of residents pay privately, though Medicare and Medicaid reimbursements are also growing revenue streams.

- This payer mix allows facilities to balance both private and public funding sources.

In summary, market trends point to a strong, long-term expansion for assisted living facilities in the U.S. Savvy investors and operators can capitalize on the market gaps across states and within local areas, positioning appropriately-sized facilities offering best-in-class design, amenities, and community connections.

2. Analyze the Competition

Starting a new assisted living facility requires thorough competitive research on other facilities in the desired geographic area. Understanding competitors in the assisted living market helps you build a stronger business plan for your own assisted living residence.

There are several best practices to follow:

- Identify facilities that would be direct competitors based on location proximity, amenities/services (e.g. adult day care, entertainment, etc.), and target resident demographics.

- Look at private pay rates, staffing ratios, occupancy percentages, and health inspection ratings, as potential benchmarks to meet or exceed.

- Drive to competitors in person to get a feeling for site visibility, external aesthetics, and convenience.

- Carefully review competitors’ digital marketing strategies including their website content, paid ads, and social media presence.

- Google Maps listings and reviews are also insightful indicators of reputation and perceived quality. This shows what digital footprint resonates in your area and can inform your online strategy.

- Also, leverage data sources like CPS Aging Insights to analyze estimates of age 75+ population density around competitor facilities and demand gaps in the market over time.

- Track and monitor competitors’ development projects, service changes, regulatory issues, and ratings over time to quickly identify problem areas.

Combining offline competitive benchmarking with continuous online monitoring and market data analysis provides the full, robust view needed to make smart positioning decisions when launching a new assisted living facility.

3. Costs to Start an Assisted Living Facility Business

Starting an assisted living facility requires substantial upfront investment and ongoing expenses. Here is a detailed breakdown:

Start-up Costs

An assisted living facility can range from $750,000 to over $10 million depending on size, location, and services offered. Key expenses include:

- Construction & Land Costs – For new standalone buildings budget $125-275 per sq ft, likely $2-5+ million total for a medium facility. Purchasing an existing property can lower costs. In prime locations expect $500k+ per acre.

- Furnishings & Equipment – $750-$1,500 per unit is typical including beds, dressers, tables, etc. Plus ~$100k for dining sets, activity furnishings, and office equipment.

- Consultants & Legal Fees – $150k+ for consultants like architects and kitchen designers. Legal fees are often $50k+.

- Licensing & Permits – Varies by state but plans for $50k+ in licensing, utility, food service, and other permitting expenses.

- Staffing & Training – Hiring an Administrator and marketer 1 year out at ~$90k each. Plus, a budget of $250k+ to train incoming staff if not opening with a seasoned team.

- Working Capital – Have a minimum of 3 months of operating capital on hand as a cushion, likely $1 million+ even for a 70-bed facility.

Ongoing Costs

- Staff Payroll – Largest cost center, often 70%+ of revenue. $55k+ monthly for core staff like nursing, maintenance, and housekeeping based on 1 caregiver per 6 residents 24/7.

- Food Supplies – Budget $1k monthly per resident. $70k+ for a 70-bed facility.

- Utilities – Power, waste disposal, etc. Easily $5k+ per month.

- Marketing – SEO services, ads, etc. $3k+ monthly.

Major annual costs:

- Property/Liability Insurance – $25k per year

- Property Taxes – $250k+ depending on value.

Proper funding and planning for these considerable startup and operating costs is imperative when undertaking an assisted living facility venture. Let me know if you need any clarification or have additional questions!

4. Form a Legal Business Entity

The appropriate legal entity is a key decision when forming an assisted living facility business. Most small businesses choose an LLC as a legal business entity. Let’s break down all your options, as you open your new assisted living facility.

Sole Proprietorship

A sole proprietorship is fully owned and managed by one individual. This offers simplicity and pass-through tax benefits but minimal protection if sued. One claim could jeopardize personal assets. High risk given residents’ health conditions.

Partnership

Partnerships enable multiple owners to combine assets and expertise. However, they still expose personal assets and complicate decision-making and leadership. Contentious exits or disputes could severely disrupt resident wellbeing.

Corporation

A corporation provides limited liability but double taxation of profits and extensive record-keeping requirements add complexity. The rigid ownership structure hinders adapting as the business evolves over a likely 30+ year lifespan.

Limited Liability Company (LLC)

A limited liability company (LLC) limits personal liability while allowing pass-through taxation. The flexible management structure readily accommodates onboarding new administrators or care specialists over time. Ownership units facilitate incentivizing standout talent or bringing on private investors down the road to fund expansion projects. These advantages make an LLC the best choice.

5. Register Your Business For Taxes

An employer identification number (EIN) is a key requirement when establishing an assisted living facility business. Here’s what owners need to know about obtaining their EIN:

An EIN serves as a social security number for your business and is used to identify tax accounts. It is required to pay federal and state taxes, open business bank accounts, apply for licenses, and even hire employees.

The EIN must be obtained directly from the Internal Revenue Service (IRS). The streamlined application process can be completed online at no cost, taking just minutes. Simply provide basic information about your LLC entity and ownership structure per the step-by-step instructions.

Upon submitting the EIN application, your unique 9-digit number will be provided immediately to print and save for your records. This expedited online process avoids paperwork and lengthy delays waiting on mailed responses.

In addition to the federal EIN, complete state-level tax registration to collect and remit any sales or healthcare-related taxes. The application is similarly straightforward but does have a small one-time registration fee, for example, $50 in California.

Securing your EIN and attending to required tax structures early on ensures full legal compliance as you work towards opening your assisted living facility. Don’t hesitate to consult a tax professional to understand all federal and state registration obligations specific to your business.

6. Setup Your Accounting

Maintaining meticulous financial records is non-negotiable for assisted living facilities, given intricate Medicaid/insurance billing and stringent regulatory oversight requiring accurate resident fund audits. Working closely with an accountant alleviates compliance risks while optimizing tax savings.

Accounting Software

Leveraging small business accounting platforms like QuickBooks greatly simplifies organizing income/expenses, automating reconciliation, and keeping tidy books for simplified year-end reporting. Easy invoice generation, inventory, and fundraising campaign features also facilitate operations.

Hire an Accountant

Outsourcing day-to-day bookkeeping and payments frees owners to focus on resident wellbeing. A specialized healthcare accountant further identifies all available credits/deductions while ensuring full compliance across Medicare access, trust fund management, and cost report filings. Expect $1,000+/month, recouping this investment in tax savings.

Open a Business Bank Account

Keep business funds including payroll completely separate from personal finances via dedicated commercial accounts. Similarly securing a business credit card in the LLC’s name builds credit history. Providers like Chase vet eligibility via past revenue and existing commercial credit lines if applicable.

7. Obtain Licenses and Permits

Opening an assisted living facility involves obtaining several critical licenses and permits to legally operate and avoid hefty fines. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

At the federal level, assisted living communities must register with Medicare and Medicaid programs to accept qualified residents and receive reimbursement for care services. Registration requires submitting detailed applications outlining capacity, staffing, policies, and more so readiness can be verified.

Additionally, administrators and certain direct care staff must clear federal-level criminal background checks to screen for any disqualifying convictions before hiring. These reduce healthcare fraud and protect vulnerable seniors.

States also assess facilities during a certificate of need process and routine inspections, issuing licenses to operate only once stringent health, cleanliness, and safety standards are met. Any unresolved issues blocking licensure must be addressed, often requiring six-figure investments in facilities or staff.

Local municipalities also play a role, requiring occupancy permits, fire inspections, and food service licenses which can necessitate kitchen upgrades or new clinical waste disposal processes if deficiencies are found.

8. Get Business Insurance

Obtaining adequate business insurance is vital for assisted living facilities to mitigate risk. Without proper coverage, just one incident could spell financial ruin for the operation.

Insurance protects against expensive property damage, resident injuries, employee claims, and more by covering repairs, legal fees, settlements, and other costs up to specified policy limits.

For example, a burst pipe could inundate a facility, requiring six figures to remediate mold and water damage without insurance. Or a resident could suffer an injury prompting a lawsuit too costly to self-fund through the appeals process. Alternatively, staff could file employment claims should disputes arise over pay policies or harassment allegations.

The right insurance tailored to assisted living risks alleviates these concerns that could otherwise force closures or bankruptcy. Packages typically include general liability, professional liability, directors & officers coverage, and property and casualty policies.

The application process entails submitting detailed information on operations, safety protocols, and history for underwriting review. Plan for a 30-60-day process to activate coverage upon approval.

9. Create an Office Space

Operating an assisted living facility generates substantial paperwork and administrative tasks beyond direct resident care. Having a dedicated office space provides administrators and managers workspace for essential business functions, optimizing efficiency and organization. There are several potential options to consider:

Home Office

A home office can offer convenience and autonomy for a sole proprietor overseeing a smaller facility. However, it may prove distracting to balance professional and personal demands in the same environment. Most zoning regulations also prohibit employee meetings or seeing residents in home spaces. Cost is minimal beyond furnishings.

Coworking Office

Coworking spaces like WeWork provide furnished private offices and common areas for $300-$500 monthly. These facilitate employee/resident meetings and feature reception staff. However, limited space could constrain expanding teams. Confidentiality may also be a concern alongside other resident companies.

Retail Office

Retail office spaces enable customer-facing interactions but lack the infrastructure for daily administrative needs. As stand-alone locations, they also lack the collaborative community of a shared coworking environment. Expect to budget $2,000 monthly for lease payments.

Commercial Office

Commercial office spaces provide the most flexibility to tailor to workflow needs with options for on-site document storage, meeting rooms, call centers, and more. These larger-scale spaces best accommodate expanding staff over time. Tenant improvements also facilitate specialized accessibility and security accommodations.

10. Source Your Equipment

Launching an assisted living facility requires extensive furnishings and equipment to create a safe, functional, private home care environment for residents. From clinical beds to kitchen appliances, here are top sources to procure essential supplies:

Buy New

Buying new enables customizing specifically to accessibility, infection control, and maintenance needs, though initial investments are highest. National vendors like Grand Healthcare furnish complete facility fit-outs. Allocate $750-$1,500 per residential unit.

Buy Used

Buying used through auction sites and estate sales presents up to 50% savings over new. However, closely inspecting safety, hygiene, and durability, items must uphold rigorous assisted living standards. Caring Transitions resells quality pre-owned furnishings.

Rent

Renting through national suppliers like CORT Events furnishes properties temporarily, useful for pilot locations or interim replacements during renovations. However, accumulative longer-term fees often exceed buying outright.

Lease

Leasing asset packages from FaciliWorks, or similar area specialists bundles required assets from resident beds to commercial washers/dryers under fixed monthly payments and capped repair costs. This simplifies upfront budgeting but transfers ownership.

11. Establish Your Brand Assets

Establishing a strong brand presence is crucial for new assisted living facilities to competitively attract families in an increasingly saturated market. As a brand marketing expert, here is a step-by-step guide:

Get a Business Phone Number

Securing a professional business phone line via providers like RingCentral lends credibility to incoming caregiver inquiries and over-the-phone tours. Toll-free routing, voicemail features, app integration, and live analytics boost staff productivity.

Design a Logo

A distinctive logo intuitively conveys an organization’s values and quality standards at a glance. For assisted living ventures, an illustrative mark with nurturing imagery often resonates best with aging audiences. Services like Looka provide full custom design services along with templates if preferable for faster launch.

Print Business Cards

Promotional items like brochures, flyers, and signage featuring visual branding help facilities differentiate and stand out. Similarly, staff business cards enable relationship-building during community networking and health conferences. Convenient online printers like Vistaprint offer affordable packages for both.

Buy a Domain Name

Purchasing a custom .com domain anchors digital properties and is invaluable for discoverability. Aim for easy-to-remember, location-relevant names. Domain marketplaces like Namecheap make registering user-friendly with management tools to prevent expiration.

Design a Website

For site-building, user-friendly drag-and-drop platforms like Wix enable launching informative pages faster and without coding skills. For large operations, custom-designed sites better showcase unique amenities but require $5,000+ developer investments via platforms like Fiverr.

12. Join Associations and Groups

Tapping into local assisted living networks, events, and online communities expedites valuable insider advice when starting an operation. From staffing approaches to marketing tactics, connecting with established area owners pays dividends.

Local Associations

Joining the State Assisted Living Foundation of America provides a direct channel to advocacy initiatives, trend reports, and fellow local members navigating the same regulations, hiring hurdles, and occupancy-building challenges. For example, the California Association hosts dozens of regional meetings annually.

Local Meetups

Attending relevant conferences and seminars through platforms like Meetup keeps leadership up-to-speed on technology innovations, safety advances, and customer preferences that shape best practices. Trade events also foster networking with vendors and potential resident referral partners.

Facebook Groups

Specialized groups on Facebook enable crowdsourcing guidance from thousands nationwide. Caregiver support groups like Home Care and assisted Living Business Owners offer first-hand experience. Location and need-specific groups also help cousins open the Arizona field.

13. How to Market an Assisted Living Facility Business

Gaining visibility is imperative for assisted living facilities to drive occupancies in an increasingly competitive senior care market. While word-of-mouth referrals from satisfied families carry the most weight, strategic marketing expands reach and discovery.

Referral Marketing

Referral rewards programs entice happy customers to endorse the facility. For example, provide a $500 credit towards the next month’s stay for any family member they invite who moves in. This incentivizes residents to boast first-hand about service and amenities.

Digital Marketing

Digital strategies should focus on driving local awareness and engagement:

- Optimized Google Business profile to rank for community searches

- Google/Facebook ads targeted by age and care needs

- Daily social media content highlighting activities & testimonials

- Blog and FAQ pages to inform family caregiver decisions

- YouTube videos touring the accommodation options

Traditional Marketing

Traditional outlets broadcast messages to wider audiences:

- Direct mail flyers to surrounding households

- Radio segments on local senior programs

- Listing sites like Caring.com and APlaceForMom.com

- Sponsoring community health fairs and church events

- Print ads in city magazines and weekly newspapers

Dedicating matching budgets towards digital and traditional channels provides optimal integrated exposure. Measure response rates and conversions to filter the lowest-performing platforms over time. Outreach should focus within a 10-mile radius initially before expanding efforts.

Please let me know if you would like any assistance developing data-driven campaigns tailored for your local market!

14. Focus on the Customer

Providing exemplary 24/7 service dramatically impacts assisted living facility success. How staff and administrators engage with visiting families, answer questions, resolve issues, and cater to individual resident preferences shapes perceptions that fuel referrals and reviews. This directly enables competitive advantage and occupancies.

Consider family members recently placing their mother into a new facility. A compassionate, thoughtful intake process welcoming worries and needs upfront sticks. They observe the care, dignity, and joy with which staff treat their mother daily. Any requests to customize her vegan menu or wall décor are obliged without hesitation.

This peace of mind refers to friends from church also seeking trusted assisted care for their father. Those families then have similarly positive interactions, opting to host their mother’s 80th birthday party in the bistro thanks to customized catering.

Customer service excellence can cement the facility’s reputation as the premier neighborhood option based wholly on word-of-mouth marketing. Be good to clients in your residential care facility, and their families.