The tax preparation industry generates over $10 billion in revenue annually in the United States alone. With over 82,000 operators, these businesses are crucial to individuals and companies alike. According to IBISWorld, the market has grown steadily over the last five years and is poised for continued expansion.

With so many taxpayers looking for assistance navigating filing obligations, tax season represents a massive opportunity for aspiring entrepreneurs to build a profitable business helping people complete their taxes.

This guide will help you learn how to start a tax preparer business. Topics include market research, registering your EIN, forming a legal business entity, branding your tax preparer business, and more. Here’s everything you need to know about starting your own tax preparation business.

1. Conduct Tax Preparer Market Research

Market research is critical to a professional tax preparer. It offers insight into income tax school requirements, your target market, local market saturation, trends in tax preparer services, and more.

Some of the details you’ll learn through market research as you start a tax preparation company include:

- This steady growth presents a strong opportunity for aspiring tax preparers. This fragmentation means newcomers can compete and build a client base without huge overhead costs.

- Demographics also favor new tax prep businesses. Over 68% of taxpayers turn to professionals for help filing returns.

- Usage is highest among older filers – 77% aged 45-64 and 80% over age 65 use tax prep services. As more Baby Boomers retire, demand will increase. Younger filers are also utilizing tax pros more often.

- Small business owners are another key target customer segment. With complex schedules and deductions, business taxes are a prime source of clients.

- Focusing your services on a niche like small business taxes can help attract and retain clients.

- While national tax prep chains chase volume by serving mostly W-2 employee filers, and independent preparers can better serve high-income individuals.

- With tax season condensed into a few months, marketing and customer retention are crucial.

- Successful independent tax preparers build year-round relationships with clients through planning, estimated payments, amended returns, and more.

- While demand is strong, tax prep still requires gaining technical expertise. Most states require licensure, certification, or registration to prepare returns for a fee.

- Expect costs of $100-$500 for training courses, exams, and credentials. Ongoing continuing education is also needed to stay current on evolving regulations.

By obtaining the proper credentials, targeting the right customer segments, and providing value year-round, aspiring tax preparers can stake their claim in this growing $10B industry. The opportunity is there for client-focused practitioners to compete with large chains and build a profitable tax prep business.

2. Analyze the Competition

Understanding the competitive landscape is crucial if you want to become a tax preparer. There are two key areas to analyze: local brick-and-mortar competitors and online/digital competitors. Some of the ways to research competition as a tax professional include:

- For local competition, identify who the major tax prep players are in your geographic area.

- Drive around during tax season and note busy storefronts.

- Search online directories and maps to see ratings and mentions of local tax preparation services.

- Stop into offices and make observations about services offered, prices, and professionalism.

- Check out what tax preparation software other professional tax preparers are using.

- Pay attention to smaller independent and solo tax prep services. Note their locations, offerings, fees, and marketing.

- Online competitors are also critical to analyze. Search for tax pros marketing themselves through websites, ads, and social media in your area.

- Evaluate the quality of their digital presence and content. Search online review sites to see ratings and customer feedback.

- Identify highly rated local competitors and learn from how they market and attract clients digitally.

- Conduct keyword research using Google’s free Keyword Planner tool to see what tax prep terms are most searched in your geography.

Ongoing analysis of both in-person and digital competitors gives tremendous insights into customer needs and how to differentiate your tax preparation offerings. Avoid copying directly, but let your competitors’ strengths and weaknesses guide your unique value proposition and service offerings.

3. Costs to Start a Tax Preparer Business

When starting a tax prep business, there are a variety of one-time start-up costs to consider in addition to the ongoing expenses of running the business. Carefully estimating these costs is important for budgeting and determining viability.

Start-Up Costs

- Registration & Licensing Fees – To legally provide tax services, registration with the state board of accountancy is required along with certain licenses or certifications depending on location. These costs range from $50-$500.

- Training & Education – Most tax prep licenses and certifications require some formal training and education. Expect $200-$1000 for exam prep courses, seminars, and study materials.

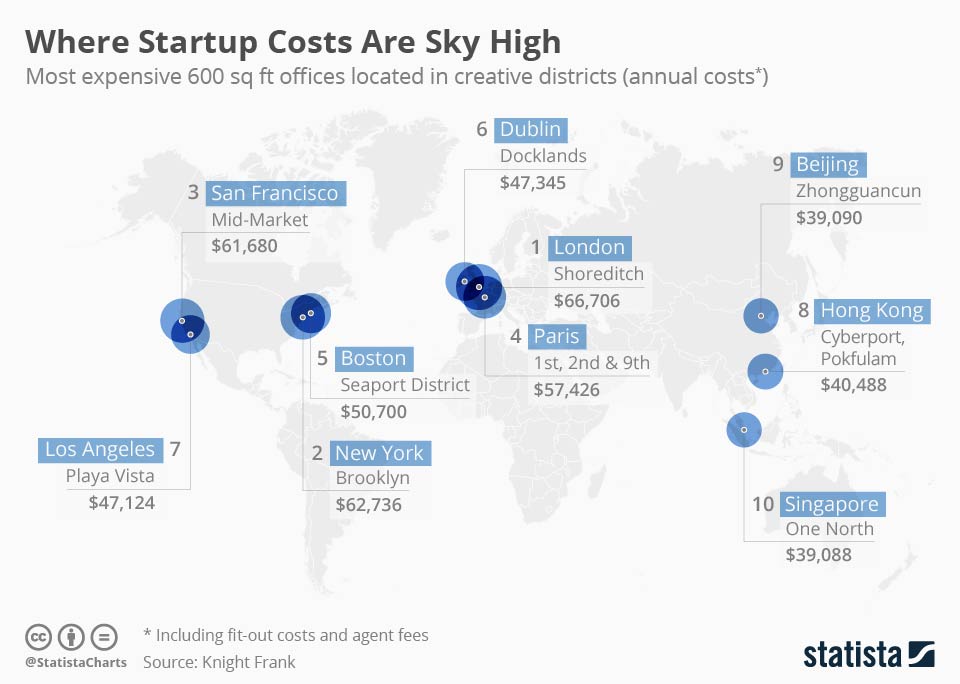

- Office Lease – Leasing office space for meeting with clients is typical for tax prep businesses. The average cost is $15-$30 per square foot monthly. For a 400 sq ft office, estimate $6,000-$12,000 yearly for rent.

- Furnishings & Supplies – Chairs, desks, filing cabinets, pens, folders, paper, and basic office furnishings will likely cost between $2,000-$5,000 upfront.

- Tax Software – Quality tax prep software like Drake Software or Lacerte starts around $2,000 for a basic single-preparer package.

- Computer & Printer – A desktop computer or laptop suitable for tax prep work can be purchased for $1,000-$2,000. All-in-one printers start around $300.

- Marketing – Initial marketing like print ads, website development, signs, flyers, and business cards could run $3,000-$5,000 to start.

- Insurance – General liability insurance for a tax prep business costs approximately $500-$1,500 annually. Workers’ comp is also required if hiring employees.

- Legal & Professional Services – Lawyers and accountants can assist with entity formation, contracts, permits, and licenses for $2,000-$5,000 upfront.

- Working Capital – Having available cash is crucial for covering expenses until revenue starts coming in. Aim for 3-6 months’ worth, potentially $10,000-$20,000.

Total one-time start-up costs realistically range from $20,000-$50,000+ depending on specifics. Many tax prep businesses launch initially from home to save on space costs.

Ongoing Costs

- Rent & Utilities – If leasing space, expect recurring monthly costs of $1,000-$3,000 for a small office. Utilities like phone, internet, and electricity will add a few hundred more per month.

- Tax Software Upgrades – Yearly updates to tax software run $500-$1,500.

- Continuing Education – Most states require tax preparers to complete 10-20 hours of continuing education annually. Online courses cost around $100-$300 per year.

- Marketing – Ongoing digital marketing, print ads, sponsorships, and local networking to attract clients will likely cost between $200-$500 monthly.

- Salaries – While initially owner-operated, tax prep businesses often grow to hire 1-3 full or part-time staff which introduces salary costs. Experienced tax pros earn $30,000-$50,000.

- Contractors – Engaging contract CPAs for specialized/complex returns or overflow work costs around $50-$150 per return.

- Insurance – General business liability and workers’ comp premiums are annual costs, averaging $1,000-$2,500 per year.

- Taxes & Licenses – Annual or quarterly taxes, business licensing fees, and permit renewals tally up to around $500-$2,000.

A realistic estimate for regular ongoing operational expenses is $3,000-$6,000 monthly. Additional costs come up as well, like computer upgrades, furniture, and tax software training. Build these assumed expenses into your initial business plan and budget.

4. Form a Legal Business Entity

When starting a tax prep business, one key decision is choosing the right legal structure. The four main options each have advantages and disadvantages to weigh.

Sole Proprietorship

This is the simplest structure where you operate as a single individual with pass-through income and unlimited liability.

- Pros: Easy and inexpensive to set up. No formal business registration is required. The owner keeps all profits.

- Cons: No liability protection – your assets can be seized for debts and liabilities incurred by the business. Difficult to raise investment capital for growth.

Partnership

In a partnership, two or more people share ownership and liabilities. Common arrangements include general partnerships, limited partnerships, and limited liability partnerships.

- Pros: Easy to establish with a partnership agreement. Profits are passed through and taxed at the partner level. Shared capital raising abilities.

- Cons: Partners are jointly liable for each other’s actions and debts. Any partner can bind the others in agreements which adds risk.

Limited Liability Company (LLC)

LLCs mix pass-through taxation with the liability protections of a corporation. Owners are called members.

- Pros: Provides liability protection for members. Only company assets are at risk. Personal assets shielded. Profits are taxed on individual returns. Easy to add members or sell ownership stakes. Low compliance requirements.

- Cons: More complex to establish than a sole proprietorship. State registration and operating agreement are required. Still pass-through so self-employment taxes apply.

Corporation

A corporation is a legal entity separate from its owners. Business income is taxed at the corporate level.

- Pros: Owners’ assets are fully protected. Additional credibility with customers. Perpetual existence. Ownership can be easily transferred through the sale/transfer of shares. Easier access to capital through the sale of stock.

- Cons: Most complex and expensive to set up and maintain. Double taxation on profits unless structured as an S-Corp. Significant record-keeping and reporting requirements.

5. Register Your Business For Taxes

One key legal step in starting a tax prep business is obtaining an Employer Identification Number (EIN) from the IRS. This unique identifier is like a social security number for your business.

An EIN is required to open business bank accounts, apply for licenses, hire employees, and file taxes for your company. Essentially any transaction conducted under your business name will require an EIN.

Sole proprietors can use their SSN for some business needs. However, an EIN adds legitimacy and separates your business finances from personal. It also enables opening business credit cards and lines of credit which is useful for building credit history.

Applying for an EIN is free and fast through the IRS website. Follow these steps:

- Navigate to the IRS EIN Assistant.

- Select view additional types including view additional types, then select Sole Proprietorship as the business structure.

- Provide your personal info, business name, address, and reason for applying.

- Submit the online application which takes just a few minutes.

Once submitted, you will immediately receive a confirmation notice with your EIN. Print this for your records. Congratulations, you now have your business EIN!

Besides federal EIN, also register with your state revenue department to obtain a tax ID number for collecting and remitting state sales tax. This requires filing additional forms and nominal fees of up to $50 in most states.

6. Setup Your Accounting

As a tax preparer, managing your financial records and taxes is a must. Having rock-solid accounting separates successful practices from struggling ones.

Accounting Software

Start by getting small business accounting software like QuickBooks. QuickBooks automates tasks like invoicing, expense tracking, payroll, and reporting. It integrates with your business bank accounts and credit cards for easy data importing and reconciliation.

For tax prep businesses, QuickBooks’ industry-specific features like project costing and progress invoicing are extremely helpful. Expect costs of $10-$50 monthly.

Hire an Accountant

Even with software, consider retaining an accountant or bookkeeper, especially at the outset. Tasks like setting up your chart of accounts, adjusting entries, preparing financial statements, and documenting expenses are best left to professionals when launching a new tax business. Expect costs of $100-$200 monthly for basic bookkeeping and assistance.

Open a Business Bank Account

Keeping business and personal finances completely separate is also critical. Have a dedicated business checking account and credit card solely for your tax prep operation. Never co-mingle funds or pay personal expenses from your business account. This makes accounting clean and protects you in case of IRS audits.

Apply for a Business Credit Card

Apply for a small business credit card using your company’s EIN rather than your social security number. Issuers will determine credit limits based on your business’s financials. Aim for at least $10,000 to cover larger advertising and software purchases if needed.

7. Obtain Licenses and Permits

When starting a tax prep service, proper licensing is required for legal compliance and your client’s protection. Find federal requirements through the U.S. Small Business Administration. The SBA also offers a local search tool for state requirements.

The IRS requires all paid tax preparers to have a Preparer Tax Identification Number (PTIN). This tracks and identifies individuals handling federal tax returns. PTIN applications cost $35-63 per year and require submitting your name, address, SSN, and prior tax compliance documents.

States also regulate paid tax preparation through licensing and regulations. For example, in California, you must become either a CPA, enrolled agent, or registered tax preparer. Each has education and exam requirements:

- CPAs need 150 college credits, 1 year of work experience under a CPA, and passing 4 exams.

- Enrolled agents must pass a comprehensive IRS exam covering all aspects of taxation.

- Registered Tax Preparers complete 60 hours of approved courses + 20 hours of continuing education annually.

Check with your state boards to determine the optimal license for your goals. For extensive services like audits and financial planning, a CPA provides the highest level of authority. For focused tax preparation, enrolled agent status may suffice.

Specialty credentials like Certified Financial Planner (CFP) or Accredited Tax Preparer (ATP) can further showcase your expertise. Optional designations help attract clients with complex situations like estates, gifts, business taxes, etc.

Tax prep professionals must also comply with IRS Circular 230 ethics rules. This covers maintaining client confidentiality, disclosure requirements, and proper due diligence. Following ethical regulations preserves your reputation and avoids penalties.

8. Get Business Insurance

Obtaining adequate insurance coverage is crucial to protect your tax prep business from unforeseen risks. The right policies safeguard your company’s finances and assets in the event of losses.

General liability insurance is highly recommended to cover any bodily injury, property damage, or errors and omissions claims. For example, a client slipping and falling in your office or you making a mistake on a return that leads to an IRS audit and penalties for the client.

Another scenario is a fire or storm destroying your office and equipment. Property/casualty insurance replaces stolen or damaged assets and covers rebuilding costs. For a small tax prep office, expect premiums around $1,000 per year.

If hiring tax preparers or assistants, workers’ compensation insurance is mandatory in most states. This covers any workplace injuries employees sustain. Rates vary based on payroll size and risk exposure.

Being underinsured opens the business up to major financial vulnerabilities. Imagine these scenarios:

- A client trips into your waiting room and sustains injuries requiring $50,000 in medical bills. Without liability coverage, your business assets could be seized.

- A pipe bursts in your office overnight, flooding equipment and files. Lacking property insurance means paying thousands for replacement costs out of pocket.

- An employee is injured commuting to work. Without workers’ comp, their lost wages and medical care falls fully on you.

With proper insurance, your tax business has a shield against costly blindsides. Protect your hard work and assets with comprehensive policies specific to tax professionals.

9. Create an Office Space

Having a professional office is important for tax prep businesses to meet with clients and handle sensitive financial documents securely. The right space projects competence and provides room to grow.

Home Office

A home office is the most economical starting. Dedicated space for a desk, computer, filing cabinet, and meeting area. Costs are just your monthly housing expenses prorated for the office portion. Home offices are good for solo preparers but lack scalability. Clients may also perceive home offices as less professional.

Coworking Office

Coworking spaces like WeWork offer another flexible option. You rent desk space in a shared office environment month-to-month. This provides meeting rooms for client consultations without a long-term lease. Expect to pay $200-$500 monthly for an individual desk.

Retail Office

Retail office settings similar to bank branches may suit high foot traffic areas. Renting ground floor retail space provides walk-in accessibility but is costlier, from $3,000-$5,000 monthly. Retail offices work best for preparing basic individual returns with volume pricing. They lack privacy for complex client meetings.

Commercial Office

A small commercial office suite in an office park or building is ideal for most tax prep businesses. Expect monthly costs of $1,000-$2,000 depending on location and size. Benefits include privacy for client meetings, room for support staff, and the capability to handle confidential documents securely. Commercial office space offers the right mix of professionalism, security, and growth potential.

10. Source Your Equipment

From furniture to tax software, tax prep businesses need certain tools and materials. Here are some options for equipping your office on any budget:

Buying New

Brand-new office furniture and the latest software ensure everything meets your needs. Shop mainstream retailers like Office Depot, Costco, and Amazon for chairs, desks, filing cabinets, printers, computers, and basic supplies like pens and paper.

Buying Used

Used office furniture is abundantly available at liquidation stores like OfficeLiquidators.com and national chains like OfficeMax. Facebook Marketplace and Craigslist also have local sellers offering desks, filing cabinets, and chairs at steep discounts.

Renting

Another flexible option is renting furniture and equipment as needed. Rental companies like CORT Events offer short-term rentals of office furniture, desks, chairs, computers, printers, and supplies for events or temporary needs. Daily and weekly rental rates fit any budget.

Leasing

Leasing lets you pay monthly to use equipment like computers, printers, and software long-term, rather than a large upfront cost. Tax software providers offer annual lease pricing from $30-$150 monthly for a single preparer.

11. Establish Your Brand Assets

Crafting a strong brand builds recognition and trust with potential clients seeking tax help. Your brand identity should convey professionalism, accuracy, and attentive service.

Get a Business Phone Number

Start with a unique business phone number to list on all materials. Services like RingCentral provide toll-free and local numbers with call routing, voicemail, and texting capabilities. Dedicated business lines project an established presence.

Design a Logo

A logo encapsulates your brand visually. Consider an icon representing precision and trust like a badge, shield, or checkmark. Use bold, official colors like blue, black, or dark green. Companies like Looka offer affordable, customized logo design services starting at $20. A quality logo unifies your website, signage, ads, and documents.

Print Business Cards

Business cards display your logo, phone number, email, and credentials prominently. They enable quick sharing of your contact information in person when networking or meeting prospective clients. Sites like Vistaprint provide 500 basic cards for under $20.

Buy a Domain Name

Secure a domain name matching your business name if possible. Adding .com projects credibility and makes it easier to find online. Use domain sites like Namecheap for affordable registration starting at around $12 annually.

Design a Website

Your website convinces potential clients to choose your services. Build it yourself with DIY sites like Wix or hire a freelancer from Fiverr. Your site should highlight your credentials, experience, pricing, and how you deliver excellent service. Include client testimonials and before/after examples detailing tax savings achieved.

12. Join Associations and Groups

Joining local professional groups builds connections and expertise critical for new tax preparers. Surround yourself with fellow professionals to swap insights and best practices.

Local Associations

Seek out local chapters of national associations like the National Association of Tax Professionals (NATP) and the National Society of Accountants (NSA) in your city. Associations offer seminars, network events, continuing education, and industry advocacy. Membership fees are generally $100-$300 annually.

Local Meetups

Leverage sites like Meetup to find regional tax and accounting groups. Casual meetups are a chance to meet peers in a social setting and swap business growth tips. Monthly gatherings may feature guest experts or tours of local accounting firms.

Facebook Groups

Nationwide online communities like Facebook groups provide support 24/7. Try Community for Bookkeepers, Accountants, & Tax Pros, Tax Pros, and Tax Questions & REAL Answers 2023. Surrounding yourself with fellow tax preparation pros creates a brain trust to overcome obstacles together. Use associations, meetups, and social media communities to help your tax business thrive.

13. How to Market a Tax Preparer Business

Marketing is crucial for any new tax prep business to attract clients and grow. With so many options, focus on tactics providing the most value based on your budget and goals.

Personal Networking

Leveraging your personal and professional network is the most affordable starting point. Reach out to friends, family, colleagues, and existing contacts to spread the word about your new tax services. Offer discounts for referrals. A testimonial from a satisfied customer on your website or in advertisements lends tremendous credibility.

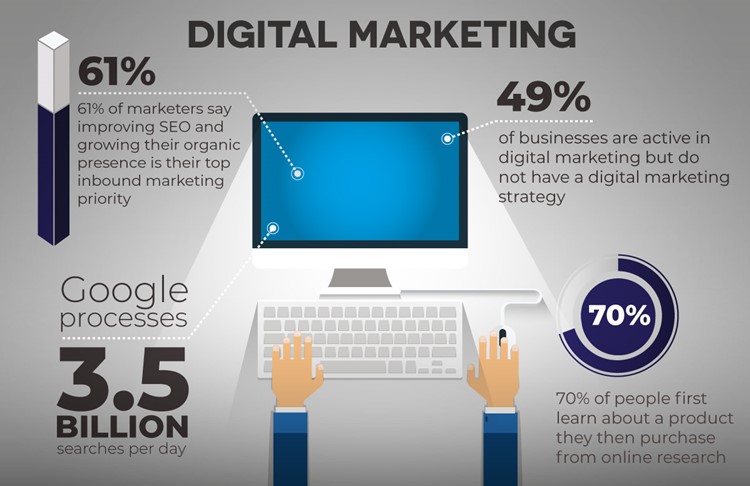

Digital Marketing

Digital marketing expands your reach exponentially:

- Google Ads target local searchers seeking tax help in your area. Pay only when someone clicks your ad.

- Facebook and Instagram ads showcase your credentials and services to targeted demographics.

- Start a YouTube channel creating tax tips videos to build organic traffic and subscribers.

- Write blog posts with actionable tax advice optimized for SEO.

- Send email newsletters with tax deadlines, planning tips, and company updates.

- Leverage LinkedIn to connect with other professionals who can refer clients.

Traditional Marketing

Traditional approaches still have value, especially for offline clientele:

- Print flyers can be displayed at local libraries, colleges, and community centers.

- Radio ads reaching drive-time commuters make for memorable repetition marketing.

- Direct mail postcards to local neighborhoods and businesses drum up new customers.

- Sponsoring local events gets your name in front of community members.

- Yard signs along busy roads capitalize on drive-by visibility.

- Billboards on highways entering your metro advertise to a captive audience.

Evaluate traditional tactics based on costs versus potential impressions in your specific area. Depending on your audience, digital or print may be more effective.

14. Focus on the Customer

Providing an exceptional client experience is crucial for tax prep businesses to retain customers and generate referrals. With so many options for tax help, you must differentiate yourself through service. Some ways to improve customer focus include:

- Respond promptly to all inquiries with thoughtful guidance, not just generic replies. Set proper expectations upfront about what services you provide and your fees.

- During tax prep appointments, listen attentively to understand each client’s full situation and needs. Take time explaining deduction options personalized to their circumstances. Educate clients so they feel empowered, and not intimidated by taxes.

- Follow up after filings are submitted to confirm acceptance and refund timing. Check-in throughout the year as tax deadlines approach. Offering year-round support builds lasting relationships, not just seasonal transactions.

- Doing someone’s taxes means handling sensitive financial data with integrity. Maintain rigorous data security and privacy measures to protect clients.

- Finally, seek customer feedback to improve. Were instructions clear? Did you resolve their questions? Would they recommend you to others? This input helps fine-tune your customer service approach.

Satisfied clients become advocates who refer family, friends, and colleagues to your practice. Prioritizing customer service nets new business at minimal marketing expense to you. A personalized, thoughtful approach shows you care about more than just preparing returns.