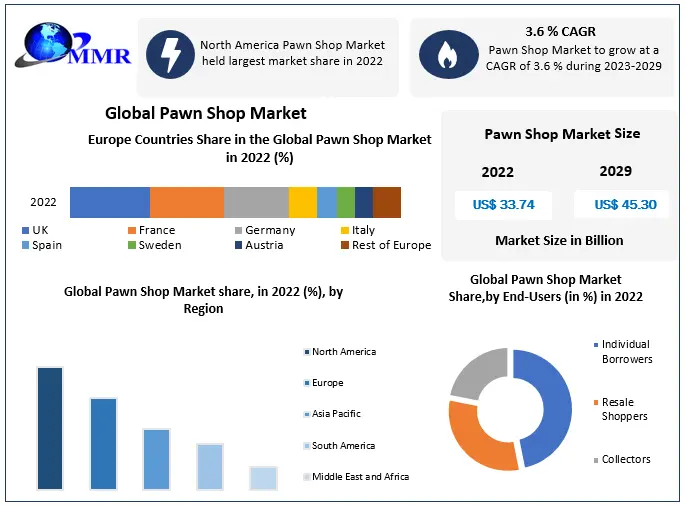

The global pawn shop industry is estimated to be worth over $38 billion as of 2022, with over 10,000 pawn shops across the country providing loans and buying secondhand goods from consumers. As the economy continues to fluctuate, more and more people are looking to pawn shops to sell their valuables or secure short-term loans using items as collateral.

This growing demand presents a lucrative business opportunity for aspiring entrepreneurs. Pawn shops fill an important niche, providing financial services to underbanked communities. They buy secondhand merchandise like jewelry, electronics, musical instruments, power tools, and more.

This guide will walk you through how to start a pawn shop. Topics include market research, competitive analysis, registering an EIN, marketing, obtaining business insurance, and even forming an LLC. Here’s everything to know about starting a pawn shop.

1. Conduct Pawn Shop Market Research

Market research is essential to starting your own pawn shop. It offers insight into your target audience, local competitors, pricing in the pawn shop industry, and other features of owning a successful pawn shop.

Some details you’ll learn through pawn shop market research include:

- When conducting your local market research, analyze demographic and financial data to determine the demand for pawn services in your geographic area.

- Pay attention to metrics like unemployment rates, median household income levels, rates of unbanked or underbanked households, and recent population changes.

- For example, areas experiencing rapid population declines may not support a profitable pawn business over the long term.

- On the flip side, lower-income urban neighborhoods where many lack access to traditional banking services often provide prime opportunities to open pawn shops.

Conducting thorough pawn shop market research takes time but drastically minimizes risk when starting any new small business. Pay attention both to overall industry growth trends and specifics within your local geographic market. Let the data guide your business planning to set up the best chance for long-term success.

2. Analyze the Competition

Carefully analyzing your competition is a key step before opening any local small business, especially a pawn shop. Start by identifying all existing brick-and-mortar pawn shops within a certain radius, such as 10 or 15 miles.

Some ways to get to know local competitors as you develop a business plan include:

- Search Google Maps and Yellow Pages listings to compile names, addresses, and basic information.

- Visit each location in person taking detailed notes.

- Pay attention to the store’s appearance, organization, security measures, and product displays.

- Estimate the quantity and variety of merchandise available.

- Score the customer service experience on factors like staff attentiveness and knowledge.

- Discretely snap photos to study later when analyzing the results.

- Take note of any long customer lines or rushed staff indicating high demand.

- Take business cards to gather phone numbers, websites, and hours of operation.

- Search online reviews for each pawn shop on platforms like Google, Yelp, and the Better Business Bureau.

- Look for recurring complaints about things like poor service, low payouts, messy stores, or lack of specialty expertise.

- Read the owners’ responses to identify opportunities to differentiate.

- Google each competitor to find their website and social media pages.

- Study services offered, focus areas like jewelry vs electronics, furniture, and online inventory.

- Search their domains on SEMrush to estimate web traffic and online visibility.

- Identify potential SEO gaps compared to market-leading sites driving the most organic search visits.

- The competitive analysis takes time but avoids replicating existing businesses.

- Find ways to stand apart in your local market. Offer night and weekend hours if competitors stay closed.

- Develop specialties around high-demand categories like power tools or designer handbags.

- Promote exceptional customer service and transparency around loans.

Ongoing competitive monitoring also helps adjust to new market entries or closures. Regularly repeat the assessment steps above to catch changes quickly rather than being caught off guard by the competition.

3. Costs to Start a Pawn Shop Business

Starting a profitable pawn shop takes careful financial planning and access to ample capital. Between startup costs, inventory purchases, and ongoing overhead, owners should prepare for substantial initial investments and regular monthly expenses.

Start-up Costs

Common startup costs when opening a pawn shop include:

- Licenses and Permits – $2,000 to $7,000 Pawn brokers must register for state and local business licenses. Additional permits around firearm sales or special taxes may also apply. Legal and accounting fees also fall into this category.

- Shop Fit Out and Display Cases – $20,000 to $100,000+ Securing and renovating retail space represents one of the largest startup costs. Expenses vary based on location size and condition. Specialized display cases and security measures also add up.

- Starting Inventory – $30,000 to $250,000 Owners need sufficient capital to purchase an initial selection of merchandise for resale. Focus on affordable items in high demand and easy to resell (mirrors, skateboards, jewelry, watches, etc.)

- Insurance – $2,000 to $10,000 per year Pawn shops require specialized property and liability insurance policies to cover potential loss, theft, or damages. Annual premiums vary based on location, size, and coverage levels.

- Advertising – $2,000 to $5,000 Promoting a new store requires print, online, and local advertising. Owners often offer special discounts or deals to drive early traffic.

- Staffing – $2,500 per employee: Staff overhead including wages, training, uniforms, and employment taxes should be budgeted for from day one. Many owners start with family help.

Ongoing Costs

Other common monthly overhead expenses include:

- Rent and Utilities: For small leased retail spaces, expect to pay 10% to 20% of sales. Storage fees or utility costs add a few thousand more.

- Loan Interest: Interest payments to banks or investors that provided startup capital funding.

- Accounting Services: Most owners hire accounting help for daily bookkeeping, payroll, taxes, and advisory services.

- Security: Ongoing costs for security guards, alarm systems, door tags, serial number trackers, and inventory software. Higher for shops specializing in firearms or luxury items.

- Insurance: Property coverage, workers’ compensation, theft protection, liability, and commercial policies.

- Advertising: Print ads, pay-per-click search campaigns, flyer distribution, local sponsorships, etc.

- Supplies: From receipt paper and printer ink to cleaning products or refreshments and employee uniforms.

- Travel: Attending trade shows and auctions to source new merchandise and stay atop industry trends.

The first few years require tight cost control measures to establish operations and build profitability. As cash flow stabilizes, ongoing investments in security enhancements, newer display cases, facility upgrades or expanded inventory help pave the growth path.

4. Form a Legal Business Entity

Choosing the right legal structure is a key first step when starting any small business. For pawn shops, the options include sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each entity type has pros and cons to weigh.

Sole Proprietorship

A sole proprietorship represents the simplest and most affordable option. There are minimal legal formalities involved. Owners file Schedule C tax forms and claim profits or losses on personal returns. However, they take on unlimited personal liability for debts and legal claims. All personal and business assets get put at risk without corporate protection.

Partnership

Forming a general partnership allows multiple owners to combine resources and split profits. But similar to sole proprietors, each partner carries unlimited personal liability for the business as a whole. Interpersonal disputes can also jeopardize operations without formal agreements in place.

Limited Liability Company (LLC)

Given the risks involved in buying and lending against secondhand goods, pawn shops stand to benefit greatly from formal limited liability protections. Forming an LLC offers the best of both worlds – combinable resources and limited liability for owners.

LLCs limit the personal assets at risk to one’s initial financial contributions. The business exists as a separate legal entity so the pawn shop itself carries liability for losses, debts, lawsuits, or claims rather than individual owners. Members create operating agreements detailing financial stakes and voting rights.

Corporation

Alternatively, some pawn shop owners opt to incorporate right from the start. This provides the highest level of liability protection but also the most paperwork and strictest operational processes. Owners distribute corporate stock based on initial investments.

5. Register Your Business For Taxes

Before opening doors, all pawn shop owners must obtain an Employer Identification Number (EIN) from the IRS. Think of it like a social security number for your business. It registers your company for federal tax purposes and helps open business bank accounts.

Applying for an EIN is completely free and only takes a few minutes using the IRS online application portal. Simply navigate to IRS.gov. Select the option for “View Additional Types, Including Tax-Exempt and Governmental Organizations.” Then choose “Sole Proprietorship” or your appropriate legal business structure established previously.

You’ll need to provide basic information about your pawn business like company name, address, and ownership details. Hit submit when finished and your EIN will get issued immediately. Make sure to print the confirmation notice, which also states your EIN for record keeping.

An EIN is crucial for registering your pawn shop business within your state. Visit your Secretary of State’s website to find the forms for state business income taxes, sales and use tax permits, and any specialty licenses related to the pawn and secondhand dealer industry.

For example, in the state of Texas, pawnbrokers must register with the Consumer Credit Commission. The application involves getting fingerprinted for background checks and usually costs a $500 processing fee.

State sales tax permits require regularly filing returns to remit owed sales tax revenues based on percentages of taxable transaction volumes. Pawn brokers in Texas pay 6.25% sales tax on the full loan amount, not just earned interest. Stay current on state and city jurisdiction tax rates impacting daily operations.

6. Setup Your Accounting

With frequent cash transactions, loan management, and inventory purchases in flux, meticulous financial recordkeeping is a must for any pawn shop owner. Investing in small business accounting software provides the foundation. Let’s look at the different types of accounting to use to start your business plan.

Accounting Software

QuickBooks seamlessly syncs with business bank accounts and credit cards for easy, automated data imports rather than manual entry. Owners can generate real-time reporting on daily, monthly, and yearly profitability to inform smarter decisions. Quickbooks plans start at $25/month with the option to upgrade as operations grow.

Hire an Accountant

Even with capable software, most pawn shop owners still benefit from Utilizing an accountant or bookkeeping firm as well. Experts handle tasks like daily/weekly reconciliation of cash register deposits against sales reports. They classify expenses properly – like separating basic supplies from security or advertising.

Open a Business Bank Account

Keeping personal and pawn shop finances completely separate is also advised. Open dedicated business checking/savings accounts and credit cards solely for store use. Never commingle money or pay suppliers from personal accounts. Not only does this simplify accounting, but establishing business credit also helps access higher future limits compared to consumer cards.

Apply for a Business Credit Card

Apply for a basic business credit card when first starting. Capital One, Chase Ink, and Wells Fargo offer options with minimal revenue requirements. Use this card only on eligible store purchases. As your pawn shop grows, monitoring business credit scores allows higher approval chances for cards with robust point systems for big outlays like trade show travel or security system upgrades.

7. Obtain Licenses and Permits

Beyond forming a proper legal business entity, pawn shop owners must research and comply with relevant licensing regulations before opening their doors. Find federal license information through the U.S. Small Business Administration. The SBA also offers a local search tool for state and city requirements.

At a minimum, standard business licenses must be filed at both the state and local county/city government levels. For example, in Florida pawnbrokers must register for a state Secondhand Dealer license through the Department of Agriculture and Consumer Services.

Counties and cities often have additional business tax certificates or regulatory permits as well. Some municipalities place restrictions on certain pawned merchandise categories or mandate detailed inventory reporting to law enforcement. Failing to comply can result in revoked permits so research requirements thoroughly.

Pawn shops dealing in firearm sales and transfers face extensive federal regulations under the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF). This includes mandates like performing customer background checks, providing suspect purchase reports, and securely storing any inventory of weapons on the premises.

The ATF application process for Federal Firearms Licenses spans several months and costs hundreds of dollars. It also requires owners to submit photos, and fingerprints and pass further individual background screenings.

Local jurisdictions also layer on added gun permit prerequisites like safety training courses, security system inspections, or restrictions on ammunition quantities. Carefully vet all state statutes and municipal ordinances before deciding to deal with firearms.

Zoning laws also deserve attention when selecting a pawn shop location. Opening in a commercially zoned area ensures compliance for a retail business with constant customer traffic. Never assume standard retail or commercial zoning automatically applies just because other shops occupy a given shopping complex.

The permitting process takes patience but pays dividends through legal compliance. Consider retaining business lawyers or permitting expediters to navigate regulations. They also prove invaluable if license applications get denied due to background checks or similar issues.

8. Get Business Insurance

Given the high-value merchandise and cash handled daily, pawn shops face substantial risks from theft, property damage, customer injury, and even employee dishonesty. Carrying tailored business insurance helps minimize financial catastrophes if disaster strikes.

For example, failing to carry adequate coverage could bankrupt your business in scenarios like:

- A burst pipe in the back office floods the premises destroying electronics, musical instruments, and appliances waiting for pickup beyond repair.

- Burglars smash display cases and empty entire shelves of diamond jewelry and gold watches one evening after closing.

- A customer slips on a wet floor and breaks an arm, then sues the pawnshop for substantial medical damages.

Specialized commercial policies like BOP (business owners policy) insurance bundle property and liability protections. Property coverage insures merchandise, equipment, furnishings, and the shop itself in the event of damage or theft. Liability guards against customer bodily injury lawsuits. BOP plans also include business interruption insurance to replace income lost while rebuilding after covered incidents.

Brokers like CoverWallet allow pawn shop owners to get fast online quotes. Expect costs ranging from $1000 to $10,000+ annually based on claim limits, insurer rating, location crime rates, and amount of cash/valuables on-premise. Work with an independent broker to review all available coverage tiers while balancing premium costs.

Policies require submitting detailed applications covering premise square footage, alarm systems, merchandise types, and more. Prepare payroll records, tax returns, and inventory manifests tallying total asset values on hand. Consider bolstering security like cameras, thick doors, and reinforced display case glass to qualify for lower rates.

Insurance costs eat into overhead but catastrophic incidents get avoided. Piece together plans spanning property damage, liability claims, theft, employee crime, and business interruptions tailored specifically to pawn shops. Protect your livelihood without risking the roof over your head.

9. Create an Office Space

While retail pawn shops focus mainly on showroom floors and secured merchandise storage, having some back office space still benefits daily operations and long-term growth. An office lets owners handle bookkeeping, make phone calls, review security footage, manage inventory systems, and consult with customers in private.

Home Office

Many owners start off using spare space in a home rather than leasing separate units. Converting a basement or spare bedroom into a basic office costs little beyond desk and computer equipment. However, working from home makes separating professional and personal life challenging. Customer inquiries after hours easily interrupt family time without boundaries.

Coworking Office

Coworking spaces like WeWork provide affordable alternatives starting around $300 a month. Shared suites house everything from desk space and WiFi to conference rooms and kitchen lounges for quick meetings. Coworking locations also give pawn shop owners access to communities of fellow entrepreneurs that outlet creativity, spark inspiration on store promotions, or even provide service referrals.

On-Site Office

For pawn shops occupying standalone buildings, devoting around 25% of total square footage to non-retail operational areas strikes an efficient balance of space. Place the office at the rear with a separate employee entrance for easy morning access prepping the showroom. Install interior windows allowing workers to peer onto the sales floor without leaving their desks.

10. Source Your Equipment

Properly outfitting a new pawn shop requires significant upfront investments into several key equipment categories – security cases, safes, video systems, custom displays, electronics testing devices, and office tools. Carefully sourcing both new and secondhand gear helps keep startup costs in check.

Buy New

When buying brand new, specialty retailers like Uline carry high-quality display cases, safes, tagging guns, and merchandise organizers specifically designed for pawn shops. Expect premium prices but access hearty guarantees plus custom fabrication options. Lead times for delivery and installation do run 4-6 weeks.

Buy Used

To save, search classified listings on Craigslist and Facebook Marketplace for gently used display cases, counters, and shelving units from shops going out of business. Expect to pay 50-75% less than retail. Coordinate pickup with a moving truck or hire a rigger crew to transport larger safes to your location.

11. Establish Your Brand Assets

Crafting a recognizable brand identity helps pawn shops connect with local communities and stand apart from strictly price-driven competitors. Investing in professional logo design, websites, signage, and dedicated business phone lines establishes credibility.

Get a Business Phone Number

Start by purchasing a unique business phone number from providers like RingCentral rather than relying solely on personal mobiles. Custom greetings deliver far better first impressions when customers call with inquiries. Plans start around $30/month for pooled minutes better suiting most startup budgets.

Design a Logo

From there, focus on creating an eye-catching logo that conveys trust and approachability. Sites like Looka make professional design accessible, with basic branding packages starting around $20. Explore playing off common pawn themes like silver bars, gold coins, gold jewelry, or shaking hands.

Print Business Cards

With logo files in hand, order professional business cards, door signs, and external marquee lettering from cost-effective printers like Vistaprint. Now staff can easily share contact info when sourcing new merchandise at auctions or secondhand sales. Keep cards behind the registers to hand customers as they complete pawn loans rather than solely relying on receipts.

Buy a Domain Name

Invest in a custom domain name that matches your pawn shop name whenever possible. For example, A pawn shop owner named Ann might purchase AnnsPawnShop [dot] com. Domain registrars like Namecheap make this fast and affordable. Keep it short and intuitive to easily share over phone calls or print materials.

Design a Website

Building out a dedicated website allows customers to browse inventory online or learn more about offered financial services ahead of visiting your store. Those with website coding skills can use DIY platforms like Wix for under $20 monthly.

Otherwise, hiring freelancers from marketplaces like Fiverr brings professional site development starting around $500. Budget extra for photography showcasing your showroom selection and staff.

12. Join Associations and Groups

Joining relevant local business associations, attending trade events, and networking online helps pawn shop owners continuously improve operations while staying atop industry trends and compliance updates. Don’t go it alone – lean on communities who have been there before.

Local Associations

Groups like the Florida Pawnbrokers Association provide new and experienced state operators access to annual conferences, regional meetups, regulatory advocacy campaigns, insurance pricing deals, and even group bulk buys on security equipment. Membership starts under $300 yearly. Trade organizations in most states offer similar perks.

Local Meetups

Attending recurring local meetups expands connections beyond just pawnbrokers as well. User groups around selling online, precious metal dealers, bitcoin acceptance, and even general small business ownership provide valued perspectives. Use event listing sites like Meetup to find these regular gatherings nearby.

Facebook Groups

Industry-specific Facebook groups enable crowdsourcing advice on everything from software tips to managing difficult customers. Pawn Shop Live shares years of aggregated hands-on expertise. The USA BUY AND SELL group shares products to buy and sell.

13. How to Market a Pawn Shop Business

Implementing creative marketing and customer retention strategies separates thriving pawn shops from those struggling to survive. New owners must move beyond just printing flyers and hoping neighborhood traffic alone floats the business. Actively promote your distinct value proposition to stand apart.

Personal Networking and Referral Marketing

Start by incentivizing happy customers into loyal brand advocates. Offer $5 store credit for any new referred customer that completes a qualifying transaction. Track referrals via paper coupons or unique referral URL links to credit advocates automatically. Suddenly your customer base becomes a sales team.

Digital Marketing

Digital channels provide affordable and trackable ways to continually engage locals. Consider tactics like:

- Google Ads campaigns with tailored ads for searchers inquiring about “selling valuables quickly near me” or “pawnshop loans.” Target within 10 miles of your location at under $2 per click.

- Facebook and Instagram ads highlight unique offerings like rare coin appraisals or 24/7 ATM access. Target followers of local Facebook groups based on relevant interests and demographics.

- Email collects customers’ addresses for future offers alerts. Send holiday coupons, birthday specials, or discounts on select merchandise categories. Mailchimp makes beautiful and automated emails easy.

- Start a YouTube channel creating quick videos on verifying genuine luxury watches or testing video game consoles. These demonstrate expertise while reaching browse audiences.

Traditional Marketing

Don’t neglect traditional mediums entirely either. Well-designed print materials establish professionalism and practicality.

- Print full-color brochures with payment terms, special service callouts, and photos of your clean organized showroom. Have all staff hand these out with business cards to every customer.

- Promote any specialty offerings like firearms consignments or computer electronics via targeted direct mail postcards to qualified recipient lists available for rental and purchase.

- Brief radio spot ads on stations popular with blue-collar and service worker commuters effectively remind neighboring communities of conveniently located pawn loans and hall payout options in their neighborhood.

The most successful pawn shops view every customer interaction as a chance to foster positive vibes and cultivate brand loyalty. Building an email list for ongoing promotions and capturing happy testimonials for public sharing compares to none in enabling sustained growth.

14. Focus on the Customer

In an industry often affiliated with sketchiness, establishing genuine customer trust should remain every pawn shop’s top priority. Taking time to compassionately understand situational context pays dividends.

Some ways to improve customer focus within your pawn shop include:

- Treat those facing financial hardships with dignity. Foster loyalty by exceeding expectations around transparency and fair deals.

- Keep tabs on deals in other pawn shops and match them.

- Hire employees who care about your customers.

- A pleasant loan experience means the struggling single mom recommends your shop to friends first when needing some quick cash.

- Reviews naming specific employees that candidly explained loan terms or pointed out intricate details on antique jewelry pieces attract customers looking for competence over solely maximum profit.

- Recommendation brings more opportunities to demonstrate community goodwill.

- Prioritizing people first builds a loyal customer base serving as your best advertising.

- Competitors luring in deal seekers through flashy banners and bold offers may temporarily boost volumes but destroy long-term profits.

Getting to know repeat local customers on a first-name basis keeps struggling community members returning to your doorsteps instead of alternatives. A few more dollars per deal never outweighs the value of a family you support week in and week out. To thrive in turbulent times, pawn shops must first serve people. The profits simply follow.